Tax Deductions for Start-up Businesses

If you’re starting a new business, you can deduct up to $5,000 of your start-up costs and $5,000 of your organizational costs as allowable business expenses in the year your business begins. The costs that are eligible for business start-up tax deductions for LLC include market research expenses, marketing and advertising expenses, employee training, and professional fees associated with establishing your business structure and organization. This only applies if you’re total start up costs are less than $50,000.

Start-up and organizational costs are generally treated as capital costs for tax purposes. The IRS considers them long-term assets — you’re investing in the future of your business.

What this article covers:

- What Are Some Start-up Costs for A Business?

- Are Business Start-up Costs Tax Deductible?

- How Much Start-up Costs Can You Deduct?

What Are Some Start-up Costs for A Business?

Start-up costs are expenses that you incur while starting a new business. Since all businesses are different, the start-up costs vary. However, some of the common expenses include:

- Employee hiring and training

- License and permits

- Technological expenses

- Borrowing costs

- Advertising and promotions

- Equipment and supplies

- Interest charges

- Insurance

- Rent

- Travel costs

- Utility bills

- Legal expenses

Are Business Start-up Costs Tax Deductible?

According to the Internal Revenue Service (IRS), start-up costs can be categorized into start-up costs and organizational costs.

Following are three specific categories of business start-up costs that are eligible for tax deductions.

- Creating a Business: The research costs incurred while creating a trade or a business includes costs for market and product analysis, feasibility studies, visiting potential locations, competitor analysis, examining the labor supply, etc.

- Launching the Business: It includes setup costs for the business such as employee hiring and training, consultant fees, travel costs and advertising and professional fees.

- Organization Costs: This includes expenses for setting up your business as a legal entity such as accounting fees, incorporation fees, director expenses, state and legal fees and expenses for conducting any organizational meetings. These costs must have been incurred before the end of your first tax year in business.

Business start-up costs are not just for one year. This is why these start-up costs, other than the amount you elect to deduct, are chargeable to a capital account and amortized over the life of the business.

They are outlined in detail in Chapters 7 and 8 of IRS Publication 535.

Not Eligible for Tax Deductions

- Capital expenses such as buildings, vehicles and equipment are considered for tax purposes separately.

- Expenses incurred before the business start date.

- Expenses incurred for entering a certain type of business, such as real estate, are non-deductible business expenses.

How Much Start-up Costs Can You Deduct?

For the first year of its operations, the IRS permits a start-up tax deduction of $5,000 for start-up costs and an additional $5,000 for organizational costs.

If you have start-up or organizational costs over $50,000, your available first-year deductions will be lowered by the amount that you exceed $50,000. The remaining amount must be amortized.

For example, if your start-up costs are $52,000, you’ll only be able to deduct $3,000 ($5000 minus $2000) in the first year of business. The remainder is amortized. To learn more about these expense deductions, follow our guide on Claiming Expenses Before Your Business Started. In the guide, we have explained what expenses you can deduct and the maximum deductible amount.

More Useful Resources

Explore our diverse tax deduction guides catering to various niches. From small businesses to real estate agents, find valuable insights to optimize your tax savings.

RELATED ARTICLES

Tax Deductible Donations: Can You Write Off Charitable Donations?

Tax Deductible Donations: Can You Write Off Charitable Donations? Tax Deduction for Legal Fees: Is Legal Fees Tax Deductible for Business?

Tax Deduction for Legal Fees: Is Legal Fees Tax Deductible for Business? Business Deductions: New Tax Plan Explained

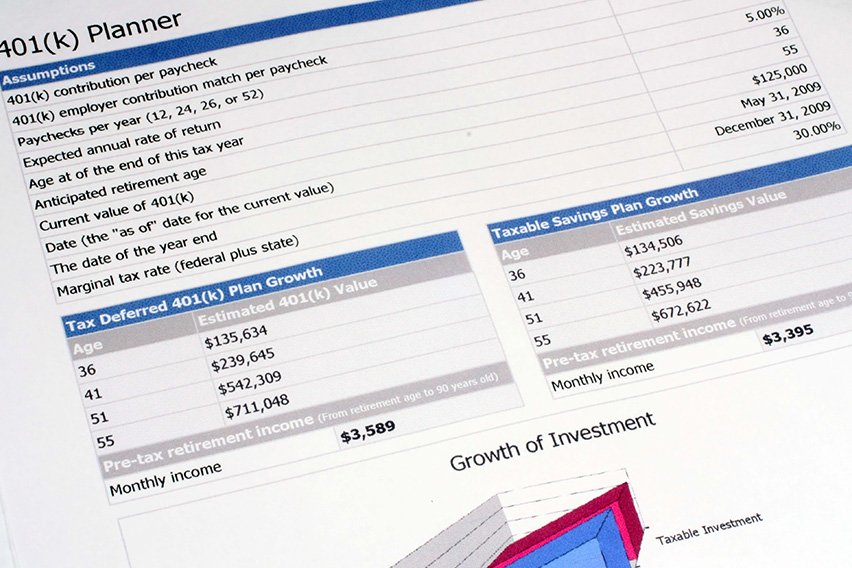

Business Deductions: New Tax Plan Explained How to Set Up a 401(k) in 4 Easy Steps (For Small Business)

How to Set Up a 401(k) in 4 Easy Steps (For Small Business) Can You Write-Off Expenses Before Incorporation? Certain Expenses, Yes

Can You Write-Off Expenses Before Incorporation? Certain Expenses, Yes Nanny Tax Deduction: Can You Write-Off Nanny Expenses?

Nanny Tax Deduction: Can You Write-Off Nanny Expenses?