Sales Order vs Invoice: Meaning & Difference

Sales orders and invoices identify details needed to make a sale, meaning they’re vital for business transactions in any company. People often refer to these two documents interchangeably. However, they have distinct differences that dictate when a business should use them during a financial transaction.

Understanding each document’s purpose is crucial to keeping your accounting books in order. Let’s dive deeper into sales order vs. invoice and discuss how each document factors into your business’s operations.

Table of Contents

Differences Between A Sales Order And An Invoice

What Is A Sales Order?

A sales order is an internal document used to initiate or request a sale. Generally, the seller prepares and issues the order while the customer fills it out to order specific products from the business. The seller keeps all sales orders on the records, thus keeping track of the orders it fulfills.

To create a sales order, the customer must express a need for a product or a service. Depending on the business, the customer might have to pay for the products when submitting the sales order. This document promises the delivery of the requested goods and services by the agreed-upon due date.

After receiving the goods, the accounts payable team uses the sales order as an official receipt to ensure their company received the correct number of products or services.

Besides facilitating the sale, a sales order helps the seller obtain information about the customer used for processing orders in the future. As such, it usually contains the following information:

- Company’s name and contact information

- Customer’s name and contact, billing, and delivery information

- Product or service description and quantity

- Price of products or services requested

- The cost of delivery, shipping, and tax

- Total cost

Types of Sales Orders

Most companies and small businesses use four types of sales orders for standard business operations.

Cash Sales

In cash sales orders, the customer places an order, picks it up, and pays for it. As the name suggests, they pay for the order in cash, so the seller enters no accounts receivables for them. Instead, they enter the order directly into a cash account. In this order type, the seller executes the delivery immediately upon entering the order. The order usually comes with a cash invoice.

Rush Sales Order

In rush sales orders, the customer expects the goods more quickly than usual after placing the order. They can pick up the order themselves, or the company can deliver the goods. Either way, the order is completed significantly faster than the regular lead time. The customer pays for the order at a later date.

Scheduling Agreement

A scheduling agreement details specific goods quantities and delivery dates. This order type is an external agreement where all data shows up as schedule lines. The company processes these deliveries in the same way as standard deliveries. After fulfilling the deliveries, the company updates the delivered quantity in the scheduling agreement.

Third-Party Sales Order

The business doesn’t deliver products directly to the customer in third-party sales orders. Instead, it hands them over to a third-party vendor that delivers them to the intended customer and generates the bill. This method is commonly used for small businesses.

What Is An Invoice?

A sales invoice is a form filled out by the business and given to the customer to request payment. As such, a commercial invoice is key to getting paid. The document is typically sent to the customer after delivering the product or rendering the service. It signals to the customer that the transaction is over and it’s time for payment.

Besides enabling payments, invoices are crucial for creating an audit trail that protects the business. It serves as an accounting record for the customer and the seller. It allows businesses to track what is owed to them and by whom.

Usually, a commercial invoice specifies the following:

- Invoice date

- A unique invoice number

- Company’s name and contact information

- Customer’s name, contact, and shipping information

- Itemized description of products or services

- Delivery date

- Accepted payment methods

- Payment terms

- Early payment discounts

- Late payment fees

- Total amount

- Payment due date

Basically, a sales invoice contains all the necessary information needed in case there’s an error related to billing. Due to this document’s importance, small business owners usually turn to software programs to cover all their bases.

