Working Capital Turnover Ratio Definition & Calculation

Working capital turnover is a way to measure how your company uses available capital to fund sales and growth. The formula measures how funds go into operations and generate profits for your organization. The goal of the working capital turnover formula is to track efficiency over time and identify the areas of improvement. Sometimes it is also called net sales to working capital.

Table of Contents

KEY TAKEAWAYS

- Working capital turnover calculates the ability to use available funds to fuel growth and profit.

- Higher working capital turnover ratios are better. They indicate that your company is more profitable.

- Working capital turnover can get too high. When this happens, it’s a sign that your company needs to raise additional capital for future sales growth.

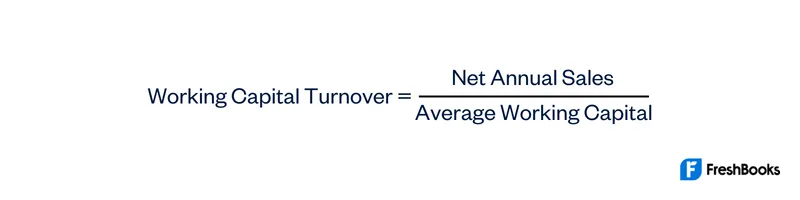

The Working Capital Turnover Ratio Formula

First, you need to gather the appropriate data to use in your formula. Determine your net annual sales by adding up your returns, allowances, and discounts. Then subtract this number from the company’s gross sales. Both numbers should be from the same period. Most businesses calculate on an annual basis.

Now find your average working capital over the same period. Take your average current assets and subtract your average current liabilities.

Example of Working Capital Turnover

Let’s say that your business has $10 million in net sales over a calendar year. Your average working capital during the same period was $2.5 million. When you use the formula, $10 million / $2.5 million = 4. This means that for every dollar of working capital, your business turned a revenue of $4.

What Does Working Capital Turnover Mean for Your Business?

High revenues are great for your company. Having a high working capital turnover means that you are good at managing short-term assets and liabilities. When sales are high, you’re turning a better profit.

A low ratio can indicate over investment in current assets that are not supported by current sales. This can result in inventory obsolescence or accounts receivable bad debt writeoffs. If you want to see how your business performs compared to others, it’s important to focus on businesses in your same industry. The average working capital turnover for another industry may be very different than in yours.

Tips for Managing Working Capital

To best manage working capital, you want to complete ratio analysis on operating expenses like:

- Cash flow

- Current assets

- Current liabilities

You also want to pay attention to your collection and inventory turnover ratios. When you are good at managing capital, you also have a strong cash conversion cycle (CCC). This means that you can convert assets and liabilities into revenue (cash) quickly.

It’s important to track working capital diligently. If your working capital gets too low, you’re in danger of liquidating assets to pay for your liabilities. This can be a downward spiral toward bankruptcy. One way to ensure this doesn’t happen is by carefully managing the following:

Try to keep a larger capital cushion that protects you from getting into the negative. If your operating capital begins to dwindle, review your level of sales for areas of improvement.

Summary

Working capital turnover is a formula for calculating funds available for growth and profit.

Having a high working capital turnover ratio is more favorable. Higher ratios indicate profitability. However, a working capital turnover ratio that is too high is bad. This can indicate a need for additional capital.

Working Capital Turnover FAQs

It tells you whether or not your leadership is good at managing cash flow within the organization. A high ratio indicates that the capital structure is strong. A low ratio indicates that the capital to sales ratio is low. When this happens, you may be in danger of bankruptcy.

Experts say that a capital turnover ratio calculation of 1.5 to 2.0 is good. Higher is also better to a certain extent. If the number is too high, it’s a working capital indicator that your available funds are too low. You need to build up more capital.

It gives you a competitive edge within your industry. You have more flexibility when financial pitfalls happen. You’re also less likely to struggle with inventory.

Share: