What Is a Ledger in Accounting?

A ledger is a book or digital record containing bookkeeping entries. Ledgers may contain detailed transaction information for one account, one type of transaction, or—in the case of a general ledger—summarized information for all of a company’s financial transactions over a period.

Ledgers are also known as the second book of entry.

Ledgers contain the necessary information to prepare financial statements.

What this article covers:

- What Is a Ledger?

- What Is a Ledger Account?

- How Do You Write a Ledger?

- General Ledger Example

- What’s the Difference Between a Journal and a Ledger?

What Is an Accounting Ledger?

A ledger is a book or digital record that stores bookkeeping entries. The ledger shows the account’s opening balance, all debits and credits to the account for the period, and the ending balance.

Companies can maintain ledgers for all types of balance sheet and income statement accounts, including accounts receivable, accounts payable, sales, and payroll. Transactions from subsidiary ledgers are periodically summarized and transferred to the general ledger, which contains transaction data for all accounts in the chart of accounts.

Preparing a ledger is important as it serves as a master document for all your financial transactions. Since it reports revenue and expenses in real-time, it can help you stay on top of your spending. The general ledger also helps you compile a trial balance, spot unusual transactions, and create financial statements.

What Is a Ledger Account?

A ledger account is a record of all transactions affecting a particular account within the general ledger. Individual transactions are identified within the ledger account with a date, transaction number, and description to make it easier for business owners and accountants to research the reason for the transaction.

Examples of common ledger accounts include:

- Asset accounts, such as cash, prepaid expenses, accounts receivable, and furniture and fixtures

- Liability accounts, including accounts payable, accrued expenses, lines of credit, and notes payable

- Equity accounts, such as common stock, retained earnings, shareholder distributions, and paid-in capital

- Revenue accounts, including sales and service fees

- Expense accounts, such as advertising expenses, utilities, rent, salaries and wages, and supplies

- Other income and expenses, such as interest, investment income, and gains or losses from the disposal of an asset

Check out the post “Maintaining a General Ledger” from Wolters Kluwer for a more extensive list of general ledger accounts that might apply to medium to large businesses.

How Bookkeepers Use Ledger Accounts

The company’s bookkeeper records transactions throughout the year by posting debits and credits to these accounts. The transactions result from normal business activities such as billing customers or purchasing inventory. They can also result from journal entries, such as recording depreciation.

The ledger might be a written record if the company does its accounting by hand or electronic records when it uses accounting software. According to CPA Practice Advisor, only 18% of small- to medium-sized businesses do not use accounting software.

How Do You Write an Accounting Ledger?

Most businesses use accounting software that posts all financial transactions directly to the general ledger. However, if you want to create your own general ledger, you’ll first need to understand the basics of double-entry bookkeeping.

In the double-entry system, each financial transaction affects at least 2 different ledger accounts. Each entry is recorded in two columns, with debit postings on the left and credit entries on the right of the ledger. The total of all debit and credit entries must balance.

Here is how to create your ledger and put it to use:

Step 1: Set Up Ledger Accounts

Start with the 5 account types: Assets, Liabilities, Equity, Revenue, and Expenses (and perhaps Other Income and Expenses). Within each account type, list the accounts you need. For example, under the Asset account type, you’ll create a Cash account and an Accounts Receivable account.

Step 2: Create Columns

Make columns on the far left of the page for the date, transaction or journal entry number, and description.

Make columns on the right side for debits, credits, and running balance. Debits increase asset and expense accounts and decrease liability, revenue, and equity accounts. Credits increase liability, revenue, and equity accounts and reduce assets and expenses.

Step 3: Record Financial Transactions

Day-to-day, record your business transactions as they occur. If you’ve made a journal entry, post it to the ledger immediately.

Step 4: Create a Trial Balance

Summarize the ending balances from the general ledger and present account level totals to create your trial balance report. The trial balance totals are matched and used to compile financial statements.

