What is the Difference Between Financial and Managerial Accounting?

The difference between financial and managerial accounting is that financial accounting is the collection of accounting data to create financial statements, while managerial accounting is the internal processing used to account for business transactions.

The certification for each of these types of accounting is different as well. People who have been trained in financial accounting have a Certified Public Accountant designation, while those with a Certified Management Accountant designation are trained in managerial accounting.

The perception that more training is required for financial accounting might be reflected in the higher pay rates of financial accountants over managerial accountants.

The following categories also show the differences between financial and managerial accounting.

SYSTEMS

Financial accounting only cares about generating a profit and not the overall system of how the company works. Conversely, managerial accounting looks for bottleneck operations and examines various ways to enhance profits by eliminating bottleneck issues.

REPORTING FOCUS

Financial accounting is focused on creating financial statements to be shared internal and external stakeholders and the public. Managerial accounting focuses on operational reporting to be shared within a company.

AGGREGATION

Financial accounting looks at the entire business while managerial accounting reports at a more detailed level. Managerial accounting focuses on detailed reports like profits by product, product line, customer and geographic region.

EFFICIENCY

A business’ profitability and efficiency are reported through financial accounting. Managerial accounting reports on what is causing a problem and how to fix that problem.

TIMING

Financial statements are due at the end of an accounting period, while managerial reports may be issued more frequently, to provide managers with relevant information they can act on immediately.

PROVEN INFORMATION

Considerable precision is needed to prove that financial records are correct. Financial accounting relies on this accurate data for reporting, while managerial accounting frequently deals with estimates opposed to proven facts.

STANDARDS

When managerial accounting is made for internal consumption there is no set of standards to compile that information. On the other hand, financial accounting must follow various accounting standards.

TIME PERIOD

Financial accounting looks to the past to examine financial results that have already been achieved, so it is historically focused. Managerial accounting looks to the future with forecasting.

VALUATION

Financial accounting is concerned with knowing the proper value of a company’s assets and liabilities. Managerial accounting is only concerned with the value these items have on a company’s productivity.

This article will also discuss:

Does Managerial Accounting Follow GAAP?

Does Managerial Accounting Follow GAAP?

Financial accounting reports are distributed inside and outside of a business and are governed by GAAP and IFRS. The external publication of financial statement makes it very necessary to follow regulation to provide correct information.

Managerial accounting reports are shared internally only and are, therefore, not subject to such rules and regulations and are not required by laws to follow any accounting standard.

RELATED ARTICLES

What is the Direct Write Off Method?

What is the Direct Write Off Method? How to Calculate Depreciation

How to Calculate Depreciation What is a Good Profit Margin?

What is a Good Profit Margin? How to Calculate Bad Debt Expense

How to Calculate Bad Debt Expense What is Managerial Accounting?

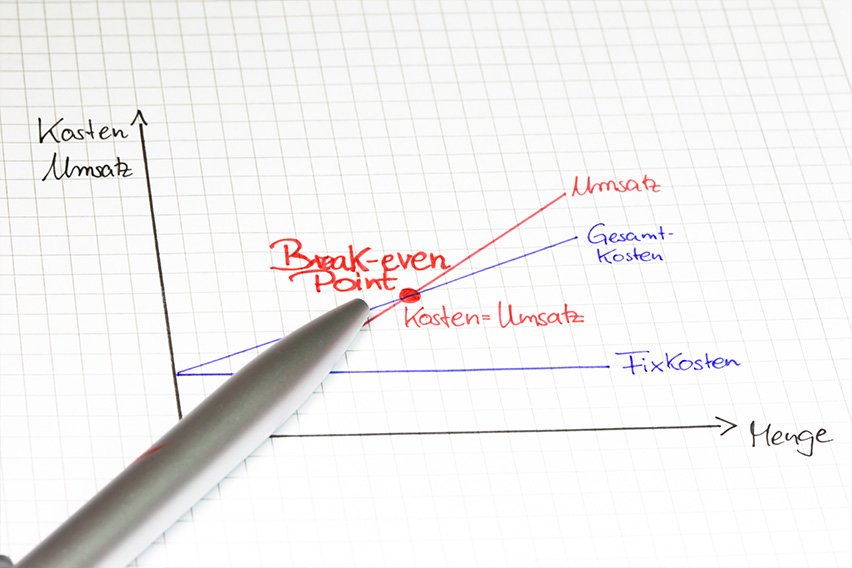

What is Managerial Accounting? How to Calculate the Break-Even Point

How to Calculate the Break-Even Point