How Much Does Stripe Charge: Guide to Cost & Pricing

Stripe has become a popular online payment solution. The pay-as-you-go platform offers users a flat-rate and transaction-based fee setup. It’s ultimately up to you to figure out if the fees and pricing will work for your business needs.

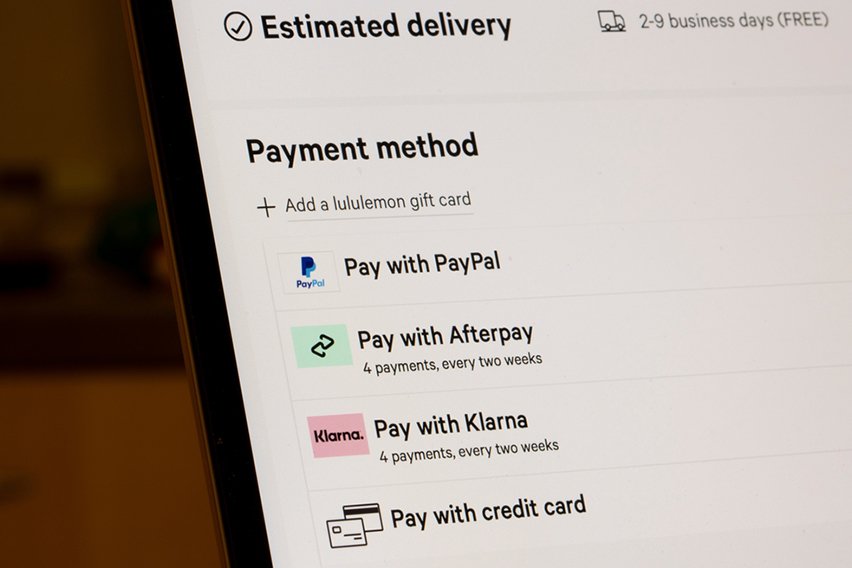

The platform is highly customizable and you can accept a broad range of payment types. It also provides the ability to connect or integrate with third-party services you’re already using. And signing up and getting started is quick and easy. You can start taking payments right away in your preferred currency.

Here’s What We’ll Cover:

What Is Stripe?

When it comes to online payment service providers, Stripe has grown into one of the best options out there. And you don’t need to have a dedicated merchant account to accept payments.

Once you have signed up and set up your account, you can start processing direct debit payments or credit payments. One of the biggest benefits of using Stripe is that its fee structure is based on a flat-rate and transparent process.

You will know exactly what to expect when it comes to transaction fees. This can allow you to make adjustments for ways to improve different processes.

How Do the Stripe Fees Work?

To fully understand the flow of fees, you must first understand how does Stripe works. As a pay-as-you-go payment processing platform, you are only charged flat-rate and transaction-based fees. There are no monthly or annual fees to consider for online transactions.

For credit card payments, you’ll pay 30 cents per transaction on top of a 2.9% fee.

For in-person payments, you would pay 5 cents per transaction on top of a 2.7% fee.

The only Stripe processing fees that you will have to consider are transaction fees. Stripe doesn’t charge a lot of fees that other payment processors might. Fees that aren’t charged by Stripe include:

- A minimum processing fee

- Any payment gateway fees

- Refund fees or cancellation fees

- An initial setup fee

- Other potentially hidden fees

The flat-rate pricing model means you will basically spend the same rate for every transaction that you make. This is regardless of the type of card used, the size of the transaction or even the card issuer. However, there are a few things to consider and keep in mind.

While those are the fees that Stripe charges, there could be additional fees you need to be aware of outside of the payment platform. For example, if the card type that is used is an international card, you could have to pay an additional conversion rate fee.

You may also get charged additional fees for things like wire transfers or if there are disputed debit payments. Each situation is unique, so it would be worthwhile to explore anything you might not usually expect.

Additional Product Fees

A debit card and credit card might be the only payment methods you need to accept. If that’s the case, then the 2.9% fee with an additional 30 cent fee per transaction are the only ones you really need to be aware of.

But, Stripe does offer a selection of extra tools that you can combine with the platform. If you use any of the additional tools there will probably be an extra fee associated.

Here are a few of the tools you can add to the Stripe product suite:

- Stripe Billing to send and receive invoice payments or for a subscription-based business model

- Stripe Connect to add the platform to other marketplaces or platforms you’re already using

- Stripe Radar to help identify fraud patterns when it comes to payment processing

- Stripe Sigma to help balance the number of monthly charges and stay within a certain threshold

- Stripe Atlas to provide the tools and guidance needed to launch your business

It all depends on the type of business that you operate and your operational needs. But combining some of the additional tools within the payment processing platform can be a good strategy. Make sure to confirm any extra fees that might come with an additional product.

Key Takeaways

Stripe provides everything you would need to manage all your payments. There are no setup costs or monthly fees and Stripe offers a range of services for third-party integrations. And they are continuously updating and adding extra features.

One of the biggest benefits to Stripe is the fact that all of its fees and pricing are completely transparent. You won’t get hit with any surprises or unexpected transaction fees. That said, you should crunch your own numbers to see if Stripe can save you money compared to the payment processor you are currently using.

Having their fees set at a flat rate can help you keep costs down. However, to get the absolute most out of Stripe it might be worthwhile to explore adding one of their featured tools. You can customize the payment experience and receive data to make better business decisions.

Take a look at the main areas of your payment process and see what could use improvement. Are you paying too much in fees? Are you having difficulty integrating with other platforms? Analyzing your business can allow you to make the best decision moving forward.

However, if you want to explore alternatives to Stripe, follow our guide How to Accept International Payments. In this guide, we have compared Stripe with other top payment methods, helping you choose the right platform for your business.

RELATED ARTICLES

How To Refund On PayPal in 6 Easy Steps

How To Refund On PayPal in 6 Easy Steps How Does Stripe Work? A Beginner’s Guide

How Does Stripe Work? A Beginner’s Guide What Is a Payroll Schedule? Pros & Cons of a Payroll Schedule

What Is a Payroll Schedule? Pros & Cons of a Payroll Schedule How to Set Up PayPal Payment Gateway

How to Set Up PayPal Payment Gateway How to Cancel Automatic Payments on PayPal

How to Cancel Automatic Payments on PayPal A Guide to Stripe Payment Methods

A Guide to Stripe Payment Methods