Income Tax Threshold, Rates, and Allowances for 2025-26

The amount of income tax you pay HM Revenue and Customs (HMRC) depends on how much of your income is taxable and which tax rate is applicable to each portion of your earnings. As an individual and business owner, these somewhat tricky figures are crucial to your financial calculations. To work out how much tax you owe, you need to total your taxable income, deduct your tax-free allowances and apply the appropriate tax rates.

Key Takeaways

- Income tax rates in the UK are based on how much of your earnings are taxable.

- Scotland’s tax rate percentages are unique from those of the rest of the UK, with several more tiers depending on how much income is taxable.

- The Personal Tax Amount allows you to earn up to £12,570 before you have to start paying any income tax.

- National Insurance Contributions (NICs) pay for your State Pension and other state benefits and are determined based on income.

- Dividend allowances let you earn up to £500 in dividends from company shares, tax-free.

- Married people and those in civil unions can use Marriage Allowance to transfer up to £1,260 of personal allowance to a spouse or civil partner.

- A UK business must register for VAT after meeting the threshold, earning at least £90,000 per year (up from £85,000 for 2023).

- Capital gains tax is applied to any profit from asset sales over £3,000 (the annual exempt amount).

Here’s What We’ll Cover:

What is the Threshold for Income Tax?

Different tax rates are applied, depending on your taxable earnings for the year and in which country you reside, as Scotland has different rate thresholds and tiers than the rest of the UK.

The majority of taxpayers are entitled to a personal allowance. This is the amount you can earn without having to pay any income tax at all. The personal allowance can change every tax year, which runs from April 6th one year to April 5th the next.

We are currently in the 2024-25 tax year, starting on 6th April 2024 and ending on 5th April 2025.

- The personal allowance for 2024-25 is £12,570

This means you can earn up to £12,570 before you have to start paying any income tax.

If you earn over £100,000, your personal allowance decreases as your income increases. For every £2 you earn over £100,000, your personal allowance amount is reduced by £1. When your income reaches £125,140, your personal allowance amount is down to zero, which is taxable.

What is Taxable Income?

Not all your earnings (income) are subject to income tax. Yay! But there are specific things required to have income tax paid against them. The whole income tax thing can be a little confusing, so here it is broken down:

The most common taxable income streams are:

- Wages or salary your job pays you

- Self-employment profits

- Income from property rental, which involves reporting and paying tax on rental income

- Social security benefits

- Pensions

- Bonuses and commissions

- Benefits that are part of your job

- Particular state benefits

- Interest made on savings that are over your savings allowance

- Personal, company, and state pensions and retirement annuities

- Some government grants, including the Coronavirus Job Retention Scheme, Self Employment Income Support Scheme, and the Small Business Grant Fund

Non-taxable income includes:

- Accounts that are tax-exempt, like Individual Savings Accounts (ISAs)

- Dividends that are under your dividends allowance

- Your trading allowance, which is the first £1,000 of self-employed total income

- Maintenance payments

- Compensation money

- Adoption allowances

- The first £1,000 you make from property rental (unless you’re using the Rent a Room Scheme)

- National Lottery and premium bond wins

- Some state benefits

You don’t need to factor in any non-taxable income when calculating your tax liability.

The Citizens Advice Bureau has compiled a comprehensive list, so if you have a slightly more obscure source of income, check the list to see if it’s subject to income tax.FreshBooks MTD compliant software has a whole section for ‘other income‘ on your dashboard so that you can keep track of everything all in one place.

What are the UK Tax Brackets for 2024-25?

Scotland and Wales have some devolved powers from the central government, which include the ability to set their own rate of income tax. At the moment, Wales is the same as England and Northern Ireland. Scotland has its own tax brackets and tax rates. The personal allowance amount and other tax reliefs apply to all four UK nations.

England, Northern Ireland, and Wales have three tax brackets and rates: Basic rate, higher rate, and additional rate. They vary year-on-year—these are the UK’s tax rates for each bracket for the 2024-25 tax year.

- Personal allowance: 0% to pay on earnings between £0 and £12,570

- Basic rate: 20% to pay on income between £12,571 and £50,270

- Higher rate: 40% to pay on income between £50,271 and £125,140

- Additional rate: 45% to pay on income over £125,140

Example:

- You earned £75,000 in the 2024-25 tax year

- First £12,570: £0 tax to pay

- £12,571 – £50,270: 20% tax to pay on this £37,699 (basic rate)

- £50,271 – £75,000: 40% to pay on this £24,729 (higher rate)

You only pay the additional or higher rates on the portion of your income over the threshold for that bracket, not the whole amount. Otherwise, you pay the basic rate.

Scotland’s Income Tax Brackets and Tax Rates

The Scottish Government has broadened its tax arrangements to include six different tax brackets (above the personal allowance amount), each with a different tax rate.

For the 2024-25 tax year in Scotland:

- 0% personal allowance applies to all earnings up to £12,570

- 19% starter: Income between £12,571 and £14,876

- 20% basic: Income between £14,877 and £26,561

- 21% intermediate: Income between £26,562 and £43,662

- 42% higher: Income between £43,663 and £75,000

- 45% advanced: Income between £75,001 and £125,140

- 48% top: Income over £125,140

When Do I Have to Pay Scottish Rates of Income Tax?

You pay more tax with Scottish rates if you:

- Live in Scotland all year round.

- Are a Scottish taxpayer who lives in Scotland more than anywhere else in the UK, even if you move back and forth.

- You have more than one home; your primary residence is in Scotland. Your ‘main home’ can be owned or rented, or you might be lucky enough to live there for free. If it’s where you spend most of your time, most of your things are there, your family is there, and you are registered with titles like GP Surgery, then it’s classed as your main home for tax purposes.

Your tax code will be different if you pay Scottish income tax. The number part of the code will have the prefix ‘S.’ For example, if you get the personal allowance and there are no other special circumstances, it will be S1250L. This lets employers know they have to use the Scottish income tax rates when they start paying income tax.

If you submit a Self Assessment tax return, there’s a designated box to declare that you pay Scottish income tax to HMRC.

How Much National Insurance Do I Pay?

National Insurance contributions (NICs) are paid to the government and are connected to your income. NICs pay your State Pension and other state benefits. Your employment position defines different rates, or ‘classes,’ of NICs. The HMRC has a full breakdown of tax rates and allowances for each type of taxpayer.

Employed Taxpayers

For the 2024-25 tax year, you should consult the HMRC to determine the rates and income tax thresholds for your NICs.

Employees will typically pay NICs at a rate of 8% on their wages above the Primary Threshold (£242 per week) and until their earnings reach the ‘Upper Earnings Limit (UEL)’ of more than £967 per week, at which point NICs are charged at 2%.

Employers’ National Insurance Contributions

Employers must pay Class 1A and 1B National Insurance on all expenses and benefits they provide to their employees. For the 2024-25 tax year, this rate is set to 13.8% above the secondary threshold for almost all employees, which is a decrease from the previous tax year.

The employment allowance reduces the amount of employer NICs payable by some businesses up to the allowance limit, currently £5,000 per year. The reduction is only available to companies with a total NIC bill below £100,000. This means at least 90% of small businesses would be eligible for the allowance.

Self-Employed National Insurance Contributions

For the 2024-25 tax year, self-employed taxpayers no longer need to pay Class 2 NIC, but you can choose to pay for it voluntarily. You might choose to pay Class 2 NIC if your earnings are below the small profits threshold (£6,275 for 2024-25), or if you’re exempt from paying Class 2 NIC but want to protect your eligibility for certain state benefits, such as maternity allowance or contributions-based employment and support allowance (ESA). If you choose to pay Class 2 NIC, it’s set at a fixed weekly amount of £3.45 per week.

If you earn more than the lower profits limit of £12,570, you are liable to pay Class 4 NIC. The rate is set at 6% for all profits between £12,570 and £50,270 (the upper profits limit) and at 2% for all additional profits above the upper profits limit of £50,270.

FreshBooks helps you with your self-assessment of how much income tax to pay by organizing all the necessary information. Learn more about how FreshBooks can help you stay organized and tax compliant.

What Are Class 3 National Insurance Contributions?

Class 3 NICs are voluntary for people with gaps in their National Insurance contribution records. Class 3 NICs allow you to make up the payments to get your full State Pension and Benefits. For 2024-25 gaps, you would pay £17.45 per week.

What is the Dividend Allowance?

If you own shares in a company, you get paid dividends, which are considered taxable income. But you don’t have to pay tax on all your dividend payments. There is a dividend allowance that you can earn tax-free. In our current tax year, this is £500 (down from £1,000 in the 2023-24 tax year). If your dividend payments don’t take you over the personal allowance, and you have no other income, then you won’t pay any income tax at all.

If you do have to pay tax on your dividends, the rate is dependent on your tax bracket.

The 2024-25 dividend rates are the same.

- Dividend allowance: £500 tax-free

- Basic rate taxpayers: 8.75% rate to pay on dividends

- Higher rate taxpayers: 33.75% to pay on dividends

- Additional rate taxpayers: 39.35% to pay on dividends

Example:

In the 2024-25 tax year, you earn £35,000 in salary and £5,000 in dividends. Your total taxable income is £40,000. Deduct your £12,570 tax-free personal allowance, leaving you with £27,430. £27,500 is in the basic rate tax bracket

So your income tax bill is:

- £22,500 in wages taxed at 20%

- £500 dividend allowance, tax-free

- £4,500 remaining dividends taxed at 8.75%

What is Marriage Allowance?

Marriage Allowance is a type of tax break that couples can take advantage of by allowing you to transfer up to £1,260 of your Personal Allowance to your civil partner, husband, or wife if you are the lower earner of the couple and have an income below your Personal Allowance. This will reduce the amount of tax they have to pay but may increase what you have to pay. Overall, the savings will benefit you both as a couple.

You may apply for a Marriage Allowance if you are married or in a civil partnership, your income is below your Personal Allowance, and your partner is paying tax at the basic rate of 20% or the basic or intermediate rate if you are in Scotland.

If you have been married or in a civil partnership for 5 years but have not yet claimed the Marriage Allowance, you can backdate your claim to include any year from 2018 to the present day to reduce your partner’s tax bill.

Value Added Tax (VAT) Rates

The UK VAT threshold is a taxable turnover over £90,000 a year. At this point, businesses must register for VAT. You can also become VAT registered if you are under this threshold, and it makes better financial sense for your business.

There are three rates of VAT:

- Standard rate: VAT is charged at 20% and applies to most goods and services.

- Reduced rate: VAT is 5% and is applied to things like domestic energy and car seats.

- Zero rate: Zero-rated goods and services are VAT taxable and must be included in your VAT return, but you apply a 0% charge. These items include children’s clothes, books, and some safety equipment.

HMRC provides a comprehensive list of all VAT rates for goods and services so that you can identify the correct rates for your business.

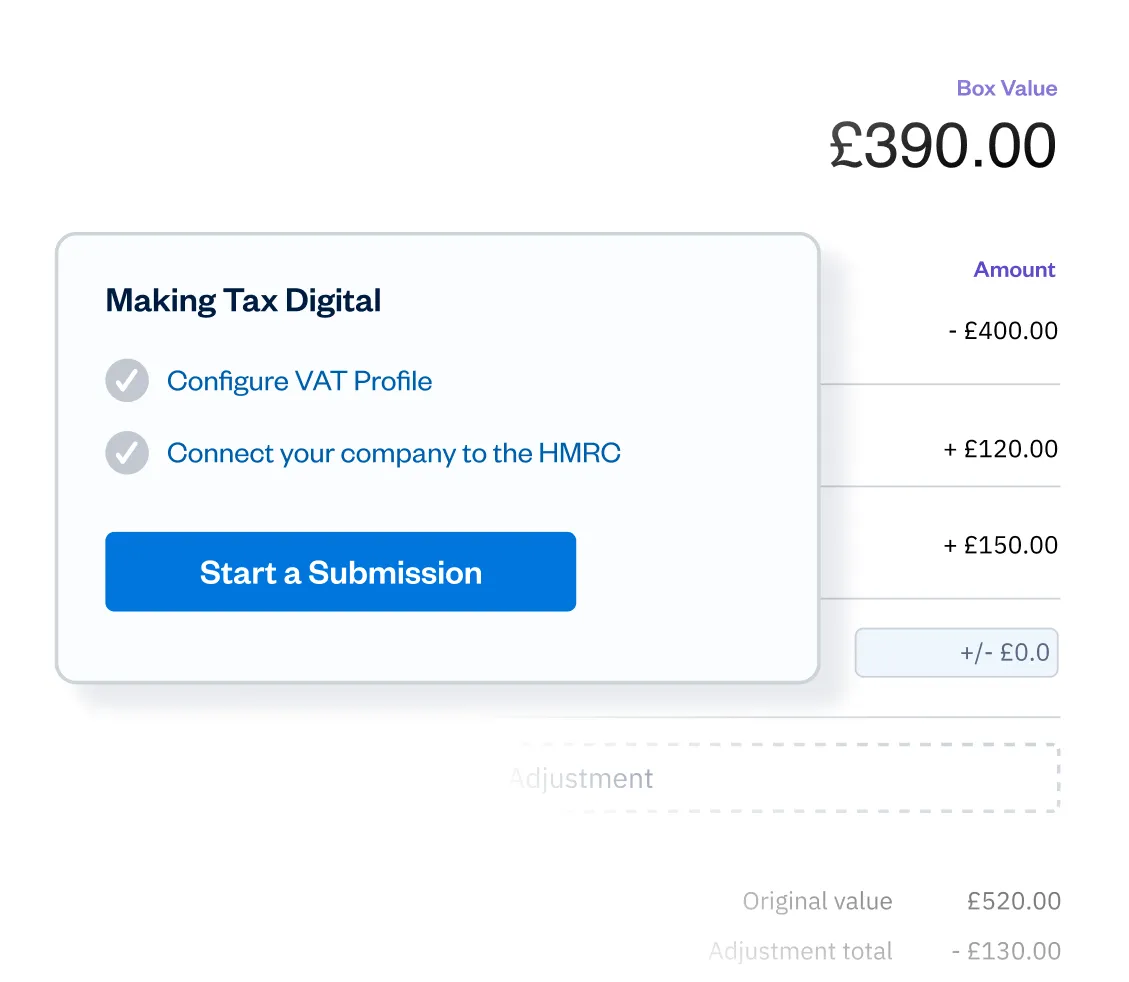

FreshBooks is an MTD-compliant software, allowing you to effortlessly access your MTD for VAT account, submit returns, view past submissions, and stay tax-compliant with just a few clicks. Learn all about Making Tax Digital in our comprehensive guide.

Capital Gains Rates

Capital gains tax is payable on the profit from asset sales of over £3,000. It only applies to the minority of taxpayers for the 2024-25 tax year. The rate of capital gains tax you pay on sales over that amount depends on your other taxable income.

- Standard rate capital gains tax is 10% on all assets, except residential property, which is 18% if your overall annual income is below £50,270.

- The higher rate capital gains tax is 20% on all assets, except for 24% on residential property and 28% on carried interest if your overall annual income is above the basic tax rate of £50,270.

Your business only pays capital gains on the sale of assets if you are a self-employed sole trader or part of a business partnership. These transactions are part of limited companies’ corporation tax calculations.

A business pays 20% on all assets, apart from any residential property, which is charged at 28%.

There is no capital gains allowance for businesses, but there are tax reliefs that can reduce or delay your bill.

This Is Much More Complicated Than I Thought It Would Be…

You’re not alone in this thought!

HMRC has a massive set of rules and regulations because they need to account for every possible situation. Working out your tax liability for any situation outside straightforward pay-as-you-earn (PAYE) employment requires time and patience. Wading through it all can make finding the regulations that apply to you quite time-consuming.

Luckily, you don’t have the same trouble with your own information. It’s all there, organised and analysed in your FreshBooks accounting software. And when you’re ready to talk to an accountant, it’s ready for them to access. Between the three of us, you’ll be totally tax-efficient—meeting all your liabilities without losing a penny in overpayments.

FAQs on Tax Threshold

How often are income tax rates and thresholds updated?

It has been determined that the basic tax rate of 20% will remain the same indefinitely, while current personal allowance and higher-rate tax thresholds in 2024 will be frozen until 2028 in England, Wales, and Northern Ireland. Scottish rates are higher, having recently changed in 2023/2024, and they may be updated again in future tax years.

Is the personal allowance the same for everyone?

Most people’s personal allowance is £12,570, but it may increase if you claim Marriage Allowance or Blind Person’s Allowance. It is also reduced by £1 for every £2 your net income exceeds £100,000, so if your income is £125,140 or higher, your personal allowance will be zero.

Can I transfer my unused personal allowance to my spouse or civil partner?

Yes, if your income is below your personal allowance, and your husband, wife, or civil partner pays tax at the basic rate of 20%, you can transfer up to £1,260 of your personal allowance to them, which will act as a tax credit to reduce their tax bill.

Can I claim tax relief for energy-saving measures against income tax?

Yes, you can claim capital allowances when you buy energy-efficient or low/zero-carbon technology for your business. This will act as a credit against the amount owing, reducing the total tax you pay for the year.

How much income can I earn before I have to pay income tax?

An individual can earn up to £12,570 without paying any income tax. If you earn between £12,570 and up to £50,270, you must pay the basic income tax rate (20%), and anything above £50,270 and up to £125,140 is taxed at a higher rate (40%). Earnings beyond £125,140 are taxed at an additional rate of 45%.

More Useful Resources

About the author

Levon Kokhlikyan is a Finance Manager and accountant with 18 years of experience in managerial accounting and consolidations. He has a proven track record of success in cost accounting, analyzing financial data, and implementing effective processes. He holds an ACCA accreditation and a bachelor’s degree in social science from Yerevan State University.

RELATED ARTICLES

Everything You Need to Know About Making Tax Digital Software

Everything You Need to Know About Making Tax Digital Software VAT on Services Outside UK: Learn the VAT Rules for Services That Take Place Outside the UK.

VAT on Services Outside UK: Learn the VAT Rules for Services That Take Place Outside the UK. HMRC Tax Refund: Does HMRC Automatically Refund Overpaid Tax?

HMRC Tax Refund: Does HMRC Automatically Refund Overpaid Tax? So, How Far Back Can HMRC Investigate Your Tax Returns?

So, How Far Back Can HMRC Investigate Your Tax Returns? Inside IR35 – What Does Inside IR35 Mean?

Inside IR35 – What Does Inside IR35 Mean?