How to Make a Sales Invoice and Get Paid Faster for Your Goods Sold

Small businesses need to create accurate sales invoices to give to customers every time they make a sale. Business owners can make simple invoices that cover all the details of a sale in order to request payment for the goods sold. To make a professional invoice, you should include a brief description of each item sold, the cost of each item, the total amount due and the payment due date. Whether you sell products in a brick and mortar store or run an ecommerce business, invoicing customers properly can help you get paid faster for your sales.

These topics will teach you how to make a sales invoices to get paid for your goods and services:

What is the Purpose of a Sales Invoice?

How to Make a Sales Invoice

Small businesses generate sales invoices to charge customers for their goods sold and provide a detailed record of the transaction. To make a sales invoice and get paid for your products, follow this easy guide:

Add Your Company Logo

Create a header for your invoice and add your company’s logo at the very top of the document.

Include Contact Details

Also in the header, add your business contact details, include your business name, address, phone number and email address.

Include Customer Contact Information

Next, enter your customer’s contact information. List their full name, shipping address, phone number and email address.

Add the Date

Add the date toward the top of your sales invoice. Depending on your financial accounting method, this could be the date of the sale, or the date you’re sending the shipment.

Create a Detailed List of Goods Sold

In the main section of your sales invoice, include an itemized list of all the goods included in the purchase. The list of items should provide the following details:

- A brief description of each product sold

- The quantity of each item sold

- The cost per unit of each item sold

- A subtotal for each product

The easiest way to display all these details in a digestible format is to create a table with separate columns for each piece of information.

Add the Total Cost

At the bottom of your invoice, include the total amount due for the sale, including all applicable tax. Make sure the balance due is the most prominent information on the page by using a large, bold font or a different font color.

Add a Payment Due Date

Include the deadline for payment on your invoice, listing the precise date the money is due. Much like your total cost, you’ll want to make this information immediately noticeable on the page so customers make note of the deadline.

Include Payment Terms

Add the details of your payment terms to the bottom of the invoice. This includes the methods of payment you accept, such as check, credit card or online payments. If you plan to charge late fees on past due invoices, include the details of your late fee policy as part of your payment terms.

What is the Purpose of a Sales Invoice?

The main purpose of a sales invoice is to request payment from a customer for your goods sold and provide a record of the business transaction. However, sales invoices can also help your small business in other ways, including:

Bookkeeping

Your sales invoices serve as a record of a sale. They’re important for bookkeeping because they provide a detailed account of the revenue flowing into your business. Invoices can help businesses track their total sales, calculate their average sales per customer and determine their most popular payment methods. All of that information is valuable to a company’s small business accounting.

Legal Protections

Your sales invoices provide important documentation that can protect your business in the case of a bogus lawsuit. Your invoices provide a record of the products that you sold and the timing of the sale. Without an invoice, you might not have proof that a sale was made or of the pricing. While an invoice isn’t a legal document in the same way a business contract is, it still provides an important paper trail of your sales.

Tax Records

Small businesses need to store all their sales invoices for tax purposes. Your invoices give a complete record of the revenue your company generates through its sales. The IRS recommends that you keep certain supporting business documents so that you have proof of your business’s financial transactions if you get audited, including all your sales invoices. Your invoices can also help you file your taxes quicker, easing the burden of tax season.

Business Planning

Sales invoices provide valuable insights into a business’s performance and growth, which can help business owners create useful plans and projections for the future. By analyzing your invoices over long periods of time, you can determine your most and least popular products, identify peak sales times and recognize revenue trends. All this information can help you make your business more efficient to increase your earnings in the future.

