Accounting Reports: Definition And 3 Types

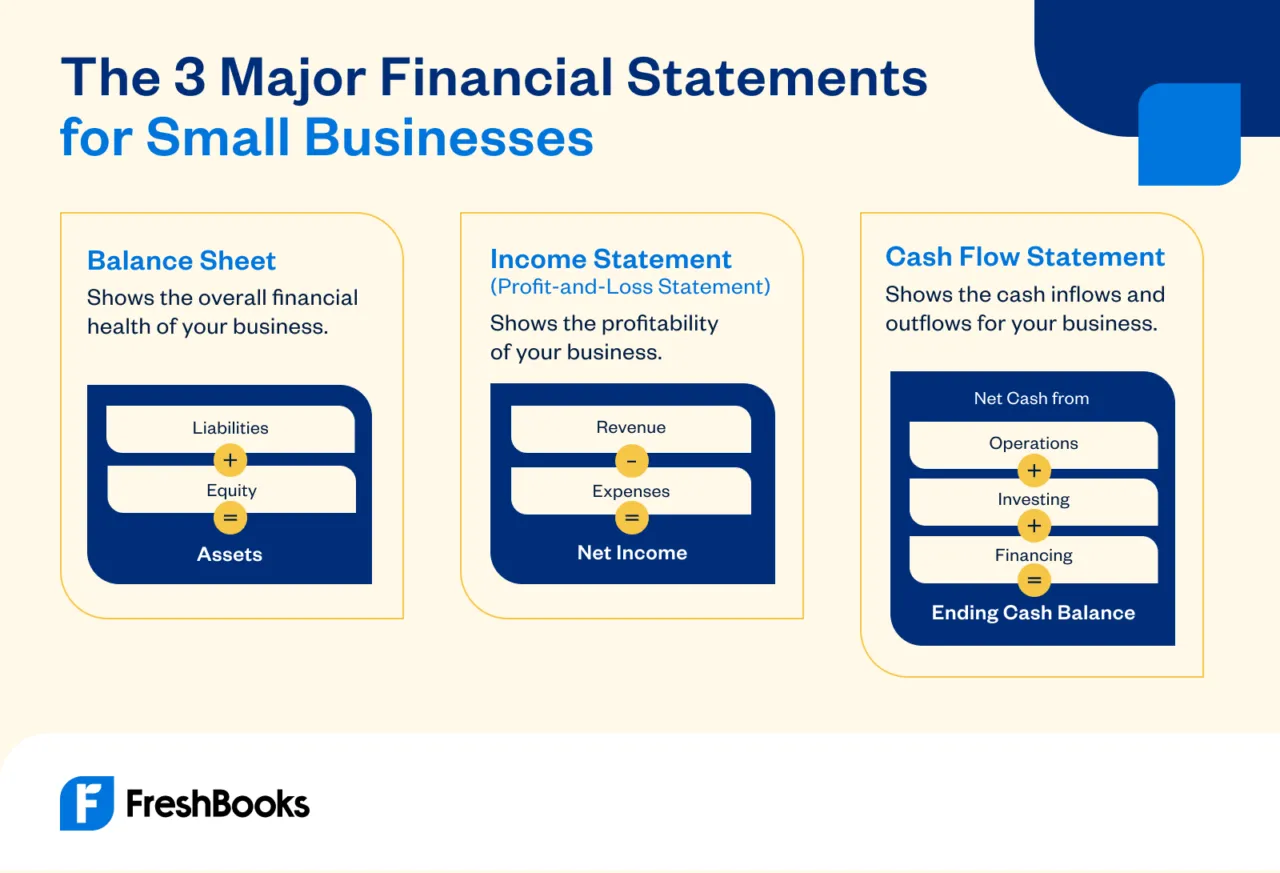

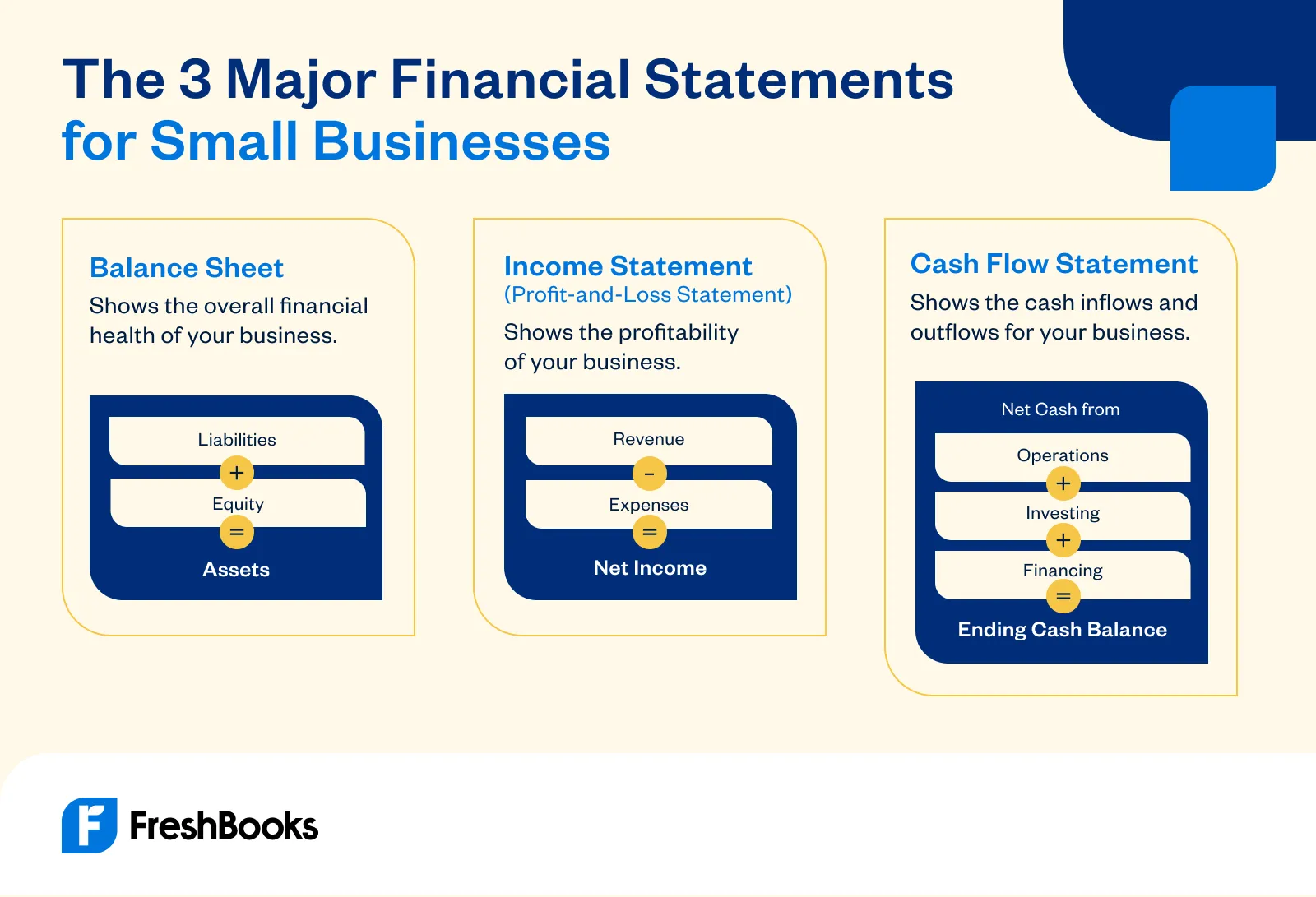

A business uses its accounting records to compile financial reports, sometimes called accounting reports or financial statements. You must understand what is monthly financial report. A financial report, also known as a financial statement, consists of three standard reports that are commonly used by almost every business. These three reports are the balance sheet, income statement (or profit and loss statement), and the cash flow statement (also known as a statement of cash flows).

Most companies prepare these three accounting reports each month after completing all of their month-end close procedures. Business owners, managers, investors, and lenders can then use the company’s balance sheet, profit and loss statement, and cash flow statement to calculate key performance indicators and monitor the business’s financial health over time.

Businesses may also use custom-made management accounting reports intended for specific purposes, such as:

- Analyzing the profitability of a product line, region, or client

- Tracking employee time or the status of projects reports

- Monitoring accounts receivable aging and accounts payable aging report

- Keeping tabs on operating expenses

Businesses might also generate reports to send to their accountant or tax preparer. For example, many accountants and tax preparers ask their clients for a trial balance report at the end of each accounting period to begin planning a financial statement audit or preparing a business tax return.

Here’s what we’ll cover:

What Is Included in Financial Reporting?

Why Does a Small Business Need Accounting Reports?

3 Most Common Types of Accounting Reports

How Are Accounting Reports Prepared?

How Frequently Should You Look at Accounting Reports?

What Is Included in Financial Reporting?

Financial reports should be comparable to those of other companies, especially ones within the same industry. For that reason, many large companies prepare their financial reports in accordance with Generally Accepted Accounting Principles (GAAP). GAAP is a set of regulatory guidelines used across the accounting industry in the U.S.

For companies that issue GAAP financial statements, financial reporting, often facilitated by efficient financial reporting software, includes the following:

- External financial statements (balance sheet, income statement, statement of cash flows, and statement of shareholders’ equity)

- Notes to the financial statements

Why Does a Small Business Need Accounting Reports?

Small business owners typically don’t issue GAAP-based financial statements. Instead, they rely on accounting reports to help them monitor their business’s profitability and financial health.

Accounting reports give a small business owner information about their operations, cash flow, net income, accounts receivable, accounts payable, and financial position. Understanding the data in these accounting reports helps a small business owner allocate resources better and make informed decisions.

They may also give accounting reports to their investors, lenders, and tax preparers, as needed.

You might find accounting reports useful for:

Credit decisions: Lenders use data in your financial statements to determine if they should extend credit to a business or restrict the amount of credit extended.

