Small Business Bookkeeping: A Beginner’s Guide (2025)

Bookkeeping is how businesses, entrepreneurs, and decision-makers monitor a company’s overall financial health and activity. Without basic bookkeeping practices, it’s easy for financial transactions and spending activities to get out of control, which can lead to confusion, disorganization, and loss of profit.

Despite the importance of accurate bookkeeping practices, most people don’t feel entirely confident with maintaining detailed business finances. Whether it’s a lack of interest or knowledge, many businesses outsource this process to a professional bookkeeper to ensure accurate and healthy finances all around.

If you’re new to doing your own bookkeeping, this guide will establish important definitions, offer tips on basic bookkeeping principles, introduce various financial options, and provide tips to get your finances on the right track.

Key Takeaways

- Bookkeeping is the process of recording, updating, and maintaining financial records reflecting a business’s transactions.

- It helps small businesses track finances, gain insights, and guide business decisions.

- Bookkeeping can be managed via accounting software or by hiring professionals.

- To start bookkeeping, you’ll need to open the correct bank accounts, choose the right bookkeeping and accounting method for you, establish payment terms, and set up a payroll system.

- Bookkeeping best practices include keeping receipts, maintaining a ledger, creating financial reports, and handling your tax liabilities.

- Business owners should also get familiar with common bookkeeping statements, such as income statements, balance sheets, and their chart of accounts.

Table of Contents

- What is Bookkeeping?

- Why Do Small Businesses Need Bookkeeping?

- Bookkeeping Options for Small Business Owners

- How to Start Bookkeeping in a Small Business

- How To Do Bookkeeping For a Small Business

- Become Familiar with Bookkeeping Statements

- 6 Tips for Small Business Bookkeeping

- How to Budget for Bookkeeping Services

- Small Business Bookkeeping Mistakes to Avoid

- Simplify Your Small Business Bookkeeping with FreshBooks and Bench

- Frequently Asked Questions

What is Bookkeeping?

Bookkeeping is the regular practice of updating a company’s financial records to reflect all financial transactions. Professional bookkeepers prepare and track financial documents, including invoices and bills, and create financial statements to ensure the business is ready for tax season and other financial reporting requirements.

Bookkeeping is different from accounting in that it is the critical first step in tracking all business activities. While bookkeeping provides oversight into each individual transaction (in order to catch discrepancies and correct mistakes), accounting provides a thorough analysis of these numbers.

Accountants rely on bookkeeping records to analyze and advise on the financial activity, health, and growth potential of a business. In other words, a bookkeeper is the first step in ensuring your company’s financials are complete and accurate, while a certified public accountant is your second step in knowing what the financial records indicate so you can plan and make the right business decisions.

Why Do Small Businesses Need Bookkeeping?

Maintaining bookkeeping tasks is essential for the stability and success of small businesses. With so many moving pieces (including assets and liabilities, and income and expenses), small business owners must stay on top of it all.

Bookkeeping can help small businesses:

- Create organized and detailed financial reports, ensuring accurate financial insights and enhancing your business decision-making process

- Be more prepared for filing your income tax returns

- Understand business transactions at a granular level

- Make a plan for profitability that leads to improved cash flow and long-term success

Bookkeeping Options for Small Business Owners

Fortunately, small business owners don’t need to be experts in mathematics to find success when doing their own bookkeeping. There are many ways to divide bookkeeping responsibilities and leverage powerful technology and small business accounting software for more accurate expense tracking.

Accounting Software

Business accounting software and modern technology make it easier than ever to balance the books. A platform like FreshBooks, specifically designed for small business owners, can be transformational. FreshBooks accounting software is a powerful tool for small businesses, helping you manage and track every transaction, automatically generating essential financial reports, and automating many of the most time-consuming bookkeeping processes.

FreshBooks has countless features for small business owners looking to update their accounting process, saving more time and money. These features include business expense tracking, time-saving invoice generation and sending tools, project management capabilities, and bookkeeping services through Bench. No matter which features you find most useful, you can count on FreshBooks to automatically generate essential reports and statements, helping you track your company’s financial health and make more informed decisions. Overall, accounting software is one of the best ways for small businesses to make their accounting process more efficient, flexible, and simple.