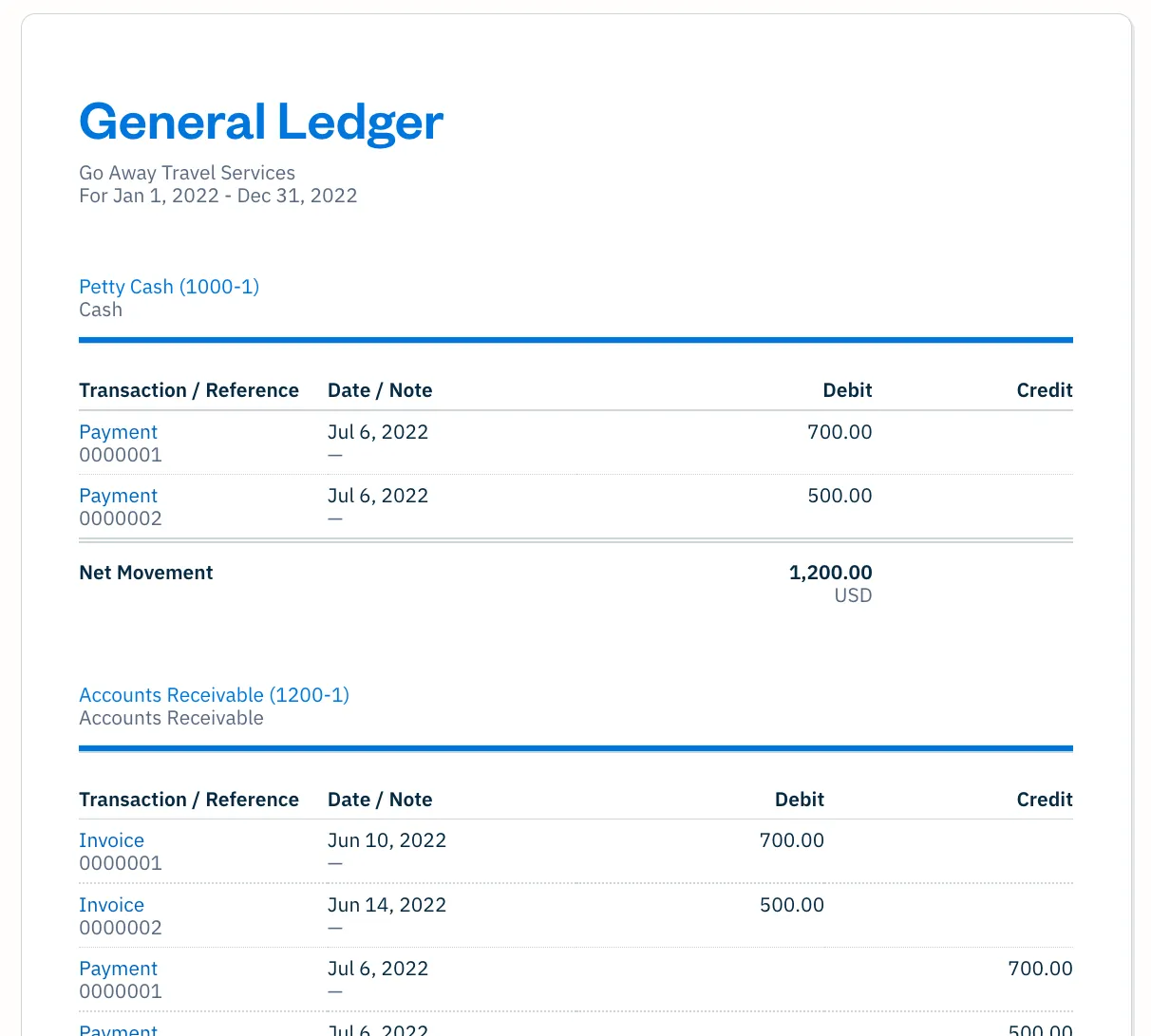

General Ledger Example

Following is an example of a general ledger report from FreshBooks. It shows all of the activity for accounts receivable for the month of April, including debits and credits to the general ledger account and the net change to the account for the month.

Check out this downloadable general ledger template if you want to create your own General Ledger.

What’s the Difference Between a Journal and a Ledger?

Both the accounting journal and ledger play essential roles in the accounting process. Bookkeepers primarily record transactions in a journal, also known as the original book of entry.

After that, the bookkeepers can post transactions to the correct subsidiary ledgers or the proper accounts in the general ledger. While many financial transactions are posted in both the journal and ledger, there are significant differences in the purpose and function of each of these accounting books.

Ledger Meaning vs. Journal Meaning in Accounting

In the double-entry bookkeeping method, financial transactions are initially recorded in the journal. It’s also known as the primary book of accounting or the book of original entry. The journal must include detailed descriptions for every transaction.

