How to Calculate Accounts Receivable Turnover

Accounts Receivables Turnover refers to how a business uses its assets. The receivables turnover ratio is an accounting method used to quantify how effectively a business extends credit and collects debts on that credit.

To calculate the Accounts Receivable Turnover divide the net value of credit sales during a given period by the average accounts receivable during the same period. An average for your accounts receivable can be calculated by adding the value of the accounts receivable at the beginning and end of the accounting period and dividing it by two.

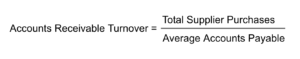

The formula for Accounts Receivable Turnover Ratio is as follows:

JUMP LINKS

How Do You Find the Accounts Receivable Turnover?

What Is the Accounts Receivable Turnover Formula?

7 Tips to Improve Your Accounts Receivable Turnover Ratio

How Do You Find the Accounts Receivable Turnover?

The Accounts Receivable Turnover Ratio indicates how efficiently a company collects the credit it issued to a customer. Businesses that maintain accounts receivables are essentially extending interest-free loans to their customers, since accounts receivable is money owed without interest. The longer is takes a business to collect on its credit, the more money it loses.

If the turnover is high it indicates a combination of a conservative credit policy and an aggressive collections process, as well a lot of high-quality customers. A company should consider collecting on excessively old account receivable that are tying up capital, if their turnover ratio low. Low turnover is likely caused by lax credit policies, an inadequate collections process and/or a customer base with financial difficulties.

Tracking your receivables turnover can be useful to see if you have to increase funding for staffing your collection department and to review why turnover might be worsening.

What Is the Accounts Receivable Turnover Formula?

The formula to calculate Accounts Receivable Turnover is to add the beginning and ending accounts receivable to get the average accounts receivable for the period and then divide it into the net credit sales for the year.

Net Annual Credit Sales ÷ ((Beginning Accounts Receivable + Ending Accounts Receivable) / 2)

For example, a company wants to determine the company’s accounts receivable turnover for the past year.

In the beginning of this period, the beginning accounts receivable balance was $316,000, and the ending balance was $384,000. Net credit sales for the last 12 months were $3,500,000. Based on this information, the accounts receivable turnover is calculated as:

$3,500,000 Net credit sales ÷ (($316,000 Beginning receivables + $384,000 Ending receivables) / 2)

= $3,500,000 Net credit sales ÷ $350,000 Average accounts receivable

= 10.0 Accounts receivable turnover

So, the company’s accounts receivable turned over 10 times during the past year, which means that the average account receivable was collected in 36.5 days.

7 Tips to Improve Your Accounts Receivable Turnover Ratio

One of the top priorities of business owners should be to keep an eye on their accounts receivable turnover. Making sales and excellent customer service is important but a business can’t run on a low cash flow. Collecting your receivables is definite way to improve your company’s cash flow.

Here are a few tips to help you improve your Accounts Receivable process to cut down collection calls and improve your cash flow.

1) Invoice Accurately, On Time, and Often

The more accurate and detailed your invoices are, the easier it is for your customers to pay that bill. Billing on time and often will also help your company collect its receivables quicker. If you have a payment system for your sales, it is less daunting for your customers to pay smaller, regular bills than one large bill every quarter.

2) Build Strong Customer Relationships

A good relationship with your customers will help you get paid. Happy customers are happy to pay for the goods and services provided. Big and small companies alike can benefit from making small friendly gestures like a friendly call or e-mail to check in. These small acts can make a difference during collections time.

3) Include Payment Terms

Adding clear payment terms on your invoices sets them up for success. You can use FreshBooks’ net 30 invoice template to ensure the terms are clear, indicating that you expect payment within 30 days. Don’t be afraid to add late payment fees, which are usually a percentage of the original invoice. Consider setting credit limits or offering payments plans for high dollar value sales.

4) Use Cloud-Based Software

Consider using a cloud-based accounting software to make your overall billing and receivables process easier. Working on the cloud enables you to access your financial data from anywhere and allows you to easily collaborate with your accounting and bookkeeping teams Cloud-based accounting software allows you to easily track your receivables and cash flow and enables you to easily automate recurring invoices and reminders for your customers.

5) Make Paying Invoices Easy

Providing multiple ways for your customers to pay their invoices, will make it easier for them to match what their own financial process. Making your customer’s lives easier will help you get paid faster. Consider accepting online payments through Apple Pay or PayPal as well as traditional methods of checks and cash.

6) Don’t Have Accounts Receivable

The best way to not deal with Accounts Receivable problems is not to have accounts receivable. That might not be possible for all business but there many industries that are able to accept pre-payment before providing a good or service.

Using online payment platforms like Square or Paypal allows businesses to remove the need for collections calls and potential losses due to non-payments. While their might be upfront commission costs for these portals, it is important to consider the money and time that will be saved in the long run.

7) Follow Up

Friendly reminders for payment don’t just need to come when a payment is late. Think about giving your customers a courtesy call or email to remind them their payment is due 10 dates before the invoice due. After the due date passes, follow up right away.

RELATED ARTICLES

What Are Fixed Assets? A Simple Primer for Small Businesses

What Are Fixed Assets? A Simple Primer for Small Businesses Operating Margin Equation: How to Calculate

Operating Margin Equation: How to Calculate Is Service Revenue an Asset? Breaking down the Income Statement

Is Service Revenue an Asset? Breaking down the Income Statement Chart Of Accounts: Definition, Types And How it Works

Chart Of Accounts: Definition, Types And How it Works What Is Comprehensive Income? It’s Income Not yet Realized

What Is Comprehensive Income? It’s Income Not yet Realized What Is Double-Entry Bookkeeping? A Simple Guide for Small Businesses

What Is Double-Entry Bookkeeping? A Simple Guide for Small Businesses