How to Calculate Depreciation

In this article, we’ll cover:

What is Accumulated Depreciation?

4 Main Methods of Calculating Depreciation

Depreciation is a way for businesses to allocate the cost of fixed assets, including buildings, equipment, machinery, and furniture, to the years the business will use the assets.

For book purposes, most businesses depreciate assets using the straight-line method.

To calculate depreciation using the straight-line method, subtract the asset’s salvage value (what you expect it to be worth at the end of its useful life) from its cost. The result is the depreciable basis or the amount that can be depreciated. Divide this amount by the number of years in the asset’s useful lifespan. Divide by 12 to tell you the monthly depreciation for the asset.

Here’s the information you need to calculate depreciation:

- Useful life of the asset: The number of years you expect to use the asset. For book purposes, you can determine your own useful life. For tax depreciation, useful lives are based on the type of asset. Your accountant can help you determine the useful life of a specific asset.

- Minus the salvage value: This is what the asset will be worth at the end of its useful life. Salvage value is usually an estimate. You can also use zero as the asset’s salvage value—especially if you anticipate using the asset for a long time.

- Divided by the asset cost: this includes all costs for acquiring the asset, including sales tax, transportation, set-up, and training.

The asset’s original cost, less any depreciation claimed on that asset, is its book value.

For example, the annual depreciation on equipment with a useful life of 20 years, a salvage value of $2,000, and a cost of $100,000 is $4,900:

($100,000–$2,000) ÷ 20 = $4,900

Accounting and tax rules require you to place the asset in service (set it up and start using it) in the first year you start claiming depreciation.

For assets purchased in the middle of the year, the annual depreciation expense is divided by the number of months in that year since the purchase.

What Is Accumulated Depreciation?

The cumulative depreciation of an asset up to a single point in its life is called accumulated depreciation. The carrying value, or book value, of an asset on a balance sheet is the difference between its purchase price and the accumulated depreciation.

Accumulated depreciation applies to assets that are capitalized. Capitalized assets are assets that provide value for more than one year. Matching Principle in Accounting rules dictates that revenues and expenses are matched in the period in which they are incurred. Depreciation is a solution for this matching problem for capitalized assets because it allocates a portion of the asset’s cost in each year of the asset’s useful life.

4 Main Methods of Calculating Depreciation

Depreciation can be calculated on a monthly basis in two different ways.

Determining monthly depreciation for an asset depends on the asset’s useful life, as well as which depreciation method you use.

Straight-Line Method

To do the straight-line method, you choose to depreciate your property at an equal amount for each year over its useful lifespan.

Use the following steps to calculate monthly straight-line depreciation:

- Subtract the asset’s salvage value from its cost to determine the amount that can be depreciated

- Divide this amount by the number of years in the asset’s useful lifespan

- Divide by 12 to tell you the monthly depreciation for the asset

Declining Balance Method

This method is used to recognize the majority of an asset’s depreciation early in its lifespan. There are two variations of this: the double-declining balance method and the 150% declining balance method. The depreciation amount changes from year to year using either of these methods, so it more complicated to calculate than the straight-line method. For the double-declining balance method, the following formula is used to calculate each year’s depreciation amount:

To convert this from annual to monthly depreciation, divide this result by 12.

Sum-of-the-years’-digits (SYD) Method

The method that takes an asset’s expected life and adds together the digits for each year is known as the sum-of-the-years’-digits (SYD) method. This is an accelerated method to calculate depreciation.

So, if the asset is expected to last for five years, the sum of the years’ digits would be calculated by adding 5 + 4 + 3 + 2 + 1 to get the total of 15. Each digit is then divided by this sum to determine the percentage by which the asset should be depreciated each year, starting with the highest number in year 1.

The formula to calculate depreciation with the SYD method is as follows:

Modified Accelerated Cost Recovery System (MACRS) Method

For tax purposes, businesses are generally required to use the MACRS depreciation method. It’s an accelerated method for calculating depreciation because it allows larger depreciation write-offs in the early years of the asset’s useful life.

Under MACRS, useful life is determined by the asset’s class. Some common examples include:

- 5 years for vehicles, computer equipment, and office machinery

- 7 years for office furniture and fixtures

- 15 years for land improvements, such as fences and sidewalks, and tenant improvements

- 27.5 years for residential rental properties

- 39 years for commercial buildings

Calculating MACRS depreciation is more complicated than other methods outlined above. You can use the tables included in IRS Publication 946, use a MACRS Depreciation Calculator, or get help from your tax advisor.

Reviewed for accuracy by Janet Berry-Johnson, CPA.

More Resources on Small Business Accounting

RELATED ARTICLES

What is a Good Profit Margin?

What is a Good Profit Margin? How to Calculate Bad Debt Expense

How to Calculate Bad Debt Expense What is Managerial Accounting?

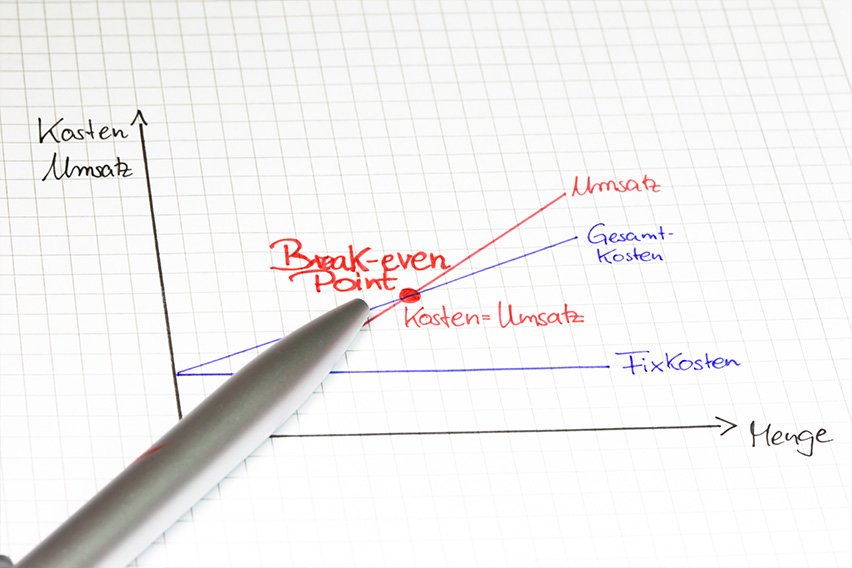

What is Managerial Accounting? How to Calculate the Break-Even Point

How to Calculate the Break-Even Point How to Calculate Retained Earnings: Formula and Example

How to Calculate Retained Earnings: Formula and Example What is Indirect Labor Cost?

What is Indirect Labor Cost?