Billable Hours: What Are They and How to Calculate Them

Billable hours are the time spent working on client projects which can be billed directly to the client. Understanding billable hours is important for setting your hourly rates, organizing your projects, preparing quotes and estimates, and creating accurate professional invoices. Many businesses, from legal professionals to freelancers, use billable hours to calculate revenue.

We’ll explore billable hours and non-billable hours, and then examine how to calculate and track billable hours. We’ll also take a look at the benefits of tracking billable hours and strategies for increasing billable hours to help you increase profits and grow your small business.

Key Takeaways

- Billable hours are hours worked that you can bill to the client.

- For hours to be billable, they must be spent on tasks directly related to client projects.

- Non-billable hours are hours worked on non-client tasks such as business administration.

- Calculate billable hours by multiplying your hourly rate by billable hours worked.

- Tracking billable hours is important for creating accurate invoices and managing projects.

Table of Contents:

- What Are Billable Hours?

- What Are Non-Billable Hours?

- How To Calculate Billable Hours

- Why Should You Track Billable Hours?

- How To Track Billable Hours Using FreshBooks

- How To Increase Billable Hours

- Maximize Your Billable Hours with FreshBooks

- Frequently Asked Questions

What Are Billable Hours?

Billable hours are the time spent working on tasks directly related to a particular client project.

What qualifies as billable hours varies between projects and industries. The important distinction is that billable hours must be directly related to and necessary for a client project.

Industries that focus on client-specific projects, such as professional services and consulting, use billable hours to track their work. Understanding billable hours is important for time tracking, project management, and fair invoicing. Many businesses use billable hours to determine how much to invoice a client for projects.

Billable Hours Example

Billable hours are the time that you invoice a client for, meaning they have to be directly related to client work. The following table outlines common tasks that qualify as billable hours, as well as some non-billable work tasks for comparison.

| Task | Billable or Non-Billable Hours? |

| Replying to client emails | Billable |

| Replying to internal company emails | Non-billable |

| Client meetings | Billable |

| Company performance review | Non-billable |

| Project planning for a client project | Billable |

| Strategy planning for company growth | Non-billable |

| Completing research for a client project | Billable |

| Research advertising methods for the company | Non-billable |

What Are Non-Billable Hours?

Non-billable hours are spent working on tasks not directly related to client projects. Even though this work may be necessary for running your business, it’s not required to complete a particular client project, so it can’t be billed to the client.

Common examples of non-billable hours include administrative work, accounting, promotion and advertising, and developing proposals for new clients. These are all important tasks, but they don’t advance a specific project for your client, so they are categorized as non-billable hours.

How To Calculate Billable Hours

We’ll explore the basic steps for calculating billable hours:

1. Set an hourly rate

If you charge a single rate for all your services and clients, this step is straightforward. If you charge different rates for services or clients, try outlining your rates in a table to ensure clients understand what they’ll pay for different billable hours.

If you have multiple team members working on projects, they may have different rates depending on their experience levels and responsibilities. For example, junior team members may have a lower billable rate than senior members.

2. Track the number of hours worked

Use a timesheet or time-tracking software to record your billable hours. Make sure to organize your billable hours chart according to task, project, and client.

3. Add up your billable hours

When it’s time to invoice, add up all the billable hours for the project. If you charge different rates for different services or individuals, make sure to keep all the hours for different services separate. For example, you may need to add up research hours, meeting hours, and work hours as three separate service lines.

4. Multiply your hours worked by your hourly rate

Once you’ve added up all your billable hours for each service, multiply them by your hourly rate for that service. Then add together all the total amounts to get your final total.

5. Add any extra fees or charges

Include any additional charges such as material costs or rush fees to reach your final invoice amount.

Why Should You Track Billable Hours?

Tracking billable hours helps you provide accurate invoicing and effectively manage your internal work systems.

Ensuring Accurate Client Billing

Tracking billable hours ensures you know exactly how much time was spent on a project. This enables you to provide an accurate invoice with a clear breakdown of how billable hours were used.

Accurate invoicing reduces the likelihood of a payment dispute and builds trust with your client. This can encourage more business in the future since your client can easily see that your company uses its billable hours effectively. It also ensures that you’re fairly compensated for your time and work, making it beneficial to both you and your clients.

Improving Project Management

Tracking your billable hours gives you a clear overview of how time is spent on each project. This helps you create an efficient workflow and catch any areas where productivity could be improved.

Billable hours help you improve individual project management as well as overall management across multiple projects. If you notice that one project has accrued a large amount of billable hours, you can budget additional time for similar projects in the future.

Tracking Efficiency

Billable hours are a useful metric for determining how efficiently your company performs. They can help assess efficiency for individual employees as well as for different projects and tasks.

Tracking billable hours also helps you track changes in efficiency so you can assess whether your business strategies are effective. This can help you catch any existing inefficiencies and measure the efficacy of new tools. For example, a change in billable hours after the implementation of a new software program can indicate how beneficial that program is to your company’s performance.

Determining Profitability

Billable hours are a key income source, so tracking them is essential for measuring your income-to-expense ratio. When you know how many billable hours you’ve spent on a project, you can compare that to labor and materials expended to determine the project’s profitability.

Tracking billable hours also helps you assess profitability across different projects. This can direct you on which projects to bid on as your company grows and how to prioritize your current projects.

Improving Team Management

Tracking billable hours helps you properly allocate tasks across your team. You can assess everyone’s workload and ensure they’re able to manage their tasks. This is important for employee morale in the workplace and can also be helpful for meeting the scheduling needs of all team members.

If certain team members perform especially well at some tasks, you can also assign them those tasks to boost your overall efficiency. Assigning tasks based on billable hour performance can increase project speed and improve the workflow of your business.

How To Track Billable Hours Using FreshBooks

FreshBooks offers an easy, straightforward system for tracking billable hours. The following steps outline the process to track billable hours using FreshBooks.

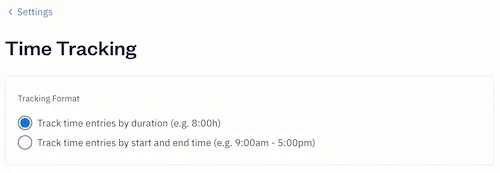

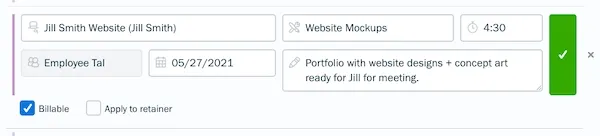

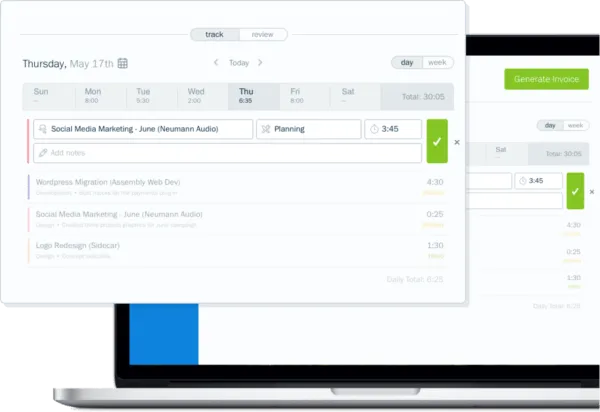

1. Choose your Tracking Format

FreshBooks time tracking software offers 2 formats for tracking billable hours: duration and start/end time. Duration tracks your billable hours in hours and minutes, while start/end time uses your beginning and end times to calculate your total time worked on a particular task.

Both billable hours formats can be applied to all team members. Entries can be adjusted to account for breaks, making it easy to get an accurate count of all your billable hours.

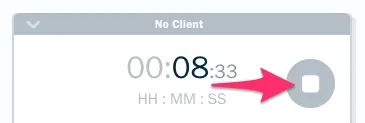

2. Start the Timer

Start the timer to begin tracking your billable hours. Within each timer, you can add details like project, client, and task. This makes it easy to organize every time entry as you go, so you can include key information while it’s fresh in your mind.

When you’re done working, simply click Stop to end the timer. You can also explore helpful features like the pause button in the duration format, which offers an easy way to stop the timer when you take breaks.

