Tax Deductions for Self-Employed Business Owners: Everything to Know

If you’re a freelancer or entrepreneur, you should always search for ways to minimize cost and increase profit. What if you could save hundreds or even thousands of dollars a year just by doing some paperwork?

Deductions are a great way to reduce your taxes (and your costs), but they can be difficult to understand for the average person. Here’s what you need to know to take advantage of self-employment reductions.

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

What Are the Deductions for Self-Employed Workers?

They are expenses that are subtracted from your adjusted gross income, which lowers the amount that can be taxed. If yours are significant enough, they may even lower your income tax bracket, resulting in a lower tax percentage as well.

There are two kinds in the United States:

- Standard: A standard deduction is a flat rate version set by the Internal Revenue Service (IRS) that varies by year. In 2020, single taxpayers and married taxpayers filing separately can claim a standard deduction of $12,400 per tax year, regardless of net earnings. Taxpayers who are married and filing jointly have a $24,800 deduction, and heads of household (single taxpayers with dependents) can claim $18,650 a year. Understanding these differences is crucial, especially when deciding between married filing jointly vs separately.

- Itemized: If your deductible expenses exceed the standard deduction, you could stand to save even more by itemizing your write-offs. There is no cap, but not all types of expenses are covered, and you’ll have to keep receipts and other documentation as proof for the IRS.

No matter which type of tax deduction you choose, the deadline for filing your personal income tax return is every April 15. If the date falls on a holiday or weekend, the deadline is always set for the following Monday.

Must-Know Itemized Tax Deduction Forms

Form 1040, also known as the individual income tax return, is required of all taxpayers. If you opt for itemized write-offs, there are other optional forms that you’ll need to attach to your Form 1040. The two most common are:

Schedule A

Schedule A is for personal write-offs that fall under one of six categories: medical and dental expenses, paid taxes (including social security payments), paid interest, charitable gifts, casualty and theft losses (in a government-declared disaster zone) and other itemized write-offs.

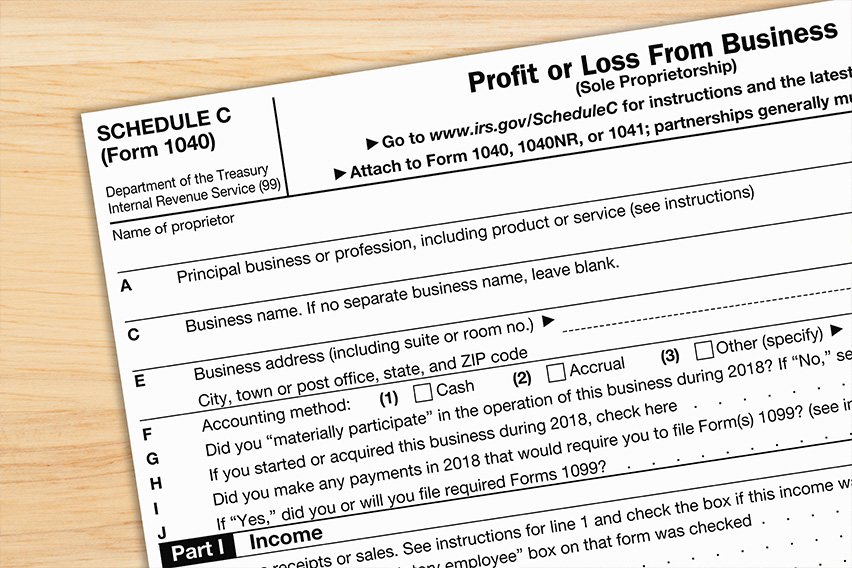

Schedule C

The Schedule C form is for the business expenses of self-employed individuals, such as operating costs, equipment rentals and business-related travel. If the cost is for a something mixed-use (e.g., an office in the home that you rent), you can only deduct the business expense.

Common Deductions for Entrepreneurs and Self-Employed People

There are potentially dozens of hidden write-offs that you can claim on your annual tax returns. This is where an accountant can help. They’ll search through bank transactions to find ways to further deduct expenses off your tax.

Here are some of the most common for freelancers and small business owners:

- Home office: If you work from home, you can claim a percentage of your mortgage and property taxes (if you own a house) or rent (if you’re leasing). For the home office deduction, you can only claim the area of your house that is dedicated to business use.

- Utilities: Working requires electricity, internet, heating, ventilation and air conditioning, phone service and more. You can claim these on the portion of those utilities that you use for business.

- Equipment, supplies and software: If you purchase, rent, lease, repair or maintain any kind of equipment for your business, you can write off those expenses as tax-deductible. This extends to office supplies and software/programs that you use at work.

- Training and development: If you go back to school, attend seminars, and/or join professional industry organizations to develop job-related skills and further your career, you can claim those expenses.

- Marketing: Websites, business cards, flyers and other kinds of advertising/marketing efforts for your business are all tax-deductible.

- Travel: Most costs associated with business travel (e.g., transportation/flights, accommodation, etc.) can be claimed as a deduction. You may also write off the business portion of car expenses like insurance, repairs and more. Gas is claimable as well, as long as it was used for business purposes. In 2019, the standard mileage rate for reimbursement was 58 cents per mile driven.

- Meals: If you pay for lunch during a meeting with a client or supplier, or if you spend on food during your business trips, you can get a portion of that deducted from your taxes. According to current tax law, you can claim up to 50% of business meals. This does not include any personal food-related expenses (e.g., groceries).

- Incorporation: To incorporate your company, you need to pay many different fees. You can deduct these charges from your taxes.

- Health insurance: If you pay for your own insurance (and meet specific criteria), you may be able to claim your monthly insurance premiums and those of your spouse and dependents.

- Other: You can deduct any expense that is necessary for your business. This could include employee wages and benefits, and fees for professional services (e.g., legal, accounting, content writing, etc).

Tax Credit vs. Tax Deduction

A common misconception is that tax write-offs and tax credits refer to the same thing, but this isn’t quite the case! A tax credit refers to a one-to-one dollar reduction off the final tax that you owe. Tax deduction, on the other hand, refers to a deduction off your taxable income.

Conclusion

On the one hand, freelancing or owning a small business comes with the perk of making your own decisions. On the other, it also comes with the responsibility of filing your own taxes and write-offs—a process that can be confusing and tedious even for the most experienced filers.

But by understanding tax deductions (and filing them correctly), you could reduce your taxes and rechannel that money into your growing business. All it takes is a little time, patience and this handy guide.

RELATED ARTICLES

What Is SECA Tax? A Simple Guide to Self-Employed Tax Obligations

What Is SECA Tax? A Simple Guide to Self-Employed Tax Obligations What Is Form 941? Facts and Filing Tips for Small Businesses

What Is Form 941? Facts and Filing Tips for Small Businesses Schedule C: The Essential Tax Form for Self-Employed Individuals

Schedule C: The Essential Tax Form for Self-Employed Individuals How To Calculate Payroll Taxes: Step-by-Step Guide

How To Calculate Payroll Taxes: Step-by-Step Guide What Is Form 8941? It’s a Tax Credit for Small Business Health Insurance Costs

What Is Form 8941? It’s a Tax Credit for Small Business Health Insurance Costs What Is Form 1099? It Reports Payments Other Than Regular Salaries, Wages or Tips

What Is Form 1099? It Reports Payments Other Than Regular Salaries, Wages or Tips