Investment decisions: Investors analyze an accounting report to decide whether to invest and what price per share at which they want to invest. The information is used to develop a potential selling price for the company.

Taxation decisions: A business may be taxed based on its assets or income, and that amount can be derived by the government using information from financial statements.

Union bargaining decisions: Financial statements can be used by a union to base its bargaining position based on a company’s ability to pay.

These are just a few purposes of financial statements. There are many more—including the important internal decisions you need to make as a business owner about your own profitability and growth.

3 Most Common Types of Accounting Reports

The most common accounting reports (or financial statements) are the income statement, balance sheet, and statement of cash flows. Now, we’ll explain what each of these accounting reports is in more detail, and explain when and how you might use them.

Income Statement (Profit and Loss Statement)

The income statement, also known as a profit and loss statement, summarizes a company’s total revenues and expenses over a specific accounting period—usually a month, quarter, or year. It shows the business’s profitability (net income or net loss) for that period.

This is the most commonly used accounting report for small business owners. It’s used by internal and external stakeholders to evaluate the company’s profitability. Investors and creditors might also use this report to assess their level of risk in working with the business.

Balance Sheet

A balance sheet shows a company’s total assets, liabilities, and stockholder equity at a particular point in time. It provides a current view of a business’s financial position, including economic resources the company owns and the sources of financing for those resources.

Balance sheets can be used to identify trends and help business owners make informed financial decisions. It’s also important to potential investors and bank lenders, as they might use it to judge the liquidity and financial reserves of a business.

Cash Flow Statement

The statement of cash flows shows how cash has changed over a particular accounting period. This statement helps a business see if it has the adequate cash flow to operate and pay its bills on time.

The statement of cash flows differs from an income statement because it only takes into account cash activity. It doesn’t consider non-cash activities like sales or purchases on credit or depreciation.

This report is the most accurate source of information regarding a business’s ability to generate cash and use it wisely.

How Are Accounting Reports Prepared?

Financial statements help businesses determine their financial position at a specific point in time and over a period of time. Data from your accounting journal and general ledger is used to prepare income statements, balance sheets, and statements of cash flows. Information from previous reports is used to develop the next period’s accounting reports.

Preparing an Income Statement

Data from accounting journals and the general ledger are used to prepare an income statement. The statement details primary sources of income, such as sales of the company’s products and services. It also shows secondary sources of income like rent from subletting a portion of your business premises or interest income earned from a bank account or other investments.

The income statement also shows business expenses. This includes primary expenses, expenses from secondary activities, depreciation, and losses from other activities, such as selling a piece of capital equipment.

Preparing a Balance Sheet

The balance sheet shows the company’s assets, liabilities, and equity as of a specific date.

Data on a balance sheet comes from the general ledger, and the format mirrors the accounting equation: assets must equal liabilities plus equity or owner’s investment.

Preparing a Cash Flow Statement

The cash flow statement has to be prepared last because it takes information from the balance sheet and income statement. It divides the cash flows into three categories:

- Operating cash flows: Cash inflows and outflows from the business’s normal activities, such as making sales, collecting receivables, and paying liabilities.

- Investing cash flows: Cash inflows and outflows from investing in the business, such as buying or selling property and equipment.

- Financing cash flows: Cash inflows and outflows from financing business operations, such as getting investments from shareholders, paying dividends, and taking out or repaying loans.

When you prepare the statement of cash flows, you start with the company’s beginning cash balance and add all cash inflows and outflows from operating, investing, and financing activities. The result should equal the ending cash balance as of the balance sheet date. To see how this works in practice, check out our financial statement example article, which provides step-by-step guidance and practical illustrations to help you master the preparation of these crucial documents.

How Frequently Should You Look at Accounting Reports?

You should review your balance sheet, income statement, and cash flow statement on a regular basis, usually monthly. You might look at other accounting reports, such as an accounts receivable aging report, on a more frequent basis.

While you might not need to send financial statements to your investors, lender, or accountant every month, monthly reporting can give you a current view of the financial state of your business. It can also help you analyze your financial data regularly to run your company effectively, make more informed business decisions and enable better operational practices.

It’s possible to prepare some of these accounting reports on your own using spreadsheets, but accounting software makes the process of preparing these reports much easier and more efficient.

Your accounting software can connect to your bank account to automatically record all transactions. Then you can simply run the reports you need to see how much cash you have in the bank, monitor your net profit, or get other financial data. This can drastically change how often you run reports and how financially savvy you need to be.

RELATED ARTICLES

Monthly Financial Reports: What Are They And How to Read

Monthly Financial Reports: What Are They And How to Read What Is Financial Reporting? Definition, Importance, and Types

What Is Financial Reporting? Definition, Importance, and Types Expense Report: What It Is and Why Is It Important?

Expense Report: What It Is and Why Is It Important? How to Handle Small Business Finances?

How to Handle Small Business Finances? What Does a Profit and Loss Summary Tell You?

What Does a Profit and Loss Summary Tell You? How to Read a Financial Report: An Extensive Guide

How to Read a Financial Report: An Extensive Guide