5 Best Online Credit Card Processing Companies

When starting a small business, one of the choices you have to make is which online credit card processing companies you should choose.

These are used as a payment gateway to allow you to accept credit card payments.

As a small business owner, there is nothing worse than turning away a customer, and a potential sale. Your ability to accept certain credit card payments from a credit card company can annoyingly dictate who you can do business with.

You could be a business that mainly deals with customers in person or one of many online businesses that use a virtual terminal.

Either way, it’s important to look at your options when it comes to accepting credit card payments.

So which company is the best for when you need to process payments? We’ll take a look at the top 5 best ones out there.

Here’s What We’ll Cover:

1. FreshBooks

We might be seen as biased here, but FreshBooks is a fantastic choice. Our services are perfectly tailored for small business owners looking to accept all types of payments.

FreshBooks is accounting software that provides accounting solutions for small business owners. It has a range of options that allow you to keep all of your business needs in one place.

The service also offers FreshBooks Payments. This is a solution that makes it easier for your clients to process online transactions. That means you can get paid twice as fast.

We offer simple pricing, the software is easy to use and there are no hidden costs.

2. Helcim

When it comes to credit card payments, Helcim is a popular choice.

The great thing about using Helcim as your payment processor is that they have affordable rates. There are no monthly, setup or cancellation fees.

They also offer volume-based processing discounts. These automatically update based on your three-month processing average.

You also don’t need any hardware to get started. Just download the payments app and you can start accepting credit card payments straight away.

The downside is that there’s only one plan to choose from, which does limit your choice.

3. PayPal

Everybody has heard of PayPal.

In fact, that’s one of its strengths as it is a tried and trusted credit card processor. People tend to be happier using a service that they have heard of as it breeds trust.

PayPal is one of the great, affordable options for small businesses with low transaction volumes.

It’s easy to use and set up and it accepts all major credit or debit card types, such as American Express, Visa and Mastercard. There are no monthly fees or a long-term contract, and no need for additional hardware.

However, once you start to scale up PayPal can fall behind. So while it’s great for very small businesses, once you start to see some success you may want to consider switching.

4. Sage

Sage is a global credit card processing service that works for all sizes of businesses.

They have a great range of options, such as being able to integrate their payment systems into their own accountancy software.

Sage offers both telephone processing and card processing for payments in person. They also provide merchant account integration, which can be a huge plus for many businesses.

The downside of Sage is its monthly costs.

Some companies prefer to pay for all of the benefits and see it as an investment. But a lot of small start-up businesses may prefer something cheaper, without all the bells and whistles.

5. Square

Square is a fantastic credit card processor purely for its simplicity.

Upon signing up, you are sent a free credit card processor which can be plugged into your smartphone and used in tandem with their app.

You are also offered a payment gateway and a virtual terminal. However, some monthly fees are required for some of their more sophisticated software.

The software runs on Android and Apple products, so there are practically no upfront costs to trying Square out and no long-term contract. This makes it an excellent option for small businesses looking to accept a wide range of credit card payments.

The downside is that with their pricing structure, it may not be cost-efficient if you have a high sales volume. So whilst this is the perfect solution for casual businesses, it may not be for everyone.

Key Takeaways

No matter what your business is, it’s important to match your size with your online credit card processing company.

What may be the perfect solution for one business, may not be ideal for you. So it’s always a good idea to conduct your own research into which of these may best suit your business.

Are you looking for more business advice on everything from starting a new business to new business practices?

Then check out our FreshBooks Resource Guide.

RELATED ARTICLES

How to Withdraw Money From PayPal Account: Tips & Tricks

How to Withdraw Money From PayPal Account: Tips & Tricks Steps on How to Transfer Money From Bank to PayPal Account

Steps on How to Transfer Money From Bank to PayPal Account What Is Compensation? Definition, Importance & Types

What Is Compensation? Definition, Importance & Types Credit Card Statement: What It Is & How to Check It

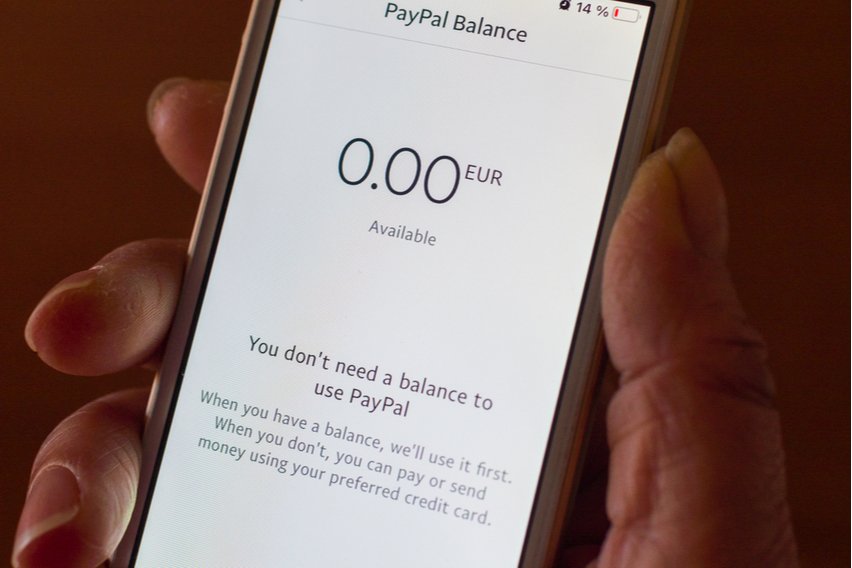

Credit Card Statement: What It Is & How to Check It How to Check PayPal Balance on Mobile or Desktop

How to Check PayPal Balance on Mobile or Desktop A Guide on How to Use PayPal on Amazon

A Guide on How to Use PayPal on Amazon