How to Receive Money on PayPal: Methods, Duration, and Fees

To receive money on PayPal, all you have to do is open a PayPal account and confirm your email address. Then you’re free to send a payment request through the website, create your own PayPal.me address, link directly to PayPal on your website, or accept mobile payments instantly using a QR code.

Paypal is the global leader in online payment processing because it makes it easy to send and receive money to your business or personal account. Once the money arrives in your account, you can instantly access it on your home page of the PayPal website, and choose to:

- Transfer it into the bank or

-

Keep it in your balance in your account with PayPal to shop online or send it to friends and family 1

PayPal is fast, international, and flexible, and can even link directly to your financial software, making client invoicing and accepting payments easier than ever.

Key Takeaways

- Requesting or sending money via PayPal is done by creating an account and verifying your PayPal email address.

- You can use the money in your PayPal balance account to make online purchases, send money to friends and family, or transfer it into your linked bank account.

- PayPal lets you withdraw money instantaneously for a fee or wait 2 to 3 days for the transaction to clear and post in your bank account.

- Integrating PayPal into your bookkeeping software can make running your business easier and simplify your financial management processes.

Table of Contents

- 5 Methods on How To Accept Money on PayPal

- How Long Does it Take to Receive Money on PayPal?

- How to Receive Money on PayPal from a Friend?

- How to Receive Money on PayPal Without Fees?

- How to Receive Money on PayPal Without Bank Account?

- How Do I Receive Money from PayPal to My Bank Account?

- How Much Does it Cost to Receive Money from PayPal?

- How Long Does it Take to Receive Money on PayPal from Another Country?

- Streamline Payments With FreshBooks and PayPal

- Frequently Asked Questions

5 Methods on How to Accept Money on Paypal

If you’ve been trying to figure out how to receive money or send a request through PayPal but aren’t sure where to start, this guide is for you. The following are the 5 main methods used to get your money on PayPal.

1. Invoicing Through Paypal

The most basic way to receive money and increase your PayPal balance is to use your personal account portal. You can send a direct money request to anyone with an email account, regardless of whether they have a PayPal account.

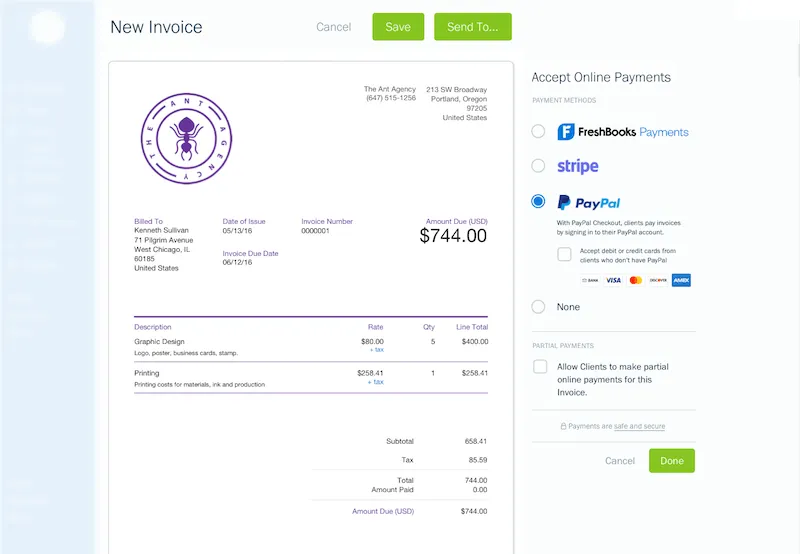

As a business owner, you can use invoicing software in your merchant account. The invoice will be sent directly to your customer, who can pay using the PayPal portal, easily selecting their preferred payment option. Customers can use their credit cards or debit cards if they don’t have an account, or their PayPal balance account or checking account if they do.

Keep in mind that you may incur a fee if invoices are paid with a credit card.

Alternatively, you can send a simple “money request” that bypasses the invoice stage by typing in your payment amount and sending it via email to your recipient. This form of payment is best for international transactions as it lets you get the money at the current exchange rate with fewer overall fees.

2. Using a PayPal.me Link

A PayPal.me link is a short URL that is unique to you. Both personal and merchant accounts are entitled to a PayPal.me payment link. You can customize your link to include your business name if it is not already claimed and send it to anyone to request funds and get paid the amount of money you want.

The payee sets the payment amount in this type of transaction, as you can’t set the payment amount before sending the link.

3. Setting Up a Paypal Payment Gateway on Your Site

A website is another place where small businesses can accept money through PayPal. You need to set up a PayPal payment gateway on your website. The way to do this depends on your web host. WordPress has PayPal plugins that create handy PayPal buttons. Wix and Squarespace have their own apparatus for connecting online sales to PayPal.

Doing this is ideal if you sell digital products, courses, physical products, or consultancy services online.

4. Linking Your PayPal Account to Your Accounting Software

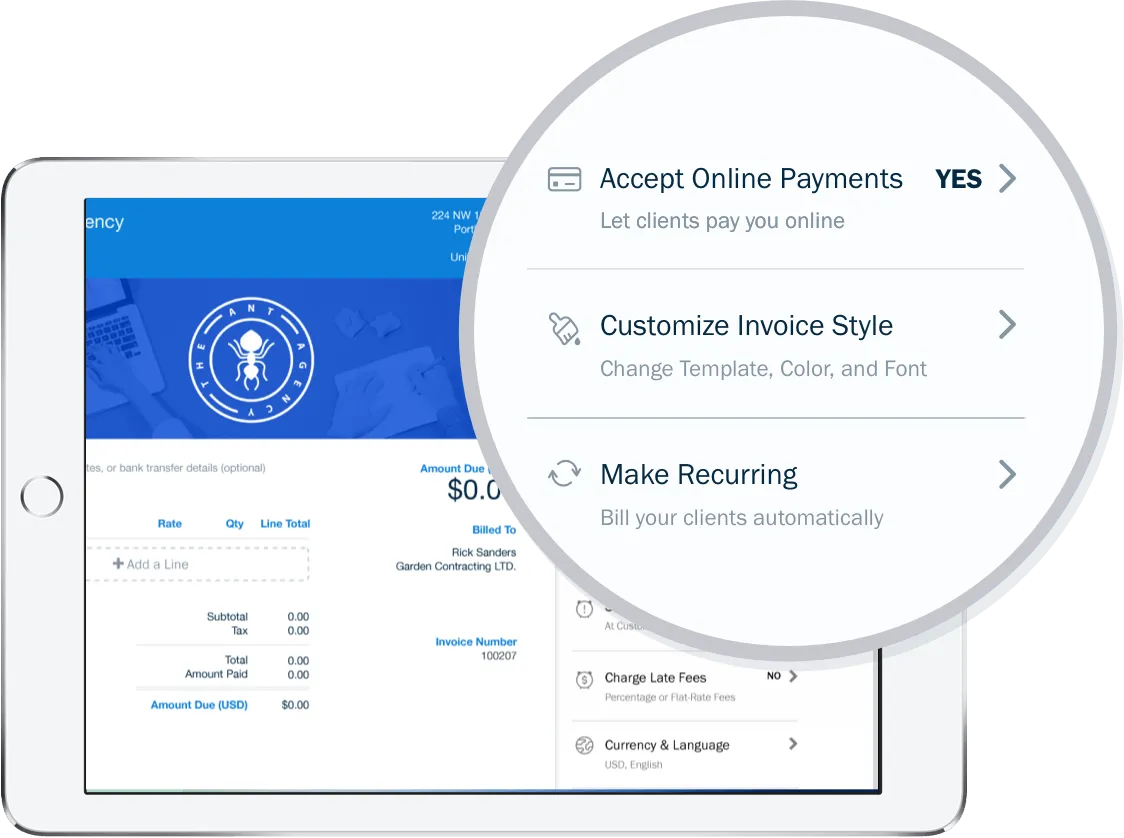

If you have a FreshBooks account, you can use it as your primary way of invoicing clients and managing payments by connecting your accounting software to PayPal if they have a partnership. FreshBooks has an alliance with PayPal, so if you send an invoice through our software, your clients can simply click to pay.

5. Using Mobile Payments via PayPal

PayPal has a contactless payment feature that works for any company or payee with an account. All your customer needs to do is scan your unique QR code with one of their mobile devices.

This payment method works well for shops, cafes, and bar owners. Accepting payments from multiple online sources makes life easier for you and your customers. See the FreshBooks Payments to learn more about how to send digital invoices that accept payments in just one click. Try FreshBooks Free to get started.

Note: These payment methods apply to merchant accounts/business accounts. That said, some of these also work for personal accounts.

How Long Does it Take to Receive Money on PayPal?

When you request money from someone or when your customer pays you using PayPal, the funds will instantly arrive in your PayPal account, usually taking just a few minutes. If the money is coming from a linked account, it may take between 2 to 3 days, depending on the bank. After you accept payment, you can make purchases directly from the money on PayPal or transfer the funds into your linked bank account.

How to Receive Money on PayPal from a Friend?

Receiving money from friends and family is as simple as clicking the “Request Money” button after logging in to your account on the PayPal website or the PayPal app. Enter their email address and the amount of money you want to receive, review your request, and then hit “confirm.” You also have the option to add a note if you like.

The person you’re requesting money from will receive an email with the amount requested and your message, along with an easy-to-follow link to their payment options.

How to Receive Money on PayPal Without Fees?

Although most actions taken on PayPal include applicable fees 2, if the money is sent from a friend or family member using their own linked bank account or PayPal balance, they won’t be charged. PayPal has also decided to waive the charges if you receive money from AmexSend accounts, or when a person sends a Visa+ transaction to a Venmo Visa+ enabled digital wallet. 3

These specific scenarios aren’t recommended when running a business but can be useful if you need to request money from a close relative or friend.

How to Receive Money on PayPal Without Bank Account?

If you want to accept money through PayPal but don’t have an account, just give the sender your email address or phone number and they can proceed. The money they send will be linked to you through the information you provided. You will need to create a PayPal account to access received money before transferring it into your bank account or using it to shop online.

How Do I Receive Money from PayPal to My Bank Account?

Setting up your business or personal PayPal account includes linking your bank account and your business email address. When you are ready to take your money out, simply go to the drop-down menu in your wallet, and click “Transfer Money.” Select the option to transfer to your bank, and choose whether you want it “in minutes” for a fee or get it in 3 to 5 business days at no cost.

How Much Does it Cost to Receive Money from PayPal?

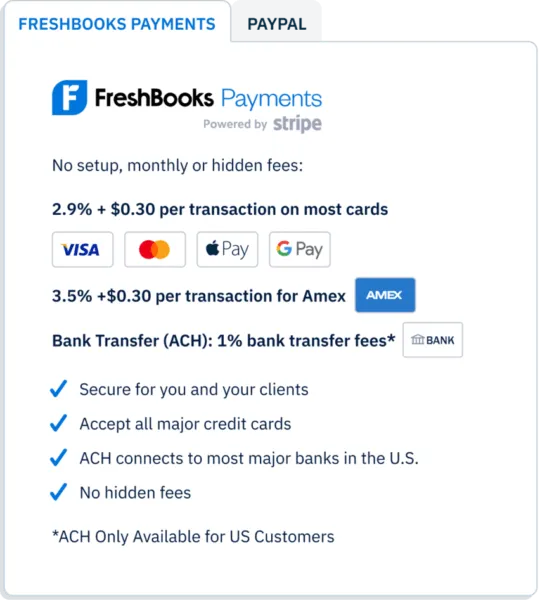

To accept PayPal payments for your business, PayPal will charge 3.49% plus a fixed fee for manually keyed-in online transactions, 2.99% for credit and debit card transactions, and a higher rate for international transactions. The full chart of fee percentages can be found on the PayPal site or by typing “PayPal merchant fees” into your search engine.

How Long Does it Take to Receive Money on PayPal from Another Country?

International transactions through PayPal are quick and often arrive within just a few minutes. If you and the sender both have PayPal accounts, the payments can be instantaneous, barring complications like international regulations regarding transaction limits. If you choose to withdraw the funds it usually adds a few days to the timeline unless you select “PayPal Instant Transfer,” but this option comes with additional charges.

Streamline Payments with FreshBooks and PayPal

PayPal makes it easy to send and receive money from people, both locally and across the globe. It’s a wonderful tool that protects your privacy while allowing you the power to connect with customers from anywhere. Millions of people worldwide trust this platform to keep their money safe, and it is one of the most straightforward and user-friendly ways to accept payments for your small business.

Connecting PayPal to your FreshBooks account will give you a hassle-free way to receive payments, ensuring precise financial tracking and improved cash flow. Simplify your small business’s financial management process by connecting FreshBooks and PayPal today.

FAQs on How to Accept Money on PayPal

We hope that you’ve found this article helpful in exploring how to send and receive money from PayPal. The following are some answers to frequently asked questions that can provide more clarity.

Which PayPal account do I need to receive money?

You can accept money using a personal or a business PayPal account. If you’re running a business, it’s recommended to use a business account so you can operate under a business name, accept debit, credit, and bank payments, link to PayPal on your website, and access useful PayPal features like PayPal checkout.

How to manually accept PayPal payments?

After receiving a payment notification through email or text message, you can manually accept PayPal payments by logging in and clicking the “Accept” option on any pending transactions you haven’t accepted yet. These are found in the “Summary” section of the PayPal website or mobile app.

Does PayPal Hold Funds Until Received?

Yes, sometimes a business PayPal will hold funds for up to 21 business days if you sell “high-risk” products like tickets or gift cards. Money may also be held if you’re a first-time seller, haven’t used PayPal in a while, or have had multiple customers file disputes.

How do I avoid PayPal fees when receiving money?

To avoid PayPal charges as a business owner, you may wish to set up an alternative payment method for getting your money, like credit card payments or direct bank transfers. If your friends or family want to send money, you won’t be charged the same fee that you would for a business transaction.

Article Sources

- How do I receive money through PayPal, Accessed June 19, 2024.

- PayPal Merchant Fees , Accessed June 19, 2024.

- Sending and Receiving Money, Accessed June 19, 2024.

About the author

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

Why Is My PayPal Money on Hold or Unavailable: 5 Reasons

Why Is My PayPal Money on Hold or Unavailable: 5 Reasons What Are PayPal Fees & How Much Do They Charge

What Are PayPal Fees & How Much Do They Charge How to Get Money Back From PayPal Transactions

How to Get Money Back From PayPal Transactions How to Change Name on Paypal

How to Change Name on Paypal 7 Best Legal Billing Software for Law Firms

7 Best Legal Billing Software for Law Firms Payroll Direct Deposit: A Complete Guide for Your Business

Payroll Direct Deposit: A Complete Guide for Your Business