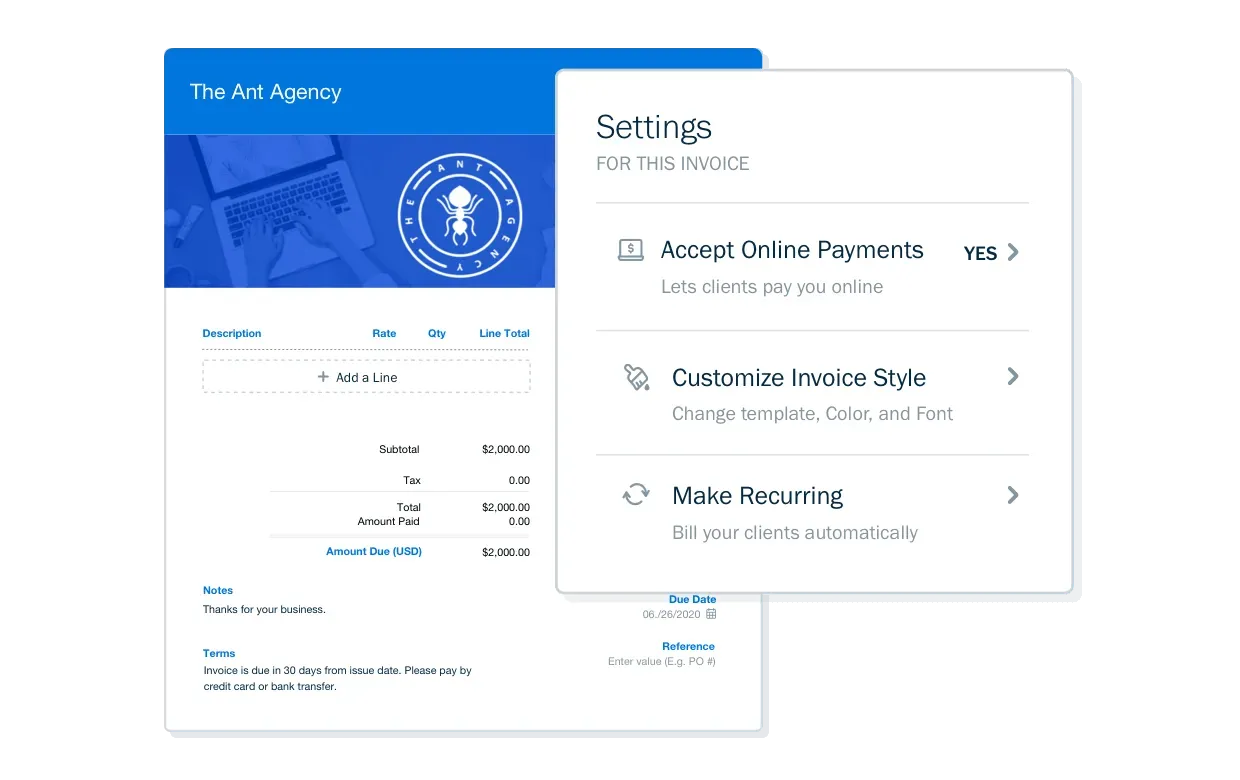

FreshBooks offers invoice software that makes small business invoicing simple. This valuable tool allows owners to focus on growing their business instead of worrying about the accounting records. The FreshBooks invoice generator will create invoices with all the necessary information. Plus, you can customize them and add your small business logo.

With FreshBooks invoice software, business owners can:

- Accept online payments

- Follow up with clients automatically

- Offer discounts

- Request deposits

- Create recurring invoices

- Generate professional reports

- Instantly view paid invoices

Types of Invoices

There are several types of sales invoices, let’s dive into the three most frequently used types.

Pro Forma Invoice

A proforma invoice isn’t a demand for payment like a traditional sales invoice. Instead, it serves as more of a pre-invoice. Simply put, it estimates how much the products or services will cost upon the completion of the order.

A pro forma invoice features the same data the invoice will have. However, it allows some wiggle room to make corrections if there are any errors.

Interim Invoice

Businesses create interim invoices for breaking down the cost of larger projects into smaller payments. Instead of issuing one on the invoice date, the business sends several smaller invoices as the project progresses. This method helps maintain a positive cash flow and keeps the project running smoothly.

Final Invoice

A final invoice is an official request for payment after selling a product, rendering a service, or completing a project. These invoices must contain all the necessary data for customers to understand the sales process entirely. In other words, they need to understand what they’re paying for, the payment methods, and when the payment is due.

Differences Between Sales Orders and Invoices

Several notable differences arise when considering sales order vs. invoice. Here are the crucial differences between sales orders and invoices.

Timing

Creating sales orders is what starts a business transaction. The sales order confirms the prospect of the business providing a product or a service. In contrast, the creation of an invoice ends the transaction. It confirms that the products or services have been delivered or rendered to the customer.

Purpose

A sales order is an internal document commonly used by sellers to track their orders. This way, they can resupply their stock in time and better regulate their inventory.

An invoice is an external document representing valid proof of business expenses for the buyer. It’s also an invaluable part of the seller’s accounting records, keeping track of owed payments. Financial auditors often review invoices to ensure they contain the appropriate tax.

Accounting Records

Unlike invoices, a sales order is rarely recorded in the company’s internal accounting records. This document serves more as a sales quote than an official internal document.

The invoice is essential for the company’s accounting. Therefore, the company should always keep it in its accounting software or ledger.

Document Date

The date on a sales order is when the customer puts in an order request. The business will begin processing the order on this day. As for the invoice date, it represents the billing date for the products or services.

Key Takeaways

Both sales orders and invoices are crucial for financial transactions. These documents become legally binding once the seller and the buyer agree on terms and conditions. There are several types of sales orders and invoices, depending on the business type, customer needs, and the length of the project. Businesses issue sales orders first but don’t necessarily keep them in accounting records. In contrast, they issue invoices at the end of the purchasing process and store them internally.

Frequently Asked Questions

Which comes first: sales order or invoice?

In the sales order vs. invoice battle, the sales order is the first document a business creates. The invoice is generally issued at the end of a transaction. It can only be created after processing the sales order.

Can I sell without an invoice?

Businesses registered under Goods and Services Tax (GST) must issue an invoice when selling goods or services to customers.

Is a sales order a legally binding document?

A sales order becomes a legally binding document once the buyer and the seller agree on its terms.

RELATED ARTICLES

Invoice Discounting: Definition and Benefits

Invoice Discounting: Definition and Benefits Fake Invoice: How To Protect Your Business

Fake Invoice: How To Protect Your Business 8 Best Invoicing Software for Small Business (2025)

8 Best Invoicing Software for Small Business (2025) Automated Invoicing Processing: How Does It Work?

Automated Invoicing Processing: How Does It Work? Invoice vs Statement: What’s The Difference?

Invoice vs Statement: What’s The Difference? EDI Invoice: Definition and How It Works Explained

EDI Invoice: Definition and How It Works Explained