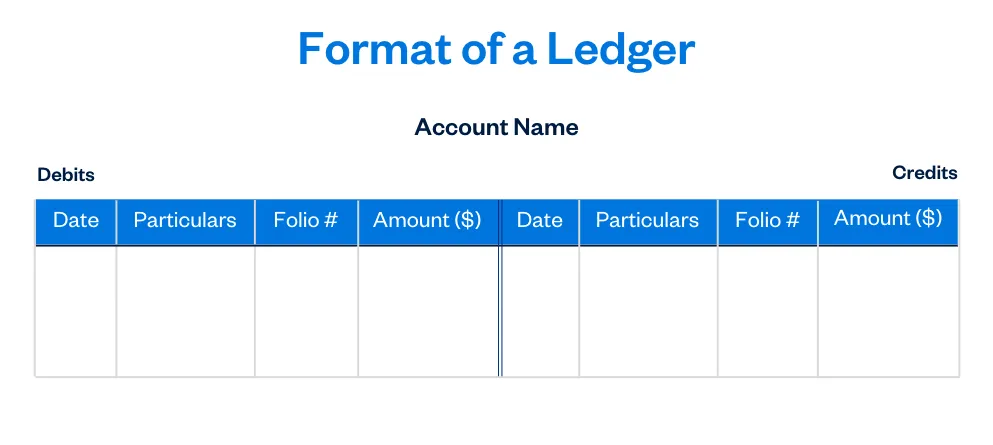

On the other hand, the ledger is the second book of entry because it has summarized information from the journal in the “T-account” format. It is used to create the trial balance, which is also the source of financial statements such as the income statement and the balance sheet

Recording Transactions

Journalizing is the process of recording transactions in a journal as journal entries. Posting is the process of transferring the all the transactions to the ledger.

Journal entries are recorded in chronological order, making it easy to identify the transactions for a given business day, week, or another billing period. By contrast, entries in a ledger might group like transactions into specific accounts to assess the data for internal financial and accounting purposes.

Transactions that occur frequently—such as revenues, cash receipts, purchases, and cash payments—are typically recorded as journal entries first.

Format

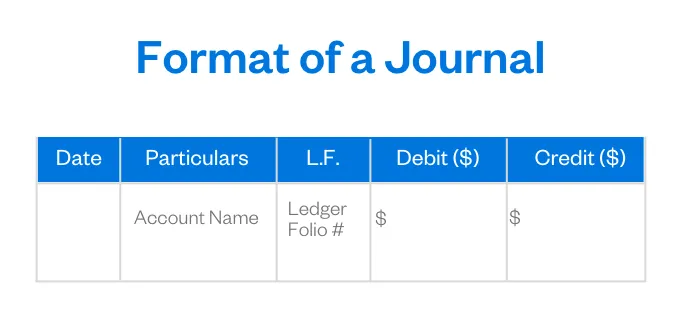

A journal format is simple. It includes the transaction date, particulars of the transaction, folio number, debit amount, and credit amount. There’s no need to balance journal entries.

The ledger uses the T-account format, where the date, particulars, and amount are recorded for both debits and credits.

Ledger accounts almost always start out with an opening balance. For balance sheet accounts, the opening balance is usually the closing balance from the previous period. Income statement accounts start with an opening balance of zero because revenues and expenses should have been closed to retained earnings at the end of the prior period. At the end of the period, all ledger amounts should balance. In other words, debts must equal credits.

Preparing a ledger is vital because it serves as a master document for all your financial transactions. Since it reports revenue and expenses in real-time, it can help you stay on top of your spending. The general ledger also enables you to compile a trial balance and helps you spot unusual transactions and create financial statements.

Using a ledger, you can maintain an accurate record of your business’s financial transactions, generate financial reports, and monitor business results.

But you don’t have to be intimately acquainted with journals and ledgers to keep tabs on the financial health of your business. Using the best accounting software or working with a professional bookkeeper or accountant makes it easier to record every transaction and make sure they balance every time.

About the author

Janet Berry-Johnson, CPA, is a freelance writer with over a decade of experience working on both the tax and audit sides of an accounting firm. She’s passionate about helping people make sense of complicated tax and accounting topics. Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, Credit Karma, and Discover, among others. You can learn more about her work at jberryjohnson.com.

RELATED ARTICLES

What Is Accounting? The Basics, Explained

What Is Accounting? The Basics, Explained What Is Management Accounting?

What Is Management Accounting? What Are Liquid Assets? A Primer for Small Businesses

What Are Liquid Assets? A Primer for Small Businesses Allowance for Doubtful Accounts: Deduction Technique Explained

Allowance for Doubtful Accounts: Deduction Technique Explained Closing the Books: Basics & 8 Steps Guide

Closing the Books: Basics & 8 Steps Guide  When Should I Hire an Accountant

When Should I Hire an Accountant