Construction Accounting: Ultimate Guide for Contractors

Accounting is an essential part of running a successful construction business. However, managing your business finances correctly doesn’t always come naturally—especially if you’re not much of a numbers person. What’s more, accounting for construction company finances has some unique challenges compared to other types of businesses.

In this guide, we address some of those challenges and cover the basics of construction accounting. Follow this resource step-by-step to establish an effective accounting process, avoid costly mistakes, and make more money.

Key Takeaways

- Construction accounting is the process of accounting for individual construction projects for enhanced financial management and compliance.

- Construction accounting includes several elements, including job costing, revenue recognition, payroll, and billing.

- Best construction accounting practices include separating personal finances, breaking down project costs, and remaining consistent with revenue recognition methods.

- Accounting software can help construction companies better manage their finances and streamline several financial processes.

Table of Contents

- What Is Construction Accounting?

- How Is Construction Accounting Different?

- Construction Accounting Foundation

- Tips for Handling Your Construction Accounting Processes

- Streamline Construction Accounting with FreshBooks

What Is Construction Accounting?

Construction accounting is a specific type of accounting focused on the needs of the construction industry. It factors in the costing structures, timelines, and contracts that make up the construction world, helping construction companies track their finances from project to project.

Unlike standard, transaction-based accounting, construction accounting focuses on individual projects and all of their financial variables throughout the process.

How Is Construction Accounting Different?

Accounting for the construction industry is more complex than it is for most businesses due to the nature of the work, revenue recognition, per-project pricing, job costing, fluctuating operating costs, and other aspects of construction projects.

Construction companies deal with a variety of requirements. So they need to be able to track accurate costs, bid on jobs, manage prevailing wage requirements, and handle a slew of other accounting responsibilities.

Below are the key ways in which construction accounting differs from other types of accounting.

Project-Based

Construction companies work from project to project and typically manage multiple projects at one time. Construction projects aren’t necessarily paid for as soon as the project is completed: There may be an upfront deposit required, the project could be paid in full, or it can take months before the final invoice is settled.

For these reasons, construction companies may need to generate separate profit and loss (P&L) statements for each project.

Mobile and Decentralized Production

Because of the mobile nature of the construction industry, construction accounting must consider the costs of transporting people and equipment to and from various job sites. It must also factor in the varying costs of wages and the different regulations in effect in different areas that the company is working within.

Your construction company may also have to lease or rent equipment or vehicles closer to a project site, which means variable expenses that need to be accounted for. Construction accounting helps to keep track of finances despite the decentralized, mobile nature of the construction industry.

Sales

Regular businesses typically offer 1-5 different types of products or services, whereas construction businesses offer a wide range of services. This may include service work, design services, consulting, engineering, sourcing materials, and more.

This can make it difficult to track expenses and effectively calculate the profit generated from each service category.

Fluctuating Overhead Costs

Construction companies also experience fluctuating overhead costs. Consider the cost of insurance, travel, workers’ compensation, materials, subcontractors, equipment, and more. You will need to factor this into your construction accounting for each construction project and for the business as a whole. To effectively manage these variable expenses, you can use FreshBooks Project Accounting Software which lets you track project financials and create reports quickly and easily.

Cost of Goods Sold

Most businesses simply record the cost of the products sold, but construction companies are quite different. Each job incurs direct and indirect costs that may fall into a wide range of categories. It’s essential that contractors have an effective method for keeping track of income and expenses, and for reconciling every transaction.

Also Read: Cost of Goods Sold Formula

Long-term Contracts

Your company may manage short- and long-term contracts, often with varying end dates. This means you may not get paid at the same time every month. To stay on top of cash flow and keep your books in check, you will need a flexible yet organized construction accounting system.

Construction Accounting Foundation

There are a few unique aspects of construction accounting that must be considered in order to be effective. These concepts address every aspect of work in the construction industry, including job estimates, unique billing structures and methods, and revenue recognition.

Job Costing

Job costing is an essential part of running a financially stable construction business. Each project generates its own individual profits and also has its own unique expenses to consider. To make the most of each project, construction companies must carefully track and allocate their costs over the course of the job.

Job costing is usually broken up into 3 categories: overhead, materials, and labor. Accurate tracking of these costs is essential for project budgeting, profit analysis, and overall decision-making.

