Invoice Wording: How to Word an Invoice For Your Business

Businesses should word their invoices in a professional tone while using clear, plain language. It’s important to always be polite when sending an invoice to a client and in all other business communications-related payments.

The wording of an invoice should be as clear as possible. Plainly state the invoice date and due date, amount owing, and services provided. If an invoice or its accompanying email contains vague language, the client can be left confused, misinterpret information, and be late sending payment.

Key Takeaways

Invoicing skills are essential to ensure steady cash flow for your business and ensure clients pay on time. Some of the top things to understand are:

- How to word your invoices and communications to get paid sooner

- How to find quality professional templates for invoice email wording

- How to follow up on unpaid invoices via email in a polite but firm way for more immediate payment

- How to improve your invoicing system for prompt payments and great client relations

Here are the topics we’ll cover to help you learn how to word an invoice professionally:

Tips for Wording Invoices That Get Paid

Sample Invoice Email Wording Template

How to Follow up on Unpaid Invoices [Email Template]

Tips for Wording Invoices That Get Paid

Invoices are documents that enable small businesses to receive payment from their clients, but there are strategies for sending invoices that are more likely to get you paid quickly. The right messaging, both within the invoice itself and in the accompanying email, can motivate clients to pay the invoice right away.

Here are some tips for communicating with clients about invoices:

1. Use Professional Language

An invoice is a formal business document, so your language should be written with that in mind. To ensure prompt payment, it’s best to keep everything as professional and to the point as possible. Aside from a short personal message (e.g., ‘thank you for your business’) at the bottom of your invoices, everything else should be strictly limited to the required information.

2. Be Consistent

It’s critical that you keep consistent with both wording and format in your invoicing system, between invoices, and within a single document. It can be jarring for even a long-standing client to come across inconsistencies in their invoices, and it can even lead to late payments.

3. Keep Important Information Clear

When writing your invoices, make sure the details are clearly written as possible. In your ‘goods/services rendered’ field, avoid using technical, industry-specific jargon wherever possible. Be sure your invoice payment terms aren’t overly complicated either—all you need to include is the payment due date, any applicable late fees, and your preferred payment method.

4. Send Invoices Promptly

It’s important to create your invoices and send them out to clients as soon as you complete the work you’re billing for. Ideally, you should send your invoice immediately upon job completion. Not only does it mean you’ll get paid sooner for your services, but it also means you’re writing invoices while the work is fresh in your mind. When you write invoices, as soon as the work is done, you’ll remember all the details and be less likely to make mistakes in your invoice, which can confuse or anger clients, delaying payment.

5. Always Be Polite

Always be polite when wording invoices and all accompanying communications, like emails. Courteous communication helps you maintain strong professional relationships with your clients, which increases your chances of landing repeat business. Being polite in your invoices also helps you get paid faster, according to a FreshBooks study. The study found that using words like “please” and “thank you” when writing invoices can increase the percentage of invoices paid by more than five percent.

6. Always Be Concise

When wording your invoices, always be concise and to the point. Clearly state the information clients need to pay you according to your terms: list the amount due and the due date. Sometimes, businesses use fancy terms when writing invoices, which can confuse clients. For example, instead of using wording on invoices such as “payment due upon receipt,” which is vague, just list the due date, i.e., “payment due December 31, 2024.”

7. Make Payment Easy

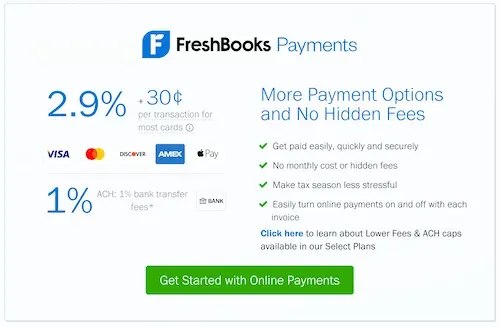

Make it easy for your clients to pay your invoices so that they have a better customer experience and so you get paid faster. Include clear wording in your invoice that tells your clients the different billing payment methods they can use. If you accept checks, include wording that covers all the necessary details, like “Please make checks payable to My Small Business and mail the check to This Business Address.” If you accept online payments, include a “Pay Now” button at the bottom of your invoice or in the body of your accompanying email linking directly to the online payment page to make it as easy as possible for your clients to find it.

FreshBooks payment features allow businesses to accept payments online, improving the overall payment process and reducing the time and effort required for payment collection. This feature allows businesses to accept payments online, making it easier for clients to pay their invoices. This can help businesses get paid faster and improve their cash flow. Click here to get started.

Sample Invoice Email Wording Template

It’s important to word invoice emails in a polite, concise manner so that your tone is professional and the information conveyed is clear to clients. This sample invoice email template can help you write professional emails to accompany your invoices:

Subject Line: Your Business’s Name: Invoice #001

Dear Client’s Name,

I hope you’re doing well.

I wanted to let you know a new invoice #001 has been created on your account. You can find the invoice attached to this email. Please pay the balance of $500 by December 31, 2024.

You can pay by mailing a check to:

Your Business Name

Your Full Business Address

Your Zip Code

Thank you for your business; I look forward to working with you again soon.

