What Is A W-2 Form? Tips for Employers on Completing Employee Tax Documents

The W-2 Form is a tax document that employers are required to send to each employee as well as to the Internal Revenue Service at the end of the year. The W-2 Form lists the details of an employee’s annual income as well as the amount of taxes the employer withheld from their paychecks. W-2 forms differ from the W-4 form, which is an input document that tells a company’s payroll department its tax withholding obligations for each employee. As a small business owner, you must learn how to properly complete a W-2 Form for employees and the IRS to accurately report their workers’ income and tax contributions to the federal government.

These topics explain what a W-2 Form is and how employers should fill them out:

What Is the Purpose of a W-2 Form?

What’s Included on a W-2 Form?

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

What Is the Purpose of a W-2 Form?

The purpose of the W-2 Form is to report the wages and salaries paid to employees and the federal, state and local taxes that were withheld from their earnings. Employees need the information detailed as part of the W-2 Form to complete their yearly income tax returns. Businesses are legally required to send out W-2s to workers whom they pay a salary or wage and from whom the employer withheld any of the following:

- Income tax

- Social security tax

- Medicare

Employers don’t need to provide W-2 Forms to independent contractors and self-employed workers, who use different forms to file taxes. The W-2 forms give the IRS and the Social Security Administration information that allows them to verify a person’s income tax return.

What’s Included on a W-2 Form?

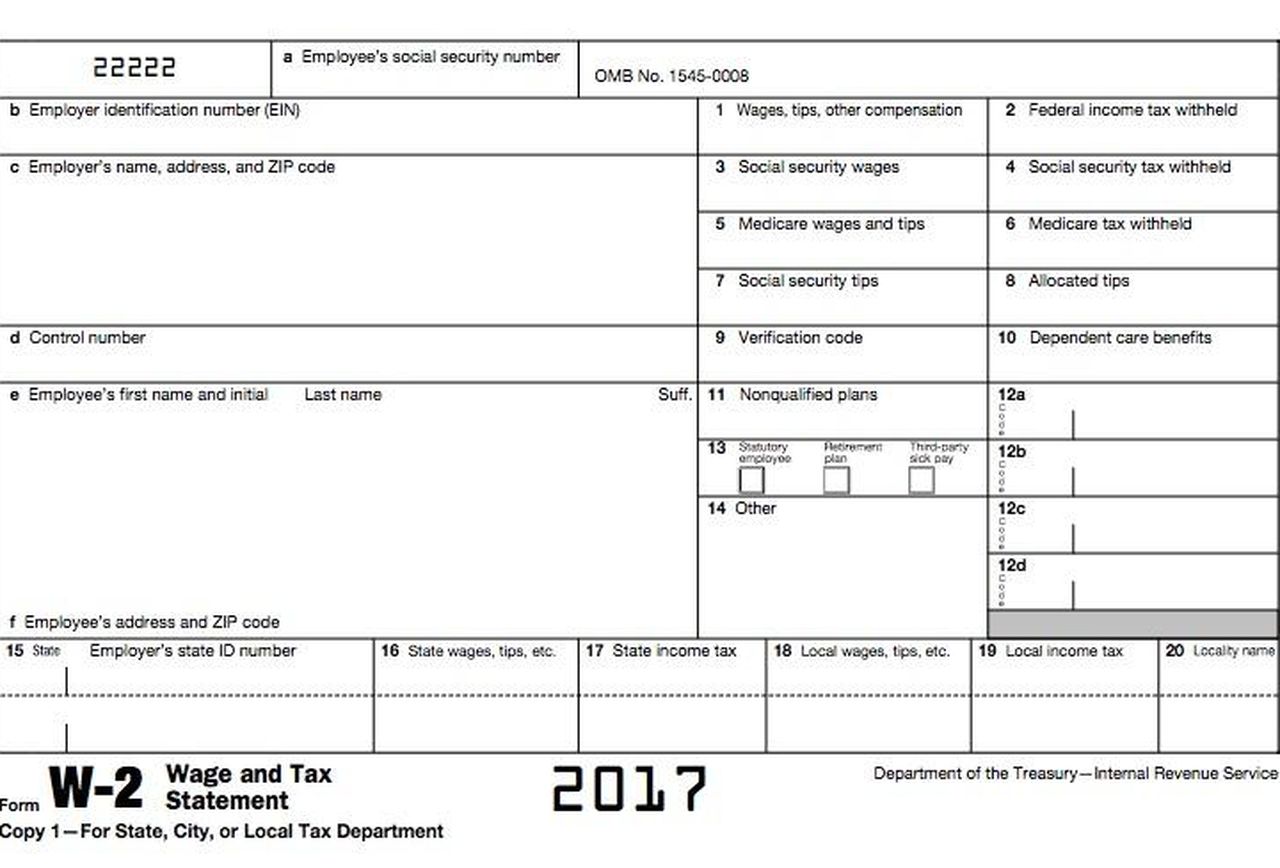

A W-2 Form includes important details that employees need to file their income taxes and that the IRS needs to verify a person’s tax statements. The W-2 always has the same fields of information, regardless of the employer or industry.

The W-2 is divided into two sections, one for state details and one for federal details, since employees need to file taxes on both the state and federal level. W-2 Forms include the following information:

1. Business Information

You’ll need to include some important details about your business on the W-2 Forms you send to employees. Those business details include:

- Your Employer ID Number

- Your business name

- Your business address

- Your business’s State Tax ID Number, which can be found through your state’s department of revenue

2. Employee Information

Your W-2 forms need to include identifying information about each of your employees, including:

- Employee name

- Home address

- Social Security Number

3. Employee Earnings

Next on the form, you’ll need to add information related to the employee’s total wages or salary and withheld taxes for the year, including:

- Total wages or salary, income from tips and any other compensation

- Social security wages

- Medicare wages

- Social security tips and allocated tips

4. Retirement Plan Details

On each employee W-2, you will need to indicate whether the worker takes part in a retirement plan within your business, whether the person is a statutory employee or if they received third-party sick pay.

5. Dependent Care Benefits

Any dependent care benefits that were paid by the employer for the employee are included here.

When is the W-2 Form Due?

The W-2 Forms must be submitted to the Social Security Administration by January 31 of the next year. So, if you’re sending out W-2 Forms for the 2018 tax year, you’ll need to file them with the SSA no later than January 31, 2020, for both mailed and online filings.

You must also send the W-2 Forms to employees by January 31 of the next year.

W-2 Form Example

This sample W-2 Form from Forbes shows you all the information that needs to be included on the document and how the boxes are numbered.

RELATED ARTICLES

What Is an I-9 Form? Tips for Employers About the Employment Eligibility Verification Form

What Is an I-9 Form? Tips for Employers About the Employment Eligibility Verification Form Form 2553: Everything You Need To Know

Form 2553: Everything You Need To Know What Is a 1120 Tax Form? Facts and Filing Tips for Small Businesses

What Is a 1120 Tax Form? Facts and Filing Tips for Small Businesses What Is Form 720? It’s a Hidden Tax

What Is Form 720? It’s a Hidden Tax Indirect Business Taxes: A Definition and Examples for Small Businesses

Indirect Business Taxes: A Definition and Examples for Small Businesses How Much Does a Small Business Pay in Taxes?

How Much Does a Small Business Pay in Taxes?