What Is Equity in Accounting: Everything You Need to Know

Equity in accounting is the remaining value of an owner’s interest in a company after subtracting all liabilities from total assets. Said another way, it’s the amount the owner or shareholders would get back if the business paid off all its debt and liquidated all its assets.

You may hear of equity in accounting being referred to as stockholders’ equity (for a corporation) or owner’s equity (for sole proprietorships and partnerships).

You may already be familiar with the term equity as it applies to personal finances. For instance, if someone owns a $400,000 home with a $150,000 mortgage on it, then the homeowner has $250,000 in equity in the property.

It’s the same general concept in business—it’s what owners (or partners or shareholders) own after subtracting what they owe.

Here’s what we’ll cover:

What Is Considered Equity in Accounting?

What Is the Difference Between Stock and Equity in Accounting?

How Does Equity Financing Work?

What’s the Book Value vs. Market Value of Equity?

Why Is Equity Important for Businesses?

A Note About Personal Equity

In personal finance, equity is known as net worth. It’s the difference between your personal assets (like your home, savings, or retirement accounts) and your personal liabilities (like credit card debt or a mortgage).

In this article, we’ll focus on equity as it applies to business owners and shareholders.

What Is Considered Equity in Accounting?

Equity in accounting comes from subtracting liabilities from a company’s assets. Those assets can include tangible assets the company owns (assets in physical form) and intangible assets (those you can’t actually touch, but are valuable).

Tangible Assets

- Accounts Receivable

- Building(s)

- Cash

- Property, plant, and equipment

- Furniture

- Inventory

- Land

- Stocks and bonds

- Supplies

Intangible Assets

- Brand recognition

- Copyrights

- Customer lists

- Goodwill (the premium paid for a business beyond its assets minus liabilities)

- Patents

- Trademarks

When calculating equity in accounting, the company’s assets are offset by its liabilities.

