What Is the Purpose of an Invoice?

An invoice is a document given to a buyer by a seller to collect payment. Invoices include the cost of products or services rendered, the associated cost, the due date to receive payment, and any other pertinent payment details, such as available payment methods. Understanding invoices helps you keep a clear line of communication between you and your customers and helps ensure best practices for quick and efficient payments.

Invoices serve an essential purpose in small business accounting. Invoicing demonstrates a client’s obligation to pay for your goods or services. This verifies, in writing, the payment agreement between your business and the client. Good invoices set your payment terms and enable you to get paid faster.

Key Takeaways

- An invoice is a record of sale that allows a business to get paid by its clients.

- Invoices provide benefits to your bookkeeping records, tax records, legal protection, marketing, and inventory tracking.

- An invoice should include a unique invoice number, your company name and address, the name and address of the payee, a description of goods or services, the date of supply, the invoice date, and the total amount due.

- Invoices are legally enforceable agreements between a business and its client, providing documentation of services or goods provided and payment owed.

- An invoice is different from a purchase order, which is a document used by a buyer to request goods or services from a business.

These topics will help you better understand the purpose of an invoice for small business accounting:

What Is the Purpose of an Invoice?

What Should an Invoice Include?

What’s the Difference Between an Invoice and a Purchase Order?

What Is the Purpose of an Invoice?

The most basic purpose of an invoice is to offer a record of sales so a business can get paid by its clients. But invoices serve other essential purposes, some of which might not be immediately obvious. The following are the invoices’ key purposes:

1. Bookkeeping

Invoices make a record of all your sales and so are helpful for bookkeeping purposes. Invoices are invoice documents that provide documentation of your business’s financial history. They track all the revenue from your business through sales and can help you gauge your profits and cash flow.

2. Tax Records

Your sales invoices serve as essential documentation to validate the information you report on your annual tax filings. The IRS recommends that all small business owners maintain daily records summarizing their business transactions, including invoices. To accurately record taxes in your invoices, you can refer to our guide on How to Generate a Tax Invoice.

3. Legal Protection

Invoices help protect small businesses from false lawsuits because invoices provide details of the services you provide to your clients and the timeline for completing the work. An invoice also records the amount a client agreed to pay you for your services, and signed invoices can serve as legally binding agreements.

4. Marketing

Records of your invoices can help you develop marketing strategies. You can analyze your invoices to identify peak times when your services are most in demand, the most popular and least popular services you offer, and other trends in your business. Once you identify these trends, you can develop intelligent marketing strategies based on the data to grow your business.

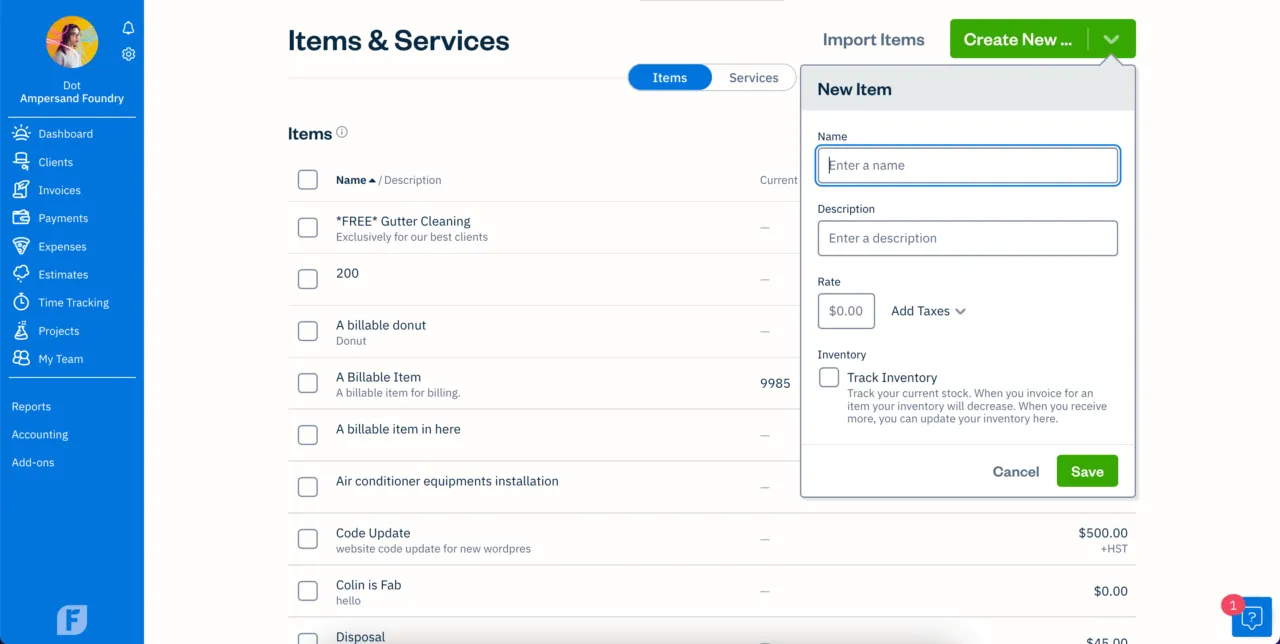

5. Tracking Inventory

If your business keeps inventory, sales invoices can help you track how much inventory you have and predict how much you’ll need in the future based on past sales. You can use invoicing software to track inventory based on your invoices automatically, or you can develop a manual tracking system for invoices on your own.

