Percentage of Completion Method Decoded

Based on the revenue recognition framework, the percentage of completion method is an accounting method that allows businesses to record revenues on an ongoing basis depending on the stage of project completion.

The costs incurred in reaching each stage of completion are matched to the revenue. This allows profits and losses to be attributed to the proportion of work completed. The percentage of completion method is usually used by construction companies for multi-period contracts. It provides a rational way of knowing how much to bill a client in each period.

What this article covers:

What Is the Percentage of Completion Method?

This percentage of completion method recognizes revenue and income related to long-term projects. The justification relies on the matching principle in accounting, where revenues and expenses are matched in the applicable accounting period.

For example, if you’re handling a long-term construction project, the percentage of completion method will help you identify the revenues and gross profit in the applicable periods of constructions, and not solely in the period when the construction is over.

The two conditions for using this method are:

- The contract specifies the rights regarding goods and services to be provided

- The buyer and seller are expected to perform or satisfy all the contractual obligations

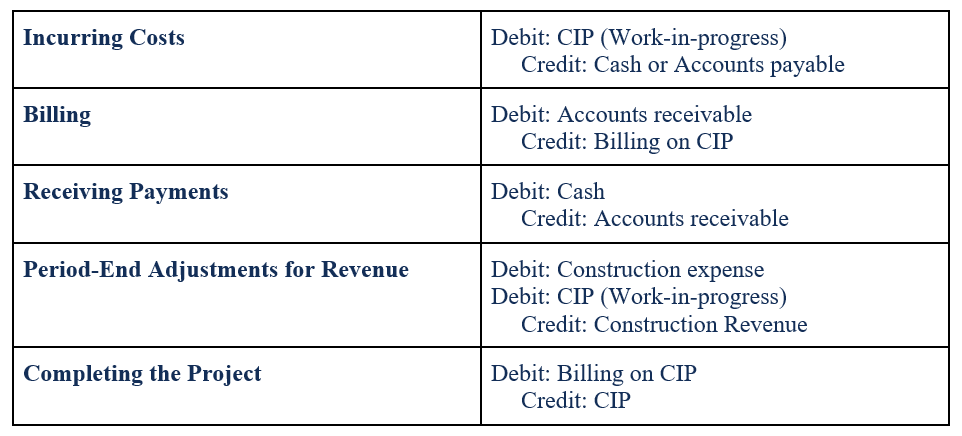

Percentage of Completion Method Journal Entries

While using this method, you need to post entries for the transactions allocated to the current period. If 20% of the work is completed in the current accounting period, the business recognizes only 20% of the profit in the current year. On completion, adjusting journal entries are made to adjust the differences.

How Do You Calculate the Percentage of Completion?

While using the percentage of completion method, companies can calculate the percentage of completion using either the input or output measures.

The input method measures the materials and labor required to satisfy an obligation. The two methods of measuring input are:

Cost-To-Cost Method

Percentage of completion method is commonly measured through the cost-to-cost method which compares costs incurred to total estimated costs. To estimate the percentage of completion, you divide the total expenditure incurred from inception to date with the total estimated costs of the contract.

It is estimated using the following formula:

Percentage of work completed = total costs / total estimates costs for the contract

This value is then applied to determining the total revenue associated with the project.

Revenue Earned = Contract amount x Percentage of work completed

Example:

If the estimated costs of a long-term project are $50,000 and you have incurred $10,000 in the current period, then the percentage of completion is calculated as follows:

Percentage Completion = 10,000/50,000

% Completion = 20%

If the estimated revenue of the project is $80,000, the revenue recognized is:

Revenue Recognized = 20% x 80,000

Revenue Recognized = $16,000

Efforts Expended Method

The completion of work is measured by the percentage of efforts expended till date as compared to estimated total effort expected to be expended for each contract. The percentage of completion is based on labor hours, machine hours or material.

The Output Method

The output method compares the results achieved till date to the total expected results of the contract. This method uses direct measurement of value to the customer of the goods or services transferred to date. This includes units produced/delivered, milestones and appraisal of results achieved.

The method you choose to calculate the percentage of completion should be based on the nature of the contract and the terms of the delivery obligation.

Things to note

- While using the input method of measurement, the IFRS 15 Revenue from Contracts with Customers provides detailed guidance on the treatment of ‘uninstalled materials’ as it affects the revenue recognized. This is because the cost related to uninstalled materials does not represent the contractor’s progress in satisfying a performance obligation.

- Under IFRS 15, while using the output method the costs incurred in relation to satisfied or partially satisfied performance obligations must be written off to the income statement as they are incurred.

The percentage of completion method is a preferred alternative to the completed contract method as your job completion is measured by costs, not opinion. The main advantage of this method of reporting long-term contracts is that you don’t have to wait for project completion for receiving compensation for work completed.

RELATED ARTICLES

9 Accounting Tips for Small Businesses

9 Accounting Tips for Small Businesses Restaurant Accounting: A Step by Step Guide

Restaurant Accounting: A Step by Step Guide What Is Non-Operating Income? 3 Things You Need to Know

What Is Non-Operating Income? 3 Things You Need to Know Liquidity in Small Business: What It Means and Why It Matters

Liquidity in Small Business: What It Means and Why It Matters What Is Inventory Valuation and Why Is It Important

What Is Inventory Valuation and Why Is It Important What Is Small Business Accounting? A Beginner’s Guide

What Is Small Business Accounting? A Beginner’s Guide