Chart Of Accounts: Definition, Types And How it Works

A chart of accounts is an important organizational tool in the form of a list of all the names of the accounts a company has included in its general ledger. This list will usually also include a short description of each account and a unique identification code number.

Whenever you need to record a new transaction, like an invoice to a client, an expense, a loan, etc., you need to record it correctly. In general, there are 5 major account subcategories: revenue, expenses, equity, assets, and liabilities.

A business transaction will fall into one of these categories, providing an easily understood breakdown of all financial transactions conducted during a specific accounting period.

Key Takeaways

- A chart of accounts is a list of the names of a company’s accounts in its general ledger

- A COA is an organizational tool that makes financial transactions easier to understand at a glance

- A COA has five main subcategories: revenue, expenses, assets, liabilities, and equity

- Accounts on the COA usually have a name, a brief description, and an identification code number

These topics will help you better understand what a COA is and how small businesses use it:

What Is a Chart of Accounts Used For?

5 Major Types Of Chart Of Accounts

Why Is a Chart of Accounts Important?

What Is a Chart of Accounts?

A chart of accounts is a small business accounting tool that organizes the essential accounts that comprise your business’s financial statements. Your COA is a useful document that lets you present all the financial information about your business in one place, giving you a clear picture of your company’s financial health. To better understand how this information is typically presented, you may want to review a sample of financial statement. This can help you visualize how your chart of accounts translates into formal financial reporting.

Similar to a chart of accounts, an accounting template can give you a clear picture of your business’s financial information at a glance. Utilizing accounting tools like these will ensure a better workflow, helping you grow your company. FreshBooks offers a wide variety of accounting tools, like accounting software, that make it easier to stay organized. Click here to start your free trial.

How Charts of Accounts Works

Charts of accounts are an index, or list, of the various financial accounts that can be found in your company’s general ledger. These accounts are separated into different categories, including revenue, liabilities, assets, and expenditures.

Balance sheet accounts like assets, liabilities, and shareholder’s equity are shown first, and then come income statement accounts like revenue and expenses, in the order they appear on your financial statements. You may also wish to break down your business’ COA according to product line, company division, or business function, depending on your unique needs.

Looking at the COA will help you determine whether all aspects of your business are as effective as they could be. If you keep your COA format the same over time, it will be easier to compare results through several years’ worth of information. This acts as a company financial health report that is useful not only to business owner, but also investors and shareholders.

What Is a Chart of Accounts Used For?

Small businesses use the COA to organize all the intricate details of their company finances into an accessible format. It’s the first step in setting up your business’s accounting system. The chart of accounts clearly separates your earnings, expenditures, assets, and liabilities to give an accurate overview of your business’s financial performance.

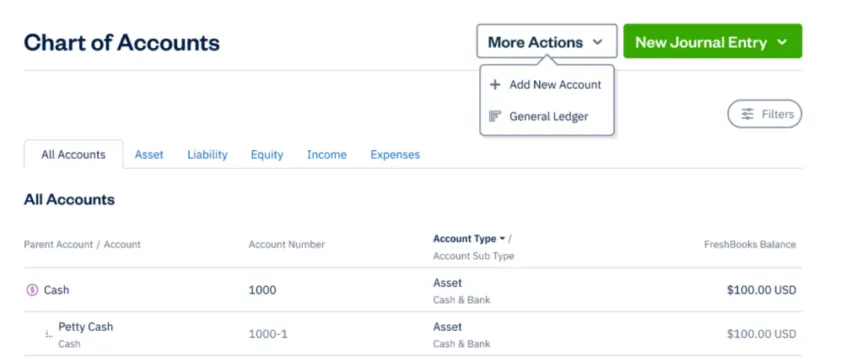

The chart of accounts organizes your finances into numbered account types. Most businesses follow this consistent, commonly accepted account numbering system:

- 1000 – 1900: Assets

- 2000 – 2900: Liabilities

- 3000 – 3900: Equity

- 4000 – 4900: Revenue

- 5000 – 5900: Expenses

Although you don’t need to follow that format, businesses generally follow the same numbering system for the COA because it makes it easier for an accountant or bookkeeper to step in and translate the information into standard financial reports.

If you’ve worked on a general ledger before, you’ll notice the accounts for the ledger are the same as the ones found in a chart of accounts.Keeping your books organized does not need to be a chore. Many small businesses opt to utilize online bookkeeping services, not only for invoicing and expense tracking but also for organizing accounts and ensuring tax season goes smoothly. FreshBooks accounting software is an affordable and reliable option for online bookkeeping services that will help you stay on track and grow your business. Click here to start your free trial.

