How to Pay Independent Contractor (6 Simple Steps)

Sometimes there are situations and circumstances where you need extra help. You might already have employees, but what if you need someone with special skills to take on a short-term project? It’s not always necessary to hire a new employee. That can be expensive and inefficient.

Hiring independent contractors is an effective way to get the help you need. Yet the process can often be confusing and complex. There are certain classifications to figure out, forms to complete, and many ways to pay them. Where should you start?

To help, we put together this guide that breaks down how to pay an independent contractor in 6 simple steps. Keep reading to learn everything you need to know.

Table of Contents

What Is an Independent Contractor?

Steps to Pay Independent Contractors

FAQ on Independent Contractors

What Is an Independent Contractor?

Simply put, an independent contractor is a non-employee who engages in a work agreement with a business or entity. But how does an independent contractor differ from a freelancer or an employee? Well, in a few ways.

Businesses employ employees. They receive a wage or a salary for the work they do. These can be part-time and full-time employees. Typically, they’re classified as W-2 employees, and the employer handles all the taxes.

Freelancers, in many ways, are quite like independent contractors. They will often have their own business and are not committed to any single employer. And more often than not, freelancers don’t have other employees working for them.

So, what’s the main difference between freelancers and independent contractors? Independent contractors often work on longer projects for fewer clients. Freelancers often have more clients but less long-term work. Simple as that.

The biggest benefit of being a freelancer or independent contractor is the freedom and flexibility. You can choose your hours, who you work with, how often you work, and everything else. Plus, you get to set your own rates for how much you get paid.

The biggest difference between an independent contractor/freelancer and an employee is classification. Freelancers are often classified as 1099 independent contractors. This means they pay their own taxes with the relevant tax forms, insurance, and benefits.

To avoid potential issues with the Internal Revenue Service (IRS), it’s important to know all the different classifications. There are different forms and tax implications if you are a W-2 worker, regular employee, or a 1099 independent contractor.

Steps to Pay Independent Contractors

Hiring an independent contractor can provide you with a range of benefits in return. But there can be a lot to know and understand when it comes to paying them properly. So, where do you start and what should you be aware of? Just follow these 6 simple steps!

Classify Workers

The first step, as mentioned above, is to properly classify the worker. This means knowing for sure whether you’re hiring a W-2 employee or 1099 contractor.

The IRS classifies a worker based on 3 things. These include the behavioral relationship, financial relationship, and overall relationship. To help distinguish these relationships, here are a few questions that you can ask yourself:

- Do you control and dictate how the worker does their job? Or are you outsourcing a need to a professional who provides a service in return?

- Are you the one that sets pay rates and determines whether expenses are reimbursed?

- What type of working relationship is it? Is there a contract included? Are you providing health insurance and other employee benefits?

Answering these questions will give you a pretty good sense of how to classify the worker.

Independent contractors are self-employed workers that you hire to complete a project. They don’t have any obligation to continue working for your business long-term. And they don’t receive any benefits from you, like vacation time, paid sick leave, or health insurance.

Determine How to Pay Contractors

Now that you have classified your independent contractor properly, you can figure out how you’re going to pay them. And the great thing? There are several possibilities.

Typically, contractors would invoice the business at the end of each month. Sometimes this happens quarterly.

But these days, there are more and more situations for flexible payment options. Some businesses pay their contractors on a weekly or daily basis. There might be a bit of push and pull between you and the contractor to figure out what works best.

Getting paid more frequently provides contractors with flexibility when it comes to cash flow. A contractor will also be more likely to spend more time and hours with a business that pays them fast. This can also lead to higher-quality work.

It works the same on the opposite side, as well. When a business pays a contractor daily or weekly, it becomes easier to reconcile invoices. One thing to keep in mind, however, is that different contractors work in different ways.

For example, some charge a flat rate for their services. Others charge by the hour. Many do a combination of both. So, it’s important to discuss these details with the contractor to determine what works best for everyone.

Collect Completed W-9 Forms

Since an independent contractor isn’t one of your employees and you won’t be taking care of taxes, you must have them complete a W-9 form. This is a federal tax form that allows you to get relevant information from the contractor. It also serves as an agreement between both parties.

The W-9 form requests information such as the contractor’s Social Security Number, their name, and the type of work they perform, among other details. You can follow our guide on how to fill out a W-9 form to complete it properly. The form indicates that the contractor is not subject to withholding taxes and is considered a non-employee.

You must keep these W-9 forms for a minimum of 3 years. It is also important to understand how they classify themselves. For example, are they a sole proprietorship?

This step is important because you might need to file a 1099-NEC form. Some contractors might need backup withholding deducted from their earnings. But this only happens if they don’t have a valid taxpayer identification number.

Set Up Contractors in Your Payroll System

Even though they aren’t your employees, you still need to pay contractors. An easy and effective way to do this is to set them up in your payroll system.

Once you’ve decided on a platform, you’ll need to connect it to the bank account that will be used to fund payments. Then you need to create accounts for your contractors.

You can do this by having contractors enter their personal information or you may upload this information from a spreadsheet.