Common Liabilities

- Accounts payable

- Interest payable

- Credit cards payable

- Loans

- Mortgages

- Accrued taxes

- Unearned revenues

- Accrued wages and salaries

- Warranties

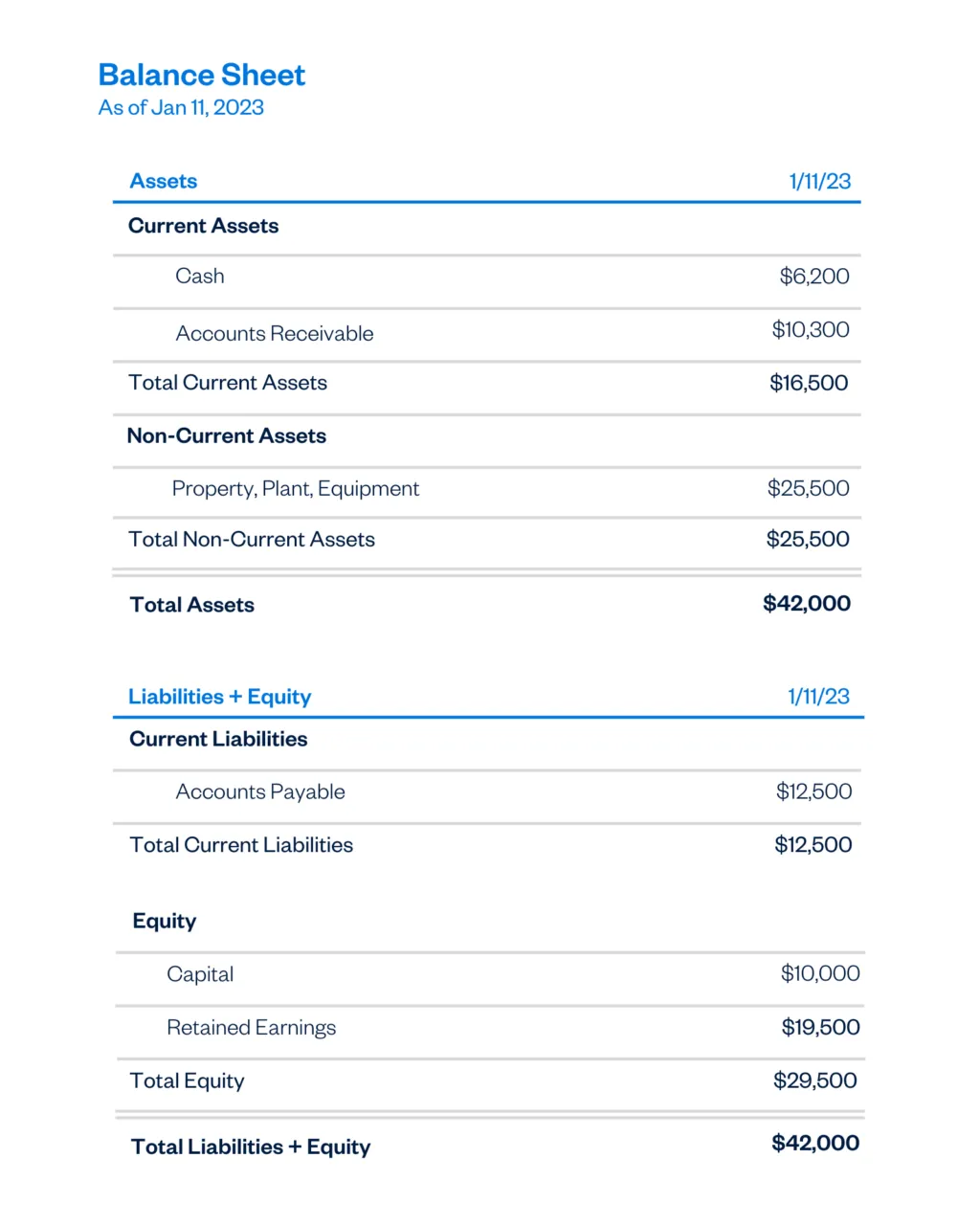

Equity on the Balance Sheet

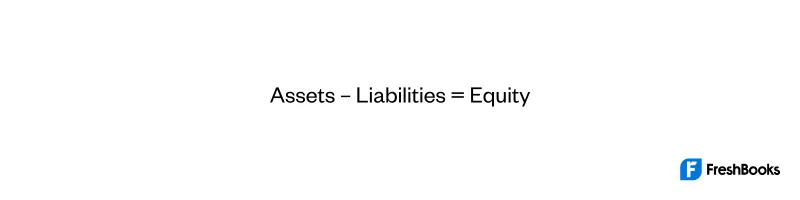

A balance sheet shows the book value of the company’s assets and liabilities. Then it shows equity—what you get when subtracting liabilities from assets. The following formula shows how equity is calculated:

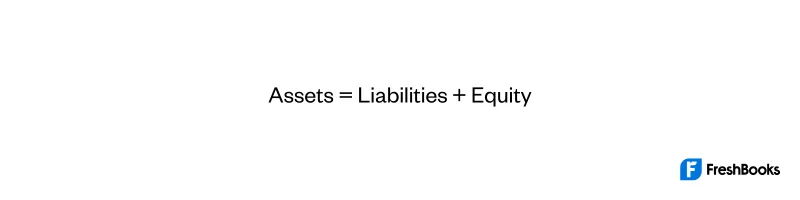

or, put another way:

Because your total assets should equal your total liabilities plus equity, a balance sheet is sometimes laid out in two columns, with assets on the right and liabilities and equity on the left.

Most accounting software, however, will stack these sections vertically: Assets first, then liabilities and equity.

Equity always appears near the bottom of a company’s balance sheet, after assets and liabilities. The total equity is followed by the sum of equity plus liabilities, so you can easily see that they balance with total assets.

Types of Equity Accounts

The owner’s equity section can include several different accounts. A small business or sole proprietorship might just show owner’s equity, partner capital, or shareholder’s equity. However, companies structured as a corporation might show other types of equity accounts, such as:

- Retained Earnings: Retained earnings are the company’s cumulative net earnings or profits after paying out dividends to shareholders.

