How to Collect Money from Clients Who Won’t Pay

Let’s face it; no business owner wants to spend their time chasing after clients for money. And yet, that’s often the reality for many small business owners: Unpaid invoices stack up and revenue is lost.

And, of course, It’s easy to lead with emotion. You’ve done the work, and payment should follow promptly. But you also want to avoid escalating the situation into an outright conflict. Finding that all-so-important balance between understanding and getting paid is often the best way forward.

In the article below, we’ll be covering a few of the steps and techniques you can use to ensure you receive prompt payment for your services. We’ll go into detail outlining a few of the initial moves you can make when a payment is in arrears. We’ll also touch on some preventative measures to stop non-payments from happening in the first place.

By the end, you’ll know how to maintain positive working relationships, save money on unnecessary legal fees and, ultimately, get your invoices paid in full.

Key Takeaways

- Protect your business’s reputation and bottom line by ensuring you make it easy for your clients to provide payment.

- Oftentimes, clients may simply be swamped with pressing matters and a simple email or phone call is all that is needed to correct the late payment.

- Preventative measures, such as early payment offers, late fees, and payment schedules, can really cut down on the chances for lost revenue to pile up.

- As a last resort, a letter written by your lawyer or the involvement of a collection agency may be required.

Here’s what we’ll cover:

- How to Collect Money From Late-Paying Clients

- The Problem with Non-Paying Clients

- Tips to Protect Your Future Invoices

- Conclusion

- Frequently Asked Questions

How to Collect Money from Late-Paying Clients

Successfully collecting money from late-paying clients starts with your mindset. Yes, it’s annoying and time-consuming to be forced to chase up late payments. But we’re all in business with other people. And the quickest way to get the money you’re owed is to understand why your invoice isn’t settled already.

There are many reasons why your client hasn’t processed your payment, like illness, personal problems, financial difficulties, the person who does the accounts is on holiday, general disorganization, or they just plain forgot. You know what life’s like—you’re a person too.

Or maybe they have a legitimate question to ask you about fees or work done. But they haven’t gotten around to the discussion yet.

Of course, regardless of the reason, you need to be paid what you’re owed. But once you understand the reason for the late payment, you can choose the best way to get what your client owes you.

But once you understand the reason for the late payment, you can choose the best way to get what your client owes you, possibly even exploring options like tax settlement.