5 Major Types Of Chart Of Accounts

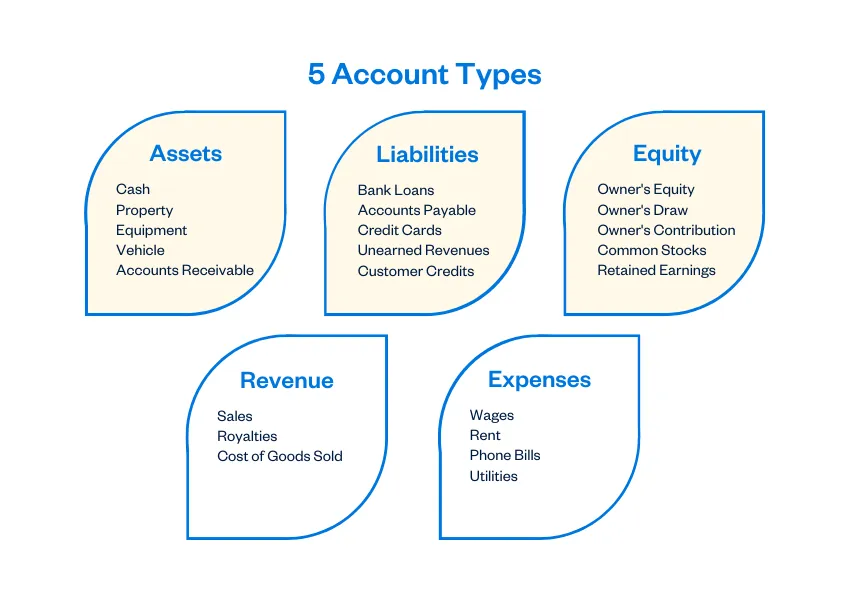

The five major account types provide the structure for your chart of accounts, breaking it down into separate types of information. Several important financial reports are built around the same five account types. Below are 5 major accounts in accounting to create your chart of accounts:

Assets

Assets are resources your business owns that can be converted into cash and therefore have a monetary value. Examples of assets include your accounts receivable, loan receivables and physical assets like vehicles, property, and equipment.

Liabilities

Liabilities are all the debts that your company owes to someone else. This would include your accounts payable, any taxes you owe the government, or loans you have to repay.

Equity

The role of equity differs in the COA based on whether your business is set up as a sole proprietorship, LLC, or corporation. This would include Owner’s Equity or Shareholder’s Equity, depending on your business’s structure. The basic equation for determining equity is a company’s assets minus its liabilities.

Revenue

Revenue is the amount of money your business brings in by selling its products or services to clients.

Expenses

Expenses refer to the costs you incur while running your business. This would include your office rent, utilities, and office supplies.

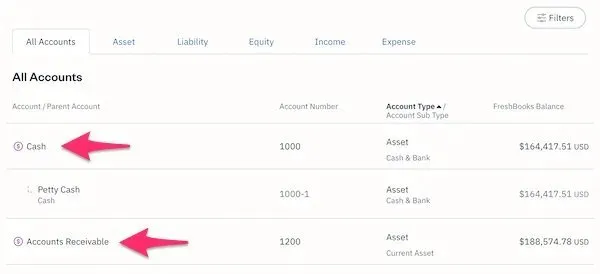

Chart of Accounts Sample

To create a COA for your own business, you will want to begin with the assets, labeling them with their own unique number, starting with a 1 and putting all entries in list form. The balance sheet accounts (asset, liability, and equity) come first, followed by the income statement accounts (revenue and expense accounts).

Why Is a Chart of Accounts Important?

The chart of accounts allows you to organize your business’s complex financial data and distill it into clear, logical account types. It also lays the foundation for all your business’s important financial reports. A COA is more than just an organizational tool, though.

Having all your financial data in one place and seeing how the separate accounts relate to one another can provide essential insights into your business’s performance. Here are some ways a chart of accounts can benefit your business:

1. Understand Your Earnings

A chart of accounts gives you great insight into your business’s revenue beyond just telling you how much money you earn. It shows peaks and valleys in your income, how much cash flow is at your disposal, and how long it should last you given your average monthly business expenses.

2. Get a Grip on Debts

A chart of accounts gives you a clear picture of how much money you owe in terms of short- and long-term debts. Your COA can help you determine how much of your monthly income you can afford to put toward your debts and help you develop longer-term debt repayment plans.

