How To Add Money To Paypal From Debit Card [2025]

If you frequently make and accept payments via PayPal, you may want to maintain a balance in your account. For most people, this is just a matter of convenience. By keeping some money in your PayPal account at all times, you can use the platform more easily without delays. This is particularly helpful if you’ve integrated PayPal into your ordinary accounting system.

There are two ways to make PayPal payments: using your existing PayPal balance and email address or choosing an alternative like a bank or a debit card. Here’s how to do both and add money to your account when needed.

Key Takeaways

- Direct transfers to your bank account from your PayPal account are simple and straightforward.

- The transfer can take up to 5 days to post to your account.

- You can pay suppliers using the credit or debit card associated with your PayPal account.

- PayPal’s Instant Transfer option allows you to receive money from your PayPal balance in minutes for a small percentage fee of the total being transferred.

- You can add cash to your PayPal balance using the barcode generator in the PayPal app at any participating retail store.

Here’s What We’ll Cover:

How to Add Money to PayPal From Your Bank

How to Use Your Debit Card for PayPal Purchases

Doesn’t PayPal Have Instant Transfer?

What if I Want to Add Cash to My PayPal Balance?

How to Add Money to PayPal From Your Bank

The easiest way to add money to your PayPal balance account is to use a direct bank transfer. First, you’ll need to create a PayPal Cash or PayPal Cash Plus account. This is free, but it requires PayPal to verify some of your personal information to comply with Know Your Customer regulations.

Next, you’ll need to have a linked bank account. This will take a few days to set up since PayPal must verify that the account is yours. They’ll deposit a few pennies and ask you to confirm the amount. When that’s done, you can transfer money back and forth freely.

To transfer money from a bank account, log into PayPal and navigate to your wallet. Now, click “Transfer Money” and select the “Add money to your balance” option. Enter the amount and select the “up to 5 days with your bank” option. With the app, the process is even easier. You click on your balance and select “Add Money.”

Either way, the rest of the process is simple. You enter the amount you want to transfer, confirm the money transfer, and you’re all set. Direct transfers to your PayPal account from your bank can take longer to process, sometimes requiring five full business days.

Using payment services helps eliminate the guesswork of payment processing. FreshBooks lets you simplify the payment process, helping you maintain clear balances and accept payments online. Find out more about the services FreshBooks offers. Click here to sign up for our free trial.

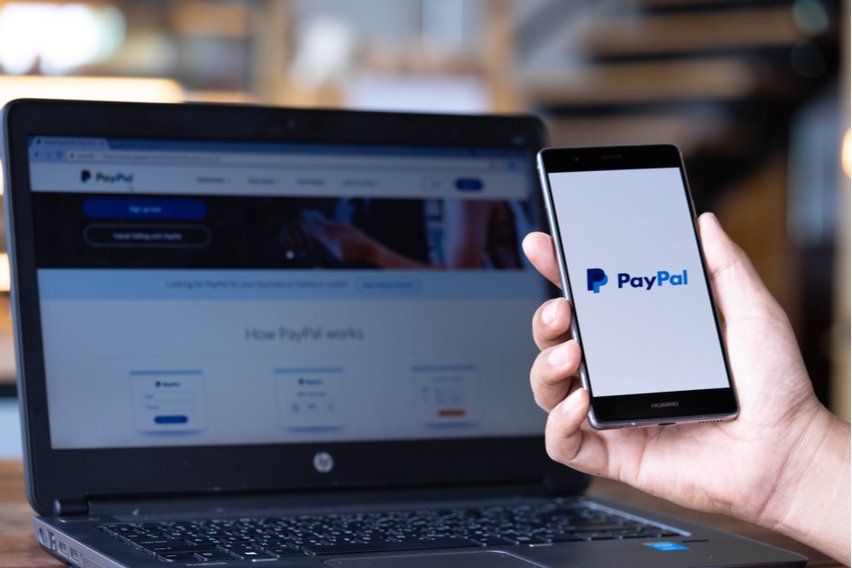

How to Use Your Debit Card for PayPal Purchases

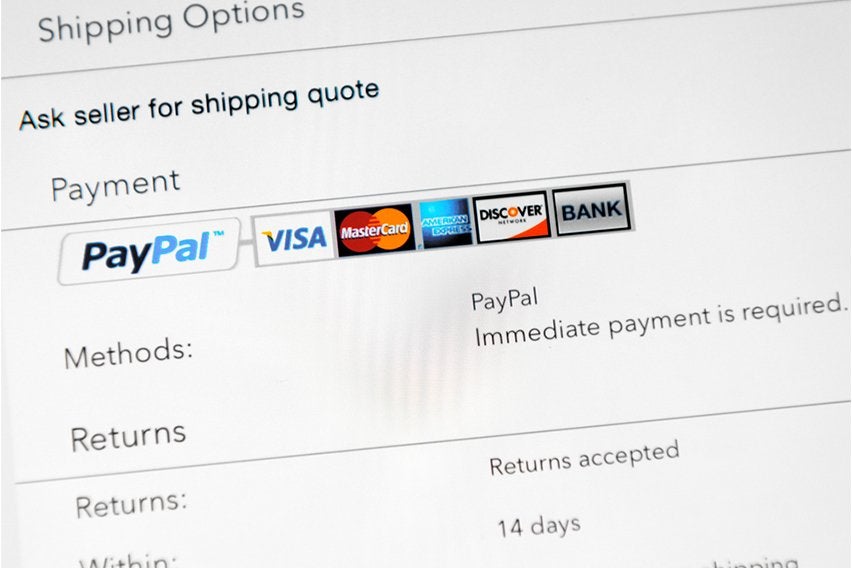

You can’t actually use a credit or debit card to transfer funds to your PayPal balance. On the other hand, you shouldn’t really have to. When you make a PayPal payment, you can use your credit or debit card instead of your PayPal balance.

As a result, you don’t need to maintain a balance if you link a card to your account. You can get money from friends or pay your vendors directly from your card. Remember that, as with any card payment service, this will incur some fees, which are tax deductible.

You’ll first need to set up a linked card for this to work. Log in, go to your wallet, and click on the link to add a debit or credit card. Follow the instructions, enter your card details and billing address, and the card will be linked. The whole process only takes a few minutes. You can also opt for a PayPal debit card that links directly to your account.

Doesn’t PayPal Have Instant Transfer?

Yes, PayPal does have an option for instant transfer. The feature eliminates payment delays, letting you instantly transfer your customers’ PayPal payments directly to your linked bank account. The PayPal instant transfer option is only available for withdrawals, not for deposits.

To get your money in minutes, log into your account and click the link that says “Transfer money.” Select the account or card you want to transfer to, and choose the option for an instant transfer. This will work for any bank account and eligible debit cards. At this time, instant transfers are not available for credit cards.

Keep in mind that instant PayPal transfers incur a service fee. Transferring money from your PayPal account to your bank instantly requires a fee of 1.75% of the withdrawal amount, for a total of $0.25 to $25. The transfers will typically post in a few minutes but can take up to half an hour.

What if I Want to Add Cash to My PayPal Balance?

Using the PayPal cash feature, you can add money to your PayPal balance at a participating retailer. To do this, make sure you have the PayPal app downloaded on your mobile device. You’ll need to generate a barcode in your PayPal app to show at the retail store, along with your cash.

To generate the barcode and add money, open your PayPal app. Tap the “More” button at the bottom of the home screen. Tap “Add Cash.” Select a retailer from the provided list, and tap “Generate Barcode.” Bring the barcode on your smartphone to your preferred retail store and the amount of cash you’d like to add. The cashier will scan your barcode to load the money into your PayPal account.

PayPal recommends waiting until you’re at the retail location to generate the PayPal Cash barcode. Generated barcodes expire after one hour. If your barcode expires, you can simply generate a new one following the same steps.

There is a service fee of $3.95 when adding cash at a store, while barcode generation is a complimentary service. Typically, you can add any amount between $20 and $500 per barcode. The daily limit for adding cash to your PayPal account is $500, and the monthly cap is $4,000. However, there are ways to lift these limits. Follow our post on PayPal Daily Limit for a detailed explanation of these limits and guidance on how to increase them.

Conclusion

Keeping a balance in your PayPal account is a convenient way to make sure you always have enough available for transactions. Direct transfers to your bank account from your PayPal account are simple and straightforward. Using the bank account associated with your debit card helps you maintain a balance and positive cash flow for frequent use. The process can take several days, or require a small fee, but does you to manage your balances as needed.

Simplify your processes and eliminate the need for complicated cash transfers. Check out FreshBooks online payroll services to make payday easy, efficient, and hassle-free. Click here to learn more about FreshBooks’ services and start your free trial today.

FAQs On How to Add Money to PayPal From a Debit Card

How do I add money to my PayPal account from Cash App?

Unfortunately, you can’t directly move money from Cash App to PayPal, but some options allow for a workaround. You can use your bank account as a middleman for a transfer or use the Cash Card from Cash App as a PayPal payment method to get the money you’d like.

How do I add money to my PayPal account for free?

No fees are associated with transferring money to PayPal directly from your bank accounts. A fee is only added to this transaction if you add the ‘Instant Transfer’ option. Otherwise, PayPal users can transfer money between their PayPal account and bank account free of charge.

Can I send money to myself on PayPal from a credit card?

It is against PayPal’s terms of service to send money to yourself from a credit card. This option is only available when sending money to a friend, client, customer, or business. Click here to read PayPal’s full user agreement for more information.

Can I spend money on PayPal without linking a bank account or card?

No. While you don’t need a debit card or bank account to set up a PayPal account, you will need to link a bank account if you want to take cash from your PayPal balance. PayPal requires an established location to transfer money to.

Why won’t PayPal accept my Visa debit card?

Typically, this issue arises when your card is associated with a specific PayPal account and you’re not logged into that particular account. It could also be because your card was associated with a PayPal account you’ve since closed, you haven’t confirmed the card link yet, or you’ve exceeded your card limit in the PayPal system.

Did you find this article helpful? If so, you might be interested in our guide on How to Transfer Money from Bank to PayPal, where we explain the step-by-step process of transferring money.

About the author

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

Semi-Monthly vs BI-Weekly Payroll: What’s the Difference?

Semi-Monthly vs BI-Weekly Payroll: What’s the Difference? How to Pay With PayPal: A Step by Step Guide

How to Pay With PayPal: A Step by Step Guide Average Credit Card Processing Fees & Rates for Business

Average Credit Card Processing Fees & Rates for Business How Safe Is PayPal for Sellers & Buyers? 4 Tips to Stay Safe

How Safe Is PayPal for Sellers & Buyers? 4 Tips to Stay Safe PayPal Exchange Rate: How to Check Currency Conversion

PayPal Exchange Rate: How to Check Currency Conversion How to Set Up a PayPal Merchant Account in 10 Simple Steps

How to Set Up a PayPal Merchant Account in 10 Simple Steps