What is PayPal and How Does it Work?

PayPal gained a lot of popularity for being a P2P payment service, but it’s much more than that.

Using PayPal makes it easy for your domestic and international customers to make online payments. In fact, PayPal ranks third in popularity as a mobile payment method for online merchants, trailing behind debit and credit cards.

In this post, we explain how PayPal works and how to use it to make you and your customers’ lives easier.

Here’s What We’ll Cover:

Receive and Collect Money Online with PayPal

In-Person Solutions from PayPal

PayPal Personal vs. PayPal Business Accounts

More Resources on Small Business Accounting

What is PayPal?

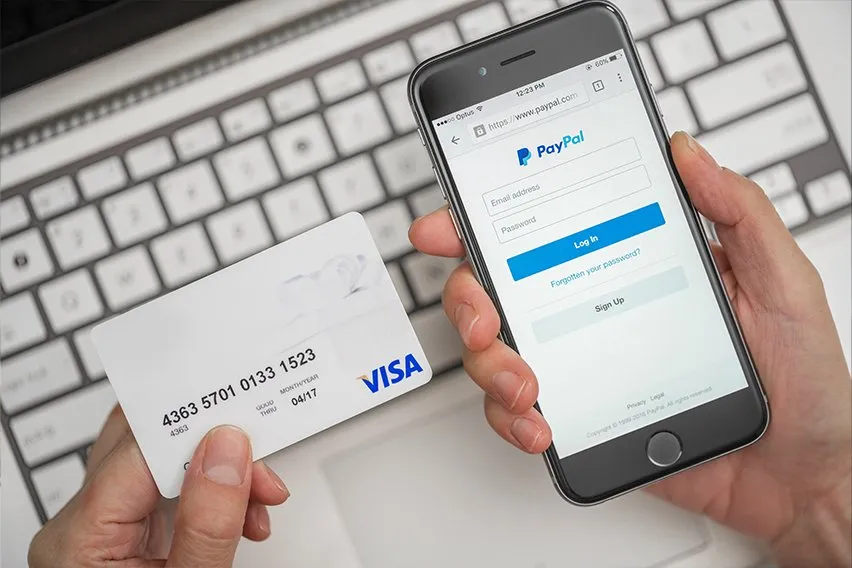

PayPal is a payment processing platform that’s available to regular users, consumers, and merchants who want to accept or send money online or in person. PayPal makes it easy to navigate online checkout without providing one’s personal financial information and allows merchants to send invoices, track payment, and more.

PayPal Key Features:

- Payment security: Purchases are protected by PayPal Purchase Protection. PayPal also has fraud protection tools like a fraud management filter.

- Payment processor: PayPal isn’t just a money transfer business, it also processes debit card and credit card payment transactions. It even acts as a payment gateway too.

- Flexible payment methods: Customers can pay with all major debit cards and credit cards, including American Express. They can also pay with a prepaid card and PayPal Credit if they need to pay in installments.

- Mobile device app: Access transaction history and make payments on the go.

- PayPal Credit (Subject to credit approval): Qualify for PayPal Credit in seconds. You’ll have funds within 1-2 business days if you qualify. No annual fee.

- Receive money quickly: With PayPal Business, you can receive your money in minutes.

Receive and Collect Money Online with PayPal

PayPal makes it easy to get paid online. You can easily add a checkout link on your page or send a secure PayPal.Me link to customers via email and other channels. You can also allow customers to pay directly via invoices.

To complete the checkout process, your customers won’t need a PayPal Business account nor a personal account at first.

PayPal makes the checkout process for online purchases easy. You have plenty of options when setting up your default payment method. You can either use your PayPal balance, PayPal Credit, a linked credit card, debit card, or bank account.

In-Person Solutions from PayPal

PayPal is mostly used with online stores, but PayPal also has a solution for those with a brick-and-mortar store or anyone who takes payments in person. The PayPal credit card reader is travel-friendly and compatible with most smartphones or tablets.

PayPal also offers a contactless card reader. To execute a contactless payment, customers use their app to scan your unique QR code.

PayPal Personal vs. PayPal Business Accounts

Personal accounts are more for casual sellers who seldom use PayPal to receive an electronic payment.

You should use PayPal Business if you frequently use PayPal. It’ll give you access to a business debit card and business tools like sales reports. You’ll need a PayPal Business account if you want to include PayPal on your invoices to customers.

Either way, make sure to get verified on PayPal or you’ll have a limited account.

Is PayPal Free to Use?

Yes – It’s free to create a personal account and PayPal Business account using your email address and a few other bits of information. There are no monthly or termination fees.

Only some optional services cost extra, including payments pro and having a virtual terminal. Additionally, PayPal will take a small cut for processing transactions.

Payment Processing Fees

PayPal charges a small payment processing fee for financial transactions. Fees vary by country.

In the United States, PayPal takes a 2.9% + $0.30 fixed transaction fee for every transaction paid in USD. If paid by CAD, it takes 3.7% + $0.30. For international payments, this number would be 3.9% + $0.30.

Keep in mind that when you accept international payments, PayPal uses its currency conversion rates to convert foreign currency for you before completing the transfer of funds.

Withdrawal Fees

It’s easy to transfer your PayPal balance to your bank account. A standard transfer to a linked bank account is free and takes 1-3 business days. If you need it faster, the fee is 1% for up to $10 in fees.

Key Takeaways

Paypal Business is the payment solution you want to make it easy for customers to pay you. In most cases, it doesn’t even take a full business day to receive payments on PayPal.

PayPal has earned quite a reputation since it first started in 1998. As a result, accepting PayPal also gives potential customers confidence that their payment is secure.

FreshBooks can now integrate with PayPal so you can receive payments hassle-free.

More Resources on Small Business Accounting

- How to Transfer Money from Bank Account to PayPal Instantly

- How to Accept Credit Card Payments | A Practical Small Business Guide

- How to Send an Invoice via Email

RELATED ARTICLES

What is Stripe and How Does it Work?

What is Stripe and How Does it Work? Salary vs. Hourly Pay: What’s the Difference?

Salary vs. Hourly Pay: What’s the Difference? What is Credit Card Churning?

What is Credit Card Churning? How to Verify a Paypal Account? Verify Process Guide

How to Verify a Paypal Account? Verify Process Guide What Is PayPal Buyer Protection & What It Covers

What Is PayPal Buyer Protection & What It Covers How to Use PayPal – Complete Guide

How to Use PayPal – Complete Guide