What Is Tax Evasion? It’s a Crime

Tax evasion, also known as tax fraud, is the purposeful nonpayment or underpayment of taxes owing. The term applies to anyone who earns income and does not report it, or hides the income by falsifying a return or the supporting documents. Tax evasion is illegal and punishable by fine, imprisonment, or both.

Here’s What We’ll Cover:

What Is Considered Tax Evasion?

Can You Go to Jail for Tax Evasion?

What Is the Difference Between Tax Avoidance and Tax Evasion?

What Does It Mean to Shelter Income?

What Happens If I Fail to File a Tax Return?

What Is Considered Tax Evasion?

An individual is considered to have evaded taxes if he has:

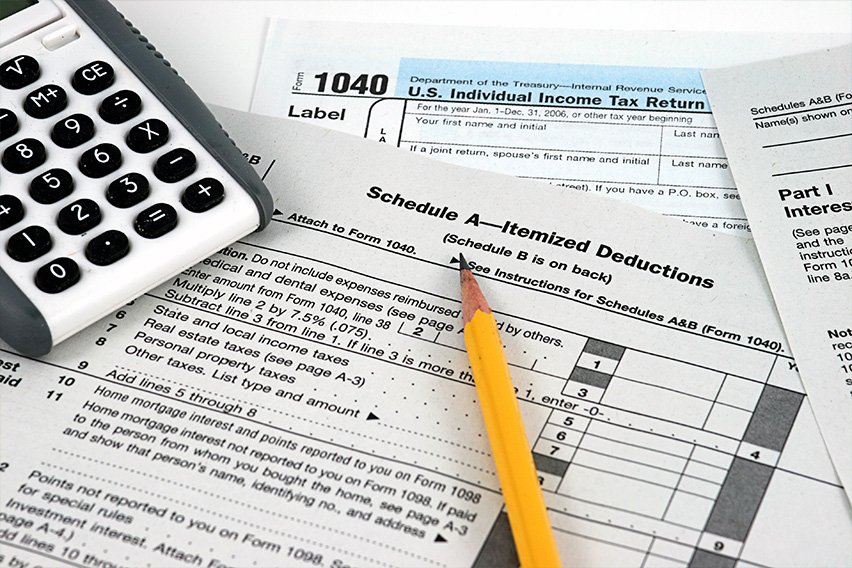

- Claimed false exemptions or deductions on a tax return.

- Accepted kickbacks (a kickback is a payment for facilitating a transaction. It is usually in cash, but can be a “gift”).

- Created fake documents.

- Altered legitimate documents.

- Failed to pay taxes.

- Failed to report income.

- Underreported income.

- Used a false social security number.

- Claimed personal expenses as business expenses.

Can You Go to Jail for Tax Evasion?

Tax evasion can result in a trial and jail time for the evader. Jail time is also a possibility for anyone who fails to file a return, or helps someone else evade taxes.

In October of 1931, the Chicago gangster Al Capone was convicted of income tax evasion. It is perhaps the most famous case of its kind, as Capone was sentenced to 11 years. He was also fined $50,000, ordered to pay an additional $215,000 for taxes owing (plus interest), and court costs of over $7,000. He was released after serving seven and a half years, and settling the amounts due.

What Is the Difference Between Tax Avoidance and Tax Evasion?

Tax evasion is illegal, tax avoidance is not.

Tax evasion is when one takes illegal measures to avoid paying taxes. Tax avoidance is when tax laws are used for benefits in ways not originally intended by the law, in order to reduce a tax liability. Often this results in other consequences.

Let’s use an example.

From 2010 – 2012, Starbucks paid no tax on its earnings in the United Kingdom. It has been reported that it did this in part by borrowing from other parts of the business at high interest rates. The methods used were not illegal, and it allowed them to declare a loss each year. However, it caused a public relations nightmare for Starbucks in the UK, because taxes are used to fund public services. The backlash was so bad that Starbucks had to announce that it would discontinue its tax avoidance policies.

It has also been reported that Amazon paid very little in state and federal taxes in the United States for the 2017 tax year. This was directly attributed to tax avoidance.

What Does It Mean to Shelter Income?

Tax shelters are the products an individual or company utilizes in its tax avoidance measures. Common examples include:

- 401K plan contributions

- IRA plan contributions

- Pension plan contributions

- Real estate investment deductions

- Charitable donations

- Employer health plans

- Employer insurance plans

- Employer funded education

- College savings plans

What Happens If I Fail to File a Tax Return?

It depends on whether you owe money or not, and your personal situation.

If you’re wondering, ‘What happens if I don’t file taxes?’ it’s important to note that failing to file can result in various penalties.

The exact deadline date for filing taxes changes slightly every year, but in the United States it is typically in mid-April. In 2019 and 2020, the due date is April 15th.

If a taxpayer needs an extension, they can get one automatically from the IRS by filling out this form. It should be noted that an extension on filing does not apply to money owed, and interest will be charged on that amount. Fines can also be levied if taxes are not paid by April 15th.

Failure to file can result in the following:

A Failure-To-File Penalty

This is the penalty you’ll receive if you don’t file your taxes on time. The penalty rate is 5% per month that your return is late, up to a maximum of 25%. If your return is more than 60 days late, the minimum penalty charge is the lesser of $210 or 100% of the tax owed.

A Failure-To-Pay Penalty

This is the penalty when taxes owed are not paid by the official tax filing deadline.

This penalty starts accruing the day after the deadline. It is typically .5% per month, of the amount owing, up to a maximum penalty of 25%. There are certain situations where the IRS will increase or decrease the penalty.

Failure to Pay Tax Not Reported

This is the penalty for income not reported by a taxpayer.

The penalty is .5% of the tax owed, if not paid in full by the due date in the official IRS notice. Usually, that due date is 21 days from the date the notice was issued.

Failure to Pay Proper Estimated Tax

This is when a taxpayer underpays the amount owing.

The IRS calculates this penalty separately and notifies the taxpayer of the amount.

Dishonored Check

For a bounced check with an amount less than $1250, the penalty is $25.00 or the amount of the tax payment, whichever is less.

For a check amount of $1250 or more, the penalty is 2% of the payment.

Keep in mind that the IRS is not without sympathy. If a taxpayer did not file on time but had a good reason, even if money is owed, the government may not level any penalties.

The IRS recommends you file your tax return on time every year, even if you’re not in a position to pay. You are allowed to apply for an installment plan through the IRS’s website.

The IRS applies any incomplete payments to the tax owing first, then to the penalty, then to interest.

For full details, you can visit the IRS’s web page on penalties and interest charges.

RELATED ARTICLES

Are Product Samples Tax Deductible? Understanding Tax Deductions

Are Product Samples Tax Deductible? Understanding Tax Deductions Unreimbursed Employee Expenses: What Can Be Deducted?

Unreimbursed Employee Expenses: What Can Be Deducted? How to Get a Business Tax ID

How to Get a Business Tax ID How Long Do IRS Audits Take?

How Long Do IRS Audits Take? Examples of Itemized Deductions

Examples of Itemized Deductions How Long Do You Tax Preparers Have to Keep Records?

How Long Do You Tax Preparers Have to Keep Records?