How to Make a Profit and Loss Report?

The financial statement that shows the revenues and expenses and resulting profit or loss of a company over a specific time period is called the profit and loss statement. A profit and loss report is often also referred to as an income statement. This report provided insight as to whether a company is able to generate profit by increasing revenue, reducing costs, or both.

In this article, we’ll cover:

How to Make a Profit and Loss Report, Step by Step

How Is a Profit and Loss Account Calculated?

What Is in a Profit and Loss Statement?

How to Make a Profit and Loss Report, Step by Step

Here’s a step-by-step process to create a profit and loss report.

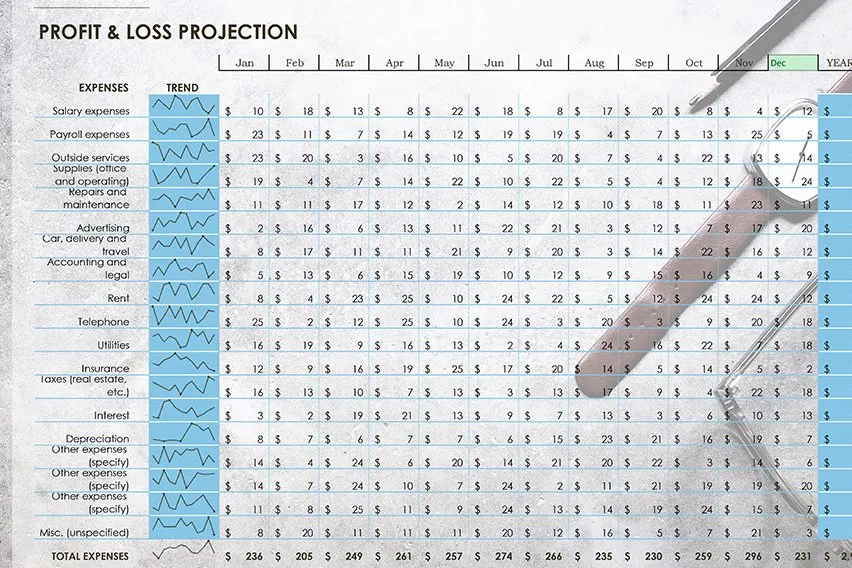

For each row, you will have a quarterly amount then a total for the year.

Step 1: Each row will have a quarterly amount then an annual amount

Step 2: Show your business Net Income or Sales for each quarter of the year. If you wish, you can break down income into subsections to show different sources of income.

Step 3: Itemize your business expenses for each quarter. Each expense should be shown as a percentage of Sales. All expenses should be equal 100% of Sales.

Step 4: Show the difference between Sales and Expenses as Earnings. This is also referred to as EBITDA (earnings before interest, taxes, depreciation, amortization).

Step 5: Show the total interest on your business debt for the year and subtract from EBITDA.

Step 6: List (estimated) taxes on Net Income and subtract.

Step 7: Show the total depreciation and amortization for the year and subtract.

Result: This number should equal net earnings, or your business profit or loss.

Also Read: How to Make an Income Statement

How Is a Profit and Loss Account Calculated?

A company’s profit and loss account shows its revenue and expenses over a specific time, typically over a month or consolidated months over a year. These numbers show whether a company has made a profit or loss over that time period.

To calculate profit or loss, simply:

- add up all your gross sales for the month

- add up all your expenses for the month

- calculate the difference by subtracting total expenses away from total income

- and the result is your profit or loss

So, you can calculate net profit when you subtract gross profit by expenses and your loss by subtracting your expenses from your income.

Profit example:

Income: $200

Minus

Expenses: $50

Net profit: $150

Loss example:

Income: $200

Minus

Expenses: $250

Loss: –$50

What Is in a Profit and Loss Statement?

Most of the information you need to create a profit and loss statement comes from your cash flow statement or your first-year monthly budget, and from estimated calculations on your depreciation.

Specifically, you’ll need:

- A list of all the transactions in your business checking account and all the purchases made with business credit cards.

- Any petty cash transactions or other cash transactions for which you have receipts.

- A list of all sources of income—checks, credit card payments, etc.—on your bank statement. Also, include cash paid to your business, for which you should have records.

- Notes about any reductions to sales, like discounts or returns.

If you’re using business accounting software to generate this statement, the profit and loss statement is likely included with the standard reports. Even so, you should still know what information is required to prepare this report. You can also use our free profit and loss report template as a starting point.

RELATED ARTICLES

Accounting Reports: Definition And 3 Types

Accounting Reports: Definition And 3 Types How to Write a Profit and Loss Statement?

How to Write a Profit and Loss Statement? Monthly Financial Reports: What Are They And How to Read

Monthly Financial Reports: What Are They And How to Read What Is Financial Reporting? Definition, Importance, and Types

What Is Financial Reporting? Definition, Importance, and Types Expense Report: What It Is and Why Is It Important?

Expense Report: What It Is and Why Is It Important? How to Handle Small Business Finances?

How to Handle Small Business Finances?