Invoice vs Statement: What’s The Difference?

As a small business owner, there is plenty to understand when it comes to customers making purchases. You need to understand what the customer owes for all the transactions and the payment due date, for example. But how are you supposed to collect payment and are there any key differences between an invoice and a statement?

Both items contain detailed information based on a specific transaction. You also send statements to your customers the same way you would for outstanding invoices. It’s important for your business to obtain any unpaid amounts.

We put together this guide to break down everything you need to know between invoices and statements. Keep reading to learn what a statement includes, several key differences, the purpose of what an invoice serves, and more!

Table of Contents

Difference between an Invoice and Statement

When To Use an Invoice vs Statement

What Is an Invoice?

An invoice is a document that a company sends to a client or buyer. It gives the specifics of a transaction, describing the items and services rendered and the amount owed. The following is a quick list of the details you should typically include when drafting and submitting an invoice:

- The name and number of the customer or client

- The specific invoice number for tacking the invoice throughout your systems

- The purchase date

- The product name and its associated number

- The total quantity of times and the per-unit cost

- The subtotal of the invoice

- Any sales tax if it’s applicable

- The final total

In many cases, you can typically find the invoice payment terms and any relevant payment methods at the bottom of an invoice. As well, it will also likely include any additional instructions if they’re needed or required.

When you receive a good or service from a company that you haven’t yet paid for, the business will send you an invoice. The invoice acts as both a formal reminder to pay the provider and as evidence of the transaction. In essence, it is a bill for services provided. Providers may hand-deliver it along with the product or service, send it via email, or mail it.

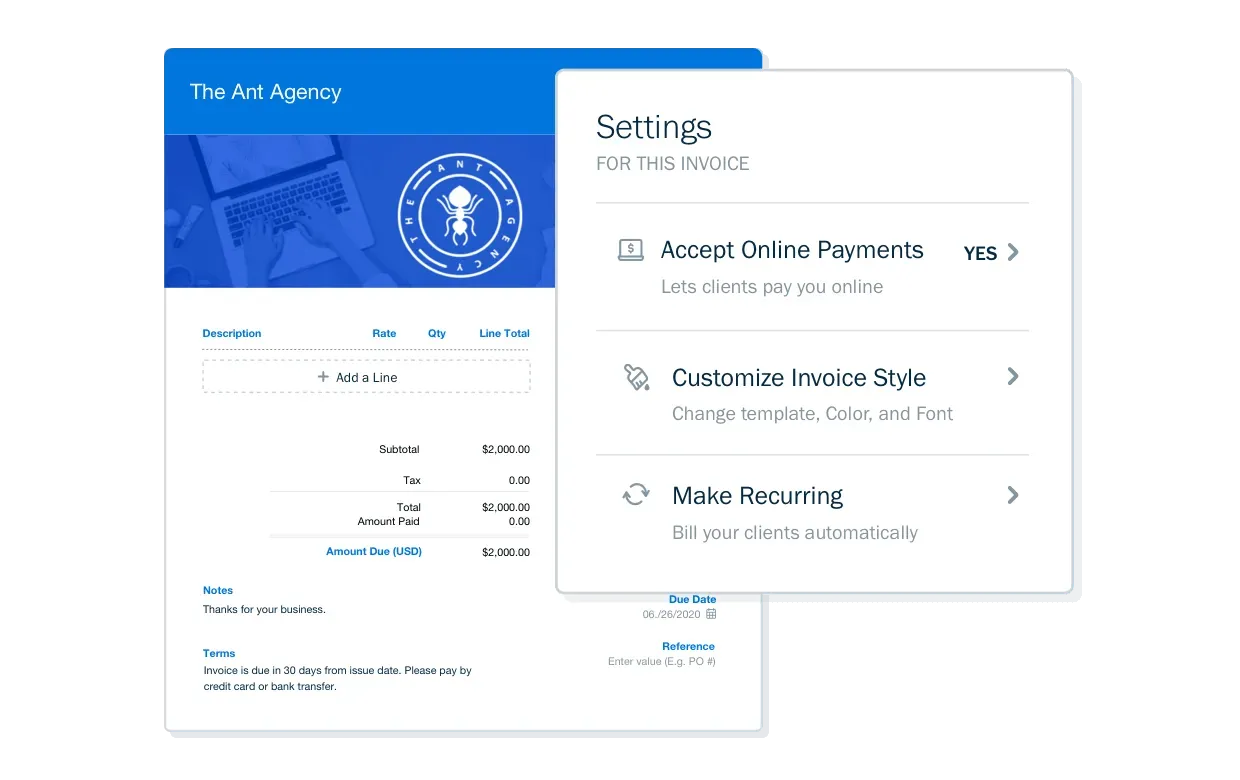

If you’re looking for a powerful invoicing software, FreshBooks offers an incredible solution for your needs. It’s easy to use and intuitive, and it makes sending and receiving invoices a breeze.