Contract Revenue Recognition

Another crucial element of construction accounting is contract revenue recognition. There are a few methods to go about doing this, and construction companies will choose their preferred method based on the size of the business and the type and duration of various projects.

Cash Method

The cash basis is the simplest method of accounting. In this method, revenue and expenses are recognized when cash is received or paid. It’s different from the accrual accounting method, in which revenue is recorded when it’s earned and expenses when they’re accrued, regardless of whether money has changed hands yet or not.

The cash method is used by smaller construction companies that have average gross receipts of $25 million or less. For larger companies, the accrual basis is used instead.

Completed Contract Method

In the completed contract method (CCM), revenue and expenses are recognized only once the project is fully completed. This lets companies defer their revenue into the future, which can help to minimize tax liability in the short term.

The completed contract method is generally reserved for smaller projects, such as home construction. The completed contract method is not compliant with the Generally Accepted Accounting Principles (GAAP), which means it isn’t suitable for all companies and projects.

Percentage of Completion Method

In the percentage of completion method (PCM), companies can recognize revenue as it’s earned throughout the lifetime of a contract. This is the most common construction accounting method, particularly for large, multi-year projects. Generally speaking, all companies with gross revenue above $25 million must use this method for projects that take two years or more (unless it is a qualifying home construction project).

With PCM, revenues are recognized proportionally to the portion of work completed so far. Because it reports both income and expenses throughout the project, this method tends to paint a more complete and accurate financial picture.

ASC 606 New Revenue Recognition Standards

The Accounting Standards Code (ASC) 606 is a recently introduced GAAP revenue recognition standard. It changes the way construction contractors recognize revenue for long-term contracts using PCM.

ASC 606 states that companies must recognize revenue according to their obligations to the customer, with each obligation having a price attached to it. This change brings revenue recognition practices into alignment with customer contracts, which means construction companies must prioritize detailed contract analysis to ensure they are compliant with this new standard.

Contract Retainage

Retainage refers to the portion of payment that is withheld until project completion (or another pre-specified time). This motivates construction companies to complete the project to the customer’s standards, protecting their clients in the event of issues or disputes. Typically, retainage amounts are around 5% to 10% of the total contract value.

Contract retainage can make a big impact on cash flow and payment timing to the company’s contractors. It represents a serious financial risk, which is why many companies may, in turn, withhold retainage amounts from their own subcontractors.

Construction Billing

Another key element of financial management in the construction industry is project billing. Most companies opt to bill with either the fixed-price method, the time and materials method, the unit price method, or the AIA progress billing method.

Fixed Price

In this method, the company and client agree to a set price to be paid for the entire project based on the company’s estimate. The fixed price method has pros and cons—on one hand, it allows the customer to see the entire price of their project upfront, which can make it easier to make a deal. On the other hand, the company is obligated to complete the project at this price regardless of the expenses they actually incur.

Time and Materials

When it’s difficult to figure out the full scope of the project in advance, companies will use the time and materials billing method. This means billing on a per-hour basis for labor and adding the cost of materials used to the invoice, usually with a standard markup.

It’s a flexible method but can lead to ballooning prices for clients. Some contracts with this method might include a price cap to protect buyers from paying too much as the project scope increases.

Unit Price

In this method, the company charges a fixed amount for each ‘unit’ completed. The rate and definition of a single unit will be predetermined and set out in the contract (e.g., a unit could be a mile of roadway completed). This is a common method when the company is providing several repeated units of the same type at a predictable cost, but the amount of units to be completed is still uncertain.

AIA Progress Billing

The American Institute of Architects (AIA) method is generally used for commercial and government-funded construction projects. It’s a standardized billing framework that lets contractors bill based on predetermined project milestones. The AIA progress billing system makes it easier for clients to understand the progress of a project and offers assurances because each invoice is signed by an architect.