- Stockholders’ Equity: Stockholders equity represents the value of the company attributable to stockholders if the company was forced to liquidate.

- Treasury Stock: Treasury stock is shares of a company’s stock that are reacquired or bought back from shareholders.

- Common Stock: Shares of ownership in a company that have been purchased by shareholders. Common stock is usually shown at its “par value” or face value. Common shareholders have voting rights.

- Preferred Stock: Shares of ownership in a company where shareholders don’t have voting rights, but their dividends are guaranteed.

- Additional Paid-in Capital: This is the excess amount paid by an investor over the stock’s par value. For example, if the par value of a company’s common stock is $10 per share and investors paid $50 per share, $40 of each share sold would be in additional paid-in capital.

Positive vs. Negative Equity

If equity is negative, then the owners or shareholders have no equity in the business, and the company is considered to be “in the red.”

Negative equity is usually a bad sign. It could mean the company is taking on too much debt. It could also signal that the company is paying out big distributions to its owners rather than reinvesting into the business.

What Is the Difference Between Stock and Equity in Accounting?

You may hear the words stock and equity used interchangeably or hear people refer to stock as “equity shares.”

Stock represents an ownership interest in a business. Whether you buy shares of a publicly traded company like Apple or invest in your cousin’s lemonade stand, you have an equity interest in the business. If your cousin happens to incorporate the lemonade stand business, you’ll own stock in the company.

Stock is part of a business’s equity in accounting, but equity includes more than just stock. It can also include retained earnings, shareholders’ equity, and other equity accounts that might appear on the business’s financial statements.

How Does Equity Financing Work?

Equity financing is a method of raising capital for a business through investors. In exchange for money, the business gives up some of its ownership, typically a percentage of shares.

Equity financing can offer rewards and risks for investors and business owners. An investor is taking a risk because the company does not have to repay the investment as it would have to repay a loan. Instead, the investor is entitled to a percentage of the company’s profits. If the business is successful, that risk could pay off. However, if the company fails, the investor can lose everything.

Equity financing can give aspiring business owners the capital needed to realize their dreams. However, they’re also giving up a percentage of the ownership. This means they might have to give the other investors a say in decisions about how to run the business.

It is not uncommon for a startup to go through several rounds of equity financing to expand and meet its goals.

What’s the Book Value vs. Market Value of Equity?

Book value and market value are terms that investment bankers and financial analysts use to evaluate companies.

The book value of your company is the same as its equity. You simply take every asset listed on your company’s balance sheet and subtract total liabilities to find the book value.

But a company’s market value can be higher than its book value if its assets are worth more than their book value.

For example, say you purchase a commercial building. Five years later, if you were to sell the property, it might be worth quite a bit more than you paid for it. The market value of the property is higher than its book value.

The market value of your business may also be higher if you have intangible assets that don’t appear in your financial statements. For example, if you have a loyal customer base and a recognizable and respected brand, your company’s market value is more than the equity value shown on your balance sheet.

Why Is Equity Important for Businesses?

When reviewing your small business’s financial statements, you probably put a lot of emphasis on financial performance: The revenues, expenses, and net income on your income statement. But don’t neglect your equity.

Potential lenders and investors will look at your company’s equity. Creating and maintaining positive equity shows that you’re generating a profit, running your business responsibly, and reinvesting in your long-term success.

Refer periodically to your company’s balance sheet to keep track of your equity value. Accounting software like FreshBooks makes it easy by automatically generating your balance sheet and other important financial statements. Making smart decisions about equity now will pay off down the road, so get started today!

RELATED ARTICLES

What Are Liabilities in Accounting?

What Are Liabilities in Accounting? Is Depreciation an Operating Expense?

Is Depreciation an Operating Expense? What Is a Statement Of Account: Definition, And Sample Formats

What Is a Statement Of Account: Definition, And Sample Formats Debit vs Credit: What’s the Difference?

Debit vs Credit: What’s the Difference? What Are Trade Receivables?

What Are Trade Receivables? What Is a Tax Write Off? Top 10 Deductions for Businesses

What Is a Tax Write Off? Top 10 Deductions for Businesses