Invoice Number: What It Is and How To Generate One

An invoice is a bill that includes a list of products or services provided to a client for payment. Sellers or vendors issue invoices toward the end of transactions after the product is delivered or the service is provided.

An invoice details the previously agreed-upon price the buyer pays now that the order is complete.

As a business owner, when your business grows, you’ll send out tons of these —which is a good problem to have but hard to track. That’s where invoice numbers come in. Set up a system to assign invoice numbers and maintain a consistent invoice number format. These handy numerals make it far easier for small business owners to manage each accounting period, avoid duplicate payments, get paid faster, and come out the other end of a tax audit unscathed.

Let’s learn more about these magical digits known as invoice numbers or invoice IDs—including how to choose, assign, track, and record them. With examples, of course!

Table of Contents

- What Is an Invoice Number?

- What Should an Invoice Include?

- Why Is an Invoice Number Important?

- Why do Invoices Need an Invoice Number?

- What Invoice Number Should I Start With?

- How Can I Correct Invoice Number Errors?

- What Is the Difference Between an Invoice and Receipt?

- Does an Invoice Require a Receipt?

- Frequently Asked Questions

What Is an Invoice Number?

An invoice number or invoice ID is a unique number generated by a business issuing an invoice to a client. You’ll find invoice numbers on digital and paper invoices as a way to track payments. When the client makes a payment, they’ll reference this invoice ID number to see what the payment is for and to keep track of where their money goes.

Tracking invoices between several projects and clients can be a pain—and once the invoice is sent out, it’s an added complication to track payments. It’s enough to keep you up at night. Who deserves a good night’s sleep more than you?

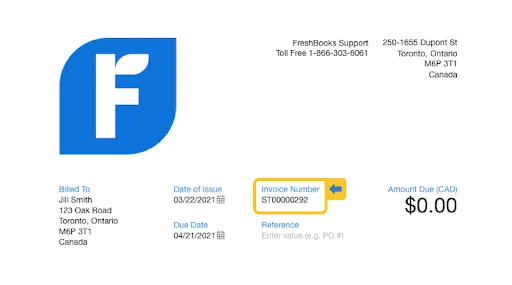

This is where FreshBooks makes your life simpler with just a few clicks. A logical invoice numbering system lets you sleep easily, knowing you’ve been paid for the goods and services you provide. (However, if your partner snores, FreshBooks cannot help you with that.)

What Should an Invoice Include?

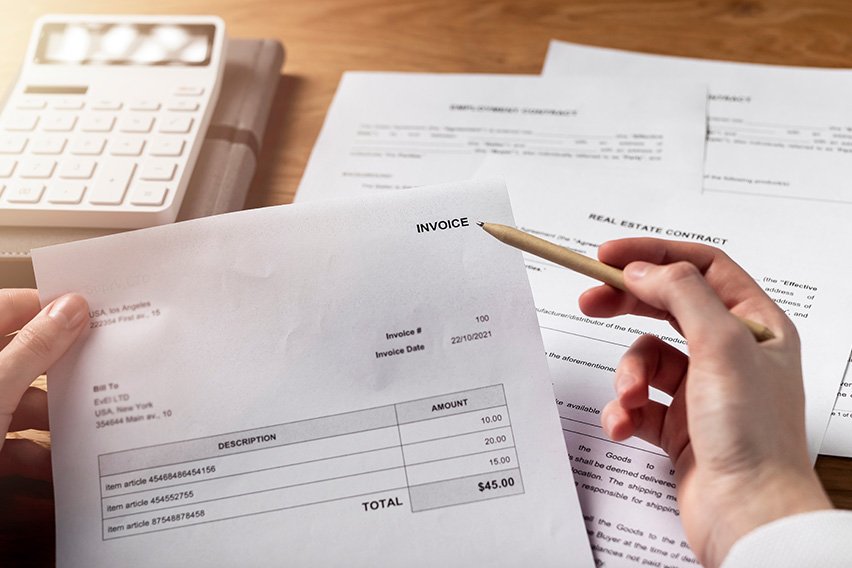

A proper invoice should include:

- The date

- An invoice number

- Vendor contact name, company name, address, phone number, and email

- Client contact name, company name, address, phone number, and email

- Purchase order number

- A description of products or services, including prices and quantities

- Delivery dates for products or services

- Subtotal

- Taxes

- Grand total

- Payment terms (i.e., payment due date)

- Late fees warning

- Payment options

Practice creating your first invoice with this free invoice template.

