Schedule C: The Essential Tax Form for Self-Employed Individuals

If you’re self-employed, you most likely need to fill out and file Schedule C to report income and losses for the tax year to ensure you comply with the IRS rules. This goes for all sole proprietors, including freelancers, single-member LLCs, contractors, and people who work a side gig.

In this guide, we’ll go over everything you need to know about the IRS tax form Schedule C, including how to fill it out, how to know if you’re required to file it, and some useful resources to make tax time faster and simpler for sole proprietors.

Key Takeaways

- IRS Form Schedule C, Profit or Loss from Business, is used to report income and expenses from self-employment.

- Freelancers, independent contractors, side gig workers, single-member LLCs, and sole proprietorships must file Schedule C.

- Schedule C is filed alongside your individual income tax return, attached to IRS Form 1040.

- Using expense tracking software throughout the year can save you money on income taxes when you claim them on Schedule C.

Table of Contents

- What Is a Schedule C?

- Who Needs to File a Schedule C Tax Form?

- What Information Does a Schedule C Contain?

- When and How To File Schedule C Tax Form?

- Tips to Make Filling out this Form Easier

- Can Only Self-Employed People File Schedule C?

- Schedule C Made Simple: Navigate Taxes Effortlessly with Freshbooks

- Frequently Asked Questions

What Is a Schedule C?

Schedule C is a tax form used to report income and losses for self-employed people or sole proprietors to the Internal Revenue Service (IRS). It’s a part of your individual tax return, so the Schedule C form is attached to your 1040 income tax return.

Those who file Schedule C probably also need to file Schedule SE to calculate self-employment tax. This form includes your Social Security and Medicare tax liability. It’s based on your yearly, untaxed income as a self-employed person or sole proprietor.

Who Needs to File a Schedule C Tax Form?

It’s sometimes hard to know which tax forms you’re required to fill out, so let’s break it down for this self-employment form.

You must report income on Schedule C as an individual if any of the following apply to you:

- You’re a small business owner.

- You work a side gig in addition to a paid, regular job.

- You do freelance work (either full or part-time).

- You’re an independent contractor.

- You receive untaxed self-employment income from another source.

In addition, the form might be required to be filed by 3 types of business entities:

- Sole Proprietorships – Unincorporated, “pass-through” entity businesses owned and run by 1 person who is entitled to all business profits and responsible for all losses/liabilities

- (e.g., most independent contractors, freelancers, and other single-person businesses)

- Single-Member Limited Liability Companies (LLCs) – A business fully owned by 1 person who has not made an election with the IRS to be treated as a corporation for tax purposes, and therefore cannot file a corporation tax return

- LLCs Owned by Spouses in a Community State – These returns can be filed as a Schedule C instead of a regular partnership tax return.

Small business owners must complete a separate Schedule C form for each eligible business they own. However, if your business is a C corporation or S corporation, Schedule C does not apply.

Generally, you probably need to file Schedule C if you do anything that generates profits that aren’t already taxed.

The major exceptions are for farming (you’ll need a Schedule F) or businesses involving royalties or rental income (Schedule E).

What Information Does a Schedule C Contain?

This form must contain the following information:

- Business name and address

- Employer Identification Number (EIN—not the same as your Social Security number) if you have it

- The main products, services, or professions that your business offers

- Accounting method you use for tax purposes (e.g., cash, accrual, etc.)

- Details of your material participation in the business

- Information on whether or not you acquired/founded the business during the current tax year

- Detailed income and profits information

- Itemized expense reporting (including inventory, advertising, insurance, professional services, wages, rent, and more) for tax deductions

- Inventory records

- Cost of goods sold (COGS—if applicable to your business)

- Business mileage records, car and truck expenses, vehicle records (if applicable)

- Other expenses not categorized above

Your gross receipts, which are the total amounts earned from your business activities, must also be reported.

You’ll also have to provide the bottom line for the tax year—your net profit or loss for that business. Deducting your total business expenses from your business tax receipts gives your net profit or loss. Schedule C is where you calculate this information. Any net profit is then reported to the IRS as income on your 1040 income tax form.

Keeping detailed records of your business activity is the key for every self-employed person. Using can help you with some of the necessary information required to file taxes. It takes just a few clicks to find, gather, and input this essential information.

When and How to File Schedule C Tax Form

Knowing when and how to file the Schedule C tax form depends on your business structure. For sole proprietors and single-member LLCs, it’s filed alongside your individual tax return, typically due by April 15.