External Consultants and Outsourcing

Professional bookkeepers and accounting professionals are available to manage, track, and report on financial activities. For a small business, this can be a great way to get the benefits of having a dedicated bookkeeper and accountant without the need to build out your own accounting and bookkeeping department.

When hiring external team members, keep in mind that some of the responsibility still falls to you as the proprietor. For instance, if you own a service-based business, a bookkeeper may still ask you to provide access to an online accounting system, pass along receipts, provide details for customer billing, or grant approval for vendor payments.

How to Start Bookkeeping in a Small Business

Every business needs bookkeeping.

Establishing a strong financial foundation for your small business begins with a few simple steps:

Open The Right Accounts

Business bank accounts should always be kept separate from personal bank accounts. Additionally, it’s important to recognize that the term “accounts” in bookkeeping refers to certain groups of transactions, rather than to actual business bank accounts. The business Chart of Accounts includes assets, liabilities, revenues (income), expenses, and equity.

Choose A Bookkeeping Method

Just as there are different accounting methods, there are two different ways to handle bookkeeping: single-entry bookkeeping and double-entry bookkeeping. Double-entry bookkeeping is the industry standard since it more accurately records and matches activity to every affected account. Most accounting software has options to work in both methods.

Choose An Accounting Method

There are 2 methods of accounting for small businesses to choose from: Cash-based and accrual. Cash-based accounting records transactions when money is exchanged, meaning invoices and bills aren’t recorded until they’ve been paid. This method helps you see your total assets and debts at any given moment in time, giving you insight into your company’s financial health.

Accrual accounting records invoices and bills even if they haven’t been paid. Accrual accounting is preferred as it gives a more complete snapshot of the company’s financial performance and more accurately matches expenses with revenue.

Establish Realistic Payment Terms

It’s wise to make and record sales transactions on time, every time, and allow the accounting system to use the payment terms to calculate customer receivable due dates. The calculated due dates will appear on sales invoices, so the customers can be informed of the expected payment deadline.

Set Up Payroll

At the end of each pay period, you’ll calculate the gross pay for each employee (using their payroll information) and then apply any taxes and withholdings. Then, you would record the primary payroll journal entry in your accounting software. A great way to save time on payroll is with a software tool. FreshBooks payroll software powered by Gusto helps make payroll accounting more streamlined and efficient, saving you time and money on this essential process.

How To Do Bookkeeping For a Small Business

Once you’ve got a handle on how to begin bookkeeping for your small business, it’s time to set yourself up for success with an ongoing bookkeeping system.

It might feel daunting at first, but the sooner you get a handle on this important step, the sooner you’ll feel secure in your business’s finances. Remember that the basic goals of bookkeeping are to track your expenses and revenue and to ensure you collect all necessary information for tax filing.

Here are the basic bookkeeping principles to keep in mind in order to establish a reliable bookkeeping process for your small business:

1. Keep Your Receipts

For both sales and purchases, it’s vital to have detailed, complete records of all transactions. You’ll need to note the amount, the date, and any other important details to ensure you can accurately summarize your finances when it comes time for tax season. Purchase receipts should always be kept as proof that the purchases took place.

2. Keep a Ledger

The information you get from your receipts should go into some kind of ledger (usually a digital option). This ledger acts as a tool to summarize your business’s overall financial performance and should include revenues, business expenses, and any other financial information your company chooses to keep track of.

3. Create Financial Reports

Using the data you gain from keeping a ledger, your next step will be to generate and prepare financial reports for analysis. The major reports to include are the profit and loss, the balance sheet, and a cash flow analysis. Additionally, the aged accounts receivables and aged accounts payables reports are helpful in knowing which clients have not paid and which vendors are yet to be paid. These reports will help you gain greater insights into the financial health of your small business.