3. Spend Smarter

It’s not always fun seeing a straightforward list of everything you spend your hard-earned money on, but the chart of accounts can give you an important view of your spending habits. You can get a handle on your necessary recurring expenses, like rent, utilities, and internet. You can also examine your other expenses and see where you may be able to cut down on costs if needed.

4. Improve Your Reporting

A chart of accounts organizes your finances into a streamlined system of numbered accounts. Having an accurate chart of accounts makes it easier for you or an accounting professional to develop in-depth financial reports to help you understand your company’s financial position, including a cash flow statement, balance sheet, and income statement. You can customize your COA so that the structure reflects the specific needs of your business.

5. File Taxes

An added bonus of having a properly organized chart of accounts is that it simplifies tax season. The COA tracks your business income and expenses, which you’ll need to report on your income tax return every year.

If you’re using accounting software and want to set up a customized chart of accounts, you can add or edit parent and sub-accounts to the existing default chart of accounts. Doing this will help you stay organized and better understand how your business is doing financially. Click here to start your free trial.

Chart Of Accounts Example

When creating your chart of accounts, you may wish to begin by breaking down the five categories further, either by listing each department’s accounts separately or you could break down your revenues and expenses into operating revenues, operating expenses, non-operating revenues, and non-operating losses. It is a good idea to customize your COA to suit your business needs in a way that makes sense to you.Incorporating accounting software into your everyday business operations can only make organizing your accounts easier. FreshBooks will help you stay organized with a user-friendly interface that keeps things simple. Click here to start your free trial.

Conclusion

Business owners who keep a chart of accounts handy will have an advantage when it comes to accounting. Having an accessible and easy-to-follow list of all accounts organized and ready to review makes it easier to correctly record financial information from a new account or business transaction under the appropriate accounting category.

Keeping an updated COA on hand will provide a good overview of your business’s financial health in a sharable format you can send to potential investors and shareholders. It also helps your accounting team keep track of financial statements, monitor business financial performance, and see where the money comes from and goes, making it an important piece for financial reporting.

FAQs on Chart of Accounts

What is the standard chart of accounts?

A standard COA will be a numbered list of the accounts that fill out a company’s general ledger, acting as a filing system that categorizes a company’s accounts. It also helps with recording transactions and organizing them by the accounts they affect to help keep the finances organized.

How do you categorize a chart of accounts?

There are five main account type categories that all transactions can fall into on a standard COA. These are asset accounts, liability accounts, equity accounts, revenue accounts, and expense accounts. These categories are universal to all businesses. If necessary, you may include additional categories that are relevant to your business.

How many levels are there in the chart of accounts?

There are five top-level categories in a standard COA. The first three are assets, liabilities, and equity, which flow into the balance sheet. The remaining two are income or revenue and expenses, which flow into the income statement. Some businesses also include capital and financial statement categories.

How can a chart of accounts be used in financial reporting?

Because the chart of accounts is a list of every account found in the business’s accounting system, it can provide insight into all of the different financial transactions that take place within the company. It helps to categorize all transactions, working as a simple, at-a-glance reference point.

How is a chart of accounts structured?

Each entry on the chart of accounts has a corresponding number that indicates which type of account it belongs to. The commonly accepted order is as follows: 1000 – 1900 is assets, 2000 – 2900 is liabilities, 3000 – 3900 is equity, 4000 – 4900 is revenue and 5000 – 5900 is expenses. These are listed in numerical order to make it easier to find any specific account.

Can a chart of accounts be customized to fit specific business needs?

Yes, it is a good idea to customize your chart of accounts to suit your unique business. This way, you can allocate each financial transaction from your business to a category that makes sense to you as a business owner, keeping track of the money moving in and out of your business while adhering to financial reporting standards.

About the author

Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. In 2022 Kristen founded K10 Accounting. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance.

RELATED ARTICLES

What Is Comprehensive Income? It’s Income Not yet Realized

What Is Comprehensive Income? It’s Income Not yet Realized What Is Double-Entry Bookkeeping? A Simple Guide for Small Businesses

What Is Double-Entry Bookkeeping? A Simple Guide for Small Businesses How to Create a Multi-Step Income Statement: A Guide to In-Depth Financial Reporting

How to Create a Multi-Step Income Statement: A Guide to In-Depth Financial Reporting The 12 Branches of Accounting: Their Uses and How They Work

The 12 Branches of Accounting: Their Uses and How They Work Cost of Goods Sold: What Is It and How To Calculate

Cost of Goods Sold: What Is It and How To Calculate What Is Unearned Revenue? A Definition and Examples for Small Businesses

What Is Unearned Revenue? A Definition and Examples for Small Businesses