What Should an Invoice Include?

A standard invoice has 12 pieces of information communicating everything necessary to receive payment. Below, we’ll delve into each aspect:

1. Invoice

Identify the document with the word ‘invoice’ near the top of the sheet in a plain, prominent font. This differentiates the invoice from a quote, credit note, or receipt. Identifying the document as an invoice helps avoid confusion or misunderstandings and increases the likelihood of punctual payment.

2. Invoice number

Each invoice should have a unique invoice number associated with it, without duplicates. This allows for clear identification and easy record-keeping. Using a sequential numbering system is the easiest way to manage this. The reference number can contain letters as well as numbers. To automate this task, you can use Excel invoice number generator. This tool helps you maintain the record of these numbers, ensuring they do not get repeated.

3. Company name and address

Clearly display your business name, address, and where the customer can contact you. This contact information can include phone numbers and email addresses. If a specific employee or department handles your invoicing, you should direct communication to the appropriate team. Customers can use this information in case of a question or dispute.

4. Customer name and address

Include the name and address of the customer. The address can be physical or an email address. Including this information is standard procedure on all invoices and is especially important for any customers who want to claim back any VAT that has been charged.

5. Description of goods or services

Include a clear and accurate description of the goods and services being invoiced. Place each product, service name, or item on a separate line for clear identification. Being as clear and detailed as possible helps customers better understand their total cost.

6. Date of supply

The date when the goods or services were issued. This is known as a ‘supply date.’ The supply date may be different from the invoice date, but they are typically within 30 days of one another. Even if the supply and invoice dates are the same, including them as separate line items are important.

7. Invoice date

This is when the invoice was generated and provided to the customer. It doesn’t necessarily have to be when the goods or services were supplied. Including the invoice date makes it clear to the customer when the deadline for payment is and how it was reached.

8. Amount of individual goods or services to be paid

This works with your list of descriptions for the goods or services. Each line item should be marked with an individual amount. This helps customers track where their money is being spent and how they arrived at their total.

9. Total owed

This is the pre-tax sum total of all goods or services listed on the invoice. This is also referred to as base pay. To get the total, simply add each individual item’s cost.

10. Payment terms

Including clear invoice payment terms increases the likelihood of your invoice being paid on time and without hassle. These payment terms are usually defined ahead of time in the terms and conditions agreed to by your customer. These are your terms for the length of time to pay and should be included at the bottom of the invoice.

11. Purchase order number

If your customer provides you with a purchase order number, it should be clearly shown on the sales invoice. Some customers may require the name of the contact person shown on the invoice as well. Asking for a purchase order is recommended since, once generated, it’s a legally binding contract between yourself and your client. If you’re not sure about the significance of a purchase order number, you can check out our post on What is a Purchase Order Number and its importance in business transactions.

12. How to pay

List the various ways the invoice can be paid. Include the bank account references. For example. Your bank sort code and account number for BACS payments. Start with your preferred payment method at the top and work your way down. You can also include any invoice payment terms you cannot accept to be extra clear. If you want to learn more about paying your invoices, follow our guide How to Pay Invoices, where we have explained the process along with tips to help you pay your invoices on time.