4. Proactively Handle Tax Liabilities

When you keep detailed, organized records of your business transactions, tax season suddenly won’t feel like such a daunting chore. By being proactive with your bookkeeping, you’ll save your small business time when it comes to taxes. Simply turn your financial statements over to your CPA or other tax filings expert, and let them handle the rest.

Alternatively, you can use these same records to make the most of a cloud-based accounting software system like FreshBooks, which is a great way to collaborate with your accountants and bookkeepers throughout the year. Most accounting software offers a range of features that are suited for almost any type of small business.

Become Familiar with Bookkeeping Statements

Financial statements showcase the stability of a business. This is particularly true once the business accounts for its operational costs and recurring expenses.

Below are some of the most common statements a bookkeeper uses to monitor activities. If you plan to do your own bookkeeping, you’ll need to learn how to prepare financial statements such as these.

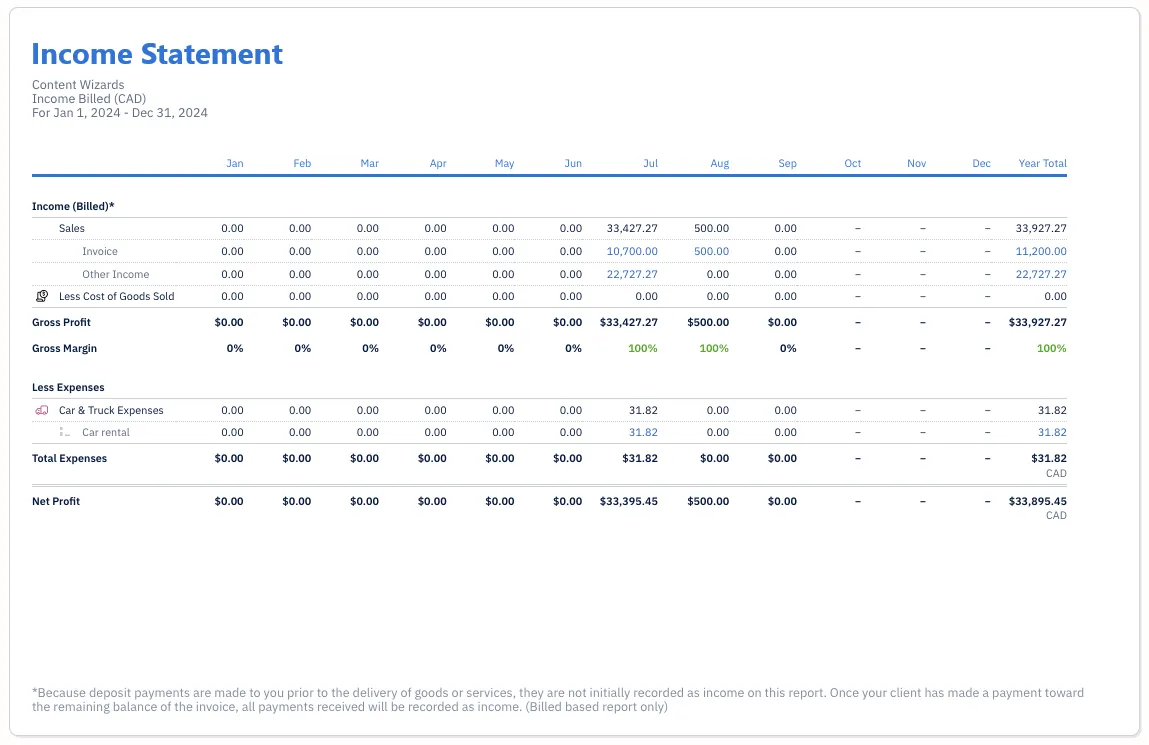

Income Statement

The income statement is a holistic report that shows revenue and expenses over a set period of time. It is sometimes referred to as the Profit and Loss Statement. It can be produced for one period to gain insight into the month’s profitability, or produced for the year to date. Often it is produced to include comparisons against the prior year’s same period or the prior year’s year-to-date data.