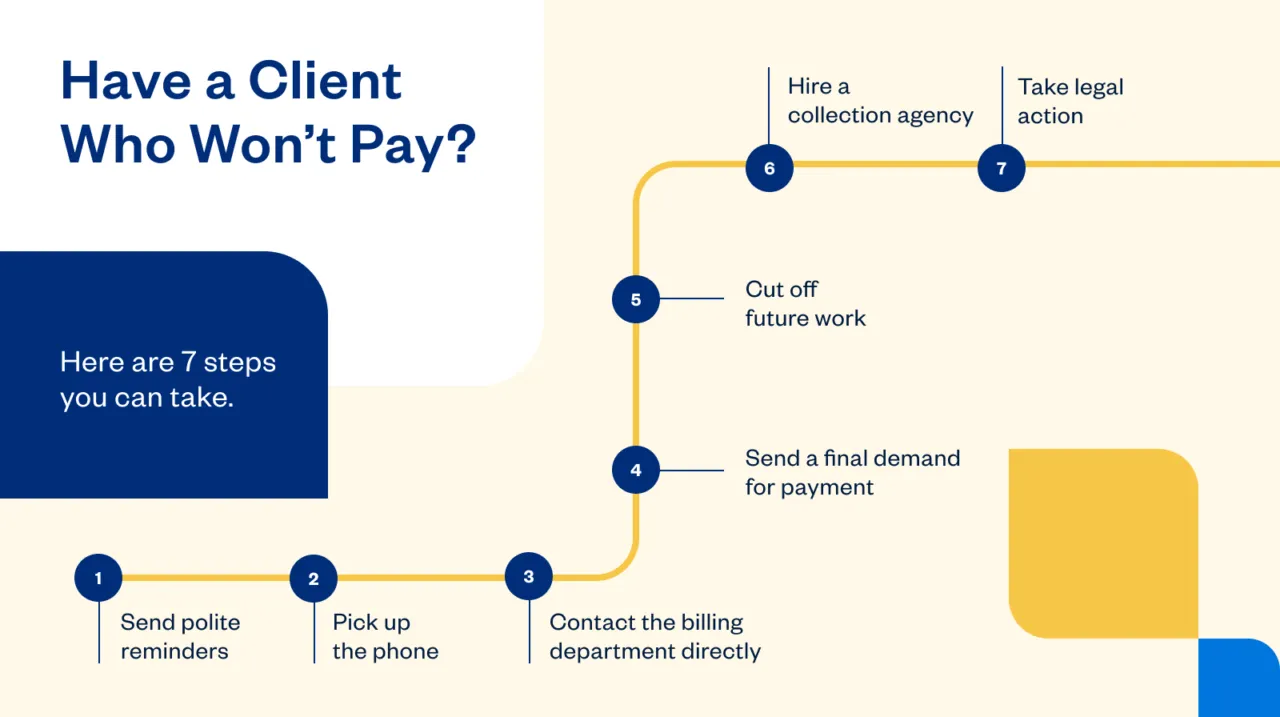

1. Send Polite Email Reminders

So let’s start by assuming the best. The first step with any overdue payments is a polite reminder email. Keep the tone light and factual. Nice, non-judgmental phrases like, “Just checking you’ve received our invoice dated.” Or, “You’ve probably just forgotten, but the invoice date was [date]. A quick confirmation that you’ve received this reminder would be great. I don’t want to charge late fees!” (Yes, with a jovial exclamation mark!)

Depending on how well you know this client, you might be able to personalize it even more. Use your own judgment here.

If it’s a new client or one you don’t know very well, you can use a payment reminder email template to help you draft a suitably professional email.

Showing empathy and a positive attitude makes it much more likely that you’ll receive payment and maintain the business relationship, especially if it’s a small business.

Keep everything polite and include helpful information like the invoice date, payment due date, your payment process, and the payment methods you accept. You might also want to draw attention to the late fees outlined in your original contract at this point.

Attaching the original invoice to this reminder email is thoughtful to save them time searching through their inbox.

2. Make a Simple Phone Call

If you don’t have success collecting outstanding payments with your email reminders, try picking up the phone. Again, it’s best to start by giving them the benefit of the doubt. This is still at the friendly reminder stage.

Instead of “clients who won’t pay,” they might actually be “clients who didn’t get your email because it went into their spam folder.” And a 2-minute chat gets the outstanding invoices paid.

Phone calls can be a friendlier way to collect money from clients because they can tell you what’s preventing them from sending payment. Sometimes it’s just easier for people to express themselves verbally.

Especially when dealing with small businesses, you can often sort out payment through phone calls. Maybe they can pay you over the phone with a credit card. Or you can set a new payment timeline for the overdue bills to be settled. You can offer payment plans at this point to ensure you eventually receive your full amount.

3. Contact the Billing Department Directly

If you’re trying to collect money from a large company, you may need to speak to someone other than your initial contact. Try going directly to their billing, finance, or accounts team. This department runs the invoicing system and knows the current status of your invoice. They’ll be able to explain any issues preventing payment, give you a realistic payment timeline, and push for a quicker settlement.

4. Cut off Future Work

While you’re waiting to collect money from clients who won’t pay, it might be time to pause any future work with them. This prevents the debt from snowballing and protects your cash flow. Service businesses will need to suspend their provision, making it clear that there will be no ongoing services until the overdue payment is made. And suppliers need to make sure that no more physical products are delivered until payments are received.

This is an incentive for them to pay so that they can continue with other projects. And it protects you from losing any more time or money to an unreliable customer.

You send clients a “final notice letter” to tell them that no work proceeds until they have settled their debt. It’s a final notice because it’s their last chance to make payment before you initiate more formal proceedings.

As well as notice that future work is cut off, this letter should include the following:

- Payment due date on the original invoice

- Demand to make payment by a particular date—most businesses allow 2 weeks

- How to pay (list all your payment methods)

- What happens if they don’t pay by then

5. Send a Final Demand Letter

Now things are moving from “let’s sort things out between ourselves” to “I’m going to have to get a third party involved.” If your final notice letter doesn’t get results, your next step is a definite escalation to a formal final demand letter.

