What Is a Schedule K-1 Tax Form? Easy Filing Tips for Small Businesses

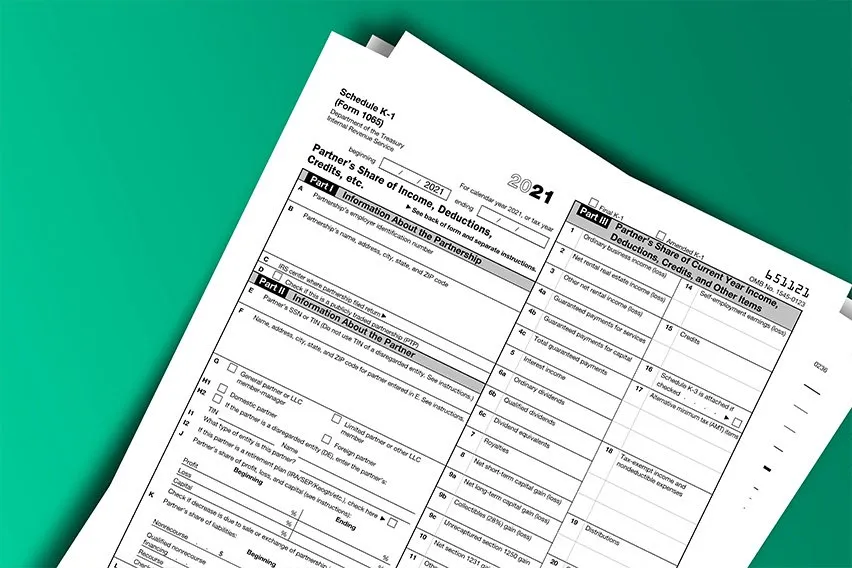

A Schedule K-1 (Form 1065) tax form reports on a partner’s share of the income, deductions, credits and more of their business. A partnership business structure has at least two partners. Each partner files a copy of this schedule with the Internal Revenue Service (IRS).

In this article, we’ll cover:

- What Is a Schedule K-1 Tax Form?

- Do You Have to File a Schedule K-1?

- What Is the K-1 Tax Form Deadline?

What Is a Schedule K-1 Tax Form?

A Schedule K-1 Tax Form is used to report a partner’s share of a business’s income, credits, deductions etc. The business must be a partnership business structure. It is not filed with a partner’s tax return, unless the IRS requires you to do so.

The partner may need to pay tax on their share of the partnership income by reporting it on their individual tax return. A partner can also claim any losses or deductions from the business on their tax return, though there may be limitations to how much you can claim.

Download the K-1 tax form and Schedule K-1 instructions.

Do You Have to File a Schedule K-1?

All partnerships must file Schedule K-1. A partnership is a business structure where two or more people run a business together. Each person shares in the profits and losses of the business and contribute skill, labor, property or money, according to the IRS.

Each partner reports their share of the profits or losses of the business on their personal income tax return (Form 1040) and pay income tax accordingly. The partnership itself doesn’t pay tax; the partners do via their personal returns.

Still, the partnership must file an information return via Form 1065 to report the businesses’ overall income, deductions, losses or gains. One must be prepared for each partner.

Partnerships include:

- Domestic partnerships

- Limited Liability Companies (LLCs) classified as partnerships for federal income tax purposes

- Foreign partnerships that have income that comes from the U.S. or receives income connected with doing business or trade in the U.S.

What Is the K-1 Tax Form Deadline?

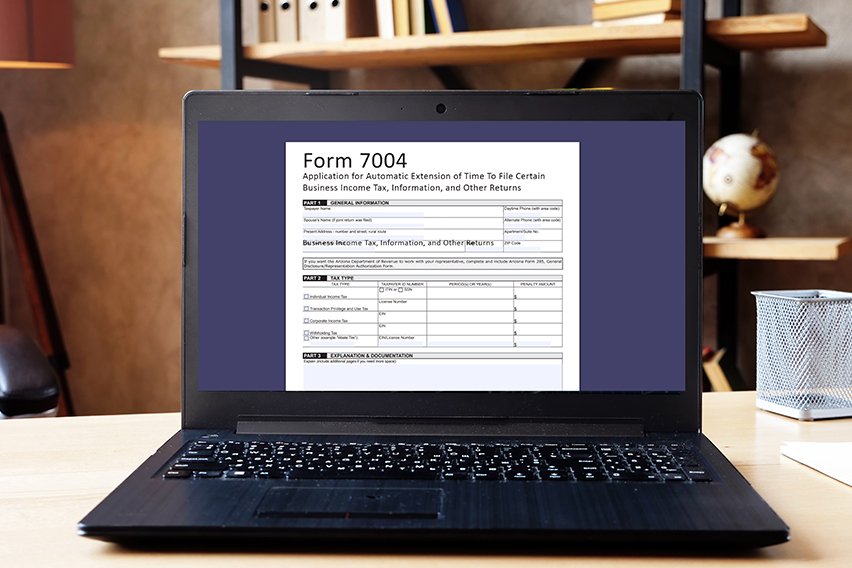

Schedule K-1 is due on an annual basis. It is due on the 15th day of the 3rd month after each tax year.

- For example, if a partnership follows the calendar year, the due date for Schedule K-1 (covering 2014) would be March 15, 2025.

If the due date falls on a Saturday, Sunday or legal holiday, the due date will be the next business day.

People also ask:

What Does a K-1 Show?

Schedule K-1 shows a partner’s share of the profits and losses of a partnership, a business structure where the business or trade is run by two or more people.

Schedule K-1 specifically shows the following information:

- Information about the partnership: name, address, partnership number

- Information about the partner filling out the K-1: name, address, identifying number such as a social security number, distributive share items

- The partner’s percentage share of profit, loss and capital at the beginning and end of the tax year in question

- Partner’s share of liabilities

- Properties contributed by the partner and their built-in gain or loss

Do I Need a K-1 for My LLC?

LLCs only need to fill out Schedule K-1 if they are classified as partnerships for federal income tax purposes. A domestic LLC with two members or more is automatically classified as a partnership by the IRS unless it files Form 8832 and asks to be taxed as a corporation instead.

An LLC with only one member is automatically treated by the IRS as separate from its owner unless the owner similarly files Form 8832. In either case, Schedule K-1 isn’t necessary for single-member LLCs.

Where Do I Report K-1 Income on Form 1040?

A partner’s share of a partnership’s gains or losses is reported on Schedule D of Form 1040. Schedule D is an attachment to Form 1040. It allows a partner to report capital gains or losses.

RELATED ARTICLES

Tax Incentives: A Guide to Saving Money for U.S. Small Businesses

Tax Incentives: A Guide to Saving Money for U.S. Small Businesses Filing Personal and Business Taxes Separately: A Small Business Guide

Filing Personal and Business Taxes Separately: A Small Business Guide What Is the Small Business Tax Rate?

What Is the Small Business Tax Rate? What Is a Business Tax Receipt?

What Is a Business Tax Receipt? How to File an Extension for Business Taxes?

How to File an Extension for Business Taxes? Can a Small Business Get a Tax Refund? Insights and Ways

Can a Small Business Get a Tax Refund? Insights and Ways