Our income statement template (pictured below) will help you understand how the financial data on this report is used for small businesses. Revenue, cost of goods sold (COGS), and operating expenses are summed to get a net profit or loss, otherwise known as the ‘bottom line.’ The Profit and Loss Statement offers essential insights for business owners.

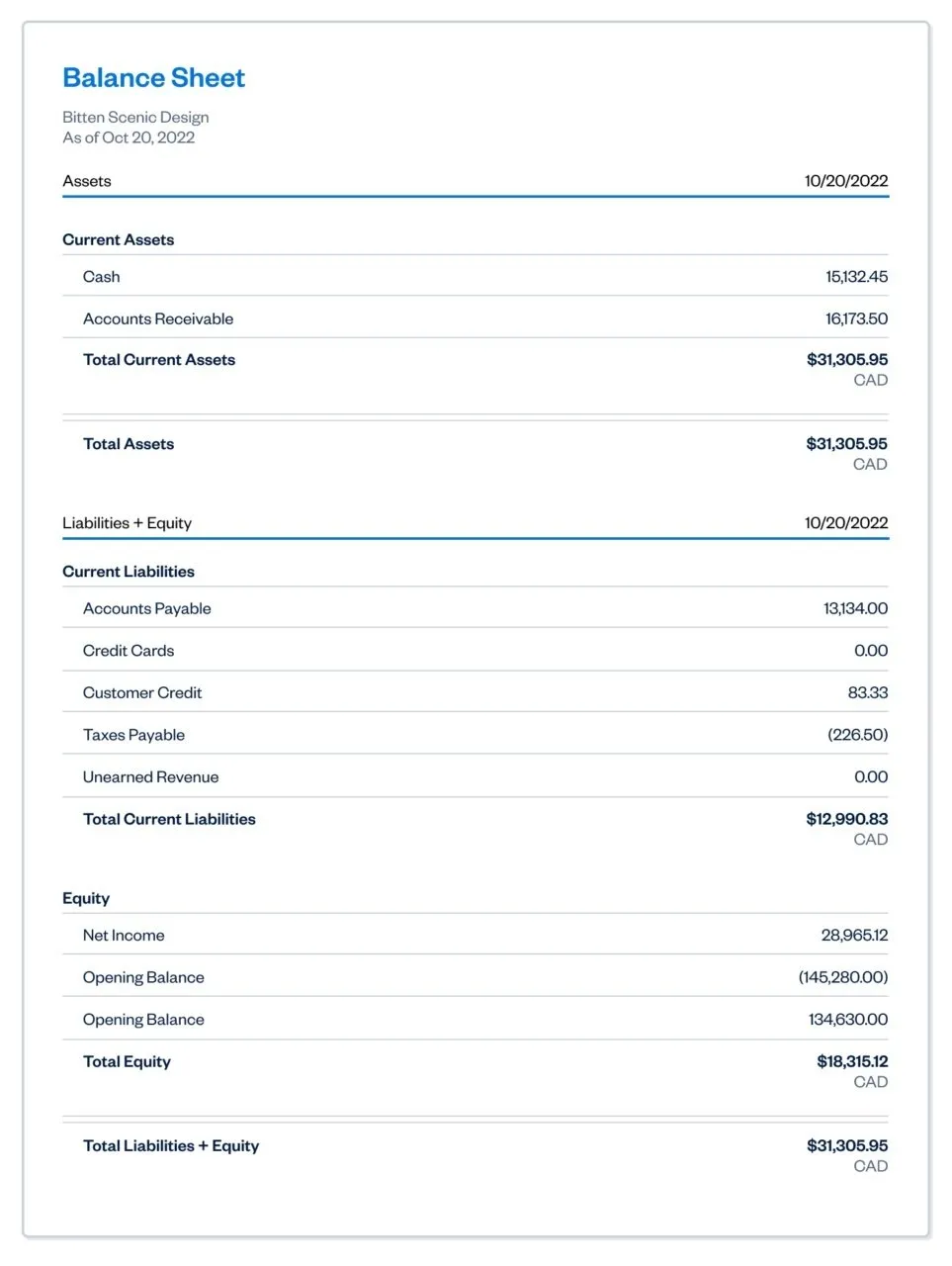

Balance Sheet

A balance sheet is an accounting tool that shows the overall financial situation as represented by the equation: Assets – Liabilities = Equity

Our balance sheet template (pictured below) is a great way to track and analyze your financial health. It shows your current assets and liabilities, as well as the total sum of your equity and liabilities (such as debt your company owes). The financial data on balance sheets helps you determine your company’s financial performance, which is essential for guiding future financial transactions and business decisions.

