What Is Compensation? Definition, Importance & Types

Any at-will employment contract is a negotiation between an employer and an employee. If they want the best staff running their business, employers must offer attractive compensation terms. This system ensures that employees are rewarded fairly for their time and effort.

But compensation isn’t just an amount on a check sent out every 2 to 4 weeks. It also includes things like benefits, perks, and more. Let’s take a closer look at compensation and explore its importance to your small business now.

Here’s What We’ll Cover:

Employee Compensation in a Nutshell

What Types of Compensation Are There?

How Important Is Compensation?

How to Choose Compensation for Your Employees

Employee Compensation in a Nutshell

No matter the form it takes, employee compensation is any payment you give to an employee in exchange for work. Compensation can include both cash and non-cash payments. For most companies, employee compensation is one of their biggest expenses. This is likely true even if your business is smaller than average.

Because it is all-encompassing, employee compensation is not just paid wages. It can also include things like benefits, stock options, and more.

What Types of Compensation Are There?

Historically, there have been many different types of compensation paid to employees. These days, most companies use a handful of compensation types depending on who they want to attract. Common types of compensation include:

- Base pay or regular wages (hourly or salary)

- Sales commission

- Tip wages

- Overtime wages and other bonus pay

- Merit pay

- Stock options

- Benefits including health insurance, retirement funds, and more

- Non-cash benefits like prizes or a company car

- And more

Your compensation management team can determine the compensation types preferred by workers. They can also recommend a compensation package that improves employee engagement.

Understanding Base Pay vs. Total Compensation

Many industries have a starting or base pay rate. This is distinct from total employee compensation.

In brief, base pay is the initial cash wage that you give your employees. It’s the minimum amount of money an employee will receive before they are taxed or receive other deductions. The total compensation includes both base pay and any other benefits or compensation types.

Base pay is usually calculated as either an hourly rate or a salary rate. An hourly rate is the amount of money an employee makes per hour of work.

A salary rate is a set amount of money an employee makes each week or month. It’s usually calculated assuming that an employee will work 40 hours per week. But the rate does not change whether the employee works less than the assumed hours or more.

How Important Is Compensation?

Very! The compensation program is a major factor that affects whether an employee will be interested in an open position at your business. Therefore, companies frequently offer attractive compensation packages to draw top talent to their organizations.

Compensation affects:

- How much money the employee will make

- What benefits they can rely on (i.e. health insurance, which is very important in America)

- Other perks like a company car, paid housing, and more. In many cases, these perks are reserved for executive compensation. But they don’t have to be!

Remember, compensation is what you offer in exchange for an employee’s time and effort. So you must offer fair compensation to get good workers for your open positions.

How to Choose Compensation for Your Employees

There are many different types of compensation and salary ranges to choose from. So how can you know which is good for your business’ employees?

You can determine total compensation for your employees by considering a few factors.

Your Budget

Of course, you must consider the budget you have to pay your workers when deciding on base compensation. Your budget will affect how much money you have to spend per worker when accounting for overtime, promotions, and more.

Consider your salary structure carefully. Average salary wages need to be fair to ensure company loyalty. Workers won’t accept payments that seem too low compared to their superiors.

Industry Research

You should do some heavy research into your industry before settling on a compensation plan. Researching your industry will let you compare the base rates that other companies pay their employees. To attract the best talent, you can try to pay your employees a little more than competing companies.

Not sure where to start? Consider annual salary surveys. These are used to determine base salary levels or hourly wages in certain industries.

Potential Perks and Benefits

If you offer your employees attractive benefits, you can offer them a lower base pay in many cases. For example, employees will often take a job with lower base pay that has health insurance over a job with higher base pay.

Additionally, most employees like employer-matched health plans like 401(k)s. If you set up such a program, you can pay your employees less of a base rate. Other employees like company stock, especially if they believe in the company philosophy.

As a business owner, you can also take advantage of tax breaks by setting up plans like this. Many employee benefits are tax breaks, so offering these benefits is good for both you and your workers!

Key Takeaways

Ultimately, compensation is one of the most important things business owners need to consider when hiring employees. Only by offering attractive employee compensation packages will you get the best talent for your open positions.

But total compensation is a flexible thing. You don’t necessarily have to pay the highest cash rates to get skilled workers to join your company. Consider benefits, perks, and other aspects to stay within your budget and get top employees working for your company ASAP.

Find more helpful guides for your small business on our resource guide.

RELATED ARTICLES

Credit Card Statement: What It Is & How to Check It

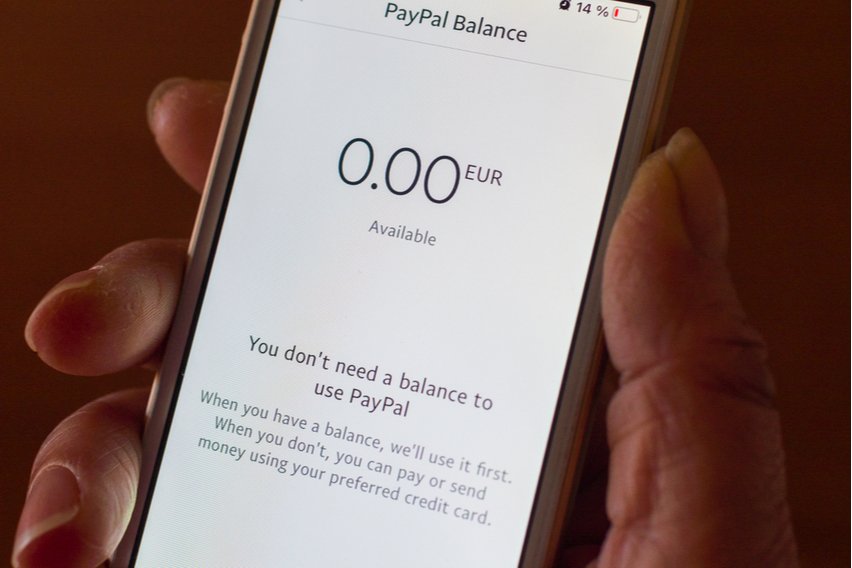

Credit Card Statement: What It Is & How to Check It How to Check PayPal Balance on Mobile or Desktop

How to Check PayPal Balance on Mobile or Desktop A Guide on How to Use PayPal on Amazon

A Guide on How to Use PayPal on Amazon How to Buy Bitcoin with PayPal Instantly: 2 Easy Ways

How to Buy Bitcoin with PayPal Instantly: 2 Easy Ways Top 5 Payment Processing Companies You Should Know

Top 5 Payment Processing Companies You Should Know How Old Do You Have to Be to Have a PayPal Account?

How Old Do You Have to Be to Have a PayPal Account?