Nonprofit Accounting: A Complete Guide with Best Practices

Nonprofit organizations play an incredibly important role in society and culture. From social justice groups to religious organizations and education to community resources, these organizations provide helpful services and drive change on a global scale.

From an operational perspective, nonprofit organizations must maintain good business practices and compliance, which includes nonprofit accounting.

The financial resources, needs, and expenses of nonprofit groups are often incredibly different from other businesses or organizations that exist based on ownership and profit.

To truly tackle and sustain the monetary health of nonprofits, staff, and team members need a strong understanding of the accounting principles that are unique to this industry.

Key Takeaways

- Non-profits focus on accountability over profit through the use of fund accounting principles.

- There are best practices for nonprofit accounting, as outlined below.

- Nonprofits’ financial statements differ from for-profit organizations.

- Nonprofits have tax obligations to manage, although they are different from for-profits.

- Nonprofits need accountants too.

- Accounting is easier with the proper software in place

Once you’ve breezed through this article, you’ll have a firm grasp on the essentials of nonprofit accounting as well as a good idea about the ideal next step for your business.

Here’s What We’ll Cover:

How Is Nonprofit Accounting Different Than in Other Industries?

What Is The Difference Between Nonprofit And For-Profit Accounting?

7 Best Practices for Nonprofit Accounting

Managing Nonprofit Tax Obligations

Choosing the Best Nonprofit Accounting Software

Do Nonprofits Need Accountants?

Get Started on Your Nonprofit Accounting Today

What Is Nonprofit Accounting?

Nonprofit accounting refers to a form of financial management and bookkeeping that focuses on providing a clear overview of a nonprofit’s overall financial health. Unlike traditional businesses that aim to generate a profit, nonprofits must instead ensure their incoming revenue is high enough to support their organization’s goals.

While there are different types of nonprofit organizations, many of them operate by the same principles when it comes to managing funds, expenses, and external accountability. For example, financial officers and other handlers must ethically and responsibly manage donations, funds, and third-party contributions and report how the money is being used to advance the mission of the group or organization.

How Is Nonprofit Accounting Different Than in Other Industries?

Nonprofit accounting differs from most other forms of business accounting in that the money these groups collect is not used to generate profit.

Contributors and donors seldom expect a monetary return on their investments, which differs from a business venture in which profits can be shared and redistributed. Practices are also subject to:

- Restrictions based on locality or jurisdiction

- Federal tax laws and filing requirements

- Operational rules set by a governing board or committee

Because nonprofit groups often receive special tax privileges, the pressure to have transparent and accurate accounting practices is even greater.

Fund Accounting Principles

In the nonprofit world, fund accounting refers to the financial process of measuring accountability instead of profitability. This distinction provides transparency into the way that a nonprofit is managed. There are generally two categories in fund accounting:

- Restricted funds: Money in this category has a specific purpose, often defined or dictated by the donor who awards it to the nonprofit group.

- Unrestricted funds: Money in this category can be used for any general purpose, which includes larger purchases like land holdings.

Fund accounting is not only helpful for donors who want to monitor their contributions, but it also provides helpful parameters and boundaries for nonprofit staff members who must prioritize and manage new projects and initiatives.

What Is The Difference Between Nonprofit And For-Profit Accounting?

The crucial difference between nonprofit and for-profit accounting is their relationship to profit. In contrast to for-profit businesses, a nonprofit’s main mission isn’t to generate a profit. Rather, they aim to meet their revenue requirements in order to continue funding their offered services. Acquiring additional revenue is considered a secondary concern.

Another major difference is the issue of taxes. Nonprofits, when approved by the IRS, are exempt from paying taxes. With that said, there are numerous other forms of taxation that a successful nonprofit will have to factor into its accounting activities.

Nonprofits also do not have owners or stakeholders. As no profit is generated, no disbursements to any controlling interests exist.

7 Best Practices for Nonprofit Accounting

Nonprofit organizations often operate on lean budgets, which means there’s not always space for a dedicated financial manager or accountant on staff.

With that being the case, all team members who spend or distribute funds should stay up-to-date on the best practices. Below are several tips and rules to follow to maintain a thriving nonprofit budget.

1. Abide by Strict Internal Policies and Ethics

One of the first steps to take when managing your accounting practices is to hire ethically responsible staff members. Individuals have thwarted many well-meaning organizations within the organization who took advantage of having access to monetary contributions.

You can avoid undue harm by taking the following steps:

- Performing background checks on new hires, interns, and staff members

- Developing a well-rounded code of ethics for the entire team

- Maintaining strict and transparent policies when it comes to handling money

- Requiring receipts and other proofs to monitor spending

2. Develop a Statement of Financial Position

In the world of nonprofit work, the term “statement of financial position” is widely used to describe how an organization plans to use its money. The official financial position is similar to a balance sheet in that it provides visibility into what a group owes, owns, or has in cash reserves at any given moment.

