What Is a VAT Invoice? Charging Value-Added Tax to EU Clients

VAT stands for value-added tax, which is a consumption tax used across the European Union and in other countries that’s applied to goods, services and other taxable supplies. VAT is a federal tax that’s used in more than 160 countries worldwide. In the EU, customers pay VAT at the time of purchase for every product or service they buy. While the United States doesn’t charge a federal value-added tax and instead allows individual states to govern sales tax at a local level, businesses based in the US that sell their products and services to clients in the European Union should understand their responsibilities for collecting VAT.

Here are the details you need to know about VAT rules and creating VAT invoices:

What’s the Purpose of Value Added Tax?

What’s the Difference Between VAT and Sales Tax?

What Is a VAT Invoice?

A VAT invoice is an accounting document issued by a business that outlines the details of the products or services sold that are subject to a value-added tax. Under European Union tax laws, a VAT invoice must be issued within 15 days of the end of the month in which the products or services were provided.

A VAT invoice allows a business to charge value-added taxes to clients in the European Union and collect those taxes for later payment to the government.

Non-EU countries are required to collect VAT for certain goods and services sold to European customers to ensure that European governments are receiving taxes on the products and services that their citizens purchase.

How to Charge VAT on Invoices

To charge VAT on invoices, businesses should follow these steps:

1. Register Your Business for EU VAT

Register your business for a VAT number in one of the 28 EU member countries; you can choose the member country in which you’d like to register. If you only speak English, it probably makes sense to register in an EU country where English is the main language used, such as Ireland. Register online for a VAT Mini One Stop Shop (MOSS) with the local tax authority you choose. This will save you time if you have clients in more than one EU country, by allowing you to submit all of your EU VAT through a single tax return. Here’s a detailed guide to applying for VAT from a non-EU country.

2. Confirm Client Details

If you’re conducting business-to-business transactions within the EU, you won’t need to charge VAT. You’ll only need to charge VAT for business-to-consumer transactions. Ask your EU-based clients for their VAT number: all EU businesses should have one. You’ll also need to ask for proof of their location. That’s because the VAT rates vary between different EU countries. The EU site can help you determine the VAT rate by country.

3. Charge VAT Correctly to EU Customers

If your client in the EU has a valid VAT number, you don’t have to charge them VAT on your invoices. Businesses with valid VAT numbers in the EU are subject to a reverse-charge mechanism. EU companies are responsible for filing their own VAT, because they can then be reimbursed for the VAT charged on products and services used to run their business.

4. Issue a VAT Invoice

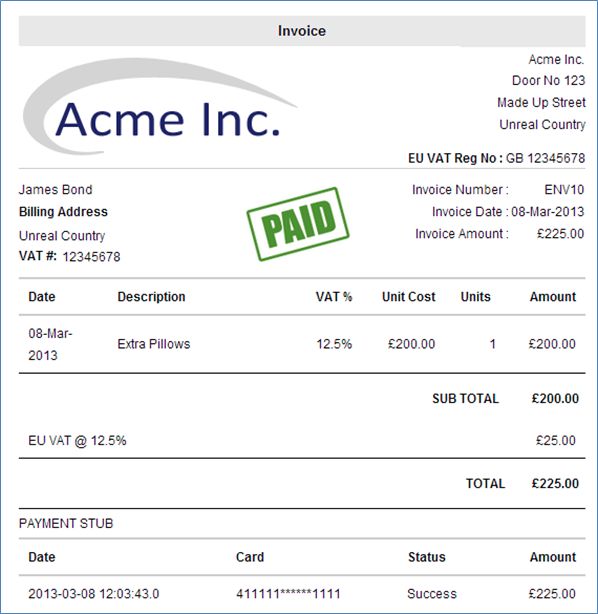

You’ll need to issue a VAT invoice to your EU clients. A VAT invoice includes some information not contained in a normal sales invoice. A VAT invoice must include:

- Your business name and address

- Your VAT number

- The invoice date

- The invoice number

- The client’s name and address

- The client’s VAT number, if applicable (the invoice will then be subject to the reverse-charge mechanism outlined above). If your client has a VAT number, you should then include the text “EU VAT Reverse Charged” on your invoice

- The VAT rate and total amount charged for each service item listed

- Total amount due after VAT is included

- The currency applied

This may sound confusing, but a VAT invoice actually looks quite similar to the normal sales invoices you’re familiar issuing for clients. Here’s an example of a VAT invoice from Whiteboard:

5. Submit VAT Returns Quarterly

Your business will need to submit a single VAT return for each quarter. VAT returns and payment can be submitted online. You’ll have 20 days to pay the amount owing for VAT from the last day of each quarter. The deadlines for filing are:

- April 20 for Q1, ending March 31

- July 20 for Q2, ending June 30

- October 20 for Q3, ending September 30

- January 20 for Q4, ending December 31

Your VAT return will need to be paid in the currency of the local tax authority with which your business is registered. So if you registered for your VAT number in Ireland, all your VAT filings will need to be converted to euros. To figure out the exchange rate for foreign currencies for your VAT filings, use the official exchange rates set by the European Central Bank.

What’s the Purpose of Value-Added Tax?

The purpose of a value-added tax, like most other taxes, is to raise revenue in order to fund government programs and other spending. VAT is a consumption tax, so it raises money for the government by charging taxes on consumer spending. Because a VAT is governed at a federal level and applies equally to all jurisdictions, it is easier to administer and more difficult for consumers to evade than many other forms of tax.

Where Does VAT Apply?

All 28 countries that make up the European Union are subject to a value-added tax, although the VAT rates vary from country to country within the EU. The EU is not the only jurisdiction to charge VAT, in fact, the United States is the only OECD country that doesn’t levy a value-added tax federally.

For more details, you can refer to this list of VAT countries and their individual VAT rates compiled by the United States Council for International Business.

What’s the Difference Between VAT and Sales Tax?

The value-added tax is levied at every stage of the supply chain and is collected by all types of sellers: suppliers, manufacturers, distributors and retailers all collect VAT. Sales tax differs from VAT in that sales tax is only collected by a retailer at the final stage of the supply chain when a sale is made to the end customer. The end consumer then pays the sales tax on their purchase.

RELATED ARTICLES

What Does FOB Mean on an Invoice? | Shipping Invoice Definitions

What Does FOB Mean on an Invoice? | Shipping Invoice Definitions Flat Rate vs Hourly Rate: What Should You Choose?

Flat Rate vs Hourly Rate: What Should You Choose? How to Invoice for Hourly Work

How to Invoice for Hourly Work How to Invoice as a Sole Trader: Guide and Example

How to Invoice as a Sole Trader: Guide and Example How to Prepare A Tax Invoice: The Step-By-Step Process

How to Prepare A Tax Invoice: The Step-By-Step Process What Is a Self-Billing Invoice?

What Is a Self-Billing Invoice?