While some sections are straightforward, others can be tricky. Understanding each part is crucial to accurately report business expenses and claim all eligible deductions. This guide will walk you through the process to help you file correctly and maximize your tax benefits.

Before you start you should gather:

- your profit and loss statement and balance sheet

- information on assets purchased during the year

- home office and truck or car expenses

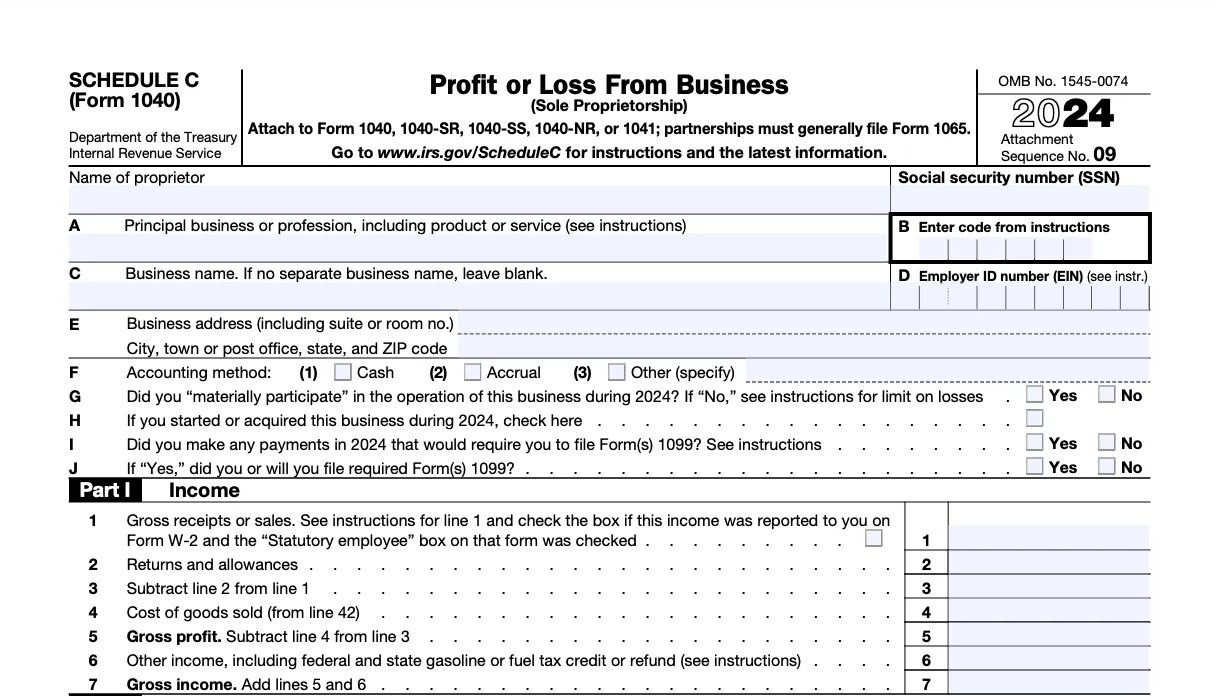

Identity Section

- Lines A and B: Enter a brief description of your business, like “website design” and input the relevant code (found in the IRS instructions for Schedule C).

- Line D: Input your EIN (employer identification number). If you do not have an EIN, leave Line D blank. Some people confuse their SSN (Social Security number) for their EIN—these are different identifiers, so make sure you’re using the right one.

- Line F: Check off the accounting method you have used when calculating your income and expenses. If this is the first time filing this form, you can choose whichever method you prefer. If you have filed before, you have to use the same method as in previous years unless you have requested a change from the IRS. Learn about the differences between accounting methods.

- Line G: Did you have an active role in your business this year? The IRS has criteria for what counts as an active role—for example, you spent at least 500 hours on business activities, or you spent at least 100 hours on business activities, which is at least as much as the other people involved in your business, or your business activities were the substantial majority of all activities for this business for the tax year, regardless of the number of hours. The IRS has a list of full criteria.

- Line I: If you paid a subcontractor or another person $600 or more during the year, you’ll need to file a 1099 form. If you want to check all the situations where you might be required to file one, you can review the IRS guidelines for Form 1099.

