How to Categorize Expenses: 14 Small Business Expense Categories to Consider

As a small business owner, you can categorize your expenses for a small business. This is done by developing a list of popular business expense categories that each transaction can be assigned to.

Categorizing your expenses will be helpful in keeping your company organized, for budgeting purposes as well as in assessing which expenses can be written off your taxable income at tax time.

The more tax-deductible expenses you have, the lower your taxable income will be, and the more cash flow you’ll have to reinvest into your small business.

So, how to categorize expenses that makes writing off business expenses a breeze at tax time? Below, we’re sharing a few common business expense categories to track in your accounting software.

In this article, we’ll cover:

- How to Categorize Expenses: 14 Common Business Expenses

- What Can I Write Off for Business Expenses?

- Can I Write off My Business Startup Costs?

- What Are the Three Major Types of Business Expenses?

How to Categorize Expenses: 14 Common Business Expenses

There’s no one-stop resource that covers all potential business expenses your company might be able to deduct, but here are some of the most common expense categories that apply to many companies of all sizes.

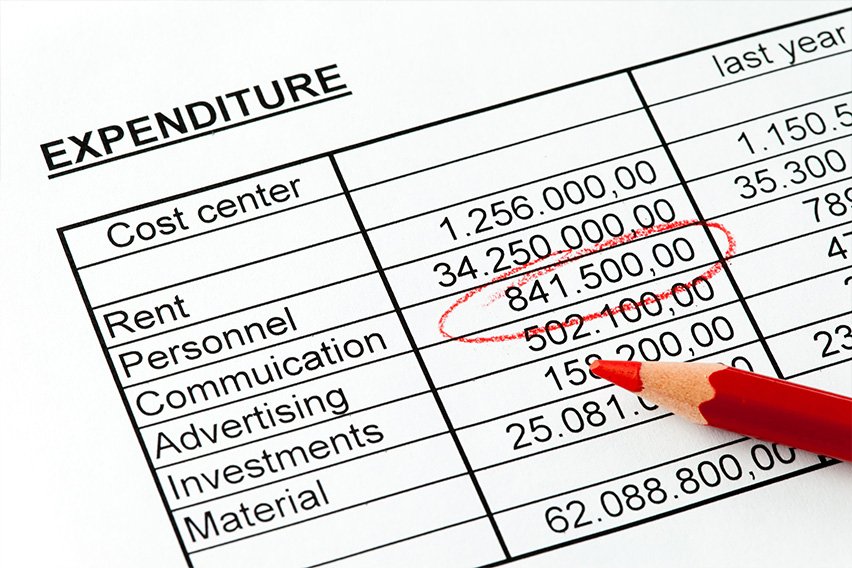

1. Advertising Expenses

Advertising Expenses should include any amount spent on ads for your business that appear in television, newspapers, radio, print or digital magazines, billboards, and direct mail.

This category of business expenses should also include charges related to online display or video ads, social media, SEM (or paid search), email marketing, sponsored content and remarketing. You should also include the actual production cost of the ad here.

2. Vehicle Expenses

It’s important business vehicles are part of this list because the many expenses related to the use of an automobile can add up considerably. You’ll want to keep track of the amount spent on:

- Mileage

- Maintenance and repairs

- Gas and oil changes

- Tire replacement

- Registration fees and taxes

- Vehicle loan interest

- Lease payments

- Insurance

- Garage rent

- Parking

- Tolls

Keep in mind that any personal use of the vehicle could unnecessarily inflate some of these figures. That doesn’t mean your company car policy shouldn’t support personal use, you will just want to figure a way to divide the charges between personal expenses and business expenses.

3. Payroll

Employee salaries and wages for staff are typically one of the largest business expense categories for most companies. You’ll want to see how much it’s costing your company just to manage it, which can help you develop cost-saving strategies for the future.

4. Employee Benefits

Ever had a friend or business contact say “the benefits at my company are great!” Well, they’re talking specifically about the additional compensation they receive from their job that is not wage-related. These benefits are designed by businesses to attract and retain talent. Common employee benefits include:

- Group health insurance (including dental, life and disability)

- Education and Training (including conferences)

- Paid Vacation

- Sick Days

- Child care

- Fitness

- Retirement contributions

There are other types of employee benefit programs like housing and domestic help, but they mainly apply to very large businesses.

5. Meals Expenses

Breakfast, lunch, dinner – even a trip to the local Starbucks, if business is discussed, it can be included here.

This category is often seen as a drain on the revenue of many companies, as it is often abused. Be sure to create an approval procedure for your staff or have a good policy in place on what qualifies for this category. Perhaps simply having a rule where you sign off on this type of request in advance is enough.

In the past, companies could deduct expenses related to entertaining clients. For example, treating clients to a concert or taking them to a sporting event, could be included in deductible expenses. However, the Tax Cuts and Jobs Act of 2017 eliminated the deduction for entertainment expenses. While you can still deduct meals, tickets to sporting events, concerts, and other forms of entertainment aren’t deductible.

Tip: Expenses related to business meals are the receipts most likely to get lost, so if you have a lot of them and are not recording them digitally, best to write out the business reason for them on each receipt as it will be much easier to remember what it was for later, and file them all in one place.