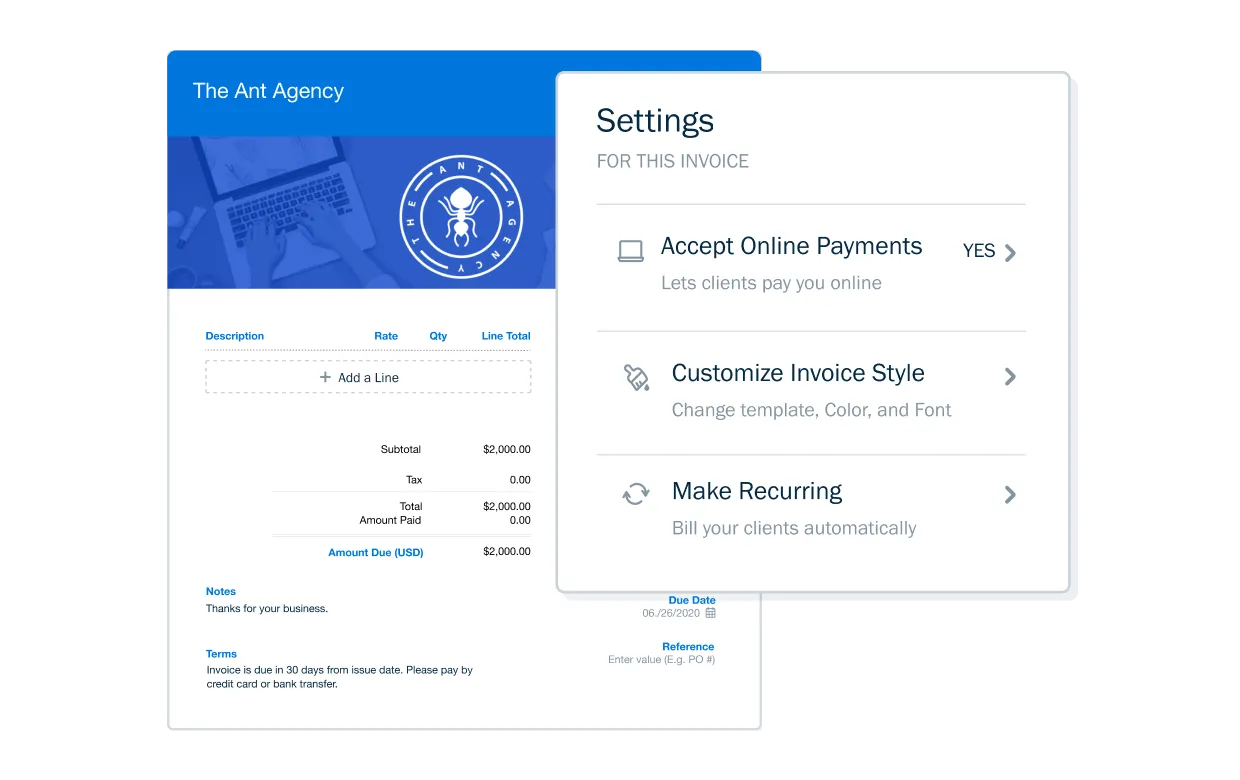

Create a worry-free invoicing process and ensure you never miss crucial information. FreshBooks offers free sample invoice templates to make invoicing a breeze. With ample customization options, professional designs, and invoice example access, it’s a great way to take the guesswork out of invoicing. Combined with our invoicing software, it makes your collections quick and easy. Click here to start your free trial.

What Is an Invoice Used For?

An invoice creates a sales agreement between a business and a client. For small businesses, invoices are used to get paid on time for the services they provide by giving clients a document that outlines the amount owed, the payment terms, the invoice due date, and an itemized listing of services.

Recurring invoices help manage cash flow and provide return customers with accurate and timely records for payment. Professional invoices help your accounts receivable department process payments faster.

What’s the Difference Between an Invoice and a Purchase Order?

The difference between a purchase order and an invoice is that the buyer and the seller issue the invoice issue a purchase order. The buyer issues a purchase order to be fulfilled by a vendor. This happens before goods or services are rendered as an upfront agreement of services in exchange for a predetermined payment.

An invoice is a document a business sends to clients to request payment for services rendered. Business owners typically create invoices after a project has been completed to provide a record of the work and request payment. If you want to learn how to create an invoice for services rendered, follow our comprehensive guide. It covers a step-by-step walkthrough, along with examples and templates.

Conclusion

Invoices offer a record of sales so your business can get paid and provide your accounts receivable department with support for accurate processing. Great invoices help encourage on-time payment and a clear and direct line of communication with customers. This enables you to retain repeat customers and keep a healthy monthly cash flow, which ultimately helps you to scale your business successfully. By including the correct information and using a professional and easy-to-use template, you’ll get paid faster and more accurately every time.

FAQs on the Purpose of Invoice

Why are invoices important?

Businesses must create physical or electronic invoices to ensure their accounts receivable department receives customer payment. Invoices serve as legally enforceable agreements between a company and its client, helping you track your sales and manage your cash flow.

What are the rules of invoices?

In order to be considered a legally binding invoice, it must contain the name and contact information of the buyer, the date of issue, a unique invoice number, the number of goods sold, and the total due.

What makes an invoice legally binding?

One simplest, most straightforward way to confirm an invoice is by obtaining the buyer’s signature. The customer is saying they accept the invoice by putting down a signature. At this point, it becomes legally binding.

Is an invoice the same as a bill?

An invoice and a bill can be the same thing but from different perspectives. A company issues an invoice to its customer to request payments for the services/products sold. When customers receive it, they refer to it as a bill they need to pay.

Why do you need an Invoice?

Businesses need to create invoices to ensure they get paid by their clients. Invoices serve as legally enforceable agreements between a business and its clients, as they document services rendered and payment owed.

Invoices also help businesses track their sales and manage their finances. Invoices provide valuable data regarding how your sales change over time and can help you create accurate business forecasts. Invoices can also help you determine the average amount of time it takes you to receive payment from your clients, which can help you manage your cash flow.

About the author

Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields.

RELATED ARTICLES

How to Make an Interim Invoice | Progress Billing for Small Businesses

How to Make an Interim Invoice | Progress Billing for Small Businesses How to Make a Commercial Invoice: Guide for Businesses with Templates

How to Make a Commercial Invoice: Guide for Businesses with Templates How to Fill out an Invoice | Professional Invoicing Checklist

How to Fill out an Invoice | Professional Invoicing Checklist Invoice Wording: How to Word an Invoice For Your Business

Invoice Wording: How to Word an Invoice For Your Business What Does an Invoice Look Like: Everything You Need to Know

What Does an Invoice Look Like: Everything You Need to Know How to Write an Invoice For Services Rendered

How to Write an Invoice For Services Rendered