Since nonprofits don’t have owners, the financial position document summarizes total liabilities and net assets.

3. Develop a Realistic Annual Operating Budget

Just because a nonprofit group doesn’t churn a profit doesn’t mean that it should forsake having a responsible and realistic budget. Depending on the type of work an organization does, the day-to-day costs could actually be substantial. When setting a complete budget, factor in things like:

- Staff salaries (both full-time and part-time)

- Expenses associated with programming and events

- Costs to maintain facilities or rented spaces

- Advertising and promotional material

4. Use Specific Language to Define Events, Activities, and Funding

Some groups may choose to use an official statement of activities. In general, a statement of activities illustrates how an organization plans to use donor funding to meet a community’s or specific population’s needs.

A statement of activities often outlines restricted and non-restricted funds from donors while clearly defining amounts associated with:

- Grants

- Membership dues

- Net assets (including money earned from sold assets)

- General contributions

5. Maintain an Accurate Ledger

Bookkeeping is incredibly important in the world of nonprofits. Not only is nonprofit bookkeeping helpful for general administrative purposes, but it also provides the transparency and accountability nonprofits rely on to stay operational.

Additionally, accurate records help ensure that tax time goes smoothly. In order to reap the important tax benefits, a nonprofit organization should maintain accurate and up-to-date financial documents and spending reports.

6. Develop a Long-term Strategic Plan

Your nonprofit organization’s success hinges on several unique factors, but having a long-term strategy in place can encourage longevity. How does accounting fit into the long-term strategic plan at your organization?

By maintaining more rigorous financial standards, you’ll be able to see exactly what expenses and contributions are needed for the future. In turn, this helps encourage growth while developing new programs or deciding which ones to discontinue.

Long-term strategies can also be helpful in recruiting new members, donors, community supporters, and more.

7. Set Sustainable Goals for Fundraising

Growing a nonprofit from the ground up hinges on the ability of organizers to fundraise at a certain level. Depending on the size of your organization, which territories it serves, and how many people are working on projects, specific fundraising, and monetary goals may differ. Regardless, monitoring this metric carefully and sharing results with donors is important.

Additionally, there may be certain costs that a nonprofit group should allocate to fundraising efforts. It’s necessary to report all solicitation activities, event-related costs, and grant-writing fees or applications. Be sure to incorporate these numbers accurately and in real time into your accounting program.

Managing Nonprofit Tax Obligations

Nonprofit groups are often eligible for beneficial tax adjustments, which reduce the overall tax burden for organizations that perform vital community work without generating profit. These benefits factor into the accounting structure of a nonprofit, and they require accurate reporting and accounting procedures.

In order to qualify for tax incentives, your nonprofit organization should:

- File for tax-exempt status, as defined by the Internal Revenue Service (IRS)

- File for official nonprofit status, as determined by laws in individual states

- Utilize Section 501 to receive tax-exempt benefits

- Responsibly pay for any non-tax-exempt activities, such as employment, sales, and real estate taxes

- Utilize Form 990 to accurately disclose any assets or revenue amounts to the public

Maintaining strong tax preparation according to state and federal policies should always play a role in any procedures.

Choosing the Best Nonprofit Accounting Software

When accounting for nonprofit practices, choosing and using affordable technology that meets your needs is helpful.

When comparing accounting solutions for a nonprofit, consider the following:

- What basic services does the platform provide?

- Does it meet your standards for essential bookkeeping practices?

- Is it relatively affordable while offering competitive features?

- Is it easy to renew or share licenses?

- How many additional features or add-ons would you need to purchase?

1. FreshBooks

FreshBooks offers nonprofit accounting software that features simple invoicing, tracking for fundraising expenses and bills, and volunteer collaboration. It is one of the best accounting software for nonprofits, freeing up more time with its ease of use and professional accounting software so that you can focus on what matters most.

FreshBooks offers late payment reminders and fees, professional-looking invoices and customizable templates, recurring profiles, auto-billing, and much more. Click here to learn more and start your free trial.

2. Zoho Books

Zoho Books is another great option for nonprofits looking to simplify their accounting practices. Zoho Books features the ability to handle multiple currencies and multiple collaboration options to help sync together employees and volunteers.

3. Xero

Xero offers a wealth of features for nonprofits looking for online accounting software. If you’re running a small team, their online software allows you to pay employees on the fly. Their software also features a dashboard view that’s great for a bird’s-eye view of overall expenses, including overhead expenses.

4. Aplos

Aplos offers a full suite of tools for nonprofits looking to bring ease and flexibility to their accounting practices. Their online software includes detailed reporting, donor management tools, and built-in email marketing and communication.

5. Sage Intacct

Lastly, there is Sage Intacct, another online accounting software company that offers tools for generating key accounting statements based on financial data. They also offer additional features, such as grant tracking and financial reporting, through other add-ons.

