What Is Expense Analysis & How to Analyse Business Account

This quick guide will show you how to analyze your company expenses for a healthier business.

A healthy happy business is a balancing act…literally. Your balance sheet is the act of managing a good business. You might have the best products and services in the world. It’s not sustainable if you’re not making a profit.

So let’s dive into how to do expense analysis as a little health check for your business account.

Here’s What We’ll Cover:

How to Analyze Your Business Expenses Step-by-Step

What Is Expense Analysis?

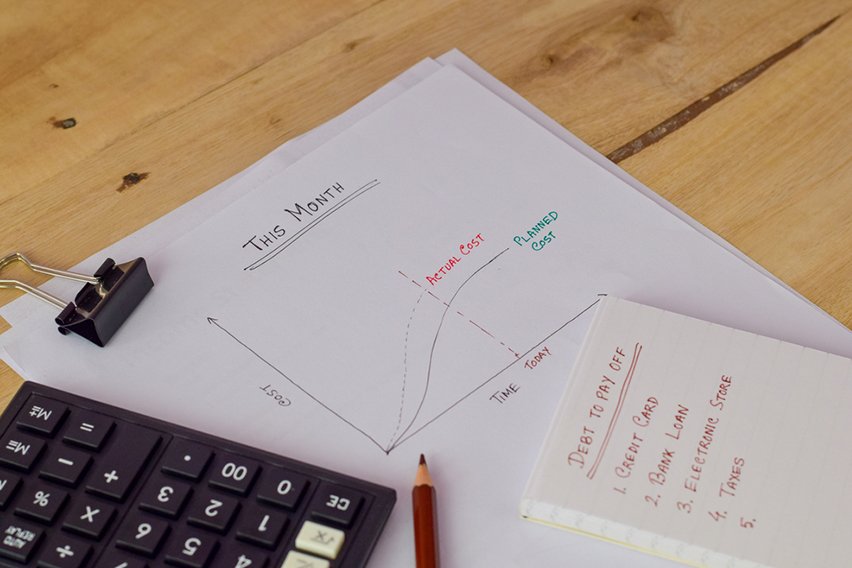

Expense analysis is essentially number crunching. Diligent business management involves taking stock of your financial statements.

What’s coming in? What’s going out? How can you improve?

Your expense trends are particularly important to pay attention to. You may find that some expenses are slowly creeping upward over time. Why is that? Is it benefitting the business at all?

Doing a thorough expense analysis once a month or once a quarter can help you spot the signs of a struggle early on.

Types of expenses to track

- Operating expenses e.g manufacturing

- Administrative expenses e.g rent, travel, insurance

- One-time expenses e.g licensing, business registration

- Marketing expenses e.g paid advertising, graphic design

How to Analyze Your Business Expenses Step-by-Step

- Write Down Your Revenue and Sales

First, decide on the time period you are measuring. It could be the month or the quarter. You need to input all of your revenue and sales into your spreadsheet. If you have accounting software like FreshBooks, this step can be completely automatic. Our system allows you to link your bank account to pull data. That way, you can see all the money coming in, and categorize it. - Write Down All of Your Expenses

Again, accounting software will do this for you. All outgoings need to be tagged and categorized for expense analysis to be accurate. Tag your expenses appropriately. For example, travel expenses, marketing, office equipment, labor costs. They all need to be accounted for on your balance sheet. - Calculating Your Gross Margin

Your gross margin is your revenue minus the cost of goods sold. The cost of goods sold includes the expenses that specifically align with delivering your service or product. These are raw materials and manufacturing mostly. This does not include labor or administrative costs.

Your gross margin is the amount of available profit you could be making on your sales.

If you have a service business, your gross margin is very high. This is because you don’t have many material costs that affect your business. The rest are variable expenses that you can control. - Calculate Your Profit Margin

To calculate your actual profits, you need to account for all of your expenses.

So, subtract the total expenses from step 2 from your revenue. What do you have left?

The remaining number is your gross profit.

It can be alarming to see a negative gross profit. While it isn’t great news, many businesses go through negative profit in the beginning. This is because you are investing more in the business than the business is making in revenue. You can turn that around. What gets measured, gets managed. - What Can You Do Better?

This is where the “analysis” part comes in. Your expenses are all within your control. Apart from raw materials and manufacturing costs, your expenses are rarely fixed.

You can downsize offices. You can hire fewer people. You can use free marketing tactics as opposed to paid advertising.

If your business is losing money, it’s time to review your expense budgets.

Key Takeaways

Expense analysis is a vital skill for any business owner. To ensure the longevity of your business, you must know where all your money is disappearing. Keeping an eye on your balance sheet will help to keep your expenses in check overall.

The best way to do an expense analysis is to use a digital accounting system. It will be far easier to pull automatic expense reports to see where you could be overspending. FreshBooks is an all-in-one solution that intuitively tracks your expenses. Everything is outlined clearly for you, so you can make the best decisions for your business going forward.

To learn more about our expense reporting software and accounting tools, click here.

For more guides on managing your business expenses, our resource hub will provide!

RELATED ARTICLES

What Is Amex Express Checkout & How Does It Work? A Guide

What Is Amex Express Checkout & How Does It Work? A Guide What Are IRS Mileage Log Requirements?

What Are IRS Mileage Log Requirements? Standard Mileage Vs Actual Expenses Tax Deduction

Standard Mileage Vs Actual Expenses Tax Deduction What Is an Expense Claim? Definition & How to Manage

What Is an Expense Claim? Definition & How to Manage How Employees Can Claim Work-Related Expenses

How Employees Can Claim Work-Related Expenses