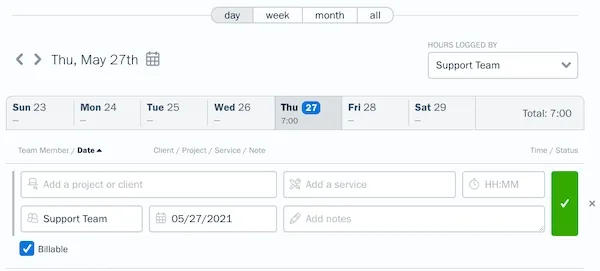

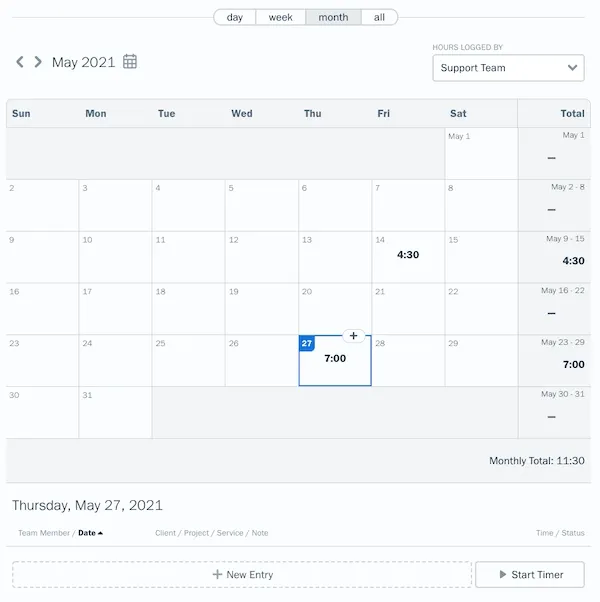

3. Add a Time Entry

You can add time entries by day, week, or month for easy tracking. Daily time entries are helpful for starting new projects or for days when you need to log a variety of different projects or tasks.

Weekly and monthly entries are useful for tracking time in bulk. For example, if you have a similar schedule 2 weeks in a row, you can duplicate your weekly time entries for faster organization. When you want to review your billable hours model, you can look at the calendar feature for a straightforward overview of all your time worked.

4. Organize your Time Entries

Time entries can be organized into three categories: billed, unbilled, and non-billable. Billed and unbilled are both used to track billable tasks and have the additional advantage of helping you track whether you’ve already billed the client for that time. This is especially helpful for ongoing projects with multiple invoices.

Non-billable hours let you track time that can’t be invoiced to your client. This time-tracking feature is useful for assessing your productivity and understanding how much time you devote to tasks that can’t be billed to any clients.

Tracking billable hours is quick and easy with FreshBooks time tracking software. A robust array of tracking features lets you choose your preferred format, while built-in categorizations make it easy to organize billable hours for every client, project, and task.

How To Increase Billable Hours

Small businesses and freelancers looking to increase their profits will probably want to find ways to raise their billable hours (ethically, of course). These tips can help you maximize your billable hours and earn more money:

Set Billable Hours Targets

The more billable hours you work, the more revenue you can generate for your business. As management guru Peter Drucker once said, “What gets measured, gets managed.” So set billable hours targets for yourself and your employees and consider offering bonuses to employees who meet billable hours targets.

How many billable hours should you aim for? It really depends on your industry and your business. According to Yale Law School, for a law firm, the target billable hours are usually between 1,700 and 2,300 hours per year. For accounting firms, the billable hours expectations usually run somewhere between 1,700 and 2,000 hours per year.

In the legal profession and in public accounting, it’s standard practice to require employees to work hours of overtime to get enough billable hours and allocate non-billable time to administrative tasks.

Track All Your Billable Hours

It might seem unnecessary in the moment to track a 5-minute phone meeting or the two minutes it takes to send a work email. But all those small increments of billable time can add up to a significant number of billable hours over the span of an entire project. Track every minute you spend working on a client’s project to increase your billable hours.

Many companies that calculate billable hours bill in tenths. This helps companies track billable hours as effectively and accurately as possible without losing time spent on time tracking.

For example, in legal services, many law firms bill in six-minute increments because it’s easy to calculate billable hours, and it allows for reasonable billable hour increments without rounding up too much. The Justice Department has an attorney billable hours chart that can help with calculating billable hours based on 6-minute increments.