Do Nonprofits Need Accountants?

While it’s true that nonprofits have different needs than for-profit enterprises, accounts are still very much required. Despite not aiming to turn a profit, nonprofits still need to generate revenue from donors and other fundraising activities. They must also prepare a statement of activities for when tax season rears its head.

A qualified accountant will help your nonprofit stay ahead of the game by carrying out all of these activities and more. They’ll also be able to provide management and the board of directors with an ongoing and clear picture of the current financial health of the nonprofit.

Get Started on Your Nonprofit Accounting Today

It’s never too late to get a leg up on managing your nonprofit accounting practices in a way that’s responsible, ethical, and practical.

Having the right tools and technology solutions at your disposal can help you avoid mistakes and promote long-term financial health within your organization. Explore the many ways that FreshBooks’ accounting software for NGOs can provide specific accounting support to non-governmental organizations (NGOs), nonprofits, and charities.

Conclusion

Just because nonprofits aren’t aiming to solely generate a profit doesn’t mean accounting isn’t necessary. Proper financial accounting for nonprofits is as important as any other business. A strong accounting practice can make tax filings a breeze, attract more donors, and ultimately propel your nonprofit toward success.

Indeed, a nonprofit that engages in accounting best practices will have a better chance to weather any financial storms that may appear on the horizon. Many nonprofits even elect to take advantage of the numerous online accounting software options that are tailored to meet the specific needs of nonprofits.

FAQs on Nonprofit Accounting

What do nonprofit accountants do?

Nonprofit accountants prepare numerous financial documents, including key statements (e.g., statements of financial position) regarding the nonprofit’s primary activities and documents related to taxation.

Is nonprofit accounting hard?

Nonprofit accounting can be challenging, but thanks to FreshBooks online nonprofit accounting software, much of the more tedious work can be automated.

Do nonprofits follow GAAP?

Both for-profit and nonprofits follow the Generally Accepted Accounting Principles (GAAP). There is some variance between individual states, so be sure to check with specific rulings in your region.

What type of accounting do nonprofits use?

Nonprofits make use of similar accounting practices as for-profits. Instead of focusing on recording and distributing profits, however, nonprofits must instead produce various financial statements (statement of financial position, statement of activities, statement of functional expenses, statement of cash flows, and notes to financial statements) related to the activities the organization carries out.

Who handles the finances of a nonprofit?

Typically accounting professionals would oversee the finances of a nonprofit. Depending on the size, however, and the available funds, the main operator of the nonprofit may elect to handle that work themselves with the aid of online accounting software.

More Resources for Nonprofit Accounting

- Nonprofit Tax Deductions

- How to Calculate Overhead for Nonprofit Organizations

- How to Start a Nonprofit Organization

About the author

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

Why is Accounting Important?

Why is Accounting Important? How Much Do Small Businesses Pay in Taxes: A Guide to Tax Rates

How Much Do Small Businesses Pay in Taxes: A Guide to Tax Rates What is the Retail Method?

What is the Retail Method? What is Interest Expense?

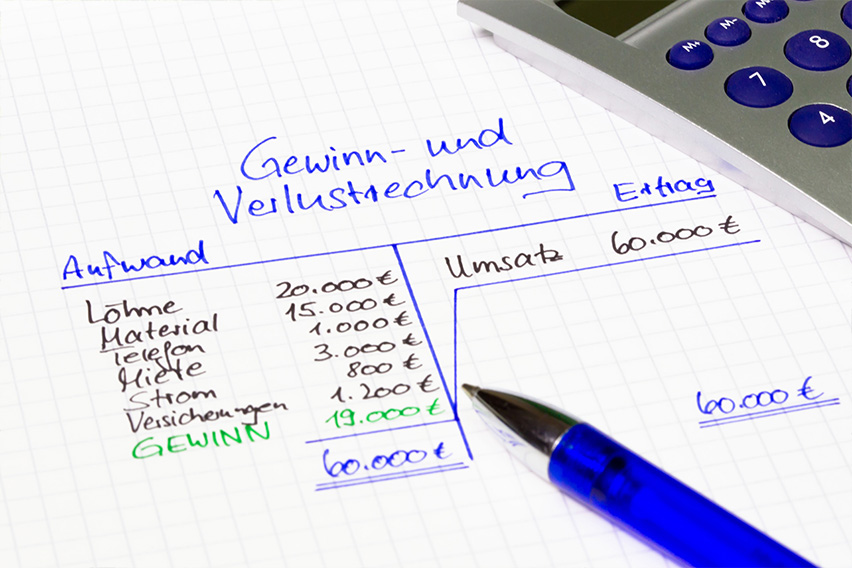

What is Interest Expense? What Is a Profit and Loss Statement?

What Is a Profit and Loss Statement? What is a T Account?

What is a T Account?