As an illustration, your business buys several cases of food from a nearby farmer. You receive an invoice for payment when the food gets delivered, in accordance with the terms of your contract with the farmer. The store might expect payment right away or might give you credit until the end of the month.

What Is a Statement?

A statement can cover multiple transactions, whereas an invoice only pertains to one particular transaction. When customers owe the company money on account, they use this document. The statement is an up-to-date report that details the customer’s account status, including both paid and unpaid invoices.

For example, let’s say that a customer of yours receives a statement that lists everything they purchased. It will outline everything from the past month and can include payment amounts, the leftover balance, and any credits available. You would then send the statement of account to the customer to acknowledge any of the purchases made. This also acts as a way to establish you’re now expecting payment for the purchases.

Statements are typically not as detailed as invoices, which include specific information about each transaction. An itemized list of transactions for the statement period will get displayed, including:

- The date of each individual transaction

- The actual invoice number and its total amount

- Any relevant debits and credits

- The ending balance

- An outline of any relevant payment terms

Difference between an Invoice and Statement

The main difference between an invoice and a statement essentially comes down to the primary purpose for it. Typically, when you send an invoice to a buyer for purchases, it’s going to serve two primary purposes. These are:

- To ask the buyer or purchaser for payment of what they purchased

- To provide revenant details to the buyer about the cost breakdown of each item that got purchased

On the flip side, a statement’s intent is to provide a greater overview of all the account activity. This is in relation to the entire term that would get included in the statement. Some of the other main purposes that a statement gets used for include:

- To ask for a specific amount of payment on an account

- To provide the customer with an overview of where they stand in regard to their account

Typically, statements get sent out at regular intervals. It can be most common for this to happen on a monthly basis. It’s also worth understanding some of the other primary differences between an invoice and a statement.

For example, it can sometimes come down to:

- The timing — In this case, statements are typically sent out in regular, pre-timed intervals such as monthly or bi-monthly. Invoices, on the other hand, get sent immediately after a sale gets completed.

- The detail — Invoices are often going to include many more details compared to a statement. Statements usually provide an itemized list of every purchase as well as the grand total of the amount.

- The accounting — Statements need to be completely informational and provide customers with an overview of purchases. Invoices need to get recorded by an accountant or bookkeeper in the accounts payable.

When To Use an Invoice vs Statement

It’s crucial to keep track of all your paperwork, including invoices and statements, whether you’re a buyer or a seller. It’s important to keep in mind that invoices get sent out for each transaction when it comes to timing. The date that an order is either processed or shipped will get included. A statement’s date only designates the day it got issued, not the day the transactions took place.

Waiting for the statement may cause some confusion because payments for specific invoices may have been made after the statement got issued. Having a tracking system will aid you in keeping track of all of the relevant bills that have gotten paid. Make sure you keep all of the credit card statements and receipts as proof of payment.

In a perfect world, customers would pay invoices right away rather than waiting for a multi-invoice statement. Your accounting system should mark the invoice as paid and include the date of payment.

Key Takeaways

Invoices and statements are common whenever purchases get made. Yet, there are a few distinguishable differences that are worth understanding. Invoices, for example, get issued as soon as a sale or purchase has been made. They will include details such as customer information, an itemized list of purchases, the amount, and any payment details.

Statements, on the other hand, act more as an overview of purchases that have been made in the past. They typically get sent out at regular intervals, such as monthly. Statements are intended to provide customers with an overview of what they have purchased and outline payment requirements.

FAQs on Statement Vs Invoice

Do You Pay A Statement Or An Invoice?

A statement is solely intended as a way to provide customers with an overview of what they have purchased. So, customers don’t pay statements, they pay invoices. Invoices get issued immediately after a purchase or sale is made.

Is A Statement A Proof Of Payment?

No, a statement only provides an overview of what customers have purchased. Invoices are what need to get paid, and after they are, the customer will typically receive a receipt of payment.

Is An Invoice Just A Bill?

They are similar but have some differences. Invoices contain set information. A bill is more of a generic item that can relate to several different documents.

RELATED ARTICLES

EDI Invoice: Definition and How It Works Explained

EDI Invoice: Definition and How It Works Explained What is a Commercial Invoice? Definition & Format

What is a Commercial Invoice? Definition & Format 6 Best Invoice Apps For Small Businesses

6 Best Invoice Apps For Small Businesses Invoice Factoring: Definition & How It Works

Invoice Factoring: Definition & How It Works How to Write a Rent Receipt?

How to Write a Rent Receipt? Online Invoicing Portal: A Small Business Guide

Online Invoicing Portal: A Small Business Guide