How to Calculate Fringe Benefits: A Comprehensive Guide

The key to attracting and keeping top talent to your team is offering the right compensation. Of course, this means paying a competitive salary, providing opportunities for advancement, and creating a good working environment. But another factor that’s becoming increasingly important is the noncash fringe benefits or perks that your company offers its staff.

From health insurance to free gym memberships, there are all kinds of fringe benefits that a company might use in its recruitment strategy. This guide will cover everything you need to know about fringe benefits, including defining them, explaining how they work, going over fringe benefit calculations, understanding fringe benefit rates, and offering practical examples of these perks for salaried and hourly employees. Let’s take a look.

Key Takeaways

- An employee’s fringe benefits package refers to stock options, insurance, educational assistance, or anything else besides monetary compensation that they receive from their employer.

- Fringe benefits are mostly chosen by the employer, such as insurance, a vehicle, or cash-equivalents, though employees might also get access to new fringe benefits as they advance in a company.

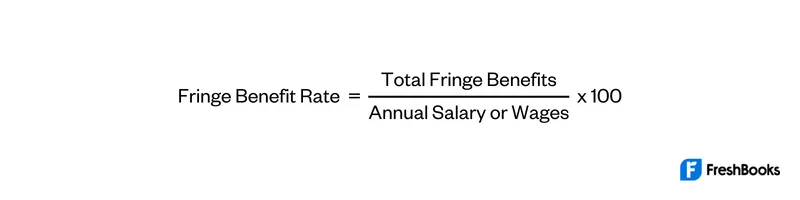

- To calculate fringe benefits for an employee, simply total the cost of fringe benefits provided to them, add their payroll taxes paid, and divide this number by the employee’s salary or wages for the year—multiply the number by 100 to express it as a percentage for the fringe benefits rate.

- Fringe benefit rate calculation is a simple but important process to help you determine how much you really spend on an employee.

Table of Contents

- What Is a Fringe Benefit?

- How Do Fringe Benefits Work?

- How Do You Calculate Fringe Benefits?

- What Is a Fringe Benefit Rate?

- How to Calculate Fringe Rate

- Fringe Rate Calculation Example

- Enhance Payroll Management with FreshBooks Payroll

- Frequently Asked Questions

What Is a Fringe Benefit?

A fringe benefit is a specific type of benefit that employees receive on top of their normal wages or salaries. It can apply to more than just part-time or full-time employees. Independent contractors and freelancers are also eligible for certain fringe benefits.

Some of the most common fringe benefits include:

- The use of a company car

- Employment stock options

- Health insurance coverage

- Life insurance coverage

- Childcare reimbursement

- Educational assistance

- Disability insurance

- Retirement benefits

- Pension plan contributions

- Bonus pay

- Paid time off

- Workers’ compensation insurance

- A portion of the Social Security tax

It’s also important to remember that only certain types of fringe benefits are taxable. Others are not subject to federal income tax withholding, Social Security, or FUTA taxes, such as accident and health benefits.

Most fringe benefits are a certain percentage of an employee’s wages and are relative to the benefits they receive in return.

The IRS allows an employer to add the value of taxable fringe benefits to regular wages for a payroll period and figure income tax withholding on the total. Or they can withhold federal income tax on the value of fringe benefits at the flat 22% rate that applies to supplemental wages.

Fringe Benefit Example

Let’s say that you have an employee who earns $100,000 per year. The fringe benefits that they receive total $25,000. This means that their fringe benefit rate would total 25%.

To help keep things simple, fringe benefits are essentially perks that you would offer your employees. They are considered supplemental wages. It all depends on the specific company; employers decide what fringe benefits they are going to offer.

On top of the examples listed above, other types of fringe benefits could include employee meals or a membership to a fitness center. Also, keep in mind there are certain fringe benefits you can choose to offer, while others are required by law.

Good examples of required fringe benefits are workers’ compensation insurance and unemployment insurance.

How Do Fringe Benefits Work?

As we mentioned above, as an employer, you for the most part have the choice of which fringe benefits to offer. More often than not, these fringe benefits come in the form of a cash equivalent, a service, or property.

They could also be non-tangible fringe benefits. Some of the most common types include insurance coverage or being able to use a company vehicle.

The type or range of benefits might also relate to the specific type of position an employee has.

Higher-ranking employees could receive a wider range of fringe benefits. A permanent employee will also likely receive a better selection of benefits compared to a contract employee.

As an employer, you would select the fringe benefits your employees will receive. Then as your employees do their jobs they become eligible to receive the benefits in return for their work.

How Do You Calculate Fringe Benefits?

Calculating fringe benefits is a standard function of operating a business with employees. It’s the same across all types of companies and industries, meaning any employer can calculate their employee fringe benefit rates using this process. To calculate fringe benefits for your employees, you only need to follow a few simple steps.

- Step 1: Make a list of all fringe benefits that you provide to an employee, such as their health insurance, retirement plan contributions, and any other relevant benefits.

- Step 2: Calculate the value of each individual benefit by determining how much you pay for each one (e.g., the premiums you pay for their insurance, your annual contributions to their retirement account, the cost of an annual, employee-provided gym membership, etc.)