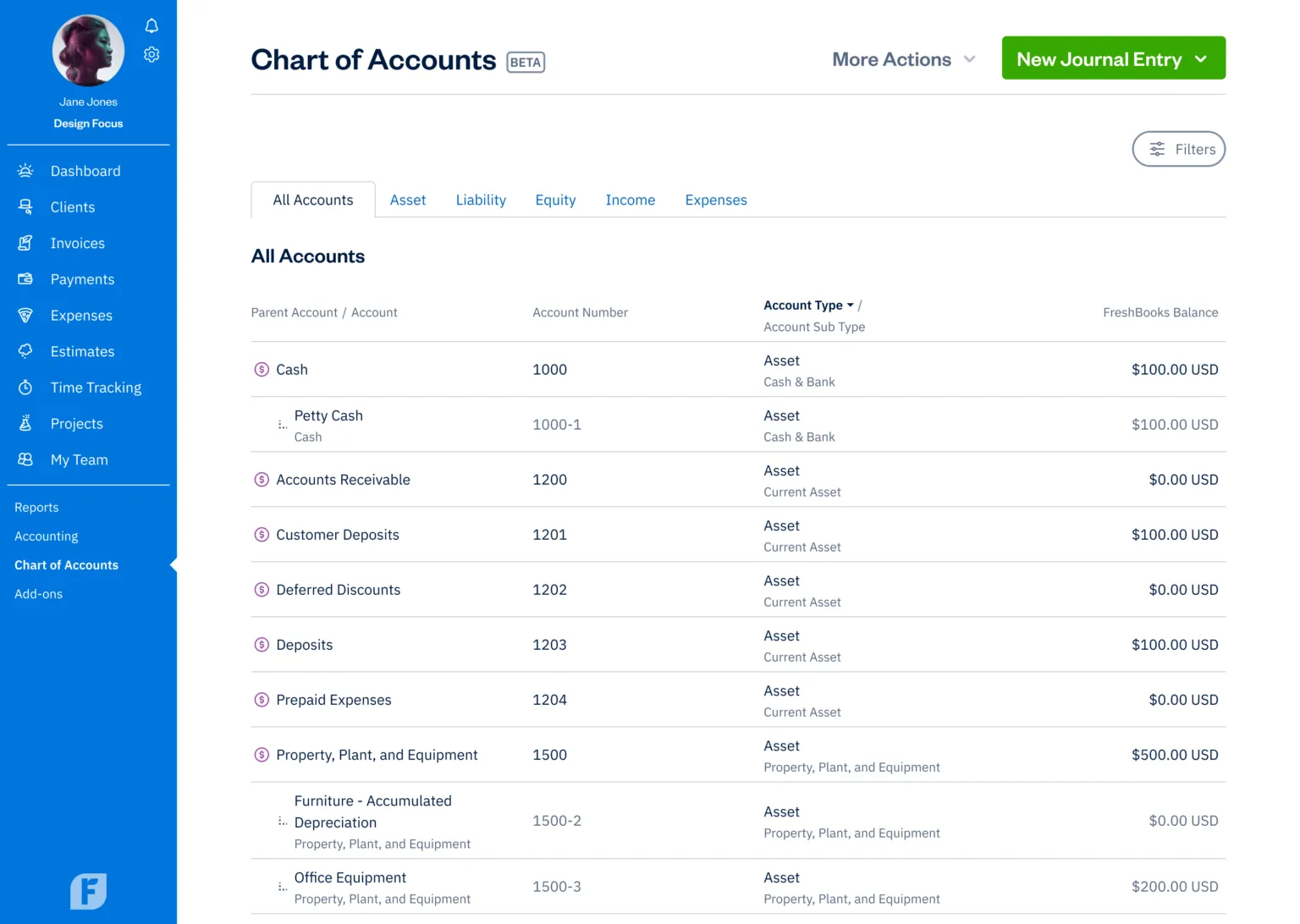

Chart of Accounts

Bookkeepers use a chart of accounts to see all of the accounts in a company’s general ledger. In many instances, an accountant prepares the initial chart, and the bookkeeper references it while recording transactions.

