Making Tax Digital Penalties: How You Can Avoid Them

In an effort to modernise tax reporting and reduce errors, the UK government is introducing Making Tax Digital (MTD). The new scheme is mandatory for certain individuals and businesses and is being rolled out in phases. Along with the new requirements are new Making Tax Digital penalties for noncompliance. Don’t get blindsided by the new points-based penalty system. Learn how it works and how to avoid hefty fines by complying with the new rules and regulations.

Key Takeaways

- The new MTD penalty regime for VAT-registered businesses went into effect in January 2023.

- The new penalty regime will apply to MTD for ITSA when that begins in April 2026.

- When you reach the relevant penalty points threshold, you will be levied a £200 fine.

- Failing to use MTD functional compatible software may result in up to a £400 fine.

- Penalty points expire after 2 years if your tax account is in good standing.

What we’ll cover:

What Is the New Making Tax Digital Penalties System?

How to Avoid MTD for VAT Penalties

How to Avoid MTD for ITSA Penalties

Appeal Against the Points or Penalties

What Is the New Making Tax Digital Penalties System?

As part of the Making Tax Digital checklist for your business, it is prudent to familiarise yourself with how the new MTD penalties may impact you as well. HM Revenue & Customs (HMRC) introduced new penalty systems in January 2023 to encourage compliance. It replaces the existing penalty system.

- Under the new points-based penalty system, you receive one point for every late submission under the MTD scheme.

- If you accrue 2 points with annual submissions, you receive a £200 fine.

- If you accrue 4 points with quarterly updates, you receive a £200 fine.

- If you accrue 5 points with monthly submissions, you receive a £200 fine.

- If you have multiple failures relating to the same submission obligation in a month, you will only incur a single point for the infraction.

- MTD penalty points expire after 2 years if you remain below the penalty point threshold.

- You may also face penalties and fines for other forms of noncompliance, plus potential late fees and interest charges.

- If you do not use MTD-compatible software for your tax returns, you may be charged with up to a £400 penalty.

- VAT-registered businesses may be charged for noncompliance if they don’t maintain accurate digital records or have digital links in place.

The new penalty point regime went into effect to file VAT returns from January 1, 2023. The new late payment penalties will also apply to MTD for income tax when that program starts in April 2026. The existing late payments penalty system remains unchanged.

How to Avoid MTD for VAT Penalties

VAT-registered businesses must comply with the new requirements to avoid penalties for Making Tax Digital for VAT returns.

- Maintain accurate digital records of your business finances.

- Ensure your VAT digital links are in place.

- Send all required MTD for VAT submissions on time.

- Remit VAT payments within 15 days of the submission deadline.

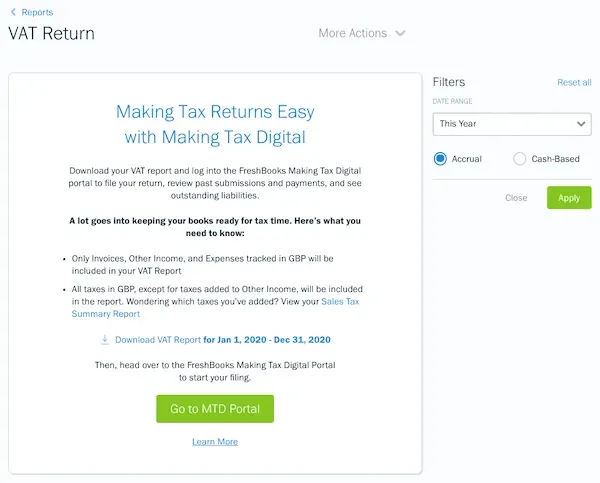

In order to avoid MTD for VAT penalties, you must use MTD-compliant software like FreshBooks as part of your accounting workflow. The software can help you and your business best meet the new MTD requirements and align with VAT accounting periods. VAT submissions only require a few clicks of the mouse.

FreshBooks makes it easy to generate the required VAT quarterly submissions and end-of-period statements (EOPS) and submit them to HMRC online. Check out FreshBooks MTD-compliant software and never fall victim to late submissions and penalty regimes again. Click here to start your free trial.

How to Avoid MTD for ITSA Penalties

It is important to note that the penalty of two points that you accrue with MTD for VAT and MTD for Income Tax Self-Assessment (ITSA) are separate. So, if you are levied 1 point for MTD for VAT and 1 point for MTD for ITSA, that does not meet the 2-point penalty threshold. Avoiding penalties relating to MTD for ITSA compliance is similar to avoiding MTD for VAT penalties.