This letter demands payment from a client by a certain date and states that formal collection procedures will follow if it’s ignored.

You’ll need to prove that you sent a final demand letter to your client if you decide to pursue legal action.

It must include the following:

- A clear statement that the client has defaulted on invoice payments

- Total amount your client owes, this includes any additional late fees

- Due date by which you must have received full payment

- The consequences if your client refuses to make payment by the due date

At this stage, it’s advisable to pay an attorney to write and send this on your behalf. An official legal letter may be enough to prompt action. And a letter costs far less than hiring legal representation for a lawsuit.

It’s not the start of full legal action or a summons to small claims court. And you’re not bound to this attorney should you decide to proceed with further legal action.

What if the final demand letter doesn’t get results?

You’ve got three main options to collect money from clients who don’t respond to your final formal letter: Arbitration, a collections agency, or legal action. All three will cost money, time, and some level of stress. So it’s important to weigh things carefully before deciding on your next move.

6. Hire a Collection Agency

To escalate the situation and get outside help to collect your money, you can consider hiring a collection agency. They are often very successful at collecting payments from debtors. But they charge a hefty fee for the service, often as much as 50 percent of the total payment. However, getting back at least some of the money you’re owed can be a good option.

Collections agencies buy the debt from you for less money and are fully responsible for recovering the money. Both state and federal laws regulate collection agencies.

7. Go To Arbitration or Take Legal Action

Instead of going to court, you can opt to take the client to arbitration instead. Arbitration can be a relatively quick and cheap way to collect payment from a client. You hire a third party (an arbitrator) to make a decision based on the evidence you provide. The arbitrator’s judgment can be enforced in the same way that a judge’s can.

If the outstanding debt isn’t too large, but you don’t think you’ll be able to collect it alone, you can consider suing the client for non-payment and taking them to small claims court. Every state has small claims courts that resolve disputes involving relatively small amounts of money, usually to a maximum between $2,000 and $10,000, depending on the state. Small claims court is relatively inexpensive and quick. You don’t need a lawyer to represent you; if the client doesn’t show up, which is common, you’ll win by default.

If the money you’re owed exceeds the limits set for your state’s small claims court, you can sue your client in superior court. Superior court cases usually take more time to go to trial than small claims cases, and you may wish to have a lawyer representing you. There are substantial legal costs involved if you go down this route. You also need to assume there will be no future working relationship with this client if you decide to sue them.

The Problem with Non-Paying Clients

Cash flow issues can be extremely damaging to the health of your business. We all like to operate in good faith, expecting all parties to act professionally. And maybe all your clients have been great so far.

But it’s wise to have a plan before anything goes wrong. The probability is that you’ll need a system to collect overdue money from a client. Just ask the question at your next networking meeting.

The Freelancers Union were so concerned that they completed a large piece of research in 2014 and found that 71 percent of freelancers struggle to collect late payment from a client at some point in their careers. And 2,500 of the 5,000 participants said they’d experienced total non-payment at least once during their freelance career. This totaled an average annual loss of $6,000 in unpaid invoices.

Given the growth in the freelance economy, imagine how much that’s risen now.

Statistically, this is a problem you’ll face at least once in your career. So, let’s dive into how to collect money from clients who won’t pay.

Tips To Protect Your Future Invoices

Here are 5 top tips to protect your business from clients that don’t pay.

1. Draw Up a Contract

Make sure you have a written contract agreed upon before you start any work. This must contain your payment expectations, payment terms, payment process, payment options, payment plan, and payment deadline.

It’s also worth talking through all elements of how clients can pay you and all these other details at contract signing time. This gives clients the chance to clarify any details and gives you the reassurance that they fully understand.

2. Send an Invoice

Send invoices as soon as the work is complete. Make sure they are accurate and make it as easy as possible for clients to pay invoices. This promptness shows that you value your own payment terms. You must also track invoices thoroughly, so you can intervene quickly if a customer refuses to pay.

3. Apply Late Fees

To encourage clients to pay on time in the future, consider adding a clause to your payment terms that include late payment fees that you’ll charge for overdue payments. Be sure to talk to your clients about your late fees during your initial contract conversation. They shouldn’t be a surprise on your invoice.

Looking to avoid late fees for your own business? FreshBooks has developed powerful expense tracking software to help you stay on top of your latest expenses. Cut down the risk of late fees while creating handy digitized versions of paper invoices.

4. Make an Early Payment Offer

This is the carrot to the late fees stick. Some businesses offer money off to clients who pay early. It’s usually a small percentage of the total invoice, for example, 5% off, if they pay before a certain date. If you decide this is a good option for you, think about the wording of the offer carefully. Make sure it’s very specific, and be clear about the parameters.

5. Request a Deposit or Payment Schedule

To better protect yourself from late payments in the future, consider requesting a deposit when you sign a contract for new work. It’s common practice to request a deposit of 25% to 50% of the contract’s total value from clients.

As a small business, you may want to secure payment upfront, either at 50% or 100% of the total, before starting a project. For a longer-term project, it might be best to create a schedule of payments at milestones during the project. For example, as a section of work is complete or on a monthly basis.

Conclusion

It can be hard to know how to collect money from clients who won’t pay, but as you can see, you do have options. From making calls to the extreme of hiring a collection agency, it is possible to get your money. But often, you’ll find with a good attitude and reasonable communication, you won’t have to use extreme measures to get your payments — and you’ll maintain your professional business relationships.

Make it a breeze for your clients to easily send you money for their upcoming bills. FreshBooks has developed an online payment processing system that simplifies the process into a few easy steps. With direct checkout links and no hidden fees, FreshBooks keeps it simple and hassle-free for both you and your clients. Dive into a brand new world of simplified payment processing with FreshBooks today.

FAQs on How to Collect Money from Clients Who Won’t Pay

How do you ask for payment professionally in a message?

If this is your first time reaching out, a gentle reminder may be all that’s required to ensure that the client completes their payment. However, if you’ve reached out previously without success, a direct phone call or even a letter written by your legal representative may be the best way to proceed.

How do you motivate customers to pay?

Motivating customers to pay their bills comes down to taking a preventative stance towards late payments. The best way to support customers in finalizing their payments is to offer incentives for early payment, deter late payment through additional fees, and also set up a payment schedule that breaks large payments into smaller chunks.

How do you follow up with a client without being annoying?

If you’ve provided a service to a client and they haven’t paid you by the agreed-upon date, you have a right to ensure you collect payments for your services. With that said, always keep it professional and keep in mind the challenges that another small business owner might face. More often than not, a gentle reminder combined with a phone call at a later date will do the trick.

Can a business sue a customer for non-payment?

Yes, a small business owner can sue a customer for non-payment if they’ve exhausted all other options like repeated follow-up phone calls, emails, and letters. At this point, they may contact a legal representative and determine their next steps.

What legal action can be taken for non payment?

You can take two courses of action: small claims court and a civil lawsuit. It’s best to consult with a lawyer to determine which is best based on the specifics of your case. While consulting with a lawyer may cost a bit upfront, it is worth it in the long run. A lawyer can set you on the right path and help you decide if you have a case and if it’s worthwhile taking it to court.

About the author

Claire is a freelance writer living in the UK and can be found online at Copy Content Writer Claire loves working with words, thoroughly enjoys the research part of her job, and approaches it with the integrity and scepticism necessary to deliver authoritative writing.

RELATED ARTICLES

How to Set Up Automatic Payments for Your Business

How to Set Up Automatic Payments for Your Business Online Payment Methods For Small Businesses: How to Choose

Online Payment Methods For Small Businesses: How to Choose Invoice Payment: What It Is, Effective Methods and Tips

Invoice Payment: What It Is, Effective Methods and Tips Automatic Bill Payment: What It Is, How to Set It Up, Pros and Cons

Automatic Bill Payment: What It Is, How to Set It Up, Pros and Cons What Is a Recurring Payment? How to Get Paid Faster with Automatic Billing

What Is a Recurring Payment? How to Get Paid Faster with Automatic Billing How to Accept Credit Card Payments

How to Accept Credit Card Payments