How Much Does a Small Business Pay in Taxes?

Most small businesses are owned by individuals and are not corporations. Sole proprietorship, partnerships and a Limited Liability Company (LLC) do not pay business taxes and pay taxes at the personal tax rate of the owner.

Since non-corporate small businesses are taxed through their owner’s personal tax returns, how much they pay in taxes can get mixed up with the tax owed by the individual for all forms of income, not just the income of the business.

Small businesses of all types pay an estimated average tax rate of 19.8 percent. This rate is the average of the tax for business or an individual taxpayer. The effective tax rate is calculated by dividing the total tax paid by the taxable income.

According to an SBA report, the tax rates for sole proprietorships is 13.3 percent rate, small partnerships is 23.6 percent, and small S corporations is 26.9 percent.

Small business owner you must pay self-employment taxes which is a flat rate of 15.3%, which is 12.4% for Social Security and 2.9% for Medicare. This is in addition to any income tax that you pay. You can calculate this with your tax software program or your tax preparer.

This may sound like a lot but small businesses also have a lot of expenses that they can deduct from their taxes too.

This article will also discuss:

What Is the Tax Bracket for a Small Business?

How Much Does an LLC Pay in Taxes?

How Much Can a Small Business Make Before Paying Taxes?

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

What Is the Tax Bracket for a Small Business?

Most small businesses are not taxed like corporations.

The Internal Revenue Service (IRS) agency does not recognize the legality of a sole proprietorship, partnerships, limited liability companies and limited liability partnerships as taxable corporation — they are instead considered “pass through” entities. This means that taxable income goes directly to the owners and members who report the income on their own personal income and pay taxes at the qualifying rate.

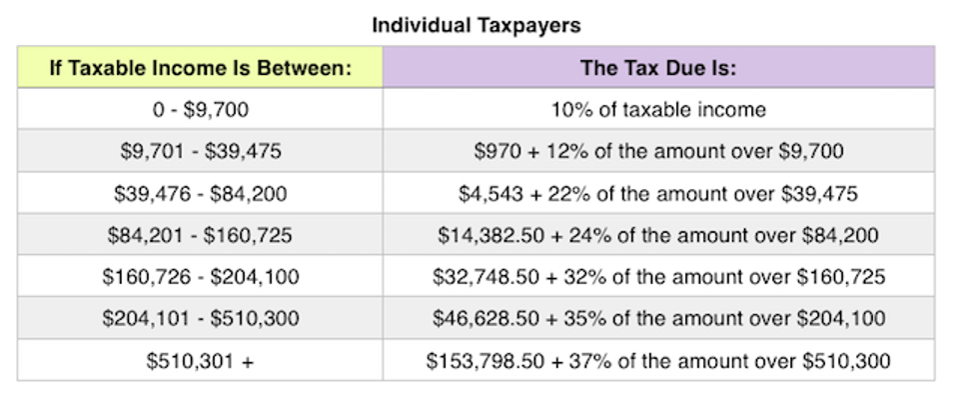

Since most small businesses are charged at an individual income tax level, here is the Federal tax brackets for 2019 for single taxpayers tax brackets:

How Much Does an LLC Pay in Taxes?

A limited liability company (LLC) is considered a pass-through tax entity. In these types of companies, profits pass through the company to individual members. Individual members rather than the company itself must report the members’ share of the profit on their personal tax returns.

For tax purposes, the Internal Revenue Services (IRS) agency treats an LLC as either a sole proprietorship, a partnership, or if the LLC decides so, as a corporation.

Like most self-employed individuals, members of an LLC must make quarterly estimated tax payments four times per year.

To figure out how much to pay quarterly, you’ll need to have a good idea of your taxable income and deductions for the year. It can be helpful to use your tax return from a previous year. In order to avoid IRS penalties, a taxpayer should make estimated tax payments that are at least equal to 90% of the total tax liability for the current year or 100% of the tax liability for the previous year (or 110% for taxpayers with higher incomes).

LLC are also responsible for self-employment taxes which is a flat rate of 15.3%, which includes 12.4% for Social Security and 2.9% for Medicare.

How Much Can a Small Business Make Before Paying Taxes?

Small businesses must keep records of their business activities and pay taxes on the money they make. You may be the only employee of your small business and operating as a self-employed independent contractor but federal income taxes apply to your income. The simplest business to set up is to become a sole proprietorship where you are the owner and the liabilities of the business are yours. Calculating profit and loss determines income and you can deduct expenses from income to determine your tax liability.

If you have made than $400 in self-employment income, you must pay self-employment tax on this income. If your business has employees, you must withhold federal and maybe state income taxes along with Social Security and Medicare taxes and unemployment insurance taxes.

RELATED ARTICLES

How Much Do You Have to Make to File Taxes in 2024?

How Much Do You Have to Make to File Taxes in 2024? How Much Cash Can You Deposit?

How Much Cash Can You Deposit? Can I Sue My Tax Preparer For Not Filing My Taxes?

Can I Sue My Tax Preparer For Not Filing My Taxes? Can I Deduct Health Insurance Premiums? It Depends

Can I Deduct Health Insurance Premiums? It Depends 8 Tips for Filing Taxes

8 Tips for Filing Taxes What Is Tax Evasion? It’s a Crime

What Is Tax Evasion? It’s a Crime