MTD for Income Tax: How Will It Affect You?

By introducing Making Tax Digital (MTD), the UK government aims to modernise its tax system. The new scheme replaces parts of the existing systems. It impacts how taxpayers file their tax reports with His Majesty’s Revenue and Customs (HMRC). MTD is mandatory for affected individuals and businesses. Noncompliance can result in hefty fines and penalties.

HMRC is implementing MTD income tax rules in phases, so you may not be affected right away. But, it is in your best interest to prepare for when Making Tax Digital for Income Tax Self-Assessment (ITSA) does apply to you. You should already have the required accounting and reporting systems in place ahead of the mandate.

Key Takeaways

- MTD for Income Tax Self-Assessment (ITSA) goes into effect in March 2026 for people with self-employment and property income over £50,000.

- The program expands to people with business income over £30,000 in March 2027.

- Affected individuals currently submitting a Self-Assessment tax return each year need to sign up for Making Tax Digital.

- MTD for ITSA requires digital records, quarterly updates, and an end-of-period statement (EOPS) submitted with MTD-compliant software.

- Your tax bill should remain unchanged under MTD.

Here’s what we’ll cover:

Timeline of MTD for Income Tax

Who Will MTD for Income Tax Affect?

What You Have to do Differently Under the New Rules

What are the Benefits of MTD for Income Tax?

How to Prepare for MTD for Income Tax

What is Making Tax Digital?

MTD is a scheme wherein the UK government requires taxpayers to submit tax reports digitally. Affected people and businesses need to keep digital business records, not just paper records. These digital records must be accurate and up-to-date. Also, tax returns and other regular updates must be sent to HMRC directly using MTD accounting software.

HMRC and the UK government hope to reduce the tax gap with the new income tax rules. The program should reduce avoidable errors and ensure taxpayers pay the correct tax owed.

If you fall under the mandate of the new program, you need to sign up for MTD if you haven’t already done so. For now, there are three parts to MTD. You and your company may be affected by one, two or all three of these components.

- MTD for Value-Added Tax (VAT)

- MTD for Income Tax (ITSA)

- MTD for Corporation Tax

Each of these three programs has different timelines and requirements. You can checkout the comprehensive guide which we have put for all the MTD related queries.

Timeline of MTD for Income Tax

Not all sole traders and people who’ve opted for Self-Assessment need to start using Making Tax Digital for Income Tax immediately. The mandate date depends on your income level. Originally, HMRC planned on starting MTD for ITSA in March 2024.

- December 2022: HMRC announces they are delaying MTD for Income Tax by two years. They also changed the income thresholds for affected individuals and business owners.

- March 2026: Everyone with Self-Assessment income or rental property income over £50,000 must start using MTD for ITSA for the current tax year.

- March 2027: The new MTD for ITSA program applies to all sole traders and landlords with a total gross income between £30,000 and £50,000.

The UK government has not yet announced a Making Tax Digital timeline for self-employed people with less than £30,000 in gross income. If this describes you, following any news from HMRC relating to MTD is a good idea. You don’t want them to find you not complying with the program once it does apply to you.

Who Will MTD for Income Tax Affect?

In April 2019, MTD for VAT became mandatory for all VAT-registered businesses and landlords with at least £85,000 in turnover. The program expanded to all VAT-registered businesses, regardless of threshold, in April 2022. MTD for Income Tax affects individuals and businesses in a similar way based on business income thresholds.

All taxpayers who either opted into Self-Assessment or are required to use it may be affected by MTD for Income Tax. This may include sole traders, landlords, people in limited partnerships, and self-employed business owners. If you have any income where tax was not deducted automatically, you must self-assess to report it in a tax return.

As per the schedule above, MTD for Income Tax will first affect people with relevant income over £50,000 starting in March 2026. It expands to those with income over £30,000 as of March 2027, the following year.

What You Have to do Differently Under the New Rules

To ensure you comply with new income tax rules, having a complete Making Tax Digital checklist on hand is helpful. There are three main requirements you’ll need to keep in mind.

- Maintain digital records of all business transactions, both income and expenses. The digital records can be in a spreadsheet or entered into an accounting program. The records must be accurate and kept up-to-date.

- Remit a quarterly update to HMRC using MTD-compatible software. The quarterly update will summarise all relevant business income and expenses. In turn, HMRC will provide an estimated tax calculation based on this information.

- File an End of Period Statement (EOPS) at the end of the tax year. The statement includes any accounting and tax adjustments to close out the year. Like the quarterly updates, you send the EOPS to HMRC using MTD income tax-compatible software.

The End-of-Period Statement fully replaces the existing Self-Assessment tax return. To simplify your bookkeeping, you should align your accounting period with the tax year. This way, your quarterly updates and EOPS align with HMRC-mandated deadlines.

What’s Not Changing?

MTD for ITSA does not change who is eligible or required to file a Self-Assessment tax return yearly. If you were submitting Self-Assessment taxes before, you would continue to do so.

The new system is not meant to increase or decrease your final tax bill either. Rather, it’s meant to streamline and digitise the process to reduce errors. This way, taxpayers will pay the correct amount owed each year. The final statement from MTD can account for all income under Self Assessment, not only business income or rental income.

MTD does not change the deadlines for making payments or filing your tax return either. They stay the same. It is simply the manner in which you submit your tax return that will change.

What are the Benefits of MTD for Income Tax?

The initial transition period to the new system may present a learning curve for taxpayers. Once you’ve taken the time to familiarise yourself with Making Tax Digital, though, the actual process itself may be even easier than before. Digital records are better for everyone.

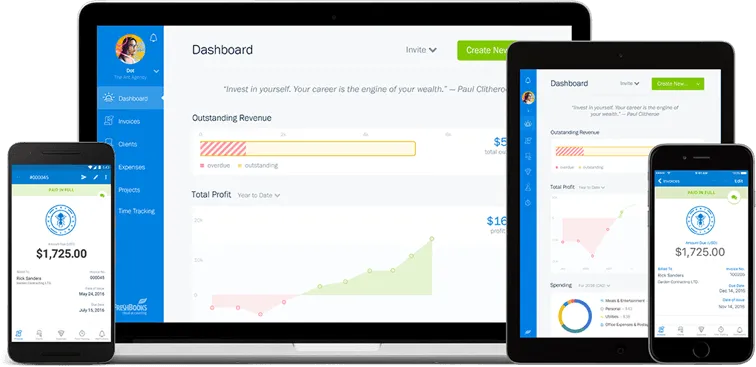

When you use MTD-compatible software for business accounting, all of your business financials can be recorded and stored in one place. With the right accounting software, you can easily generate income statements, profit and loss statements and other business reports. The software satisfies the digital record-keeping requirements. And you can send in the required quarterly updates and EOPS from within the program too.

The goal of MTD for Income Tax is to reduce errors. This benefits taxpayers, too, because you should make fewer mistakes on your tax return. You should have to make fewer tax adjustments with this program. Tax administration is much simpler and easier to manage as a small business owner.

How to Prepare for MTD for Income Tax

To get ready for MTD for income tax, follow these helpful tips:

- Check your eligibility. If your business income meets the relevant thresholds, you must start using MTD for ITSA. Confirm the criteria against your situation.

- Migrate your data. Start moving your accounting data to an MTD-compliant digital format. Get comfortable with maintaining accurate, up-to-date financial records.

- Start using MTD-compliant software. MTD-compliant software makes it easy to submit your reports to HMRC when they are needed.

- Ask questions. Clarify any confusion you may have around MTD before you are required to sign up.

FreshBooks helps taxpayers manage their finances and stay organised in their accounting activities. Our MTD-compliant software is recognised and approved by the HMRC. Click here to try it today.

Conclusion

HMRC’s Making Tax Digital undertaking aims to reduce the tax gap and modernise the UK tax system. MTD for Income Tax affects all individuals who currently file a Self-Assessment income tax return. It goes into effect for people with income over £50,000 as of March 2026. MTD for ITSA expands to people with income over £30,000 in March 2027.

Your total tax bill should not change under the new system. Deadlines don’t change, either. You will be required to maintain digital records, submit quarterly updates, and use MTD-compatible software like FreshBooks to send an end-of-period statement each year.

FAQs on MTD for Income Tax

Is Making Tax Digital Compulsory?

If your business income exceeds a certain threshold, MTD is mandatory. If you earn over £50,000 in property or self-employment income, you will need to start using MTD for ITSA in March 2026. If your relevant income exceeds £30,000, you must start MTD for ITSA in March 2027.

What are the Penalties for Non-Compliance for MTD for Income Tax?

HMRC is implementing a new penalty points system for MTD non-compliance. Points are levied when you miss submission deadlines for your quarterly updates and EOPS. If you meet a penalty threshold, you are fined £200. This is in addition to any late payment penalties. These start on day 30 after the payment was due at 2% of the outstanding amount.

Will MTD for Income Tax Require me to Submit my Tax Returns More Frequently?

Not exactly. You will continue to submit one annual tax return. However, under MTD, you are also required to submit quarterly updates.

Who is Exempt From Making Tax Digital?

For the time being, sole traders and other individuals with self-employment income below £30,000 are not required to sign up for MTD. That may change as the UK government reviews the program and decides how it might best apply to smaller businesses. You can also submit a formal request to HMRC to see if you can opt out of MTD.

Do I Need MTD if I am Not VAT Registered?

You do not need to sign up for MTD for VAT if you are not VAT registered. Even if you are not registered for VAT, however, you do need to sign up for MTD for ITSA if you meet the minimum income thresholds as of March 2026 and March 2027.

About the author

Balil Warraich is an ACCA and CPA with over ten years of experience in the financial space. He specializes in accounting, assurance, and taxation services. Balil currently resides in British Columbia, Canada, where you’ll find him at https://www.notioncpa.com/

RELATED ARTICLES

Making Tax Digital Timeline: Key Dates You Should Know

Making Tax Digital Timeline: Key Dates You Should Know 10 Best Making Tax Digital (MTD) Software for VAT

10 Best Making Tax Digital (MTD) Software for VAT Does Making Tax Digital Apply to Sole Traders?

Does Making Tax Digital Apply to Sole Traders? When Does Making Tax Digital Start?

When Does Making Tax Digital Start? Making Tax Digital for Landlords: Everything You Need to Know

Making Tax Digital for Landlords: Everything You Need to Know Everything You Need to Know About Making Tax Digital Software

Everything You Need to Know About Making Tax Digital Software