How Long Does It Take To File Taxes

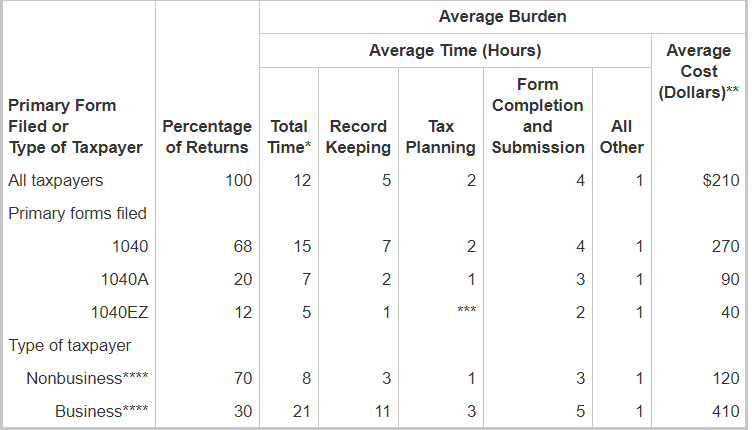

It takes an average American taxpayer 11-13 hours to prepare their taxes, according to the IRS. Record keeping, tax planning, form submissions, and other related activities are considered when calculating this time.

Of course, it can take much longer, depending on the complexity of your return. Individuals who are self-employed or have multiple streams of income can expect to spend more time on their returns.

The best way to make tax preparation more efficient is to keep your records organized and accurate all year long, not just during tax season. Some easy ways to do this are to keep your receipts in labeled envelopes and file your taxes using tax preparation software.

This chart, Estimated Average Taxpayer Burden for Individuals by Activity, from the IRS, will breakdown the tasks involved in preparing your income taxes by hours spent. You can also discover how to file taxes more efficiently by learning about the time allocation for various tax-related activities.

In this article, you can also learn more about the following topics:

How Can I Check the Status of My Tax Return?

How Can I Check the Status of My Tax Return?

After your return has been accepted, you are on the IRS payment timetable.

The average American tax refund was around $3,000 in 2022. That tax refund might be the biggest check you get all year. Many Americans will be counting down the days to getting that money in their hands after hitting the e-file button.

If you e-filed your taxes, you have the option of getting your refund deposited directly into your account. This is the fastest way to get your federal tax refund. After IRS acceptance, those who choose direct deposit typically get their returns in less than three weeks.

If you filed your tax return on paper through the mail, you could expect a processing time of 6 to 8 weeks from the date the IRS received your tax return documents.

Here’s the process by which the IRS processes your tax return:

- Check the status 24 to 48 hours after e-filing using the IRS app or visiting the Where’s My Refund? Tool online. If you filed a paper tax return, you can start checking your status 4 weeks after the IRS has received your documents.

- Use the IRS Where’s My Refund tool to check the status of your tax return. Once the tool displays a “Return Received” status, it means the IRS has started processing your return. A refund date will only be provided once the IRS completes processing and approves your return. For a detailed breakdown of the time it takes for tax return processing, follow our comprehensive guide.

- Once you see that your status has changed from “Return Received” to “Return Approved, the IRS has finished processing your tax return and has confirmed your tax refund.

- After your status moves to “Refund Approved”, the IRS will provide you with a personalized refund date in the Where’s My Refund? Tool. You can most likely expect your refund within three weeks after e-filing with direct deposit.

- When your status in Where’s My Refund? shows “Refund Sent” your money should have been sent to your financial institution. It can take another 1 to 5 days for your financial institution to deposit funds into your account. If you’ve requested your tax refund be mailed, it could take several weeks to receive your check.

More Useful Resources

- How to Make a Tax Invoice

- How to File an Amended Tax Return

- Tips for Filing Taxes

- What Does Your Accountant Need to Do Your Taxes?

- What Happens If You Don’t File Taxes?

- How to File Taxes

- Best Tax Software

- Estimated Tax Payments

RELATED ARTICLES

What Does Your Accountant Need to Do Your Taxes?

What Does Your Accountant Need to Do Your Taxes? Closing the Books: Basics & 8 Steps Guide

Closing the Books: Basics & 8 Steps Guide  When Should I Hire an Accountant

When Should I Hire an Accountant How To Choose an Accountant: 8 Things To Look For

How To Choose an Accountant: 8 Things To Look For What Is the Difference Between Bookkeeping and Accounting?

What Is the Difference Between Bookkeeping and Accounting?