6. Office Expenses

Office expenses are common costs a business incurs that are necessary in order to run the business, like purchasing new computer equipment, fax machine, printer, etc. You can also deduct bank fees for your business bank account and the cost of accounting software.

7. Office Supplies

Business supplies are tangible items like pens, paper, staplers, printer ink, and postage. You should also consider listing office furniture here, as some of it may be tax-deductible depending on the cost.

8. Professional Services

Professional Services are fees charged by individuals with training in a specific field, hired by your company to perform a service. These services exist because many companies do not have all the resources they need in-house.

For instance, maybe you don’t have an accountant on staff but need one short-term or for a special project. Or you need to hire an outside agency to provide the content for your company blog. The payments of these fees would be categorized under “Professional Services”.

Accountants, lawyers, tradesmen, security, marketing consultants – all of these would be considered ‘professional services’.

9. Rent, Utilities & Phone

Costs incurred for renting or leasing your place of business would be included here. If you own the property your business is situated on, or work out of your home, you still want to track those business expenses too. Don’t forget your utilities, phone, and any real estate taxes you pay on your building.

10. Travel Expenses

This includes any costs related to traveling for the benefit of your small business, like a sales trip or business meeting. This includes airfare, cabs, food, laundry and long-distance telephone calls as well as any necessary purchases required to make the trip.

11. Training and Education

The IRS allows you to deduct training and education expenses. This could be for things such as tuition, books, laboratory fees, and other such materials.

You can also deduct other activity fees such as making copies of assignments or traveling to and from classes.

12. Business Insurance

If you’re operating a business for profit, you can deduct business insurance from your taxes if it is both necessary and ordinary.

An ordinary business expense is anything that is common and accepted in your business or industry. While a necessary business expense is helpful and appropriate.

13. Depreciation

Depreciation is a tax deduction that allows you to recover the cost of any assets that you purchase and then use for your business.

The amount of tax depreciation is calculated based on the classification that is assigned to an asset, no matter how much you use it.

14. Loan & Interest Payments

Any interest that is paid on personal, car or credit card loans is not generally considered tax-deductible.

However, you can claim the interest you’ve paid if you take out a loan or accrue credit card charges to finance business expenses.

Other Questions Related to How to Categorize Expenses:

What Can I Write off for Business Expenses?

Can I Write off My Business Start up Costs?

What Are the Three Major Types of Expenses?

What Can I Write off for Business Expenses?

The IRS states on its website that in order for a business expense to be deductible on a tax return, the expense must be both “ordinary and necessary”.

One of the primary reasons to categorize business expenses is so that they can be properly assessed for tax breaks at year-end. However, not everything is allowed to be written off, and some business expenses, like meals, only allow for a partial tax break.

The IRS is ultimately responsible for deciding what constitutes a deductible business expense. For more examples of deductible business expenses and detailed rules for claiming different deductible expenses, check out this IRS Publication 535.

Can I Write off My Business Start up Costs?

Typically, business owners must treat any costs they incur before beginning business operations as capital expenditures. This means they’re added to the company’s balance sheet as an asset, and depreciated over 15 years.

However, there are situations where small business owners can write off start-up costs as a deductible expense. As long as the business had total start-up and organizational costs of $50,000 or less, it can deduct up to $5,000 in start-up and organizational costs in the first year the business operates.

Allowable expenses include anything related to legal or incorporation fees, getting the business ready (for example, staff training) or research into potential markets or office space, advertising, and business travel to meet prospective distributors, suppliers or customers.

Interest on business loans, taxes, or product research and development don’t qualify as start-up tax deductions.

Also Read: Can I Claim Expenses Before a Business Starts

What Are the Three Major Types of Business Expenses?

There are three major types of financial expenses: Fixed, Variable, and Periodic.

Fixed expenses are expenses that don’t change for long periods of time, like office rent or vehicle lease payments for you or your staff. Variable expenses change from month to month. Such as utilities or meals and entertainment.

Periodic expenses are expenses that happen infrequently and are hard to plan for, such as car repairs or an emergency trip.

These types of business expenses often need more scrutiny, especially by small business owners, as there can be quite a variance from month to month.

Did you find this article helpful? If so, check out our article on Small Business Tax Deductions where we have compiled a list of expenses that you can write off on your taxes.

About the author

Janet Berry-Johnson, CPA, is a freelance writer with over a decade of experience working on both the tax and audit sides of an accounting firm. She’s passionate about helping people make sense of complicated tax and accounting topics. Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, Credit Karma, and Discover, among others. You can learn more about her work at jberryjohnson.com.

RELATED ARTICLES

Nonprofit Accounting: Basics and Best Practices Guide

Nonprofit Accounting: Basics and Best Practices Guide What Is a Favorable Variance? What It Means for Your Small Business.

What Is a Favorable Variance? What It Means for Your Small Business. What Is Burden Cost in Manufacturing and Why You Should Calculate It

What Is Burden Cost in Manufacturing and Why You Should Calculate It Conversion Method: Easy Steps to Convert from Single-Entry to Double-Entry Accounting

Conversion Method: Easy Steps to Convert from Single-Entry to Double-Entry Accounting What Is Accumulated Depreciation?

What Is Accumulated Depreciation? A Simple Guide to Small Business Write Offs

A Simple Guide to Small Business Write Offs