What Are Adjusting Journal Entries?

To ensure that financial statements reflect the revenues that have been earned and the expenses that were incurred during the accounting period, adjusting entries are made on the last of an accounting period.

Adjusting entries are need because:

- An expense has been incurred but not yet recorded

- Revenue that has been earned has not yet been recorded

- A customer paid their invoice in advance of receiving goods or services. Until the goods or services are delivered, the amount is reported as a liability. After the goods or services are delivered, an entry is needed to reduce the liability and to report the revenues.

- A business might have paid six-months of insurance coverage, but the accounting period is only one month. Therefore, five months of insurance expense is prepaid and should not be reported as an expense on the current income statement.

Usually, adjusting entries need to be recorded in an income statement account and one balance sheet account to ensure that both sheets are accurate.

This article will also discuss:

What Is Included in Adjusting Entries?

What Is an Adjusting Journal Entry?

What Is an Adjusting Entry Example?

What Is Included in Adjusting Entries?

The purpose of Adjusting Entries is show when money has actually changed hands and convert real-time entries to reflect the accrual accounting system.

Adjusting entries always involve a balance sheet account (Interest Payable, Prepaid Insurance, Accounts Receivable, etc.) and income statement account (Interest Expense, Insurance Expense, Service Revenues, etc.). Entries are made with the matching principle to match revenue and expenses in the period in which they occur. Adjustments reflected in the journals are carried over to the account ledgers and accounting worksheet in the next accounting cycle.

Adjusting entries, also called adjusting journal entries, are journal entries made at the end of a period to correct accounts before financial statements are made.

There are three different types of adjusting journal entries:

- Payments

- Accruals

- Non-cash expenses

Each entry adjust income and expenses to match the current period usage. The journal entry will divide income and expenses into the amounts that were used in the current period and defer the amounts that are going to be used in the current period.

What Is an Adjusting Entry Example?

Recording Adjusting Journal Entries can be done in three easy main steps.

- Determine current account balance

- Determine what current balance should be

- Record adjusting entry

These adjustments are then made in journals and carried over to the general ledger in the next accounting cycle.

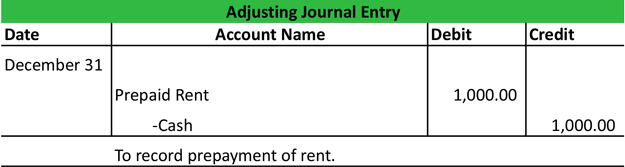

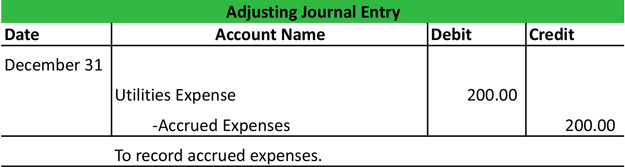

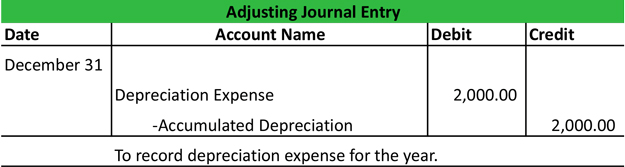

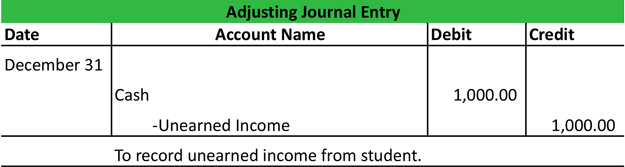

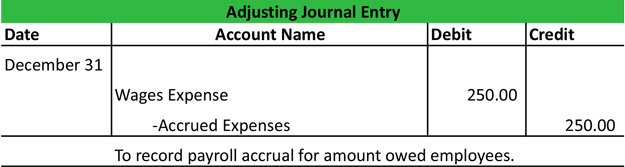

Here’s an example with Paul’s Guitar Shop, Inc.,where an unadjusted trial balance needs to be adjusted for the following events.

— Paul pays his $1,000 January rent in December.

— Paul’s December electric bill was $200 and is due January 15th.

— Paul’s leasehold improvement depreciation is $2,000 for the year.

— On December 31, a customer prepays Paul for guitar lessons for the next 6 months.

— Paul’s employee works half a pay period, so Paul accrues $500 of wages.

Now that these adjusting journal entries have been made in the accounting system, it can be recorded in the accounting worksheet and an adjusted trial balance can be prepared.

RELATED ARTICLES

Accrual Accounting: Definition, How It Works, and Examples

Accrual Accounting: Definition, How It Works, and Examples How To Read A Balance Sheet: An Overview

How To Read A Balance Sheet: An Overview What Is a Payback Period? How Time Affects Investment Decisions

What Is a Payback Period? How Time Affects Investment Decisions What Is the Accounting Equation?

What Is the Accounting Equation? Cost Accounting Standards: They’re Policy for Government Contracts

Cost Accounting Standards: They’re Policy for Government Contracts How to Balance a Checkbook?

How to Balance a Checkbook?