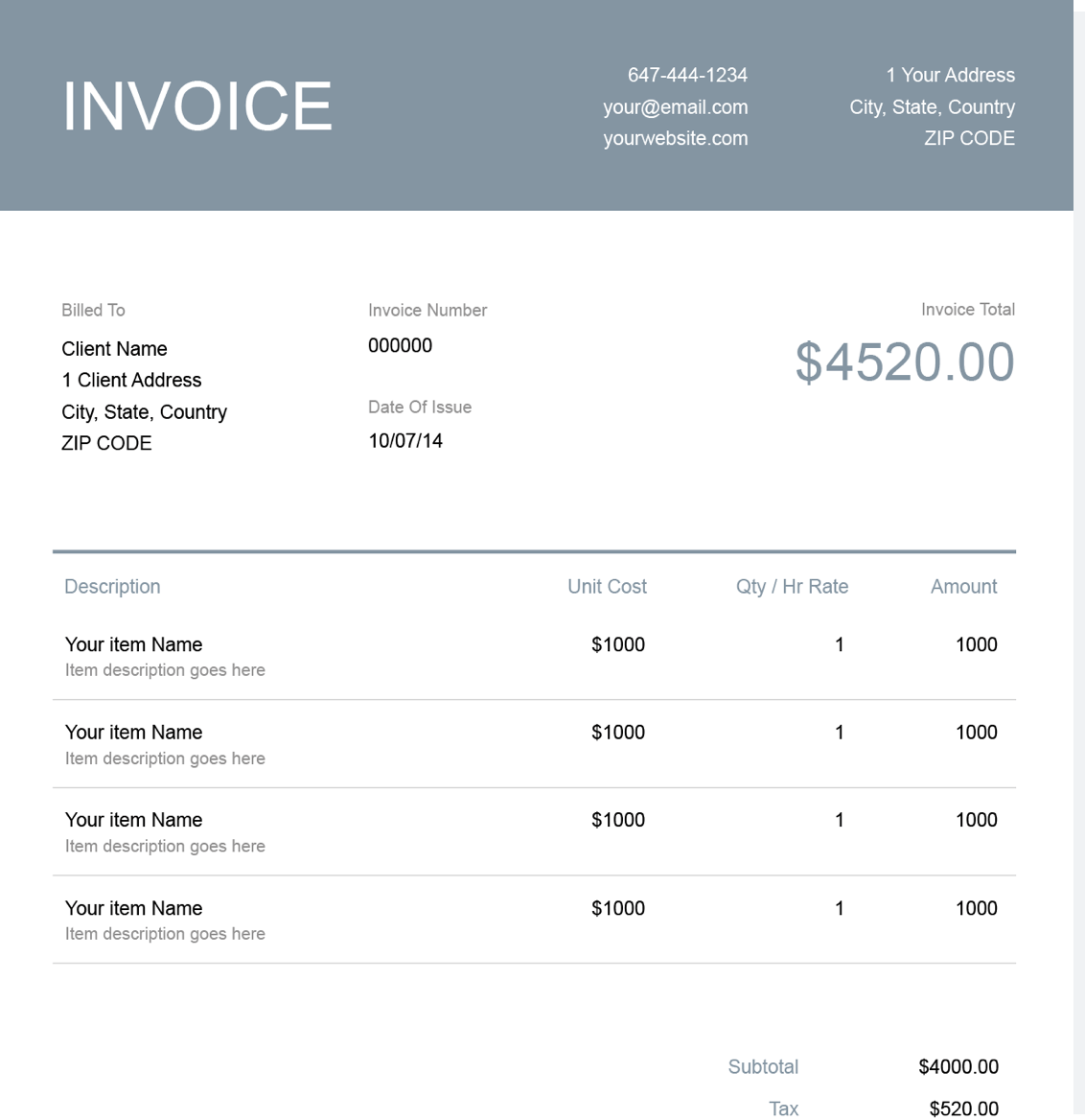

Sales Invoice Example

This sample sales invoice from FreshBooks shows all the details you should include on your invoices, including an itemized list of the goods sold and the total amount owing on the invoice, in a bold font.

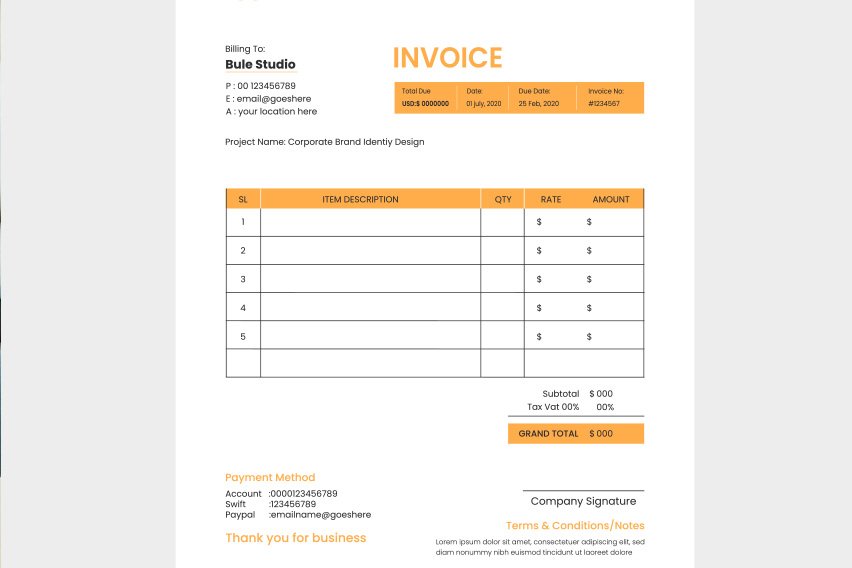

Sales Invoice Template

If you’d prefer to use an existing sales invoice design rather than creating your own from scratch, you can download and customize invoice templates online. Download the free sales invoice template from FreshBooks, edit it to suit the needs of your business and send the completed invoice to your customer to request payment for your products.

RELATED ARTICLES

How to Make a PDF Invoice? Steps Explained

How to Make a PDF Invoice? Steps Explained How to Invoice as a Freelance Designer: A Step-By-Step Guide

How to Invoice as a Freelance Designer: A Step-By-Step Guide How to Make a Service Invoice and Get Paid for Your Work

How to Make a Service Invoice and Get Paid for Your Work Late Payment Fee: How to Charge Late Fees on an Invoice

Late Payment Fee: How to Charge Late Fees on an Invoice Is an Invoice a Contract? How To Create a Legally Binding Contract

Is an Invoice a Contract? How To Create a Legally Binding Contract How to Make an Invoice in Word (with Free Template)

How to Make an Invoice in Word (with Free Template)