Why Is an Invoice Number Important?

Assigning invoice numbers is important because they allow a business to track whether payments have been made and by whom.

Example time! Hollywood Limousine Services (HLS) issues 50 professional invoices in September. By December, HLS can tell 45 of those invoices have been paid. How can they tell? Because each client has referenced the invoice number with their payment. Now all they have to do is follow up with the five remaining clients who still need to pay their invoices.

Accounting software like FreshBooks makes this even easier by making unpaid invoices simple to find. This is a huge relief when your invoice numbers reach double or even triple digits. FreshBooks’ invoicing system helps you track old invoices, avoid duplicate payments, and prepare for future invoices.

Why Do Invoices Need an Invoice Number?

Invoices require an invoice number to identify them. Since the invoice number is a unique record number assigned sequentially, both the buyer and the seller refer to it for tax and accounting purposes. Often clients will reject invoices that don’t provide an invoice number or invoice ID because paying it makes it impossible or difficult to track payments and could lead to payment duplication.

If the invoice ID is missing, the vendor has to spend time reissuing the invoice—and who wants more work and confusion?

What Invoice Number Should I Start With?

You can choose whatever logical numbering system makes the most sense for the way you do business. Chronological invoice numbering is a great example. This system is based on assigning sequential invoice numbers—i.e., each invoice issued is one number higher than the previous one. If you issue three separate invoices to one customer, the invoice numbers won’t necessarily be sequential for that client since another company may be issued an invoice in the interim.

Invoice numbers aren’t limited to sequential or chronological invoice numbering systems. Custom invoice numbers are entirely up to the business issuing the invoices. There are no federal laws or state financial regulations regarding what a company’s invoice numbering system must include. A company can generate an invoice number sequence using whatever method works best, chronological or otherwise.

It’s important to choose a logical invoice numbering system to make tracking more manageable. However, beyond that, you can number invoices however you want. Using Excel can be a great choice, as the Excel invoice number generator helps generate unique numbers while keeping track of these numbers to avoid any duplication. This feature ensures that the invoice numbering system remains organized and prevents any potential reputational issues arising from repeated invoice numbers.

Here are some tips and best practices for creating an invoice numbering system that works best for you.

Use an Identifier

Let’s use our old friend Hollywood Limousine Services again for this example. The company’s accounting department wants a unique identifier to record invoice numbers, so they’ve decided to use the first letter of each word in their name to start all of their invoice numbers. As such, it reads as “HLS0001”.

If you’re invoicing a company with a large number of vendors, these alphanumeric invoice numbers can separate you from all the others who are just using “0001”, in case you need to track payment later.

An alternative is to use a customer number as an identifier. Suppose your business is larger, and every client has an exclusive client number. In that case, you could create an effective invoice numbering system that starts with the customer number, followed by sequential invoice numbers. For instance, if Hollywood Limousine Services is issuing an invoice to client #742, the invoice number would be “742-0001.” Using this invoice number format makes it easy to quickly identify the customer it belongs to.

Lastly, you could just use the date the invoice was generated. For instance, if HLS issued an invoice to a client on December 18, 2018, the invoice number would be “121818-0001,” or if they wanted to use a combo date/client number system, the number would be “121818-742-0001.”

Go With Sequential Numbering

Sequential numbering is an accounting and auditing best practice. You deserve the best! Example time again: If your system says you raised ten invoices this month, but you check your printed records and only find nine, this can indicate several things. Maybe your records are incomplete. Or maybe an employee’s been making fake invoices in your system. Either way, a sequential numbering system lets you keep better tabs on your invoices and pinpoint where the problem lies.

Keep your invoices easy to track, and always start from the beginning. You don’t want to make up invoice numbers, like “HLS0009,” for your first invoice. Start with “HLS0001” and take it from there. Every time you issue a new invoice number, it should be the next sequential number—in this case, “HLS0002.”

Use Invoicing Software

Overwhelmed by your first invoice? No need! Accounting software like Freshbooks makes invoice numbering and payment processing stress-free. Most online invoicing accounting software automatically generates invoices for you, with fields for you to enter the proper information. The software will create an invoice number too, which you’re free to use, modify, or replace if you prefer to assign invoice numbers another way.

For tracking purposes, invoicing software will tell you when a payment is overdue. At that point, you can easily reference any invoice numbers when you reach out to the client to check on payment status.

Only use invoice numbers once, even if you’re invoicing different companies. Accounting software and free invoice templates help you keep your invoice numbering accurate across all of the businesses you partner with, ensuring each customer number is a unique code.

How Can I Correct Invoice Number Errors?

Mistakes happen. If you issue a duplicate invoice number, the solution depends on where you are in the payment process. If you catch it before sending the invoice to the client, change it and send it to the customer. If it’s sent but not yet paid, send a quick email or make a phone call to inform the customer you’ll be sending a new invoice with the corrections made.

A few extra steps are required for payments made to a duplicate invoice number. Ideally, you want to revise the duplicated invoice number and send this revised invoice to the payer. In writing, both parties agree that payment will go to the new invoice number. For very strict institutions, such as banks, you’ll want to refund the money, cancel the duplicate invoice, and re-issue it properly.

These options allow you and the payer to keep the accounting records accurate and avoid future complications.

FreshBooks helps you avoid these errors, eliminating the need to track your invoice number count.

What Is the Difference Between an Invoice and a Receipt?

A vendor issues an invoice to notify a client that payment is due. A receipt, typically issued by a retailer, shows that payment has been made. Generally, retail doesn’t provide invoices—you simply purchase the item, and the store gives you a receipt for your payment.

Does an Invoice Require a Receipt?

Although receipts and invoices track payments, typically, an invoice doesn’t require a receipt. Let’s explain with examples.

Tom’s Coffee provides coffee delivery to various businesses in the San Diego area. He issues a client, Sal’s Surf Cafe, an invoice for $842.00. According to the terms, Sal must pay Tom within 30 days. Sal makes a payment within three weeks in the form of a check to Tom. Tom cashes the check. At that point, if there’s any discrepancy in payment, Sal can confirm with his bank that Tom cashed the check. A receipt is not necessary.

Let’s use another example. Tom’s company doesn’t issue an invoice at all. Instead, when he arrives at Sal’s Surf Cafe and delivers the coffee, Sal pays him in cash right then and there. Tom would then issue a receipt showing that the goods are paid for.

FAQs on Invoice Number

What Is a PO Number on an Invoice?

A purchase order (PO) number indicates which purchase order the invoice deals with. This is important to track orders and confirm quantity and price.

Is the Invoice Number the Same as the Receipt Number?

Invoice numbers are different from receipt numbers. An invoice number helps you track multiple invoices sent to clients to indicate payment is due. A receipt number helps track receipts, which are given when a payment is made.

When Should I Change My Invoice Number?

Change your invoice number with each new invoice. From the first invoice number onward, there should never be a duplicate number. Giving each business transaction an assigned invoice number makes tracking transactions much easier—especially once you get into double or triple figures.

Can I Add an Invoice Number to a Proforma Invoice?

Generally, a proforma invoice, also known as a quote, wouldn’t have an invoice number. If you include one, you’ll have to reserve that invoice number, which may create gaps in your sequential invoice numbering system. Consider listing a proforma as “Quotes” at the top for less confusing terminology.

About the author

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

How to Pay an Invoice in 5 Easy Steps

How to Pay an Invoice in 5 Easy Steps What Is a P.O. Number on an Invoice and How to Use It

What Is a P.O. Number on an Invoice and How to Use It Net 30 : What Is It and How Does It Work?

Net 30 : What Is It and How Does It Work? How to Get a Client to Pay an Invoice: 8 Effective Tips

How to Get a Client to Pay an Invoice: 8 Effective Tips How to Write an Invoice Letter: A Small Business Guide

How to Write an Invoice Letter: A Small Business Guide 8 Tips to Write an Overdue Invoice Letter That Will Get You Paid

8 Tips to Write an Overdue Invoice Letter That Will Get You Paid