Kind Regards,

Your Name

Your Contact Details

For more email templates and tips, follow our guide on How to Ask for Payment Professionally in Messages. The guide includes detailed steps and strategies to ensure your payment communications are effective and maintain positive client relationships.

How to Follow up on Unpaid Invoices [Email Template]

It’s important to follow up on unpaid invoices as soon as they become past due. The wording you use to follow up on them should be polite but direct. Give your client the benefit of the doubt: there’s a good chance that the late payment is due to a clerical error and they aren’t withholding payment maliciously. A personal note always helps too.

Here is an email template to help small businesses follow up on outstanding invoices:

Subject Line: Your Business’s Name: Invoice #001

Dear Client’s Name,

I hope you’re doing well. I’m contacting you in regard to invoice #001. This is a friendly reminder that the payment was due on December 31, 2024. Please send payment as soon as possible.

You can pay by mailing a check to:

Your Business Name

Your Full Business Address

Your Zip Code

I look forward to hearing from you. Please contact me if you have any questions.

Kind Regards,

Your Name

Your Contact Details

Conclusion

Invoicing is essential for the average small business owner. That’s why understanding the appropriate wording to use in your invoicing system is so important. Being courteous, professional, and efficient will win you more business, help you earn long-standing clients, and ensure a steadier cash flow for your company.

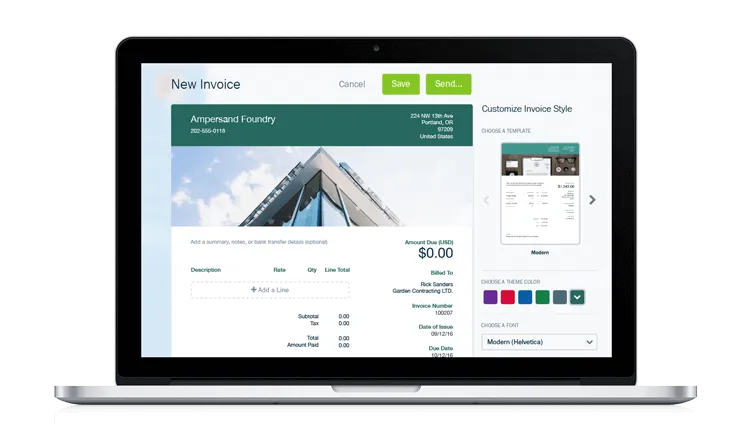

If you’re looking for a better way to do invoices, FreshBooks is here to help. Our cloud-based invoicing software solution streamlines the entire process, ensuring perfect invoice wording, clear payment terms, and timely payments.

Click here to get started.

FAQs on Invoice Wording

More questions on the best practices for wording your invoices? Here are some of the most frequently asked questions on the topic:

How do I write a short invoice?

Your invoice only needs to include a few things: the invoice date, due date, invoice number, your and your client’s company name and contact information, and a breakdown of the goods/services rendered, their costs, and the total. Invoice best practices can be hard to manage on your own, which is why so many use a free professional invoice template like the one from FreshBooks.

How to send invoices to clients?

After you’ve filled out your invoice, it’s time to send it off. You can do this manually by email or letter mail or by using online invoicing software. When dispatching the invoice, it’s recommended to include a brief personal note, often referred to as an invoice letter. This letter should contain the invoice details and a thank you message for the clients. For ready-made templates, you can refer to our post on Invoice Letter Templates.

What are standard invoice terms?

Every small business owner will take a different approach with their invoice terms, but there are some to consider, including the payment due date, late fees, an early payment reward, and flexible payment methods for your clients.

How do you word a payment on an invoice?

When explaining your invoice payment terms on your invoices, you should write as clearly, concisely, and professionally as possible to avoid confusion. Explain in clear language the payment due date, the applicable late payment fees, and the available payment methods. If you are unsure how to write it clearly and professionally, follow our guide on How to Request Payment Professionally in a Message.

What is the wording for payment due?

Rather than using tricky terms like “Net 30” or “Payment due upon receipt,” it’s best to make your payment due wording simple. Just write something understandable and courteous, such as “Please pay by January 30th” or “Invoice due 01/30/2025.” Keeping this section clear will help you get paid on time.

About the author

Jami Gong is a Chartered Professional Account and Financial System Consultant. She holds a Masters Degree in Professional Accounting from the University of New South Wales. Her areas of expertise include accounting system and enterprise resource planning implementations, as well as accounting business process improvement and workflow design. Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields.

RELATED ARTICLES

What Does an Invoice Look Like: Everything You Need to Know

What Does an Invoice Look Like: Everything You Need to Know How to Write an Invoice For Services Rendered

How to Write an Invoice For Services Rendered How to Send an Invoice: An Overview

How to Send an Invoice: An Overview How to Create an Invoice in Excel (Template Included)

How to Create an Invoice in Excel (Template Included) Invoice vs Receipt: What’s the Difference

Invoice vs Receipt: What’s the Difference Is an Invoice the Same as a Bill? With Definitions and Examples

Is an Invoice the Same as a Bill? With Definitions and Examples