What Is Accounts Aging and How Does It Help Your Small Business?

In accounting, the term aging is associated with the accounts receivables of a business. It is the classification of accounts by the time elapsed after the billing date or due date.

An account aging report lists the outstanding balances of clients and the length of time the invoices have been outstanding. If the report shows that receivables are being collected slower than usual, it might indicate a greater credit risk in sales or be a sign of the business lagging behind in collections.

What this article covers:

- What Is an Accounts Aging Report?

- What Is the Aging of Accounts Receivable Method?

- Why Is Aging of Accounts Receivable Important?

- What Is Aging of Accounts Payable?

What Is an Accounts Aging Report?

The accounts aging report is a management tool that shows how much you’re owed at a specific period of time by each client. With this report you can track:

- How much the client owes you

- How long they have owed you

- Which clients owe you the most

The report is broken down by the aging periods which are:

- Current – Due immediately

- 1 – 30 days – Due within 30 days

- 31 – 60 days – 1 month overdue

- 61 – 90 days – 2 months overdue

- 91 and over – More than 2 months overdue

If a client has several bills at different times, the report will show how much is due at what time.

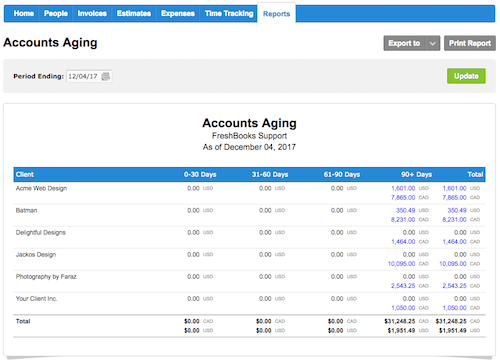

Here’s an example of an accounts aging report.

Source: https://www.staging.freshenv.com/support/what-is-an-accounts-aging-report

What Is the Aging of Accounts Receivable Method?

Accounts receivables is the money that the business has to receive as a payment for goods and services on credit. The aging of accounts receivable is the process of sorting these receivables by their due dates.

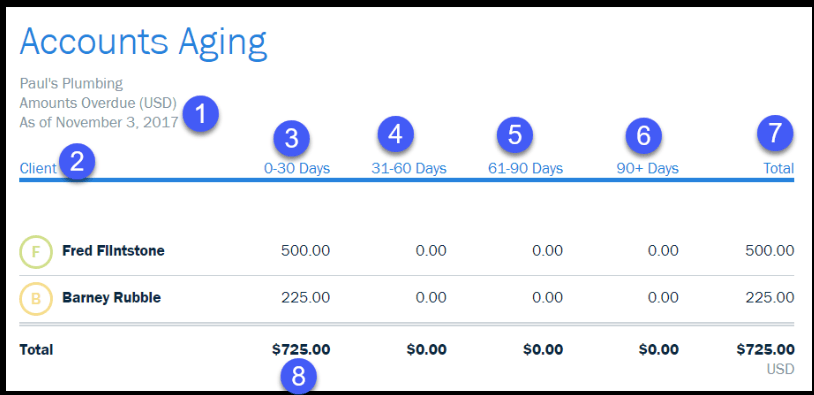

To prepare an aging report, sort the accounts receivable according to the dates of the unpaid invoices. The current invoice amounts are entered into the first column. The second column lists the invoice amounts that are 31-60 days past due date and so on. Review the aging to determine the approximate amount of the receivables.

Source: https://fitsmallbusiness.com/aging-of-accounts-receivable-report/

Description of information in the report

- Date

- Names of the clients

- Invoices between 0 to 30 days past their due date

- Invoices between 31 and 60 days past their due date

- Invoices between 61-90 days past their due date.

- Invoices between 61 and 90 days past their due date.

- Total

Using your collections management system, determine how to handle the large invoices. Contact clients with invoices that are 30 days or more overdue with email reminders and calls.

If customers have invoices older than 60 days and have not responded to repeated reminders, it might be time to take legal action. You can either send the overdue accounts to a collection agency or decide to file a suit in a claims court.

Why Is Aging of Accounts Receivable Important?

The purpose of an account receivable aging report is to find the receivables which business owners must deal with immediately. This is because the longer a debt is owed, the lesser are the chances you would be able to collect it. This report helps you spot potential collection early on and deal with them effectively.

Here are the benefits of accounts aging reports:

- It helps you analyze the financial reliability of the clients. If a client is consistently late in paying invoices, they could be a potential bad credit risk. You might decide to sever ties with the client or extend business on a cash-only basis.

- You can send timely reminders for invoice payments and stay on top of your billing and collection process.

- It helps in handling cash flow and time payments.

- It makes it easier to plan future expenses.

- It is useful for laying out credit and billing policies.

- Factoring companies request aging reports to assess the outstanding receivables and their quality.

What Is Aging of Accounts Payable?

Accounts payable (A/P) aging report show the balances you owe to other businesses. This could be for services your company receives, inventory and supplies.

Some of its key features are:

- The report outlines the unpaid invoices along with the due date of the invoices and how far they are behind the payment dates.

- Similar to accounts receivable aging report, the accounts payable aging report is broken down in such a way that you can review all accounts that are due and past due.

- An A/P aging report not only helps you pay your invoices on time but also allows you to manage cash flows and take advantage of any early payment discounts. It also helps small business owners avoid any credit or supply problems

The best way to stay on top of your invoice and payment process is by using online accounting software that allows you to set up recurring invoices, send automatic payment updates to clients and lets clients pay their invoices online.

RELATED ARTICLES

What Are Operating Activities in a Business?

What Are Operating Activities in a Business? Foreign Currency Translation: International Accounting Basics

Foreign Currency Translation: International Accounting Basics What Is a Periodic Inventory System and How Does It Work?

What Is a Periodic Inventory System and How Does It Work? What Are Financing Activities?

What Are Financing Activities? Balance Sheet vs Income Statement: Differences With Examples

Balance Sheet vs Income Statement: Differences With Examples How to Prepare Financial Statements for Small Businesses

How to Prepare Financial Statements for Small Businesses