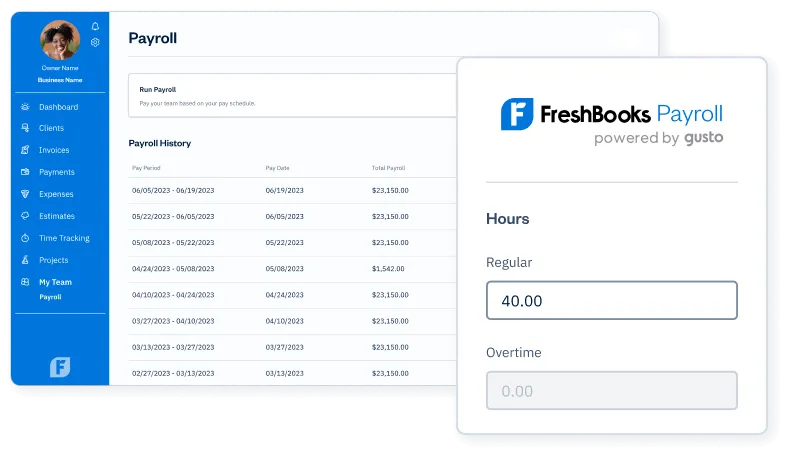

Construction Payroll

Payroll is another key element of construction accounting. As with billing and accounting, there are a few different payroll considerations you’ll need to make, FreshBooks Payroll powered by Gusto—a solution designed to simplify prevailing wage calculations, union payroll compliance, multi-state processing, and regulatory reporting, all in one easy-to-use platform.

Prevailing Wage

For companies working on public, government-funded projects, prevailing wage laws dictate the amount that workers are paid. These are essentially government-defined minimum wages for various jobs based on surveys of pay for similar work in nearby areas.

Federal prevailing wages are publicly available and must be adhered to, and many states also set prevailing wages for any state-funded projects. Rates can change and vary often, so it’s important to remain up-to-date on the latest information to ensure compliance.

Union Payroll

Construction trades are highly unionized, which means wages and other work conditions are determined through collective bargaining. Whereas non-union payroll offers far more flexibility to employers, union payroll requires employers to disclose payment information to each union, deduct union dues from payroll, and keep track of labor hours to ensure union workers are not exceeding the hours specified in their contracts. You may also have to assist with benefits administration if your workers’s unions offer insurance to members.

Multi-State Payroll

Many construction companies operate in multiple states, making the payroll process more complex. There are varying state tax laws, wage regulations, and compliance reporting requirements in different states, so you’ll need to carefully manage and oversee these various payroll obligations, including if an employee works in one state and lives in another.

Compliance Reporting

Compliance reporting is another key requirement for construction companies. This involves reporting compliance to federal, state, and/or local agencies, and covers many regulatory requirements, including tax filing rules, labor laws, and various safety regulations.

On the federal level, you’re required to report work-related deaths and serious injuries to the Occupational Safety and Health Administration (OSHA), and employers with more than 100 employees must submit annual reports about employee race, ethnicity, and gender to the Equal Opportunity Employment Commission (EOEC).

Tips for Handling Your Construction Accounting Processes

The following steps can help you get your construction accounting started on the right foot and help you stay on top of your bookkeeping and financial management.

1. Separate Personal and Business Expenses

The first step for all construction firms is to open a separate business bank account that will be used exclusively for your business.

You can go to a bank or credit union to set up a company checking account that suits the needs of your firm. This will make it easier to keep your finances organized.

To set up a business bank account, you will need:

- Social security number or employer identification number (EIN)

- Personal identification, such as a driver’s license or passport

- A copy of your business license

- Organization documents filed with the state

2. Break Down Project Costs—Job Costing

Since construction accounting is project-centric, you’ll need a way to track, categorize, and report transactions for each job. This is called job costing.

Job costing is a method for allocating expenses and revenue to each specific job. Not only will this help you prepare for tax time, but it provides an accurate accounting of profitability for each contract.

It essentially ensures that your service price covers all overhead expenses and helps ensure you make a profit on all of your construction projects.

Job costing is calculated by determining the cost of labor, materials and overhead on a specific job (Total Job Cost = Direct Materials + Direct Labor + Applied Overhead).