Part 1: Business Income

Here’s where you’ll list the money that you earned during the year from your business. Some lines that might be confusing include:

Line 1: Enter the total amount of income you’ve brought in through business activities. If you received a W-2 form and the “Statutory employee” box (box 13) of that form was checked, check the box on this form as well. Otherwise, leave it unchecked.

A statutory employee is an independent contractor who is treated as an employee by having Social Security and Medicare taxes withheld. You’ll need to file 2 separate Schedule C forms if you have both self-employment income (from freelance work, for example) and statutory employee income.

Line 2: If you had any returns or allowances this year, this is where you’ll put them. A return is a refund given to customers, and an allowance is a reduction in the sales price. Most service-based businesses won’t have returns or allowances to include.

Line 4: Your total cost of goods sold. You’ll need to jump down to Part 3 to calculate this.

Line 6: Here’s where you’ll input any money that wasn’t from regular business activities (e.g., bad debts you recovered, interest, fuel tax refunds or awards you’ve won would all count here). For specifics, check out the IRS website.

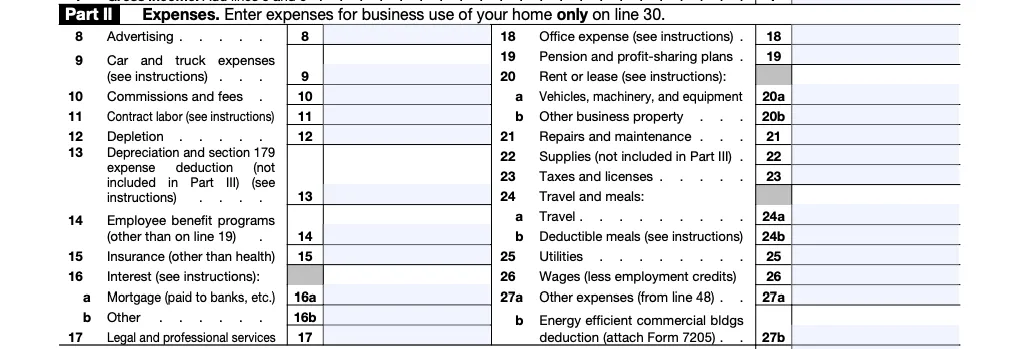

Part 2: Expenses

Many of the line items in the expense section are self-explanatory, and you should be able to find the amounts needed on your income statement. There are a few tricky items that need a little more explanation.

Line 9: The amount you spent on car and truck expenses. You’ll be able to claim expenses using two different methods: by using a standard mileage rate deduction or by using the actual expenses incurred (e.g., gas, parking, tires, registration, fees, etc.). Whichever method you choose, be sure to keep accurate records and receipts to support the expense.

Line 11: This is the total amount you spent on contract labor during the year—people who aren’t considered employees but performed a service for your business. Don’t include any payments here that you include elsewhere (e.g., if you hired a repair person, you could include that on Line 21, repairs, as opposed to Line 11).

Line 13: Depreciation is an annual deduction that allows you to recover the cost of property that has a life beyond a single tax year. You would enter your eligible depreciation deductions on this line. This article explains depreciation expenses.

Line 18: This line only includes office supplies and postage. Stamps, envelopes, paper, and printer ink all fall into this category.

Lines 24A and 24B: This is where you’ll include costs for travel and meals. The IRS does have restrictions on the expenses you can take. Refer to IRS Publication 463, section 1, to understand which travel expenses are allowed.

Line 30: If you use your home for your business, you’ll need to fill out Form 8829. Whatever total you arrive at Line 36 of Form 8829 is what you want to enter on Line 30 of Schedule C.

Part 3: Cost of Goods Sold

Most service-based small businesses won’t have any dollar values to enter in this section. This is because they aren’t producing and selling a product but rather selling time and expertise.

If your business does involve selling products and you have an inventory, though, you’ll want to read the instructions listed in Part III.

<figure class="wp-block-image size-full"><img src="https://www.staging.freshenv.com/wp-content/uploads/2024/11/Schedule-C-income-tax-return.png" alt="part iii - Cost of Goods Sold" class="wp-image-331538"/></figure>Part 4: Information on Your Vehicle

If you’re claiming an expense for your car or truck, you’ll need to fill out this section. When filling out Line 44, don’t guess. You’ll want to keep a written log of your mileage to claim this expense.

