How Does VAT Work: An Overview

Value-added tax (VAT) is a “consumption tax” that is collected by businesses on behalf of HM Revenue and Customs (HMRC). It is charged on goods and services that individuals and businesses buy.

But there are different rates for different types of goods and services, so how does VAT work in the UK?

The good news is that you can claim VAT relief on your business purchases.

Put very simply:

- You charge your customers VAT

- You’re charged VAT as a customer

- You owe HMRC the difference

Of course, it’s more complex than that, and there’s record-keeping and other paperwork to contend with. Don’t panic—FreshBooks keeps all these transactions in order, ready for your quarterly reports to HMRC.

Key Takeaways

- VAT, or Value Added Tax, is a general consumption tax that applies to almost all goods and services in the UK.

- Businesses with an annual turnover of £85,000 or more must register for VAT.

- VAT is divided into Standard rate, Reduced rate, and Zero rate.

- To charge VAT, calculate the VAT rate and add it to the price of your goods or services.

- VAT-registered businesses can reclaim VAT on valid business expenses.

- The VAT flat-rate scheme allows businesses with a taxable turnover of less than £150,000 to pay a fixed VAT rate.

- It’s important to keep detailed records of all VAT transactions and submit VAT returns every three months.

Here’s What We’ll Cover:

When Do I Have to Register for VAT?

Benefits of Being VAT Registered

What Is the VAT Flat-rate Scheme?

What VAT Records Do I Need to Keep?

What is VAT?

You’ve likely heard of VAT before, but you may be wondering how does UK VAT work for a small business. VAT, or Value Added Tax, is a general consumption tax that applies to almost all goods and services consumed in the UK. Because VAT applies to things consumed in the UK, it’s usually not charged on exports. It’s also not mandatory for all businesses to register for VAT–they’re only required to register if they meet the VAT threshold. If they fall below it, registration is optional.

VAT is typically charged as a percentage of the price of the goods or services. This means that it’s easy to measure the tax burden at every stage of production since VAT is added as price increases through production.

When Do I Have to Register for VAT?

As soon as your business’s annual VAT taxable turnover hits the VAT threshold, you need to register in the UK. For example, the current tax year threshold in the UK is £85,000. As soon as your turnover reaches that amount, you must register for VAT. From this point, you must charge UK VAT rates on your goods or services and pay the tax on your business purchases.

Some businesses choose to register for VAT when they haven’t yet reached the taxable turnover threshold because it makes the best financial sense for them.

You report your VAT sales and purchases to HMRC on specific returns normally submitted every three months.

The balance between the two is crucial to balancing your books. As HMRC summarises: “If you’ve charged more VAT than you’ve paid, you have to pay the difference to HMRC. If you’ve paid more VAT than you’ve charged, you can reclaim the difference from HMRC.”

What are the VAT Rates?

Different categories of goods and services include three levels of VAT rates, exempt, and out of scope.

Let’s deal with what you don’t charge VAT on first.

Exempt Goods and Services

Some goods and services are exempt from VAT, including some health and hospice care, educational establishments, and public postal services. You don’t need to register for VAT if your business only trades in exempt goods and services. See the complete HMRC list of all goods and services and their VAT status here.

Outside the Scope

Some items like charity donations, hobby sales, and items purchased and used outside the UK are considered ‘outside the scope’ of the VAT systems. None of these out-of-scope items are chargeable for VAT and cannot have VAT relief claimed on them.

3 VAT Rates

The UK has three VAT rates: Standard rate, Reduced rate, and Zero rate. All of these transactions must be recorded and reported to HMRC on your VAT returns. If you are registered for VAT, it’s vital that you pay the correct rate of VAT.

Standard Rate of VAT

Most goods and services are charged at the standard rate of VAT. This is currently set at 20%.

Reduced Rate of VAT

The reduced rate of VAT is currently set at 5%. An item, or the “circumstances of the sale,” may put it into the reduced rate. For example, domestic power, sanitary products, and children’s car seats are always charged at a reduced rate. But, as in HMRC’s own example, mobility aids are only subject to the 5% reduced rate if they are installed in the home of someone over 60 years old. It’s important to pay attention to the details of the regulations.

Zero Rate of VAT

This is the trickiest one to get your head around. At first, it feels redundant. Goods and services that are zero rate for VAT are classed as ‘VAT chargeable.’ But the rate of VAT is, literally, 0%. You add 0% to your customers’ bills.

