How to Prepare A Tax Invoice: The Step-By-Step Process

To create a sales tax invoice, the seller issues a record of sales, providing the details of the sale, including the type of product or service provided, the quantity, the agreed-upon price along with the tax amount for each item.

To claim back the taxes a company has paid on the purchase of their business, they must have a valid tax invoice from the supplier. The tax invoice serves as the primary evidence to support an input tax credit claim.

What this article covers:

- What Is a Tax Invoice?

- What Details Should a Tax Invoice Include?

- How to Make a Tax Invoice

- What Is a Recipient-Created Tax Invoice?

- What Is a Tax Invoice Used For?

- Best Practices For Tax Invoices

- Conclusion

- Frequently Asked Questions

What Is a Tax Invoice?

A tax invoice shows the taxes on goods and services. It’s an itemized list of charges for individual products sold or services rendered, along with the indirect tax amount for each product and service.

Tax invoice requirements include the description of the product or service, quantities, date of shipment, mode of transport, and prices. It also includes the total value and the tax charged on the supply.

What Details Should a Tax Invoice Include?

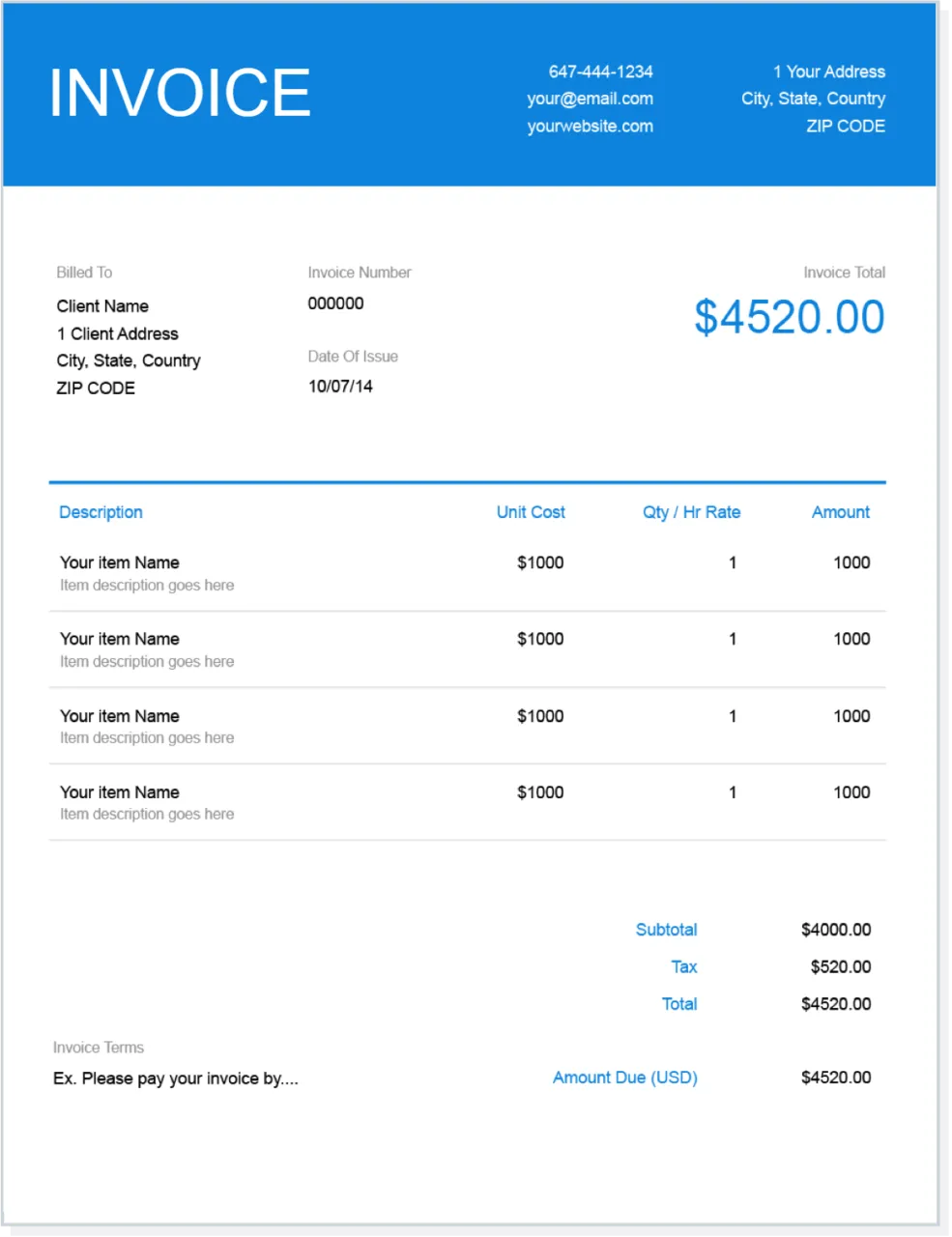

To create invoices that include all the mandatory relevant tax information, it is important to have the following:

- Invoice number and date

- Customer name

- Shipping and billing address

- The words ‘tax invoice’ clearly displayed

- Seller’s identity and business number

- A description of the goods and services, their quantities, and price

- The tax applied for each item

- The total value, including tax

- Signature of the supplier

Want to feel confident creating your own tax invoice? Use an online invoice template that you can customize, fill out and save for free. Click here to get started.

How to Make a Tax Invoice

To make a tax invoice in Microsoft Word, follow the steps below:

1. Open a blank document and enter the words Tax Invoice as the header

2. On the right side of the header, enter your business’s details. Include the name, address, phone number, email, and logo

3. Underneath and on the left-hand side, write your client’s information

4. Enter the date prepared and the due date, along with the unique invoice number on the right-hand side

5. In the body of your invoice, break down products or services into line item descriptions, along with charges associated with each.

6. Calculate the total amount, including applicable taxes, delivery fees, etc. It’s helpful for record-keeping purposes to put the grand total in a bold font so that it clearly stands out.

7. In the notes, indicate the method of payment and other relevant details.

What Is a Recipient-Created Tax Invoice?

Instead of being issued by the supplier, a recipient-created tax invoice is issued by the buyer of the products or services. These can be issued only when there’s a written agreement between the recipient and the supplier that is current and effective.

This form of tax invoice should prominently state the words “recipient-created tax invoice.” The recipients must issue the tax invoice to the suppliers within 28 days of the sale. They should also retain the original or a copy of the invoice for tax purposes.

What Is a Tax Invoice Used For?

For sellers, tax invoices serve as proof of the taxes they have collected from their sales and validate the amount they file for corporate tax return. For some, this tax return may provide some financial relief. For others, it may be tax owing. For buyers, the tax invoices serve as proof of the taxes they have paid for their purchases, thus validating the tax credit they are claiming.

For the government, tax invoices are important as they prevent tax evasion.

Best Practices For Tax Invoices

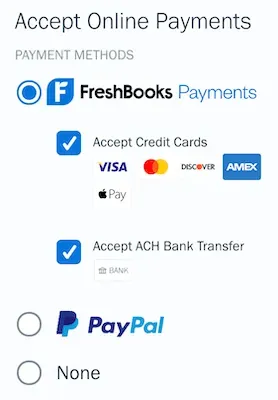

As a business owner creating a tax invoice for customers, it’s crucial to ensure your invoice includes all necessary relevant, accurate information, including preferred payment methods.

Format the document clearly, ensuring it is easy to read without unnecessary information. If you are unsure how to prepare your invoice, use a template for your accounting purposes.

Conclusion

A tax invoice is an important business document that shows the amount of tax payable on a transaction that is sent to the purchaser during a taxable sale, used to help businesses take advantage of tax credits and for the government to prevent tax evasion.

Information required on tax invoices includes the description, amount, and value of goods and services provided, as well as the sales tax charged.

It is important to format your invoice in a clear and easy-to-read table and to send invoices in a timely manner, usually within twenty-eight to forty-five days.

If you want to be sure to format your document, there are plenty of tax invoice templates on the FreshBooks Invoicing software you can use for free. Click here to signup and use a tax invoice template.

FAQs on How to Prepare Tax Invoices

What is a full tax invoice?

A full tax invoice is a detailed record of all taxable value on services rendered, showing payment details and the amount of tax payable. It’s used as evidence for the recipient to claim tax credits for the goods and services listed. A full tax invoice will include descriptions, quantity, value and taxes charged, and any other relevant and necessary details.

What is a tax invoice example?

If you need to figure out how to create a tax invoice, you may be able to find the step-by-step process laid out for you by searching for an online template. These are usually screenshots or fillable forms that show the proper way to fill out a tax invoice, helping you understand what is expected of you when creating this necessary documentation for your client.

Is a tax invoice and a bill the same thing?

No, although they both offer information about payments, professional tax invoices differ as they are usually much more detailed, with pertinent information regarding services or products purchased by the client that can be used for tax purposes. A bill is a generic term for any document requesting payment.

Is it mandatory to write tax invoices?

No, sending tax invoices is not mandatory, although doing so provides both you and your client with all the details of transactions that have taken place. This can be helpful for accounting and when filing tax returns with the IRS.

About the author

Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields.

RELATED ARTICLES

What Is a Self-Billing Invoice?

What Is a Self-Billing Invoice? Proforma Invoice: Definition, Uses and Template

Proforma Invoice: Definition, Uses and Template What Is a Tax Invoice?

What Is a Tax Invoice? How to Make an Invoice

How to Make an Invoice How to Invoice a Client: 10 Steps to Get Paid on Time

How to Invoice a Client: 10 Steps to Get Paid on Time What Is the Purpose of an Invoice?

What Is the Purpose of an Invoice?