This chart of accounts example shows a breakdown of the various accounts your business may have, displaying each one’s description, account number, account type, and total balance. This helps you get a big-picture perspective of your various accounts, which will help you set goals and priorities for your business.

6 Tips for Small Business Bookkeeping

Bookkeeping beginners need quick wins to get started quickly and efficiently. The tips below are industry standards that will help any small business excel at bookkeeping.

1. Bring Your Bookkeeper Up to Speed

Occasionally, you might hear financial professionals reference a “backlog.” This refers to a collection of past records, transactions, and financial statements that a bookkeeper needs in order to learn the history of a business. When you first begin the bookkeeping journey, collect everything you have that could be relevant to establishing financial history.

2. Keep Personal and Business Costs Separate

A separate bank account is the first step in distinguishing between personal and business expenses and incomes. Bookkeeping becomes more difficult when business transactions are lumped together with personal activity. Keep all cash, credit card, and other financial activities separate.

3. Track Absolutely Everything

As businesses grow, it becomes easier to let small activities slip. Since good record keeping relies on accurate expense tracking, it’s important to monitor all transactions, keep receipts, and watch business credit card activity. Many bookkeeping software options automate the tracking process to eliminate errors.

4. Plan Ahead for Taxes

Efficient bookkeeping involves foresight, meaning that a business should always plan for upcoming financial events, including tax time. Good preparation and documentation are critical for paying taxes (including payroll taxes) on time.

5. Set Aside an Emergency Fund for Major Expenses

The specific amount of an emergency fund may depend on the size, scope, and operational costs of a given business. Regardless, work with your bookkeeper and accountant to ensure the amount of cash left in the bank is sufficient for unexpected costs. Finding the right level of cash to be kept on hand requires a proper cash flow forecast and cash monitoring. Businesses might not want to keep all cash in the bank, as having an excessive amount of cash in the bank could mean missed opportunities in investment income.

6. Regularly Cross-Check and Audit Files

Never leave the practice of bookkeeping (or your business assets) to chance. No matter what system you implement, incorporate a practice of reconciliations, by comparing the numbers in your system to the source records, like bank statements, receipts, and invoices. This habit improves communication, boosts transparency with your bookkeeping team, and promotes longevity and compliance.

Also Read: How to Do Bookkeeping for Small Business in Excel

How to Budget for Bookkeeping Services

Although bookkeeping is an investment, it’s generally much more affordable than attempting to correct costly mistakes down the road.

When it comes to budgeting for bookkeeping, the difference hinges on whether you hire or manage using software tools.

- A professional bookkeeper may charge $30-$90 per hour for their services. This amount can range based on the bookkeeper’s location, level of expertise, and availability.

- Bookkeeping software ranges from free services with limited functionality to full-fledged accounting suites. For instance, FreshBooks pricing ranges from $7.50 to $25 per month, based on the number of clients and accounts required. Typically, higher-priced service plans offer greater visibility, functionality, and automation.

Small Business Bookkeeping Mistakes to Avoid

When it comes to bookkeeping tasks, there’s a great deal to learn. If you have mistakes to fix or transactions to track down, don’t stress. Most of the time, a qualified professional can correct or document these errors.

By avoiding these common mistakes, small businesses can skip unnecessary financial hassle associated with poor bookkeeping habits.

Hiring A Bookkeeper Only At Tax Time

The best results happen when a business implements a bookkeeping strategy over a period of time or builds a long-term working relationship with a qualified bookkeeper. Waiting until crunch time to prepare documents and fix bookkeeping errors can be too late if the records are kept with many mistakes.

