Net Realizable Value (NRV): Definition & Calculation

Is it worth it to hold on to that equipment or would you be better off selling it? Net realizable value (NRV) is used to determine whether it’s worth holding on to an asset or not.

Other times NRV is used by accountants to make sure an asset’s value isn’t overstated on the balance sheet. If you’re a CPA, you’ll come across NRV within cost accounting, inventory, and accounts receivable.

There are different methods for calculating this depending on the purpose of finding the NRV. Mostly like you won’t have to break out the calculator since the formula is very simple.

Table of Contents

KEY TAKEAWAYS

- NRV is used in cost accounting, inventory and accounts receivable.

- It uses a conservative approach to assign value to an asset within accounting records.

- The costs of completion, fees, advertising and other extra costs associated with selling the inventory are subtracted from the sales price.

What is Net Realizable Value NRV?

Net realizable value is a valuation method used to value assets on a balance sheet. It estimates the net present value of an asset. NRV is calculated by subtracting the estimated selling cost from the selling price. NRV is generally used on financial statements for assets that will be sold in the foreseeable future, not the ones expected to go up for liquidation.

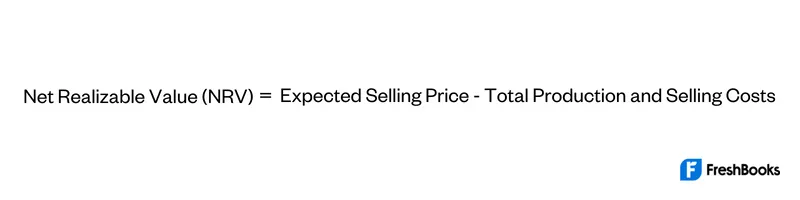

Net Realizable Value is also known as net sales value or net resale value. It’s calculated by subtracting the selling cost from the sale price. To arrange it as a formula it would look like this:

The selling costs include any fees or predictable expenses that will be associated with selling.

Since NRV abides by the conservatism principle of accounting, it uses the most conservative approach to estimate value. This prevents the value of the item(s) from being overstated on financial statements.

Methods of Calculating NRV

The calculation for Net Realizable Value has a variety of methods to get an answer. The method used will depend on the purpose behind finding the NRV. No matter which method you use to find the NRV, the value you find must fit the conservative method of accounting reporting.

Are you a business owner looking to complete the eventual sale of equipment or inventory? Are you an accountant trying to assess the value of your client’s assets? Were all of the asset sales done at the same time? The answers to that will determine which method you use.

The most common methods are:

- Cost Method: This method is used when you sell products purchased at different times but at an equal cost.

- Sales Method: This method is used when you sell products purchased at different times and at different costs.

- Income Method: This accounting method is used when selling products purchased at different times and with different costs. But all sales still occurred in the same year.

- Market Value Method: This method is used when you don’t know how much your inventory items are worth. This is also done if you want to account for any potential increase in their value.

How to Calculate NRV

There are a few steps involved in calculating the net realizable value for an asset. First, you’ll have to determine the expected selling price or the market value. Keep in mind that this should follow the conservatism principle in accounting. Meaning the value estimate should fall on the conservative side.

Next, you’ll have to find all the anticipated costs and fees associated with selling the asset. This might involve transportation, manufacturing costs, delivery costs, and even advertising. If the inventory is unfinished and needs to go through the final stages of the production process before the sale, there may also be a completion cost per unit included. Finally, you’ll use the formula we mentioned earlier. Calculate the difference between the expected selling price and the approximate cost of selling the asset.

Example of Calculating NRV

Let’s say Star Company Inc Is selling some of its inventory to Moon and Co. Inc. To properly report the sale, Star Company is determining the net realizable value for the inventory they’re selling.

The expected sales price of the inventory is $7,000. Star Company has to spend $300 in transportation costs. With that in mind, the NRV would get calculated as follows:

$7,000 – $300 = $6,700

All in all the NRV for Star Company’s sale of inventory is $6,700. When doing the NRV calculations for accounts receivable, the allowance for doubtful accounts or bad debts takes the place of total selling costs.

Summary

NRV helps business owners and accountants understand the true value of an asset. The conservative principles involved in the calculation prevent the overstatement of assets. This information helps inform important business decisions. It also allows for the conservative and appropriate recording of assets for a business.

FAQs on Net Realizable Value (NRV)

NRV is important to companies because it provides a true valuation of assets. That valuation helps inform business decisions. It’s also a metric used in market method accounting.

NRV and market value aren’t actually the same. Within market method accounting, NRV is only used as an approximation of market value when the market value of inventory is unknown.

NRV is not the same as cost. It’s the selling price of an asset less the total cost of selling the asset.

Bad debts are taken off the Accounts Receivables, which is basically the NRV for Accounts Receivables, representing exactly how much of the receivables will actually be received.

Share: