How Long Does Direct Deposit Take: A Guide to Direct Deposit

There was a time when workplaces distributed paychecks printed on paper — hard to believe, isn’t it? Every payday, a manager would walk around and give everyone their check. You had to be careful not to lose it before you got to the bank.

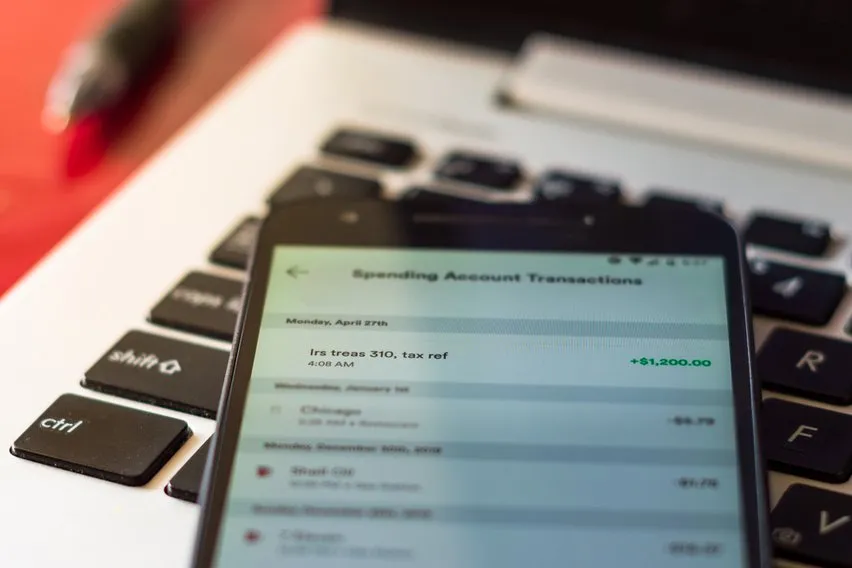

Not anymore. Today almost everyone is paid using direct deposit. Direct deposit is also used for tax refunds, stimulus checks, and other government payments. There are still a lot of questions about how long it takes to receive a direct deposit payment.

If you’re curious about direct deposit, this article will help. Let’s dive in!

Here’s What We’ll Cover:

How Can You Set Up Direct Deposit?

How Long Does Direct Deposit Take?

What Is Direct Deposit?

As we mentioned, depositing a payment used to mean waiting to receive a physical check. It would come from your boss or in the mail. Then you needed to go to the bank, wait in line, and deposit your money with the teller. You wouldn’t actually gain access to your money until the check cleared several days later.

Direct deposit electronically transfers money from one account to another. Everyone saves time and money. An employer can arrange for the funds to be deposited in your account on a specific date. Other payments arrive much more quickly, and you don’t have to worry about waiting for the payment to clear.

Direct deposit is used by the federal government for tax refunds, social security, unemployment benefits, and stimulus payments. It’s also used by almost everyone you pay bills to. When you pay online, you’re authorizing a direct deposit into their account from yours.

How Can You Set Up Direct Deposit?

If you’re a business owner, you might wonder how to authorize direct deposit for your employees or vendors. As an employee, you have questions about how to get paid with automatic deposits.

Generally, the person issuing payment will give a direct deposit authorization form to the employee or vendor being paid. The payment recipient will fill in their routing number, bank account number, and bank address. They may also specify whether it’s a checking or savings account and attach a voided check.

The direct deposit authorization process then goes to the payer’s bank, and everything is in place for the next automatic payment. There are various software options that can help you do this with ease. Follow our guide on Direct Deposit Payroll Software for a detailed explanation and tips on choosing the best software that can help you streamline the direct deposit process.

How Long Does Direct Deposit Take?

Direct deposit can be instantaneous, but sometimes banks and credit unions take a bit of time to review the payment. The exact time will depend on your bank, and it may take one to three business days to access the money you’ve received.

When you get paid regularly by an employer or by the government for unemployment benefits or social security, their accounting software will be set up to deposit the money into your account on the day you get paid. Generally, you’ll have access to your paycheck that same business day, whether you make a withdrawal or use debit cards.

If you make a payment using direct deposit, you can expect it to take one to three days to show up as a debit in your account. Sometimes the payment will show up right away with a “pending” designation until it’s finalized.

Benefits of Direct Deposit

Why use direct deposit instead of issuing a regular check for payment? There are a lot of benefits.

The primary benefit of direct deposit is that it’s faster. Employers save time and paper, while employees don’t have to worry about losing their paycheck or not being present on payday. Payment issuers don’t have to print a paper check and secure them until they are delivered to the employee or vendor.

Direct deposit is also more secure. It can’t be stolen or lost, and the payment is applied from one bank account to another quickly. There’s no concern about waiting for the check to clear another person’s account before you can access your money. That means less bookkeeping and fewer mistakes.

As an employer, you don’t have to wonder what to do with an employee’s paycheck if they are out or on vacation. You also have access to online transaction reports right away, allowing you to reconcile your books immediately. You’ll have lower payroll costs and better control of your systems.

Key Takeaways

Direct deposit is an electronic way to transfer payments from one person to another. With direct deposit, the recipient does not need to take personal checks to the bank and can access their funds within one to three days.

Direct deposit is cost-effective and efficient for employers, employees, and government agencies. Paper checks are already almost obsolete, and the many benefits of direct deposit are part of why.

Interested in learning more about business finance? Check out more of our guides today! We’re here to help.

RELATED ARTICLES

What Is PayPal Credit? Virtual Credit for Online Shopping

What Is PayPal Credit? Virtual Credit for Online Shopping How to Send Money on PayPal?

How to Send Money on PayPal? How to Send Money on Cash App: A Complete Guide

How to Send Money on Cash App: A Complete Guide What Is a Contactless Payment? A Complete Guide

What Is a Contactless Payment? A Complete Guide What Are PPP Loans? How the Paycheck Protection Program Works

What Are PPP Loans? How the Paycheck Protection Program Works PayPal Instant Transfer: Fees, Limits, and How It Works

PayPal Instant Transfer: Fees, Limits, and How It Works