There are multiple ways to track your billable hours. A law firm might use legal practice management software that includes built-in time-tracking software. Accounting software like FreshBooks also includes time-tracking features.

Track In Real Time

To make sure you don’t overlook any of your billable hours, track them in real-time. Record your start and end times for each project as they happen, rather than looking back at the end of the day and trying to add up all the billable hours you spent on a client’s project. If you track time as it happens, you won’t overlook any billable time.

Record Your Non-Billable Hours

If you’re keeping track of all your time, not just your billable hours, you’ll be able to look back at your work day and see where you can become more efficient. If you’re spending time every day on non-billable activities, such as simple administrative tasks, it might make sense to hire an assistant to help with the non-billable work so you can spend more time on important projects. Or, if you’re spending a lot of time invoicing, you may want to invest in accounting software that allows you to automate the invoicing and billing process. To streamline your financial management and save valuable time, consider exploring options for the best accounting software for your business needs.

When you track both total billable hours and non-billable hours, you can track your utilization rate, which is the percentage of your total working hours that you spend on work that can be billed to a client.

You calculate utilization by dividing the total hours worked during the year by billable time.

For example, if you work 2,080 hours during the year, and 1,900 of those hours are billable, your utilization rate is 91.3%. Measuring utilization rates can help you benchmark employee performance and increase profitability. If some employees are working more non-billable hours than billable hours, you might have poor cash flow and unhappy clients.

Stop Procrastinating

This is probably the most obvious and the most difficult way to increase your billable hours. When you stay on track during business hours, you may be amazed to see how much your billable hours increase.

Some tips to avoid wasting time on non-billable hours include:

- Install a browser extension that limits the time you spend on time-sucking sites or completely blocks you from accessing them. Social media sites and even news sites are common culprits to target first.

- Clear your workspace of distractions. If you take away the temptation to procrastinate, you’ll encourage yourself to spend more time working.

- Create a daily work plan to outline and prioritize tasks. You can even use your calendar to block time off for specific projects, which can help you avoid getting pulled away for less important, often non-billable, tasks.

Maximize Your Billable Hours with FreshBooks

Billable hours are the time spent working on client projects that you can charge directly to your client. Understanding billable hours helps you structure your time management and ensure you’re compensated fairly for your work when billing clients. It’s also valuable when setting your rates for different services.

FreshBooks time tracking software provides an easy and efficient system for tracking billable hours. Explore different tracking modes, categorize your time according to client and project, and then create and send a professional invoice for your billable hours with FreshBooks invoicing software. Try FreshBooks for free to get started tracking your billable hours today.

FAQs On Billable Hours

How many billable hours in a day?

In most cases, someone would work eight billable hours in a day, as an 8-hour day is standard in most industries. However, your company may choose to work longer days and may bill clients at standard or overtime rates for the extra time.

What industries bill by the hour?

Billing by the hour is standard practice in many industries, including law firms, accounting practices, advertising, and consulting agencies. Hourly billing is also common for many freelancers in fields like graphic design and web development.

How can I tell if my time is billable?

Billable hours must be directly related to client work. If you’re not sure whether a specific task is billable, consider whether it’s necessary for the project and actively advances progress. For time to be billable, it should be spent working on tasks outlined in the project’s contract.

What are billable hours vs actual hours worked?

Billable hours are the hours worked for which you can bill the client, while actual hours worked may include time spent on other projects that can’t be charged to your client. In order for time to be billable, it must be spent directly on client work.

About the author

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

Is Land a Current or Long-Term Asset? How to Classify Land on the Balance Sheet

Is Land a Current or Long-Term Asset? How to Classify Land on the Balance Sheet Accounts Receivable and Accounts Payable: What’s the Difference?

Accounts Receivable and Accounts Payable: What’s the Difference? Inventory Write-Off: How To Do It With Examples

Inventory Write-Off: How To Do It With Examples Accounting For Startups: Everything You Need To Know In 2025

Accounting For Startups: Everything You Need To Know In 2025 How you use the Shareholders Equity Formula to Calculate Stockholders’ Equity for a Balance Sheet?

How you use the Shareholders Equity Formula to Calculate Stockholders’ Equity for a Balance Sheet? How Do You Calculate Operating Income?

How Do You Calculate Operating Income?