Examples of zero-rate items are:

- Children’s clothes and shoes

- Newspapers and books

- Motorcycle helmets

- Goods supplied to a VAT-registered EU business

- Most exports to non-EU countries

Your customers don’t have to pay VAT, but once you register for VAT, you have to record and report zero-rated goods and services sales on your VAT return.

HMRC points out that: “Rates can change, and you must apply any changes to the rates from the date they change.”—which makes some sense for the 0% rate. HMRC have organised all goods and services into their VAT categories. This simplifies any future changes to the VAT rates. At any point, the government can announce that all standard rate VAT goods and services are now 21%. Or that the 0% rate is now 1%. And it’s the responsibility of every VAT-registered business to apply that change immediately.

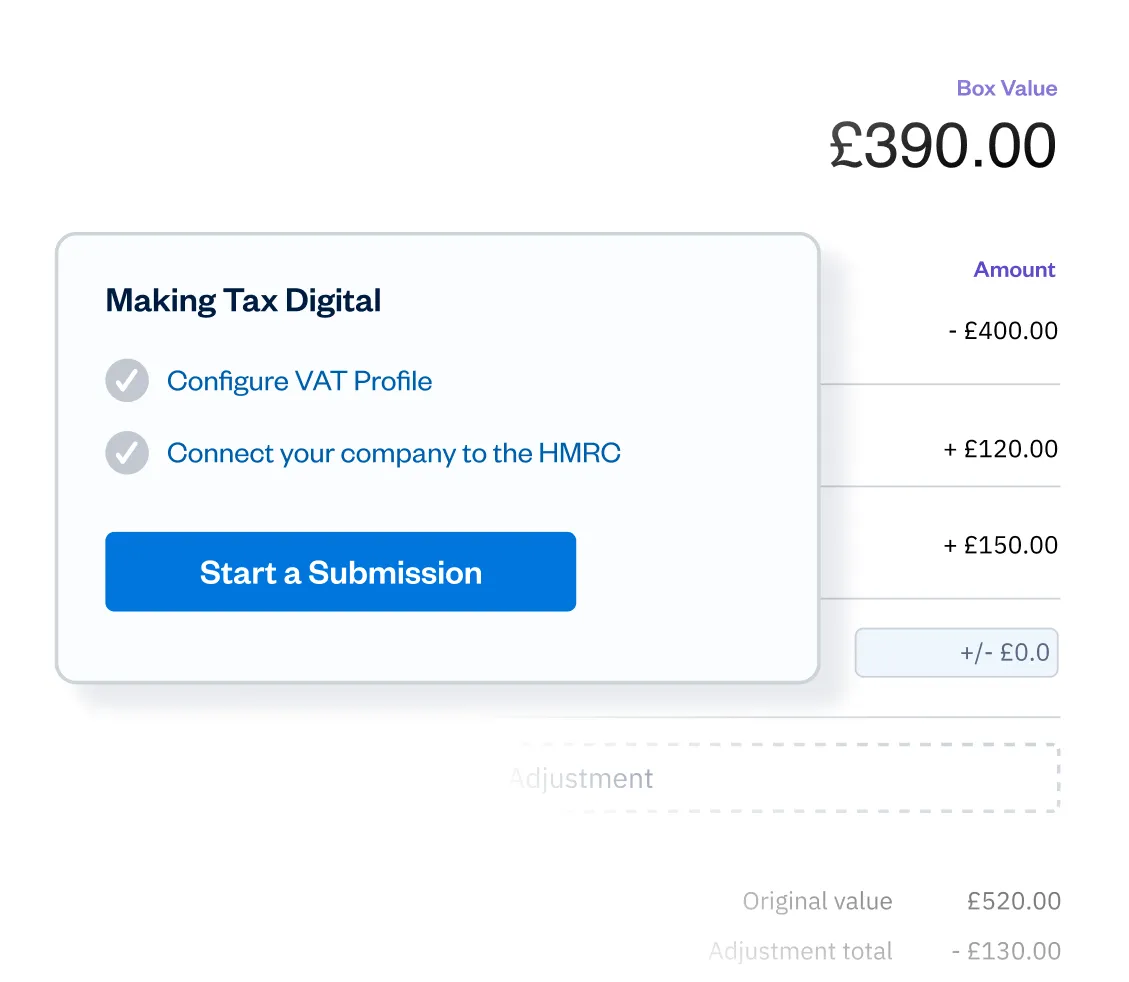

Looking for an easy way to manage your VAT returns? FreshBooks MTD Compliant Software lets you organise and file your VAT returns online, all in one easy system. It’s HMRC Recognised, MTD-compliant, and easy to use for all your VAT needs.

How to Charge VAT

Here are the basic stages of charging VAT:

- Determine the correct VAT rate—for most goods and services, this is 20%

- Add this to the price to get VAT-inclusive prices

- Display your VAT information—when charging for VAT, you’ll be required to have your VAT number and show VAT separately

- Finally, create a clear record of all VAT transactions and include each VAT transaction on your VAT returns

Benefits of being VAT Registered

There are several benefits to being VAT registered, including:

- Claiming back VAT on your input purchases

- Increased credibility, which can lead to greater cash flow

- Some clients and businesses only work with VAT-registered businesses

Since you’re required to pay VAT even if you don’t charge it, many small businesses register for VAT so that they can charge and claim VAT, and it ends up being the most financially beneficial option.

What Is the VAT Flat-rate Scheme?

Outside the VAT flat-rate scheme, the amount of VAT you pay or claim back is the difference between the VAT you collect from your customers and how much VAT you pay on your business expenses. It’s a fluctuating amount that you have to record carefully.

If your business’s taxable turnover is less than £150,000, you can join the VAT flat-rate scheme. This means that you pay a fixed rate of VAT. The rate depends on the industry you’re in and if you fit into the ‘limited costs business’ category.

You only pay HMRC the flat-rate amount. You can keep any VAT you charge over that figure. But you can’t claim back VAT relief on your business purchases. Discussing this as an option with your accountant to see if it’s a good fit for your business is wise.

What VAT Records Do I Need to Keep?

You really do need to be meticulous about your VAT record keeping. Luckily, FreshBooks does most of the hard work for you, ensuring you’re ready to submit your VAT returns digitally.

Whether you’re supplying services or goods that are zero, reduced, or standard rate, you must make sure that your business keeps accurate records of all VAT information. The records you’re required to keep digitally include:

- VAT on all goods and services you supply and receive

- The time of supply and value of supply (without VAT) on everything bought and sold

- Any adjustments you make to VAT and VAT returns

- Total daily gross income

- Any goods and services you can reclaim VAT on

You’re also required to record:

- Copies of any invoices you send and receive

- Records of everything bought and sold for your business, regardless of its VAT rate

- Self-billing agreements and the associated name, address, and VAT registration number

- Debit and credit notes

It’s a good idea to keep detailed records of all accounting for your small business, whether or not it’s specifically related to VAT. When you’re new to this, especially for small businesses, it does seem a bit fiddly to do yourself. But clarity in your record keeping is the way to make sure you pay all the value-added tax you owe. And it’s the evidence of your business integrity.

If you’re a small business owner, any tax reliefs and allowances are a welcome cash boost. The turn-off for many is usually the process of claiming input tax back. At least claiming your VAT refund is done within the VAT return process you already know.

Claiming Back VAT

You can claim VAT back on most goods and services you buy for your business. If there is a part-business, part-private use situation, you are able to claim the business proportion. You can also claim some items purchased before your business registered for VAT, including goods purchased four years prior and services purchased six months prior.

High-ticket assets, such as those worth over £50,000, have slightly different VAT rules. They apply if you buy individual computers, other technology equipment, boats, ships, or aircraft with a price tag over £50,000+, excluding VAT, or if you purchase property or land costing £250,000+, before VAT.

All together, acceptable claims include:

- Backdated claims for goods purchased four years prior to registration and services purchased six months prior to registration, so long as you still have and use those goods

- Assets worth over £50,000, excluding VAT

What VAT can’t be Reclaimed?

While you can claim VAT on most goods and services that are used for your business, some exceptions do apply. These include:

- Goods or services that aren’t for business use

- Anything used to produce VAT-exempt goods

- VAT-exempt purchases

- Anything you spend on business entertainment, like taking clients for lunch

- Anything you receive as part of a going concern transfer

- Any items you buy within a VAT second-hand margin scheme

Reporting VAT to HMRC

You submit a VAT Return to HMRC every three months. Each of these quarters is known as an ‘accounting period.’ Every quarterly VAT return is a full record of all your VAT sales and purchases for that three-month accounting period. All VAT-registered businesses must submit VAT Returns, even if they don’t owe any VAT payments or have any to reclaim.

They must show all your figures for:

- Total sales

- Total purchases

- Total VAT you’ve charged your customers

- Total VAT you’ve paid on your purchases

- How much VAT you owe HMRC

- How much VAT refund HMRC owes you

Good to know: HMRC usually has your VAT refund to you within 10 days.

The HMRC now requires all businesses to use Making Tax Digital to submit their VAT return online. You must submit your VAT return and pay any VAT you owe one calendar month and seven days after the end of your accounting period. As expected, there are financial penalties for missing submission and payment deadlines.

Make submitting your VAT returns a breeze with FreshBooks’ accounting software. It is MTD-compatible, HMRC Recognised, and helps record all your VAT transactions, organise them for tax season, and submit them online through MTD.

Conclusion

VAT applies to almost all goods and services in the UK, so it’s important to understand how it applies to your business. Any business with an annual turnover of £85,000 or more must register for VAT and charge VAT on their goods and services. VAT is divided into standard, reduced, and zero rates, with some goods and services being exempt.

VAT-registered businesses are required to submit their VAT returns to the HMRC every three months, so keeping accurate VAT records is a must. Some small businesses also choose to register for VAT because they can reclaim VAT on eligible business expenses. If your business sells VAT-applicable goods or services, you may be able to register even if you don’t meet the threshold.

Frequently Asked Questions

What are the benefits of being VAT-registered?

The main benefit of being VAT registered is saving money by claiming VAT on your business purchases. FreshBooks accounting software makes it easy to keep track of all your VAT-related business expenses and file your VAT returns online so you can claim VAT and receive your compensation from the HMRC.

Can I reclaim VAT on purchases made before I registered for VAT?

Yes, you can reclaim VAT on purchases made prior to VAT registration, with some limitations. You can claim VAT on goods purchased up to four years prior to registration and services used up to six months prior. In order for these claims to be eligible, you need to be still using these goods for your current registered business.

How do I account for VAT on international transactions?

If your business is purchasing goods or services from outside the UK, you’ll need to use the ‘reverse charge’ rule. Calculate the VAT due and include it on your return, then credit and debit your VAT account with the amount of VAT due. While the overall outcome is that you normally won’t pay tax, it’s important to keep those records.

Can I reclaim VAT on business entertainment expenses?

No, business entertainment is one of the non-reclaimable categories for VAT. Generally, your VAT claims have to be directly related to the registered purpose of your business. While entertaining clients is a business expense, it’s not related directly to the goods or services you provide and is therefore not VAT-reclaimable.

Do I need to charge VAT on supplies to non-VAT registered customers?

Yes, if you’re a VAT-registered business, you need to charge VAT on goods and services you sell, even if your customers aren’t VAT-registered. Charging for VAT depends on the status of your business rather than that of your customers, so once you become VAT-registered, you will typically be required to charge VAT.

About the author

Levon Kokhlikyan is a Finance Manager and accountant with 18 years of experience in managerial accounting and consolidations. He has a proven track record of success in cost accounting, analyzing financial data, and implementing effective processes. He holds an ACCA accreditation and a bachelor’s degree in social science from Yerevan State University.

RELATED ARTICLES

Do You Know How to Pay Your UK Gov, VAT Bill Online? Learn How to Pay VAT Online in Our Quick Guide.

Do You Know How to Pay Your UK Gov, VAT Bill Online? Learn How to Pay VAT Online in Our Quick Guide. Can You Live Chat With HMRC?

Can You Live Chat With HMRC? Income Tax Threshold, Rates, and Allowances for 2025-26

Income Tax Threshold, Rates, and Allowances for 2025-26 VAT on Services Outside UK: Learn the VAT Rules for Services That Take Place Outside the UK.

VAT on Services Outside UK: Learn the VAT Rules for Services That Take Place Outside the UK. HMRC Tax Refund: Does HMRC Automatically Refund Overpaid Tax?

HMRC Tax Refund: Does HMRC Automatically Refund Overpaid Tax? So, How Far Back Can HMRC Investigate Your Tax Returns?

So, How Far Back Can HMRC Investigate Your Tax Returns?