- Register for MTD for ITSA if you meet the minimum income thresholds starting in April 2026 (over £50,000) and April 2027 (over £30,000).

- Keep up-to-date, accurate records of income and expenses in a digital format.

- Remember to submit quarterly updates to HMRC by the mandated due dates.

- Submit your end-of-period statement (EOPS) on time.

If your self-employment or property rental income is below £30,000, ensure you stay current with relevant HMRC announcements. MTD for ITSA may apply to smaller businesses at a future date. You don’t want to be found in noncompliance because you didn’t know you were subject to the new MTD requirements and missed a timely submission.

Appeal Against the Points or Penalties

Taxpayers have the ability to appeal any MTD penalties levied by HMRC. To request a review of financial penalty under the new points system, you have two options:

- An internal HMRC review process

- An appeal to the courts via the First Tier Tax Tribunal

For the internal review, you formally request HMRC to re-evaluate your case. You can appeal by post using the appeal form or appeal online via your Government Gateway account. If you do not have an appeal form, you can send a signed letter with your name, a full explanation, and relevant dates. You must also include your reference number, like your Unique Taxpayer Reference (UTR) for MTD for ITSA or VAT registration number for MTD for VAT returns.

In both cases, it is up to the taxpayer to provide and explain a reasonable excuse for missing submission deadlines. The reviews and appeals process for penalty points is identical to the existing process for appealing the related tax assessment. You may also appeal the penalty through the digital tax account. For clarification, you or your agent can reach out to HMRC directly.

Conclusion

Along with the new Making Tax Digital scheme to modernise the UK tax system, HMRC is also introducing a new penalty system. The new penalty system is point-based. When you’ve been levied a certain number of points, you are charged a £200 fine. If you do not use MTD-compatible software, you may receive a fine of up to £400.

The best way to avoid MTD for VAT and MTD for ITSA penalties is to start using MTD software right away. FreshBooks makes it easy to satisfy the digital records requirement and submit the required reports directly to HMRC. Click here to start your free trial.

FAQs On Making Tax Digital Penalties

Can I manually file my taxes?

No. Once MTD requirements apply to your situation, manual submission of tax returns is no longer permissible. You must use MTD-compatible software to submit the relevant reports directly to HMRC. If MTD does not yet apply to your business, then you may continue to manually file your taxes until that changes.

Do all businesses need to register for MTD?

All VAT-registered businesses are required to comply with MTD for VAT return regulations from April 2022. Be mindful of VAT accounting periods for your VAT returns to comply with the new rules.

If you are a sole trader or earn property rental income, MTD for ITSA is mandated starting in April 2026 if you earn over £50,000 and April 2027 if you earn over £30,000. Individuals who file a Self-Assessment income tax below £30,000 do not need to register for MTD until HMRC announces otherwise.

How do I know if I am compliant with MTD regulations and avoiding penalties?

Be sure to read up on the MTD rules and regulations that apply to your situation. HMRC offers published guidance around these requirements. Keep digital records, submit the required updates and reports on time, and use functional-compatible software.

There are no new late payment penalties, but you may accrue interest if you have an outstanding amount on your account. Check your Government Gateway for any messages that require action.

What are the consequences of repeated non-compliance with MTD requirements?

Failing to comply with MTD requirements can result in a financial penalty, fines, and other charges and fees. They may include daily penalties that continue to accrue until your account is back in good standing.

What is the penalty for failing to register for MTD on time?

While there is no penalty specifically for failing to register for MTD, you will become subject to penalties and fines when you fail to comply with MTD reporting requirements. HMRC will levy fines against you for failing to use MTD-compatible software. All accounting periods with missing updates and reports will result in fines too.

About the author

Balil Warraich is an ACCA and CPA with over ten years of experience in the financial space. He specializes in accounting, assurance, and taxation services. Balil currently resides in British Columbia, Canada, where you’ll find him at https://www.notioncpa.com/

RELATED ARTICLES

Agent Services Account For MTD: How to Set It Up

Agent Services Account For MTD: How to Set It Up MTD Digital Links: Definition & Why You Need To Use It

MTD Digital Links: Definition & Why You Need To Use It Self-Assessment for Sole Trader: How to Prepare for MTD

Self-Assessment for Sole Trader: How to Prepare for MTD What Is Making Tax Digital: An Extensive Guide

What Is Making Tax Digital: An Extensive Guide Sign Up for Making Tax Digital for VAT: A Complete Guide

Sign Up for Making Tax Digital for VAT: A Complete Guide MTD for Income Tax: How Will It Affect You?

MTD for Income Tax: How Will It Affect You?