Failing To Communicate About Financial Reports And Activities

Every involved party should understand a company’s bookkeeping practices and expectations. Because of the number of accounts and moving pieces, collaboration is critical for successful implementation.

Choosing The Wrong Accounting Method

Whether it’s cash basis or accrual, choose the system that’s most appropriate for your specific needs and industry. The chosen method affects record keeping, expense tracking, and most importantly–interactions with the IRS.

Simplify Your Small Business Bookkeeping with FreshBooks and Bench

Bookkeeping is one of the most important tasks that a business owner will delegate over the life of a business. Without it, it’s nearly impossible to produce an accurate record of financial transactions that affect everything, from profit to equity to payroll, and more.

If you’re looking for a way to make this essential process more efficient and manageable, FreshBooks and Bench can help! FreshBooks can automate several time-consuming business tasks, from invoicing to expense tracking, all while automatically creating detailed, insightful financial reports. Bench, meanwhile, supports your business with expert bookkeeping services, helping you manage your finances accurately and efficiently, leaving you with more time to run the business itself.

When they’re used together, FreshBooks and Bench can dramatically reduce the time you spend on administrative work for your business, saving you time, money, and stress while ensuring accurate financial reporting and bookkeeping. Discover why so many small businesses depend on this outstanding tool: Try FreshBooks for free!

FAQs on Small Business Bookkeeping

Do you have more questions about the bookkeeping process for small businesses? Here are some of the most frequently asked questions on bookkeeping for small businesses.

Is it worth paying a bookkeeper?

As soon as you see growth in your company, it will soon be essential to have a detailed, consistent bookkeeping approach. While you can manage your own accounting during the initial stages, it’s best to invest in a professional bookkeeper to ensure your business’s success in the long term.

What is the easiest way to do bookkeeping for a small business?

The easiest way to do small business bookkeeping is by using accounting software, such as FreshBooks. FreshBooks makes it easy to automate large parts of the bookkeeping process, simplifying this vital task while ensuring accurate financial reports, tracking, and records.

Can you do bookkeeping by yourself?

Yes, you can do bookkeeping by yourself, but we strongly recommend using accounting software to help reduce the time it takes to do your own bookkeeping. Accounting software also helps reduce errors when compared to manual bookkeeping thanks to its automated features, improving the accuracy of your income statements and other financial records.

What is the cost of small business bookkeeping?

Costs vary greatly for small business bookkeeping depending on the volume of transactions you make and the overall complexity of your financials. Generally, you can expect to pay between $200 and $2,500 per month for business bookkeeping services.

Why does a small business need a bookkeeper?

Bookkeepers help small businesses create and manage their financial records, process transactions efficiently and accurately and reconcile various financial accounts. They also ensure that these processes are reported accurately, providing valuable financial insights and helping guide future business moves. They help businesses remain profitable and make data-informed decisions.

More Small Business Accounting Resources

- Accounting for Start-Up Business

- How to Do Bookkeeping for Small Business in Excel

- How to Do Accounting for Small Businesses: Basics of Accounting

- How to Do Accounting for Your Cleaning Business

- 7 Signs Your Business Needs Bookkeeping Services

- Bookkeeping vs. Accounting: What’s the Difference, Anyway?

About the author

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

Budgeting vs. Forecasting: What’s the Difference Between the Two?

Budgeting vs. Forecasting: What’s the Difference Between the Two? What is an Undeposited Funds Account? Everything You Need to Know

What is an Undeposited Funds Account? Everything You Need to Know Merchant Account vs Payment Gateway: What’s the Difference

Merchant Account vs Payment Gateway: What’s the Difference Human Resource Budgeting (HR) Planning: Key Components

Human Resource Budgeting (HR) Planning: Key Components What is a Virtual CFO & How to Become One?

What is a Virtual CFO & How to Become One? What Is an Employer Account Number or EIN

What Is an Employer Account Number or EIN