- Step 3: Add the values of each individual benefit to get a calculation of all fringe benefits that your employee receives during the year.

What Is a Fringe Benefit Rate?

Fringe benefit rates are specific percentages of the benefits received in relation to the employee’s salary or wages. Understanding these calculations will provide you with a ton of valuable information. You’ll also get great insights into business costs.

By calculating fringe benefit rates, you can make more informed business decisions when it comes to the number of employees you can hire. This will help you figure out the number of fringe benefits you can provide them.

How to Calculate Fringe Rate

Calculating your employees’ fringe benefits rates is quite straightforward, here are the steps to do it:

- Step 1: Calculate the annual cost of fringe benefits provided to an employee (using the process described above), including insurance, pension plan contributions, free employee meals, and any other relevant benefits. Don’t forget to add the total annual payroll taxes paid to this number, too.

- Step 2: Divide the total annual fringe benefit costs by the employee’s yearly salary or wages.

- Step 3: Multiply the above number by 100 (total annual fringe benefit costs divided by annual salary) to express it as a percentage. This is the employee’s yearly fringe benefits rate.

The formula would look like this:

It’s important to remember to include all of the necessary benefits in the calculation of the total cost of fringe benefits. These might include the likes of pension plan contributions or health insurance. You may also include car insurance or unemployment insurance.

Fringe Rate Calculation Example

Want to get a good understanding of fringe benefit rate calculations? We’ve got you covered. Here, we will take a look at examples for both hourly and salaried employees.

For Hourly Employees

One of your employees earns $25 per hour and receives a total of $10,000 in fringe benefits. If they work a total of 40 hours per week for the entire year it comes to 2,080 working hours in a year, you can calculate the fringe benefit rate. The calculation for the total cost of fringe benefits would look like this :

$10,000 / ($25 x [40 hours x 52 weeks])

$10,000 / ($25 x 2,080)

$10,000 / 52,000

= 0.19 x 100

= 19% fringe benefit rate

For Salaried Employee

To calculate a salaried employee’s fringe benefit rate, the calculations are fairly similar. Let’s say one of your employees earns an annual salary of $75,000 per year. They also receive around $18,000 per year in fringe benefits. The calculation for the total cost of fringe benefits would look like this:

$18,000 / $75,000 = 0.24

0.24 x 100 = 24% fringe benefit rate

Ultimately, this would mean that you pay an additional 24% to your employee on top of their annual base salary.

Enhance Payroll Management with FreshBooks Payroll

Calculating your employees’ fringe benefit rates might seem daunting, but the process is actually quite straightforward. Understanding how to calculate fringe benefits becomes simple once you have a detailed record of the various benefits your employees receive throughout the year. One of the most important parts to keep organized is payroll taxes—a process made much simpler with the help of well-designed payroll software.

FreshBooks payroll software makes it simple to manage the entire payroll process. With automated calculations for payroll tax and other deductions and an easy-to-use interface, it’s never been simpler to manage payroll for your business. Try FreshBooks for free today!

FAQ on Calculating Fringe Benefits

Still wondering about the best practices for how to calculate fringe benefits? Here are a few frequently asked questions to expand your knowledge even further.

What percent of salary should be fringe benefits?

According to a 2022 report from the Bureau of Labor Statistics, the average fringe benefit rate ranges from 22% to 32.7%, depending on industry. Typically, private industry employees receive a lower fringe benefit rate, with government employees often receiving a higher rate.

What is the difference between no-additional-cost services and de minimis fringe benefits?

No-additional-cost services are benefits provided to employees at a minimal cost to employers, such as allowing hospitality workers to stay in a hotel’s vacant rooms. De minimis fringe benefits are services or property provided to employees that have such a small value that accounting for them would be unreasonable or impracticable. Examples include coffee provided on-premises, personal copier use, or occasional meals.

Are fringe benefits deducted from paychecks?

No, fringe benefits are on top of the normal hourly wage or salary an employee earns. They’re considered supplemental wages. A fringe benefits package can be a great option for a salaried employee.

How do I avoid fringe benefits tax?

One way to avoid fringe benefits tax is to replace the benefits with an increase in cash salary. If you do this, it’s important to consider your total taxable income and the overall fringe benefit percentage.

Are fringe benefits considered wages?

In many ways, yes, we consider fringe benefits as wages. This is because they get added on top of an employee’s regular gross income. Also, it means there can be taxable fringe benefits. We calculate an employee’s fringe benefit rate percentage the same if they’re an hourly employee or salaried employee.

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

Commission Income: Definition, Types, Pros & Cons

Commission Income: Definition, Types, Pros & Cons Draw Against Commission: What It Is, How It Works, & Examples

Draw Against Commission: What It Is, How It Works, & Examples Payroll for Startups: Top 7 Payroll Software for Entrepreneurs

Payroll for Startups: Top 7 Payroll Software for Entrepreneurs What is FUTA? How to Calculate it?

What is FUTA? How to Calculate it? What Does Paid in Arrears Mean?

What Does Paid in Arrears Mean? Types of 401(k) Plans: Everything You Need to Know

Types of 401(k) Plans: Everything You Need to Know