Tips to Make Filling out Schedule C Form Easier

Filing out this form can feel like a lot of work to do during tax time. Here are some tips to make it feel like less of a chore:

- Keep good records throughout the year: Filling out your business income and expenses is much easier if you keep your records accurate and updated throughout the year. Try using accounting software designed to help keep small businesses organized.

- Make quarterly estimated tax payments: Don’t wait until the end of the year to pay your taxes—you could end up being hit with penalties from the IRS. File your quarterly estimated taxes by the deadline each quarter.

- Don’t leave filing to the last minute: In most cases, the deadline to file your 2024 taxes is April 15, 2025; however, you can request a six-month extension. Don’t leave things to the last minute. You’ll not only cause yourself undue stress, but you won’t have time to consult an expert or look up any records if needed.

Can Only Self-Employed People File Schedule C?

Schedule C is primarily for self-employed people, such as freelancers, independent contractors, or people with side gigs that they actively work on (essentially, anything more than a slightly profitable hobby), and it is filed as part of your personal tax return. It’s a method of reporting income and tax liability for profits that are not already taxed—so you wouldn’t file this form for employment income, since it’s already taxed when you receive it.

If you earn money through any other means besides employment (i.e., working for yourself), you’ll probably need to file a Schedule C form. This means collecting all 1099 forms from your clients (if applicable) and detailing all other income you made with your business for that tax year.

As mentioned above, certain small businesses, including single-member LLCs and sole proprietorships, may also be required to declare their income and expenses on IRS form Schedule C.

Navigate Tax Time Effortlessly with Freshbooks

Tax time can be daunting for sole proprietors—especially when you’re new to the process. But as you can see, Schedule C is fairly straightforward, particularly if you set yourself up for success with an online tool for tax prep and organization like FreshBooks expense tracking software. FreshBooks makes tracking and categorizing business expenses throughout the year simple, helping you accurately file Schedule C at tax time.

Looking for help with business taxes this year? Many sole proprietors use FreshBooks accounting software to save time, money, and hassle when it’s time to file taxes. Try FreshBooks for free today.

FAQs About Schedule C

Still wondering about the details of filling out and filing form Schedule C? Here are a few answers to frequently asked questions on this form:

What is the minimum income to file Schedule C?

There is no minimum income threshold for filing Schedule C. You must report all business income and expenses on your Schedule C, no matter how much or how little you make.

If you make less than $400, you don’t need to file Schedule SE or pay self-employment tax, but Schedule C is still required.

What’s the difference between Schedule 1 and Schedule C?

Schedule C is used to report self-employment income and expenses, while Schedule 1 reports net income from all sources. Schedule 1 will report income from sources like capital gains, unemployment benefits, alimony, or income adjustments like student loan interest.

Do I need to file a Schedule C for 1099-NEC?

If you receive a 1099-NEC form for providing services, you may be required to file a Schedule C, even if you don’t have a business. This goes for all non-employment income, even if it’s a small piece of paid work on the side of your regular job.

How do I prove my Schedule C income?

You’ll need to be prepared to provide proof of your income reported on form Schedule C. This can include 1099 forms from your clients, bank statements, profit-and-loss statements, and possibly self-employed pay stubs you create for your own records.

What is the benefit of Schedule C?

The potential benefit of Schedule C is for sole proprietors to maximize their deductible expenses to minimize their tax liability. Of course, deductions are deducted from your profits, but you’ll generally save more money by thoroughly completing the deductions section of your form Schedule C.

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

What Is Form 8941? It’s a Tax Credit for Small Business Health Insurance Costs

What Is Form 8941? It’s a Tax Credit for Small Business Health Insurance Costs What Is Form 1099? It Reports Payments Other Than Regular Salaries, Wages or Tips

What Is Form 1099? It Reports Payments Other Than Regular Salaries, Wages or Tips What Is Form 4562? It’s the IRS’s Depreciation and Amortization Form for Tax Filing

What Is Form 4562? It’s the IRS’s Depreciation and Amortization Form for Tax Filing What Is a Schedule K-1 Tax Form? Easy Filing Tips for Small Businesses

What Is a Schedule K-1 Tax Form? Easy Filing Tips for Small Businesses Are My Business Tax Returns Public? Advice for Small Businesses

Are My Business Tax Returns Public? Advice for Small Businesses Tax Incentives: A Guide to Saving Money for U.S. Small Businesses

Tax Incentives: A Guide to Saving Money for U.S. Small Businesses