A good idea is to find a payroll solution designed to handle a large number of contractor direct deposits. This should allow you to upload a spreadsheet containing payment data to make bulk payments. At the end of the day, this will be a huge time saver.

Here is a list of some important information to add:

- Full name

- A worker ID (so you can identify them in your payroll system)

- The payment amount(s)

- Payment information and payment options, like the hourly rate or direct deposit details

- Notes (to provide you with context about the job the contractor completed)

FreshBooks has easy-to-use payroll software that can save you a ton of time. You can get started in minutes, and then you can get back to focusing on work, not on paperwork.

Process Payments to Independent Contractors

Getting the contractor added to your payroll system means you’re getting close to having to pay them. The good news is that there are a few different options for this. It can be helpful to discuss these details with the contractor when you have them complete the W-9 form.

A couple of the most common payment methods are by check or through direct deposits. These are similar to wire transfers. It’s important to be aware of processing times. A direct deposit can sometimes take up to 4 business days to process.

There may also be additional transfer fees depending on how you set up your payroll. If you pay by direct deposit, you will need bank account details for paying contractors.

In this case, paying independent contractors would work the exact same way as paying employees. But you don’t have to worry about income taxes or other employment taxes.

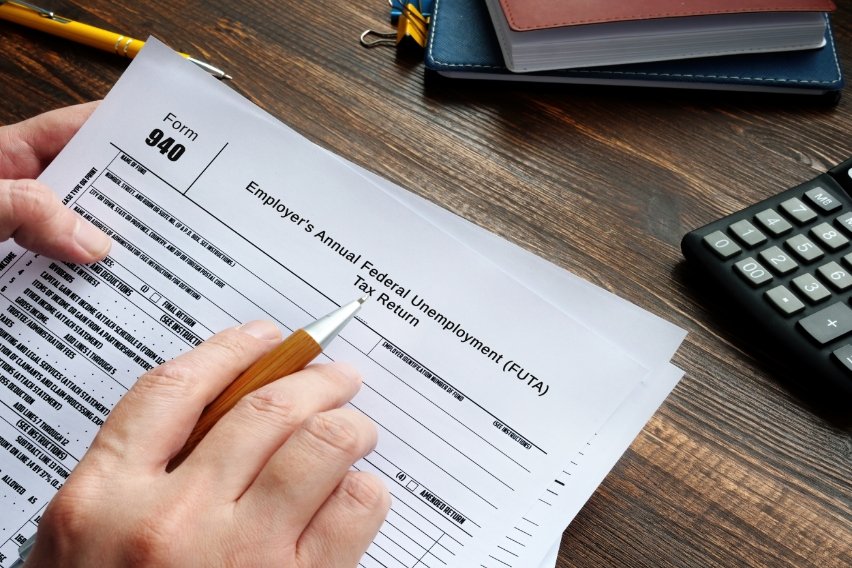

Send 1099-NEC Forms

As tax time approaches, you are going to need to start compiling and sending some information.

1099-NEC forms should be sent to any contractors for whom you pay over $600 in the year. You need to send each contractor you work with a copy. And you also need to send a copy to the IRS and the relevant state tax agencies if needed.

Make sure you also keep copies for your own business records. It can be helpful to keep these along with the W-9 forms you collected at the beginning of the relationship. 1099-NEC forms are also incredibly helpful for contractors. Since they pay their own income taxes, they need to report payments.

Key Takeaways

Certain payment processes and compliance requirements for paying independent contractors can be unclear. There are certain classification rules and IRS forms to complete and keep track of. Knowing your options and the steps to take can make a big difference.

Start by classifying the worker correctly. Once that’s done, you can figure out how to pay them. Figuring out the payment schedule and the type of payment is necessary.

You will also need to collect a completed W-9 form and set them up in your payroll system. From here, you can process all your payments. Also, make sure to send 1099-NEC forms to the contractor and keep a copy for your own records.

FAQ on Independent Contractors

How Much Can You Pay an Independent Contractor Without 1099?

You only need to fill out and send 1099 forms when paying independent contractors $600 or more in a tax year.

How Much Can I Pay Someone Without Putting Them on Payroll?

Actually, how much you pay someone doesn’t dictate whether you have to put them on payroll. The most important thing to consider is the total amount that you pay them. You can make contractor payments through payroll or through other means.

Can I Use PayPal to Pay Independent Contractors?

Yes, you can use PayPal for independent contractors. But you will need to have a business PayPal account, and so will the contractor. Be sure to discuss this payment method when agreeing to payment terms.

RELATED ARTICLES

How to Calculate Fringe Benefits: A Comprehensive Guide

How to Calculate Fringe Benefits: A Comprehensive Guide Commission Income: Definition, Types, Pros & Cons

Commission Income: Definition, Types, Pros & Cons Draw Against Commission: What It Is, How It Works, & Examples

Draw Against Commission: What It Is, How It Works, & Examples Payroll for Startups: Top 7 Payroll Software for Entrepreneurs

Payroll for Startups: Top 7 Payroll Software for Entrepreneurs What is FUTA? How to Calculate it?

What is FUTA? How to Calculate it? What Does Paid in Arrears Mean?

What Does Paid in Arrears Mean?