Read our complete guide on How to Calculate Job Costing

3. Record Day-to-Day Financial Transactions

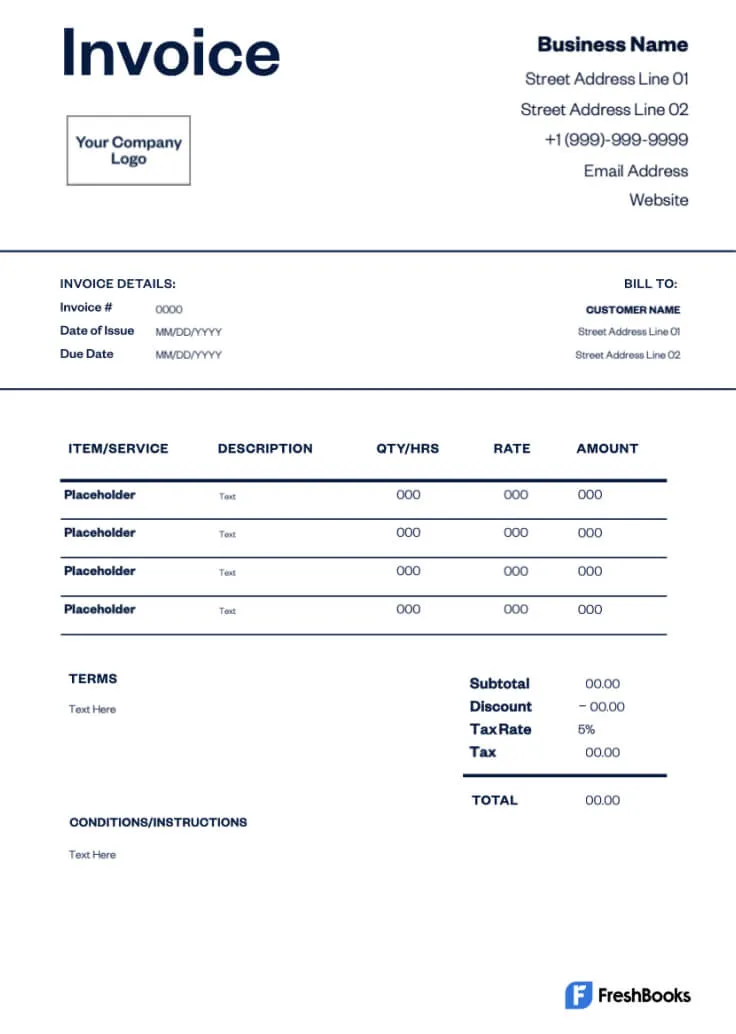

Use a journal, spreadsheets, or construction accounting software to record day-to-day transactions like accounts payable, accounts receivable, labor costs, and material costs incurred. You’ll want to include a description of each transaction, the date of the transaction, and the revenue received or expense paid.

You can use construction invoice templates to bill your clients and keep a paper record of all construction projects and revenue generated.

If you use a contractor accounting software, it can usually connect to your business bank account to automatically report expenses that flow through the account, including equipment and labor costs and administrative costs.

4. Select Revenue Recognition Methods

Revenue recognition is how a business determines when they’ve officially earned revenue from a contract or project.

Under regular business accounting circumstances, revenue recognition is simple because they sell a product or service and collect a fixed price right away. They can choose between the cash method or the accrual accounting methods. However, the nature of construction companies makes how these businesses recognize revenue more complicated.

In general, a construction business with gross receipts (also known as Business Tax Receipts) over $10 million must use the percentage of completion revenue recognition method for tax purposes. A construction business with gross receipts under $10 million can use the completed contract method on construction projects that last less than two years. They’re only required to use the percentage of completion method for construction contracts that extend over two years.

If your construction business follows generally accepted accounting principles, you should use the percentage of completion method for financial statements as well.

5. Track Business Expenses

You’ll also want to categorize these expenses by service, and by individual job so you can easily track how much money came in as well as how much you spent on expenses. Using an expense tracker and saving your receipts can help you keep track of all of your expenses and project profits on each job.

The most common expenses construction industry businesses have include:

- Business registration and licensing

- Bank fees

- Tools and equipment

- Travel expenses (including fuel)

- Electronics

- Trade school tuition

- Vehicle maintenance

- Phone and internet expenses

- Lodging

- Software subscriptions

- Membership fees (unions and associations)

- Mileage (tax write off)

- Insurance

- Lease payments

- Safety equipment and uniforms

- Subcontractors

- Employee payroll

- Advertising and marketing

6. Reconcile Bank and Supplier Statements

Each month your bank will send you a record of your income and expenses. You can use that bank statement to reconcile your transactions to make sure they match up with your own accounting system, invoices, payments, etc.

Reconciling your transactions involves:

- Comparing your bank records to your expense receipts

- Looking for any discrepancies between your construction accounting system and your bank account

- Comparing transactions in the bank statement to what you have in your record of financial transactions

- Contacting your bank to discuss any discrepancies

7. Pay Estimated Taxes

To pay estimated quarterly taxes, you have a few options, including:

- Signing up for the Electronic Federal Tax Payment System (EFTPS) online

- Paying online via the IRS website

- Paying using debit or credit card

- Sending a check or money order by mail to the IRS

Many construction companies use a “completion percentage” approach, meaning they calculate estimated taxes based on quarterly income and expense reports.

However, you can take a “completed contract” approach as well, which involves calculating taxes owed on each contract. A benefit of this approach is that you can track income, operating expenses, profit, and taxes on the micro-level so you gain a better understanding of where you stand on each construction project.

The important thing is that you adopt a construction accounting strategy that works best for you, and stick with it so there’s no confusion come tax time. If you need extra help, it’s recommended that you seek out an accountant or professional tax preparer.

8. Hire an Accountant (Optional)

While it’s possible to manage your construction accounting on your own, owning a construction company comes with many complexities that may lead to you making costly accounting errors.

Just as you have project managers overseeing each job site, it might make sense to hire a professional accountant to help you reconcile a variety of transactions for various jobs and services.

An accountant will help you make sense of the numbers, manage your books, generate reports, estimate your quarterly tax payments, maintain a healthy cash flow, and protect narrow profit margins.

Nervous about the cost? The average hourly rate for an accountant in the U.S. is about $35, making it quite affordable for the average owner. However, these rates may vary depending on the size of your company, the number of jobs and employees you manage, and your unique needs.

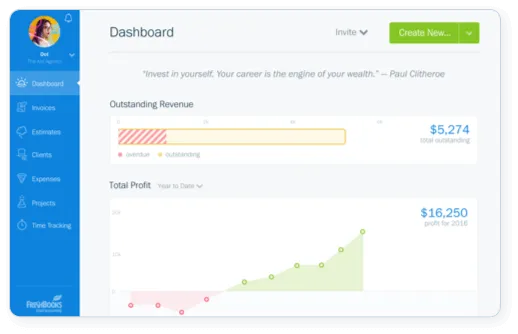

9. Leverage Professional Construction Accounting Software

Invoice templates and spreadsheets will only take you so far. If you truly want to master your construction accounting and avoid costly mishaps, you may want to look into the best construction accounting software.

This will make it easy for you to send invoices online, track expenses, monitor payment status, generate financial reports, and more.

Even better, clients are more likely to trust businesses that use construction accounting software over manual methods because accounting software provides a safe, convenient way for them to pay online.

Plus, you’ll have all the tools you need to stay on top of your construction accounting and make smarter financial decisions.

Streamline Construction Accounting with FreshBooks

Construction accounting doesn’t have to be a headache. With the right process, you can save time on your invoicing, accounting, bookkeeping, and tax preparation, even without previous construction accounting experience.

Improving your process starts with understanding how construction accounting is unique, and determining the different types of job costs you can incur on each project.

The best way to stay organized is by tracking your day-to-day transactions, reconciling your accounts on a regular basis, and using construction accounting software. If you’re looking for an outstanding tool to help you with construction accounting and administration, FreshBooks accounting software can help. It streamlines countless essential processes, including job costing, payroll, and billing, to ensure effective financial management and compliance.

With the steps in this guide, you have everything you need to do construction accounting for your company the right way. For those looking to streamline their operations further, explore our post on the best construction apps to enhance your efficiency.

About the author

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

Nonprofit Accounting: A Complete Guide with Best Practices

Nonprofit Accounting: A Complete Guide with Best Practices Why is Accounting Important?

Why is Accounting Important? How Much Do Small Businesses Pay in Taxes: A Guide to Tax Rates

How Much Do Small Businesses Pay in Taxes: A Guide to Tax Rates What is the Retail Method?

What is the Retail Method? What is Interest Expense?

What is Interest Expense? What Is a Profit and Loss Statement?

What Is a Profit and Loss Statement?