Revenue Definition, Formula & Example

Revenue is one of the most important things to consider when running a business, especially when it comes to your income taxes and tax credits.

Without commercial revenue, your business is doomed to fail. That’s why you must have a good understanding of what exactly it is.

So what is revenue?

Read on as we give you a detailed definition and answer some common questions.

Table of Contents

KEY TAKEAWAYS

- Revenue is the value of all sales of goods and services.

- Revenue minus operating expenses is what’s known as operating income.

- It is a calculation of periodic income.

- A non-operating income is a nonrecurring or infrequent income that comes from secondary sources.

What Is Revenue?

Revenue is the value of all of a business’s sales of goods and services. These are sales that are recognized by a company. Business revenue can be calculated as the average sales price multiplied by the number of units sold.

If you subtract costs from the top-line figure of your revenue, then you can determine your net income.

Revenue is also known as the top line. This is because it appears first on a business’s income statement. This is opposed to net income, which is known as the bottom line. Net income is revenues minus expenses.

A business will therefore see a profit when its revenue exceeds its expenses.

What Is the Formula for Revenue?

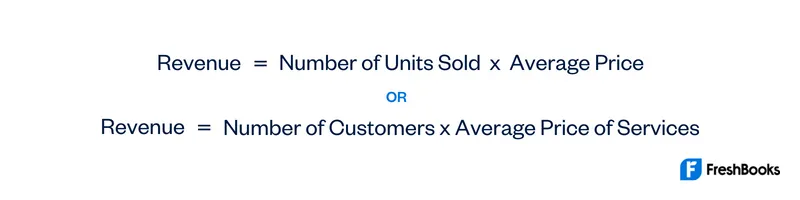

The calculation of revenue is very straightforward. It can be done by following one of the two below formulas:

Examples of Revenue Calculating

Let’s say that you run a small bakery that sells wedding cakes. Over a business month, you sell 30 wedding cakes, and the average price for each cake is $59.99. You would figure out your revenue as follows:

Revenue = 30 x $59.99

Therefore your business revenue over the month would be $1,799.70.

The Difference Between Revenue and Cash Flow

Revenue is the money that a business earns from selling products or services. However, cash flow is the net amount of cash that is being transferred in and out of the business.

Looking at a business’s revenue gives you a measure of how effective the company’s sales and marketing efforts are. Cash flow is a good indicator of a business’s liquidity. To get a comprehensive review of the financial health of a company, it’s important to take both cash flow and revenue into account.

What Is Accrued Revenue?

Accrued revenue is the term given to revenue that is earned by a company. This is specifically for the successful delivery of goods or services that haven’t yet been paid for by the customer. In accrual accounting, when a sales transaction takes place, it is reported as revenue. This doesn’t necessarily always represent a physical payment.

What Is Deferred Revenue?

Deferred revenue is also known as unearned revenue. It is essentially the opposite of accrued revenue. Meaning that it accounts for money prepaid by a customer for any good or service that has yet to be delivered.

Any company that has received a prepayment, can recognize the revenue as unearned. However, they would not recognize the revenue on their income statement. This would be recognized when the goods or services are delivered to the customer.

Does Positive Revenue Always Mean Positive Profit?

No, it does not. A company can actually have a positive revenue whilst having a negative profit. This is because companies have a cost to produce goods, as well as other fixed costs such as taxes and interest payments on loans. This means that if a company’s total costs exceed its revenues, the company will have to take a negative profit. Even though they may be taking in a large sum of money from sales.

Summary

As a small business owner, your revenue is your lifeblood. That’s why it’s imperative that you have a full and detailed understanding of exactly what it is and what fuels your income growth. By keeping a close eye on your revenue, you can take steps to ensure the future financial health and therefore the success of your business.

FAQs on Revenue

Revenue is generated when money is brought into a business via its business activities. This could be from the sales of products or from various services. Because of this, revenue can be sometimes known as gross sales.

Revenue can be divided into two different categories:

- Operating Revenue – the sales from the core business of a company.

- Non-operating Revenue – any revenue that is derived from secondary sources.

Revenue is any recurring transaction from business activities related to the sales of the business. It includes income such as:

- Sale of goods or services

- Commissions received

- Interest from debtors.

- Income from donations. Including donations from individuals or charitable institutions.

- Interest dividend and bonus shares.

Calculating your sales revenue is relatively easy. Just take the average price of the products from your income statement that you have sold and multiply it by the number of units sold.

The six main types of revenue models are:

- Transaction-based model

- Advertisement-based model

- Commission-based models

- Affiliate model

- Interest revenue model

- Donation-based / pay-what-you-want models

Share: